Press release

Cloud Services in Insurance Market Unlocking Potential: Cloud Services Driving Customer-Centric Insurance

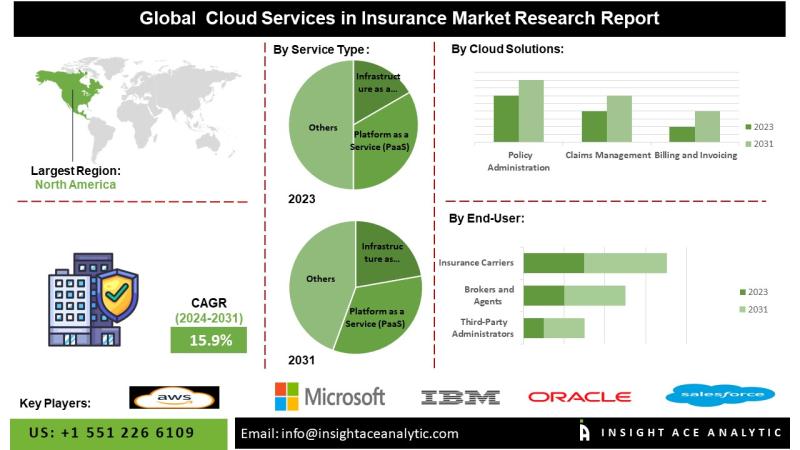

Cloud Services in Insurance Market to Record an Exponential CAGR by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Cloud Services in Insurance Market - (By Service Type (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS)), By Cloud Solutions (Policy Administration,

Claims Management, Billing and Invoicing, Customer Relationship Management (CRM), and Risk Management), By End User (Insurance Carriers, Brokers and Agents, and Third-Party Administrators)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

According to the latest research by InsightAce Analytic, the Global Cloud Services in Insurance Market is predictable to expand with a CAGR of 15.9% during the forecast period of 2024-2031.

Cloud Computing: Transforming the Insurance Industry

Cloud computing is revolutionizing the insurance sector, paving the way for more adaptable, customer-centric, and data-driven operations. As the insurance landscape undergoes rapid change, cloud technology empowers insurers to enhance services, streamline processes, and gain a competitive edge.

This transformation is driven by the adoption of cloud-based services, encompassing software, storage, data analytics, and infrastructure. These services are acquired from external providers, offering significant advantages for insurance companies:

• Enhanced Customer Experience: Cloud computing enables insurers to cater to the growing demand for personalized experiences.

• Improved Disaster Recovery and Business Continuity: Cloud services ensure continued operation during disruptions, allowing insurers to remain compliant with regulations.

• Reduced Costs: By eliminating the need for physical servers and their associated maintenance, insurance companies can achieve significant cost savings.

• Scalability and Flexibility: Cloud solutions offer a pay-as-you-go model, enabling insurers to scale resources based on their specific needs.

• Remote Access and Collaboration: Cloud-based solutions facilitate remote access to data and applications, fostering collaboration and improving customer service.

However, the path forward is not without challenges. The market faces potential hurdles such as:

• High Computational Needs: Implementing and utilizing cloud solutions may necessitate significant computational resources.

• Development Costs: The initial development and deployment of cloud-based solutions can be expensive.

• Regulatory and Ethical Considerations: Stringent regulations and ethical considerations surrounding data privacy could restrict market growth.

Despite these challenges, the potential benefits of cloud computing are undeniable. By embracing innovative cloud solutions, insurance companies can unlock a future of efficiency, agility, and a superior customer experience.

Request for free Sample Pages: https://www.insightaceanalytic.com/request-sample/2394

List of Prominent Players in the Cloud Services in Insurance Market:

• Amazon Web Services (AWS)

• Microsoft Corporation

• IBM Corporation

• Oracle Corporation

• Salesforce

• SAP SE

• Cisco Systems, Inc.

• Dell Technologies Inc.

• Google Cloud

• DataRobot Inc.

• Zest AI

• Other Prominent Players

Market Dynamics:

Drivers-

The worldwide insurance industry fuels the growing demand for cloud services in the insurance market because insurance companies increasingly turn to more advanced cloud services for their solutions to meet regulatory requirements and improve claims processing, underwriting, and pricing.

Also, insurance companies can easily handle changes in workload without overprovisioning because of the scalability of cloud services, which allows them to adapt resources to demand. The market, propelled by various factors such as innovation toward better, more efficient, and customer-focused services, will drive demand for cloud services in the insurance market.

Challenges:

The prime challenge is a high cost and requires specialized knowledge, which is predicted to slow the growth of cloud services in the insurance market. Cloud infrastructure requires a considerable upfront expenditure, particularly for large-scale implementations. Risks associated with implementing strong cybersecurity measures, moving data and systems to the cloud, and integrating different services must be covered by insurers.

Smaller insurance organizations may find these charges particularly difficult due to their limited budgets. In addition, adopting cloud service in insurance also necessitates industry-specific expertise. Still, there is a need for more specialized knowledge experts in this industry, challenging market growth in the coming years.

Regional Trends:

The North American cloud services in the insurance market are anticipated to register a major market share in revenue. It is projected to grow at a high CAGR in the near future because the area is ideal for digital transformation. After all, it has a well-developed insurance industry, a robust presence of big insurance companies, and sophisticated customers.

Businesses, especially insurance firms, are adopting sophisticated technologies like artificial intelligence and cloud computing at a significant rate due to the demand for increased customer service for insurance. In addition, insurers are among the many businesses that are quickly adopting new technology to improve customer service and operational efficiency. Besides, Europe had a substantial market share because of a rise in the middle class, which is driving up demand for insurance services.

The speed at which technology is developing and becoming more digitalized is pushing insurance businesses to use cloud-based solutions to provide unique, practical, and individualized insurance services that can be accessed through digital platforms.

Curious About This Latest Version Of The Report? Enquiry Before Buying: https://www.insightaceanalytic.com/enquiry-before-buying/2394

Recent Developments:

• In Feb 2024, Oracle Exadata Database Service has been chosen by Max Life Insurance to facilitate its exponential expansion. In addition, Max Life implemented an OCI migration for its fundamental systems, encompassing marketing, customer service, claims management, and policy issuance. An increase of as much as 70 percent was observed in application performance as a consequence of this migration.

• In Oct 2023,

completed the acquisition of ON Service GROUP, a well-established provider of insurance operations-focused business process services. The breadth of given delivered to clients in Germany for insurance business processes, including policy administration and sales, was expanded through the acquisition of ON Service GROUP, which bolstered capabilities in insurance operations. capability to oversee the complete process chain was fortified as a result of the acquisition, allowing clients to enhance operational efficiency, increase flexibility, and stimulate expansion via digital services.

Segmentation of Cloud Services in the Insurance Market-

By Service Type-

• Infrastructure as a Service (IaaS)

• Platform as a Service (PaaS)

• Software as a Service (SaaS)

By Cloud Solutions-

• Policy Administration

• Claims Management

• Billing and Invoicing

• Customer Relationship Management (CRM)

• Risk Management

By End-User-

• Insurance Carriers

• Brokers & Agents

• Third-Party Administrators

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of the Middle East and Africa

For More Customization @ https://www.insightaceanalytic.com/customisation/2394

Contact Us:

InsightAce Analytic Pvt. Ltd.

Tel.: +1 718 593 4405

Email: info@insightaceanalytic.com

Site Visit: www.insightaceanalytic.com

Follow Us on LinkedIn @ bit.ly/2tBXsgS

Follow Us On Facebook @ bit.ly/2H9jnDZ

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions.

Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses.

We help clients gain a competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets, and repositioning products.

Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cloud Services in Insurance Market Unlocking Potential: Cloud Services Driving Customer-Centric Insurance here

News-ID: 3569157 • Views: …

More Releases from InsightAce Analytic Pvt.Ltd

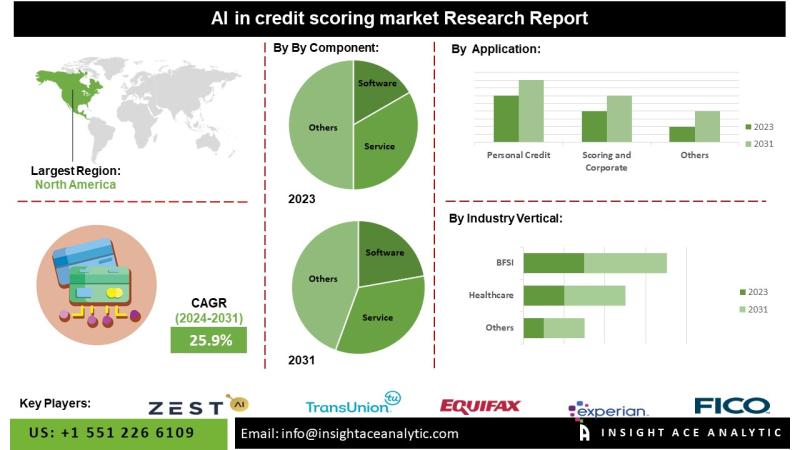

AI In The Credit-Scoring Market Smarter Credit Decisions: How AI is Transforming …

AI In The Credit-Scoring Market to Record an Exponential CAGR by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global AI In The Credit-Scoring Market - (By Component (Software and Service), By Application (Personal Credit Scoring and Corporate Credit Scoring), By Industry Vertical (BFSI (Banking, Financial Services, Insurance), Retail, Healthcare,

Telecommunications, Utilities, and Real Estate)), Trends,…

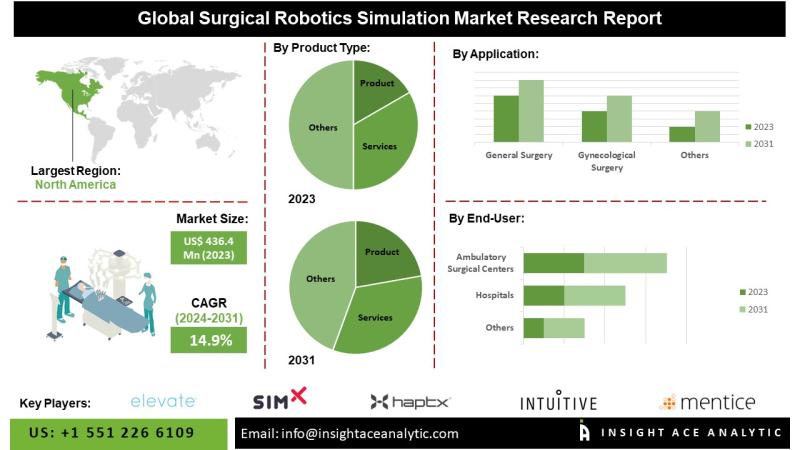

Surgical Robotics Simulation Market Guiding the Next Generation of Surgeons: Gro …

Surgical Robotics Simulation Market Worth $1,283.6 Mn by 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Surgical Robotics Simulation Market Size, Share & Trends Analysis Report By Product Type (Product, Services), By Application (General Surgery, Gynecological Surgery, Urological Surgery, Neurological Surgery (Head and Neck Surgery), Cardiological Surgery, Orthopedic Surgery, Others), By End User (Hospitals, Ambulatory Surgical Centers,…

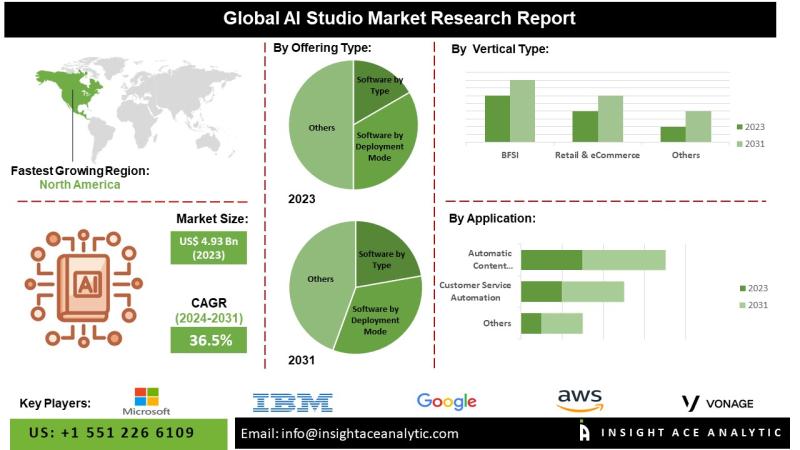

AI Studio Market Accelerating Innovation: The Benefits of AI Studios for Busines …

Global AI Studio Market Worth $57.89 Bn by 2031 - Exclusive Report by InsightAce Analytic Pvt. Ltd.

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global AI Studio Market- (By Application (Sentiment Analysis, Customer Service Automation, Image Classification & Labelling, Synthetic Data Generation, Predictive Modelling & Forecasting, Automatic Content Generation, and Others), By Offering, By Vertical, By Region, Trends, Industry Competition Analysis, Revenue and Forecast…

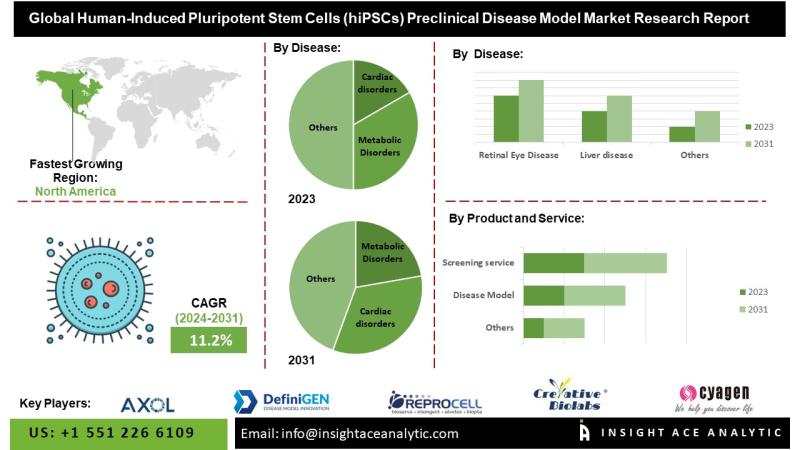

Human-Induced Pluripotent Stem Cells (hiPSCs) Preclinical Disease Model Market G …

Global Human-Induced Pluripotent Stem Cells (hiPSCs) Preclinical Disease Model Market to Record an Exponential CAGR by 2031 - Exclusive Report by InsightAce Analytic

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Human-Induced Pluripotent Stem Cells (hiPSCs) Preclinical Disease Model Market- (Disease (Neurological Disorders and Dystrophies, Cardiac disorders, Retinal Eye Disease, Metabolic Disorders, Liver disease, Others), Products and Services (Disease Model,

Reprogramming service, Differentiation…

More Releases for Cloud

Government Service Cloud Market SWOT Analysis by Leading Key Players: Google Clo …

HTF MI just released the Global Government Service Cloud Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major companies profiled in Government Service Cloud Market are:

Amazon Web…

Cloud Model Hosting Platform Market Size, Status, Global Outlook 2025 To 2033 | …

New Jersey, United States: The latest research study by Infinity Business Insights, titled 'Global Cloud Model Hosting Platform Market,' 118 analysis on business strategies adopted by key and emerging industry players. It provides insights into current market developments, trends, technologies, drivers, opportunities, and overall market outlook. Understanding various segments is crucial for identifying the factors that drive market growth. Some of the major companies featured in this report include Amazon Web…

AI Supercomputing Cloud Market to Witness Huge Growth by 2029 | AWS, Oracle, Mic …

The AI Supercomputing Cloud Market a detailed study added to provide most recent insights about critical reports of the Global AI Supercomputing Cloud market. This report provides a detailed overview of key factors in the AI Supercomputing Cloud Market and factors such as driver, limitation, past and current trends, guiding scenarios, and technology development. In addition, AI Supercomputing Cloud Market attractiveness according to country, end-user, and other measures is also…

Open Cloud Services Market Size in 2023 To 2029 | Google Cloud - T-Systems - IBM …

The Open Cloud Services market report includes market-driving factors, major obstacles, and restraining factors impeding market growth. The report assists existing manufacturers and start-ups in developing strategies to combat challenges and capitalize on lucrative opportunities to gain a foothold in the global market. Moreover, the report provides thorough information about prime end-users and annual forecast during an estimated period.

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐅𝐫𝐞𝐞 𝐏𝐃𝐅 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 + 𝐃𝐞𝐭𝐚𝐢𝐥𝐞𝐝 𝐓𝐎𝐂 ➡️ https://www.reportsnreports.com/contacts/requestsample.aspx?name=6778415

𝐋𝐞𝐚𝐝𝐢𝐧𝐠 𝐩𝐥𝐚𝐲𝐞𝐫𝐬 𝐩𝐫𝐨𝐟𝐢𝐥𝐞𝐝…

Mini Program Development Services Market Size in 2023 To 2029 | Tencent Cloud, A …

The Mini Program Development Services market report provides valuable insights for new entrants and stakeholders, offering a comprehensive understanding of market dynamics. It analyzes the competitive landscape and future market scenarios using tools like Porter's five forces and parent/peer market analysis. The report evaluates the product portfolios and services of key market players in detail. It also examines the impact of government regulations during the Covid-19 pandemic and provides market…

Customized Cloud Service Market May See a Big Move | IBM Cloud, Oracle Cloud, Al …

Global Customized Cloud Service Market Growth (Status and Outlook) 2023-2029 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Global Customized Cloud Service Market. Some of the key players profiled in the study are Google…