Press release

Future Prospects of the Retail Banking Service Market: Competitive Landscape and Trend Analysis

The Retail banking service market report offers a comprehensive study on the global market size & forecast, segmental splits, and further classification into regional & country-level. Furthermore, it highlights the market dynamics & trends, Porters' five force analysis, competitive landscape, and market share analysis.Request Sample Report at: https://www.alliedmarketresearch.com/request-toc-and-sample/A115170

The retail banking service market is experiencing significant growth driven by several key factors, including technological advancements, changing consumer preferences, and increased regulatory demands. One of the primary drivers of this growth is the rapid digital transformation within the banking sector. Banks are increasingly adopting digital channels, such as mobile and online banking, to enhance customer experience and streamline operations. The integration of advanced technologies like artificial intelligence (AI), machine learning, and blockchain is also revolutionizing retail banking by providing personalized services, improving risk management, and enhancing security.

Digital Transformation and Innovation

Digital transformation is at the heart of the retail banking service market's growth. Consumers are demanding more convenient and efficient ways to manage their finances, leading to a surge in the adoption of digital banking solutions. Mobile banking apps, online banking platforms, and digital wallets are becoming ubiquitous, allowing customers to perform a wide range of banking activities from their smartphones or computers. Additionally, the rise of fintech companies is pushing traditional banks to innovate and collaborate with tech firms to offer more competitive and customer-centric services.

Regulatory and Security Developments

The regulatory landscape is also shaping the growth of the retail banking service market. Governments and regulatory bodies worldwide are implementing stricter regulations to ensure the stability and security of the financial system. Compliance with these regulations is driving banks to invest in robust security measures and advanced compliance solutions. Cybersecurity is a critical focus area, with banks deploying cutting-edge technologies to protect customer data and prevent fraud. These efforts not only enhance customer trust but also contribute to the overall growth of the market.

For Report Customization: https://www.alliedmarketresearch.com/request-for-customization/A115170

Market Expansion and Customer Focus

The retail banking service market is expanding globally, with emerging economies presenting significant growth opportunities. In regions such as Asia-Pacific, Latin America, and Africa, increasing financial inclusion efforts and rising middle-class populations are driving the demand for retail banking services. Banks are focusing on delivering tailored solutions to meet the specific needs of diverse customer segments. Enhanced customer experience, personalized products, and seamless multi-channel services are becoming key differentiators for banks seeking to capture market share.

Segmental Outlook

The global Retail banking service market is segmented based on by types, by applications. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Spain, Italy, and rest of Europe), Asia-Pacific (China, Japan, Australia, South Korea, India, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

By Types:

1. Traditional Retail Banking: Includes in-person banking services offered at physical bank branches. Services typically include checking and savings accounts, personal loans, mortgages, and other conventional banking products.

2. Digital Retail Banking: Encompasses online and mobile banking services. This segment is growing rapidly due to the increasing preference for digital solutions and the convenience they offer. Services include online account management, mobile check deposit, digital payments, and financial planning tools.

By Applications:

1. Personal Banking: Focused on individual customers, providing services such as personal accounts, personal loans, mortgages, credit cards, and other financial products tailored for personal use.

2. Small and Medium-sized Enterprises (SMEs) Banking: Targets small and medium-sized businesses, offering business accounts, business loans, credit facilities, cash management, and other financial services designed to meet the needs of SMEs.

3. Corporate Banking: Caters to large corporations, offering a range of services including corporate loans, treasury and cash management, commercial real estate financing, and corporate investment services.

Buy Now & Get Exclusive Report at: https://www.alliedmarketresearch.com/retail-banking-service-market/purchase-options

Region-wise:

1. North America: Dominated by well-established financial institutions, the market here is mature with a high level of adoption of digital banking services. The United States and Canada are the major markets in this region.

2. Europe: Characterized by a mix of traditional and digital banking, with significant growth in digital banking adoption. The United Kingdom, Germany, France, and Italy are key markets.

3. Asia-Pacific: Exhibits rapid growth, driven by increasing digital banking penetration and a large unbanked population moving towards formal banking systems. Major markets include China, India, Japan, and Australia.

4. Latin America: Witnessing growth due to improving financial inclusion and increasing adoption of digital banking. Brazil, Mexico, and Argentina are the leading markets.

5. Middle East and Africa: Growing market with significant potential for expansion in digital banking due to the high mobile phone penetration and a young population. Key markets include the UAE, Saudi Arabia, South Africa, and Nigeria.

The segmental analysis includes real-time and forecast in both qualitative and quantitative terms. This helps clients understand the most lucrative segments for investors to capitalize on in the market.

Access the full summary at:

https://www.alliedmarketresearch.com/retail-banking-service-market-A115170

Competitive Scenario

The report includes an in-depth analysis of the major market players operating across the globe, along with an outlook on top player positioning. Furthermore, the report focuses on developmental strategies such as mergers & acquisitions, product/service launches, and collaborations adopted by the market players to maintain and enhance their foothold in the market.

Key players identified in this report are Allied Irish Bank (UK) Aldermore Bank Bank Of Ireland UK Close Brothers The Co-Operative Bank Cybg (Clydesdale And Yorkshire Banks) First Direct Handelsbanken Masthaven Bank Metro Bank Onesavings Bank Paragon Bank Secure Trust Bank Shawbrook Bank TSB.

Inquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/A115170

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, Europe, or Asia.

If you have special requirements, please tell us, and we will offer you the report as per your requirements.

Lastly, this report provides market intelligence most comprehensively. The report structure has been kept such that it offers maximum business value. It provides critical insights into the market dynamics and will enable strategic decision-making for the existing market players as well as those willing to enter the market.

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll-Free: 1-800-792-5285

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow Us on: LinkedIn Twitter

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP, based in Portland, Oregon. AMR provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domains.

AMR launched its user-based online library of reports and company profiles, Avenue. An e-access library is accessible from any device, anywhere, and at any time for entrepreneurs, stakeholders, researchers, and students at universities. With reports on more than 60,000 niche markets with data comprising 600,000 pages along with company profiles on more than 12,000 firms, Avenue offers access to the entire repository of information through subscriptions. A hassle-free solution to clients' requirements is complemented with analyst support and customization requests.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Future Prospects of the Retail Banking Service Market: Competitive Landscape and Trend Analysis here

News-ID: 3567313 • Views: …

More Releases from Allied Market Research

Autonomous Aircraft Radars & Transponders Market Overview, Size, Share, Top Comp …

The global autonomous aircraft radars & transponders market is experiencing a significant growth due to increasing procurement of autonomous UAVs globally. Autonomous aircraft is a fully automated manned or unmanned aircraft that require minimum or no human intervention in its operations. Autonomous aircrafts radars & transponders are equipped with technology to provide situational awareness, cooperative surveillance, extended squitter message, and autonomous navigation, among others. However, installation of such system on…

Autonomous Aircraft Radars & Transponders Market Overview, Size, Share, Top Comp …

The global autonomous aircraft radars & transponders market is experiencing a significant growth due to increasing procurement of autonomous UAVs globally. Autonomous aircraft is a fully automated manned or unmanned aircraft that require minimum or no human intervention in its operations. Autonomous aircrafts radars & transponders are equipped with technology to provide situational awareness, cooperative surveillance, extended squitter message, and autonomous navigation, among others. However, installation of such system on…

Indoor Farming Equipment Market Outlook, Top Key Players Analysis, Current Trend …

The report highlights numerous factors that influence the growth of the global Indoor farming equipment market such as market demand & forecast and qualitative and quantitative information. The qualitative data of market report includes pricing analysis, key regulations, macroeconomic factors, microeconomic factors, key impacting factors, company share analysis, market dynamics & challenges, strategic growth initiatives, and competition intelligence. The study cracks market demand in 15+ high-growth markets in the…

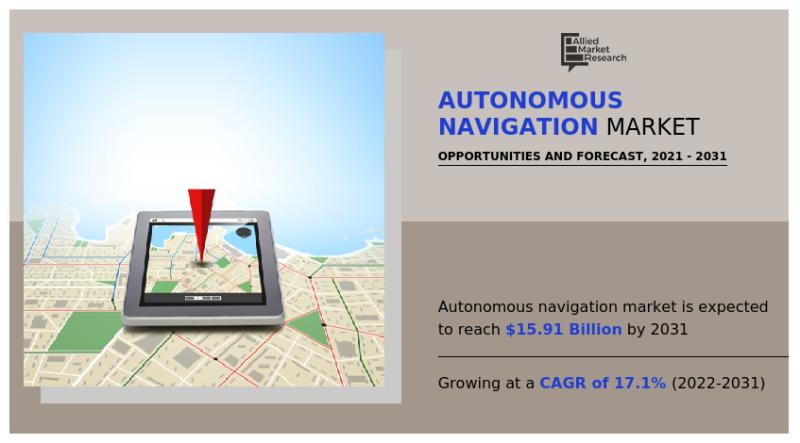

Autonomous Navigation Market Analysis and Forecast with a CAGR of 17.1% (2022-20 …

The global autonomous navigation market garnered $3.27 billion in 2021, and is estimated to generate $15.91 billion by 2031, manifesting a CAGR of 17.1% from 2022 to 2031.

Increase in demand for sense & avoid systems in autonomous system, rise in adoption of autonomous robot in commercial & military applications, and surge in demand for real-time data in military applications drive the growth of the global autonomous navigation market. During…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…