Press release

Fixed Income Asset Management Market: Detailed Analysis of $104,950.94 Billion, Size, Growth Outlook, Key Trends, and Competitive Landscape Driving Market Dynamics

The new report published by The Business Research Company, titled "Fixed Income Asset Management Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033", delivers an in-depth analysis of the leading size and forecasts, investment opportunities, winning strategies, market drivers and trends, competitive landscape, and evolving market trends.As per the report, the fixed income asset management market size has grown strongly in recent years. It will grow from $64,200.12 billion in 2023 to $70,684.63 billion in 2024 at a compound annual growth rate (CAGR) of 10.1%. The fixed income asset management market size is expected to see strong growth in the next few years. It will grow to $104,950.94 billion in 2028 at a compound annual growth rate (CAGR) of 10.4%.

Download Free Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=14714&type=smp

Rising Demand For Income Investments Fuels Growth In The Fixed Income Asset Management Market

The increasing demand for income investments is expected to propel the growth of the fixed-income asset management market going forward. Income investments refer to financial assets or securities primarily acquired to generate regular income rather than capital appreciation. Investors seek income investments due to a growing preference for stable returns and regular cash flow in an uncertain economic environment. Income investments are utilized in fixed-income asset management to construct portfolios focused on generating regular income streams through interest payments, dividends, and other distributions while seeking to preserve capital. For instance, in June 2021, according to the European Fund and Asset Management Association (EFAMA), a Belgium-based trade association representing the European investment management industry, in Q1 2021, the net assets of UCITS (Undertakings for the Collective Investment in Transferable Securities) surged by 5.6%, driven by robust stock market gains and net solid sales, while AIFs (Alternative Investment Funds) saw a growth of 2.6%. The combined net assets of UCITS and AIFs reached EUR 19.6 trillion (USD 21.4 trillion), marking a collective increase of 4.5%. Therefore, the increasing demand for income investments is driving the growth of the fixed-income asset management market.

Emergence Of Fixed Income Exchange-Traded Funds (ETFs) Transforming The Fixed Income Asset Management Market

Major companies operating in the fixed-income asset management market are developing innovative solutions, such as JPMorgan Active Bond ETF (JBND), to gain a competitive edge. JPMorgan Active Bond ETF (JBND)) are investment funds traded on stock exchanges, comprising a diversified portfolio of assets such as stocks, bonds, or commodities, designed to track the performance of a specific index or sector. For instance, in October 2023, J.P. Morgan Asset Management, a US-based financial services company, launched a new actively managed fixed-income ETF called JPMorgan Active Bond ETF (JBND) on the NYSE Arca. JBND adopts a bottom-up, value-oriented strategy that primarily focuses on delivering value to investors. The approach places significant importance on security selection, aiming to optimize total return through investments primarily in a well-diversified portfolio of intermediate- and long-term debt securities. JBND specifically emphasizes securitized debt within its investment strategy. The overarching goal is to outperform the Bloomberg US Aggregate Bond Index over a three- to five-year market cycle.

The fixed income asset management market covered in this report is segmented -

1) By Asset Class: Government Bonds, Corporate Bonds, Municipal Bonds, Mortgage-Backed Securities, Asset-Backed Securities, High-Yield Bonds, Other Asset Classes

2) By Investment Strategy: Core Fixed Income, Active Fixed Income, Passive Fixed Income

3) By End User: Institutional Investors, Retail Investors

Buy Now & Get Exclusive Discount on this Report, Checkout link @

https://www.thebusinessresearchcompany.com/Discount?id=14714&type=discount

Major companies operating in the fixed income asset management market are JPMorgan Chase and Co., International Business Machines Corporation (IBM), Goldman Sachs Group Inc., Oracle Corporation, State Bank of India (SBI), ABB Ltd., Fidelity Investments, BlackRock Inc., Adobe Inc., Housing Development Finance Corporation Ltd., State Street Global Advisors, Franklin Resources Inc., Axis Bank Ltd., The Vanguard Group, T. Rowe Price Group Inc., Invesco Ltd., Synaptics Inc., Wellington Management Company LLP, Oppenheimer Holdings Inc., Pacific Investment Management Company LLC (PIMCO), IDFC Ltd., Evergreen Investments LLC

Contents of the report:

1. Executive Summary

2. Fixed Income Asset Management Market Report Structure

3. Fixed Income Asset Management Market Trends And Strategies

4. Fixed Income Asset Management Market - Macro Economic Scenario

5. Fixed Income Asset Management Market Size And Growth

…..

27. Fixed Income Asset Management Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Explore the report store to make a direct purchase of the report @ https://www.thebusinessresearchcompany.com/report/fixed-income-asset-management-global-market-report

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fixed Income Asset Management Market: Detailed Analysis of $104,950.94 Billion, Size, Growth Outlook, Key Trends, and Competitive Landscape Driving Market Dynamics here

News-ID: 3566169 • Views: …

More Releases from The Business research company

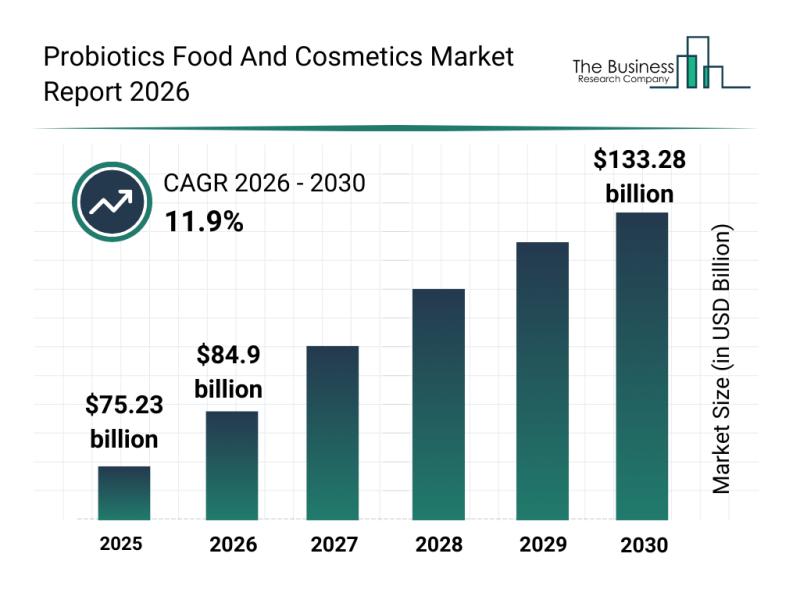

Outlook on the Probiotics Food and Cosmetics Market: Major Segments, Strategic D …

The probiotics food and cosmetics sector is on the brink of significant expansion, driven by increasing consumer awareness and innovative product developments. As wellness trends continue to evolve, this market is set to experience remarkable growth, presenting vast opportunities for manufacturers and retailers alike. Here, we explore the market's expected size, key players, emerging trends, and detailed segmentation.

Projected Market Size and Growth Trends in the Probiotics Food and Cosmetics Market…

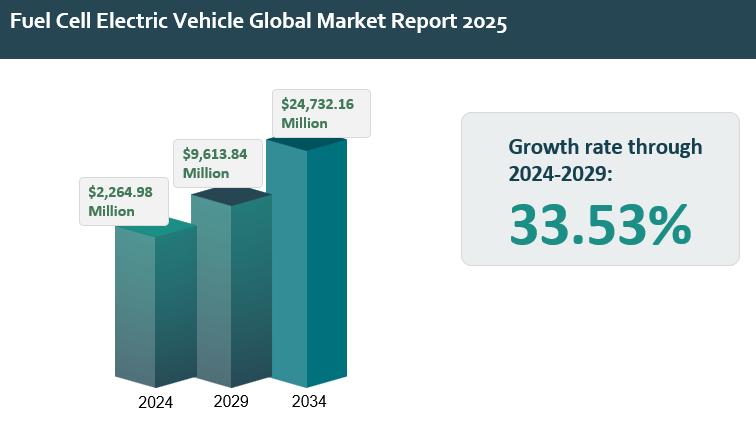

Global Fuel Cell Electric Vehicle Market Outlook 2025-2034: Growth Acceleration, …

The fuel cell electric vehicle report outlines and analyzes the fuel cell electric vehicle market, covering the historic period 2019-2024 and the forecast periods 2024-2029 and 2034F. The report assesses the market across regions and the major economies within each region.

The global fuel cell electric vehicle market was valued at $2.26498 billion in 2024, increasing at a CAGR of 6.88% since 2019. The market is projected to rise from $2.26498…

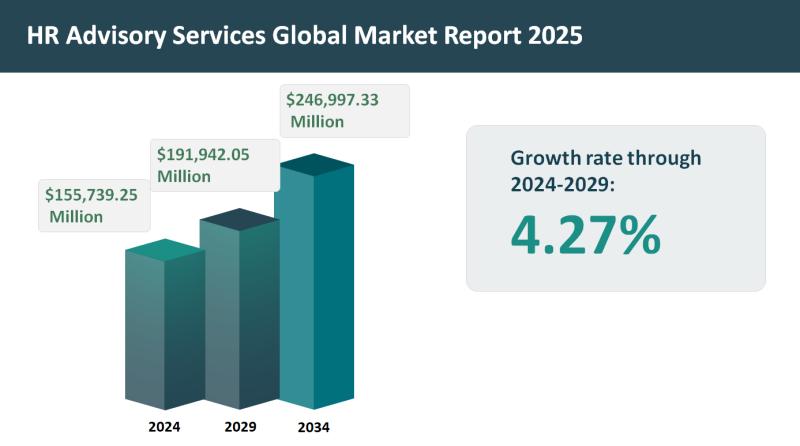

Global HR Advisory Services Market Set for 4.27% Growth, Projected to Reach $191 …

The HR advisory services report outlines and analyzes the HR advisory services market across 2019-2024 (historic period) and 2024-2029, 2034F (forecast period). It examines market performance across global regions and key economies.

The global HR advisory services market was valued at approximately $155.73925 billion in 2024, increasing at a CAGR of 4.22% since 2019. The market is anticipated to rise from $155.73925 billion in 2024 to $191.94205 billion in 2029, reflecting…

Evolving Market Trends In The Integrated Geophysical Services Industry: Enhancin …

The Integrated Geophysical Services Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Integrated Geophysical Services Market Size During the Forecast Period?

The integrated geophysical services market has experienced consistent growth in recent years, expected to rise from $2.35 billion in 2024 to…

More Releases for Income

Chris Patterson Retirement Income Strategist, Interviewed on the Influential Ent …

Image: https://authoritypresswire.com/wp-content/uploads/2024/09/Chris_Patterson__1_-removebg-preview.png

Chris Patterson discusses the role of annuities in retirement income strategies

Listen to the interview on the Business Innovators Radio Network: Interview With Chris Patterson, Retirement Income Strategist Discussing Annuities & Income Planning - Business Innovators Radio Network [https://businessinnovatorsradio.com/interview-with-chris-patterson-retirement-income-strategist-discussing-annuities-income-planning/]

Annuities play a crucial role in income planning for retirees by offering several key benefits. Firstly, they provide guaranteed lifetime income, ensuring a steady stream of income throughout retirement regardless of market…

Sophie Howard's Kindle Publishing Income Program Opens Passive Income Opportunit …

Image: https://www.getnews.info/wp-content/uploads/2024/08/1723523441.png

A proven pathway to success with expert guidance, comprehensive support, and a thriving community of aspiring authors.

Sophie Howard, a bestselling author and seven-figure digital entrepreneur, is offering aspiring entrepreneurs and authors an opportunity to potentially create a profitable income stream through her comprehensive online training program. For years, Howard and her Kindle Publishing Income team have helped individuals build successful businesses as Amazon Kindle publishers, leveraging her extensive experience…

All Roads Leads to Income: How Guaranteed Lifetime Income Can Transform Retireme …

The Vital Role of Guaranteed Income in Modern Retirement Planning

In today's economic climate, the classic pension plan is becoming a relic of the past, yet the necessity for reliable retirement income has never waned. As we navigate longer lifespans and the unpredictability of investment returns, the retirement phase-particularly the distribution or "decumulation" phase-presents a significant challenge. This is where the concept of guaranteed lifetime income steps in, offering a promising…

Yalla Group's net income increased by 56.2% in Q1, with a net income margin of 3 …

Yalla Group (NYSE: YALA [https://www.talkmarkets.com/symbol/YALA]) delivered an impressive scorecard in Q1 2024. Its revenues of $78.7 million approached the upper limit of the company's guidance range, while the net profit margin escalated substantially to 39.5%, marking a significant enhancement compared to the corresponding period of the prior year.

Intro:

Yalla Group primarily offers voice-centric group chat platform, and casual gaming application featuring online versions of board games, popular in MENA (Middle East…

Free Appliances For Low Income Families

How To Get Appliances For Low Income Families is a guide for those who want to buy or rent appliances for their low-income families. This guide will cover the different types of appliances, what to look for when selection, budgeting and more. Trendsnbest is a non-profit organization that assists low-income families, individuals with low incomes who are in need, and children from low-income families . Trendsnbest is a non-profit organization…

Making Money With Residential Income Properties

LOS ANGELES, CA. You have heard time and time again “If I only had purchased that rental property, I would be worth millions today”. Years ago, I discovered that real estate was the best investment to control risk and create wealth. The Real Estate Digest reports that seven out of ten millionaires made their money in real estate, and Forbes magazine states that there is a three times greater chance…