Press release

Motor Insurance Industry to Witness Massive Growth (2024-2031) | Allianz SE, PICC Property & Casualty Co. Ltd, Zurich Insurance Group AG, AIA Group Ltd

DataM Intelligence has published a new research report on "Motor Insurance Market Size 2024". The report explores comprehensive and insightful Information about various key factors like Regional Growth, Segmentation, CAGR, Business Revenue Status of Top Key Players and Drivers. The purpose of this report is to provide a telescopic view of the current market size by value and volume, opportunities, and development status.Get a Free Sample Research PDF - https://datamintelligence.com/download-sample/motor-insurance-market

The Motor Insurance market report majorly focuses on market trends, historical growth rates, technologies, and the changing investment structure. Additionally, the report shows the latest market insights, increasing growth opportunities, business strategies, and growth plans adopted by major players. Moreover, it contains an analysis of current market dynamics, future developments, and Porter's Five Forces Analysis.

The motor insurance market involves the provision of insurance coverage for vehicles against risks such as accidents, theft, natural disasters, and third-party liability. It encompasses various types of policies including comprehensive, third-party, and specialized coverages tailored to different vehicle types and usage scenarios. The market serves individual vehicle owners, commercial fleets, and rental companies, providing financial protection and legal compliance in case of unforeseen events. Factors driving the market include increasing vehicle ownership, regulatory mandates, advancements in insurance technology (InsurTech), and the evolving landscape of risk management and customer preferences.

Forecast Growth Projected:

The Global Motor Insurance Market is anticipated to rise at a considerable rate during the forecast period, between 2024 and 2030. In 2023, the market is growing at a steady rate, and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

List of the Key Players in the Motor Insurance Market:

Allianz SE, PICC Property & Casualty Co. Ltd, Zurich Insurance Group AG, AIA Group Ltd, Assicurazioni Generali, Nationwide Mutual Insurance, Chubb Ltd, Liberty Mutual Insurance, Global Insurance Brokers Private Limited, American International Group

Segment Covered in the Motor Insurance Market:

By Vehicle Type (Passenger Cars, Commercial Vehicles (Light Commercial, Medium Commercial, Heavy Commercial), Two-Wheeler)

By Policy Type (Third-party Liability, Third-party Fire and Theft, Comprehensive)

Regional Analysis:

The global Motor Insurance Market report focuses on six major regions: North America, Latin America, Europe, Asia Pacific, the Middle East, and Africa.

Get Customization in the report as per your requierments: https://datamintelligence.com/customize/motor-insurance-market

Regional Analysis:

The global Motor Insurance Market report focuses on six major regions: North America, Latin America, Europe, Asia Pacific, the Middle East, and Africa. The report offers detailed insight into new product launches, new technology evolutions, innovative services, and ongoing R&D. The report discusses a qualitative and quantitative market analysis, including PEST analysis, SWOT analysis, and Porter's five force analysis. The Motor Insurance Market report also provides fundamental details such as raw material sources, distribution networks, methodologies, production capacities, industry supply chain, and product specifications.

Chapter Outline:

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of Motor Insurance manufacturers competitive landscape, revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product revenue, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Revenue of Motor Insurance in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Get a Free Sample PDF copy of the report @ https://datamintelligence.com/download-sample/motor-insurance-market

FAQs

How fast is the Motor Insurance Market growing?

The Motor Insurance Market will exhibit a CAGR of 4.9% during the forecast period, 2024-2031.

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Motor Insurance Industry to Witness Massive Growth (2024-2031) | Allianz SE, PICC Property & Casualty Co. Ltd, Zurich Insurance Group AG, AIA Group Ltd here

News-ID: 3563776 • Views: …

More Releases from DataM Intelligence

U.S. Radiopharmaceuticals Market to Reach USD 2.36 Billion by 2033, Growing at 6 …

The United States radiopharmaceuticals market was valued at USD 2.21 billion in 2024 and is projected to reach USD 2.36 billion by 2033, exhibiting a CAGR of 6.3% during the forecast period, according to DataM Intelligence. The market expansion is primarily fueled by the growing prevalence of chronic diseases such as cancer and cardiovascular disorders, advancements in diagnostic imaging, and regulatory support for nuclear medicine infrastructure. Radiopharmaceuticals play a pivotal…

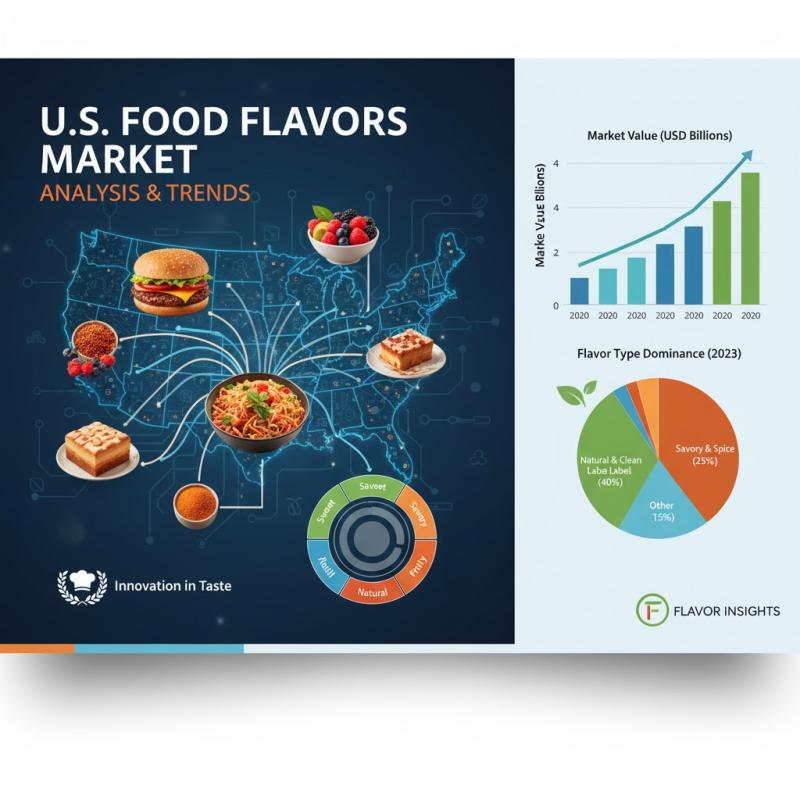

U.S. Food Flavors Market to Reach USD 6.1 Billion by 2033, Registering 5.2% CAGR …

The U.S. flavors market was valued at USD 3,887.7 million in 2024 and is projected to reach USD 6,108.4 million by 2033, growing at a CAGR of 5.2% during 2025-2033, according to DataM Intelligence. The market's growth is driven by surging demand for processed foods, global flavor innovation, and increasing consumer preference for natural, clean-label, and wellness-oriented products. Flavors continue to play a vital role in enhancing the sensory experience…

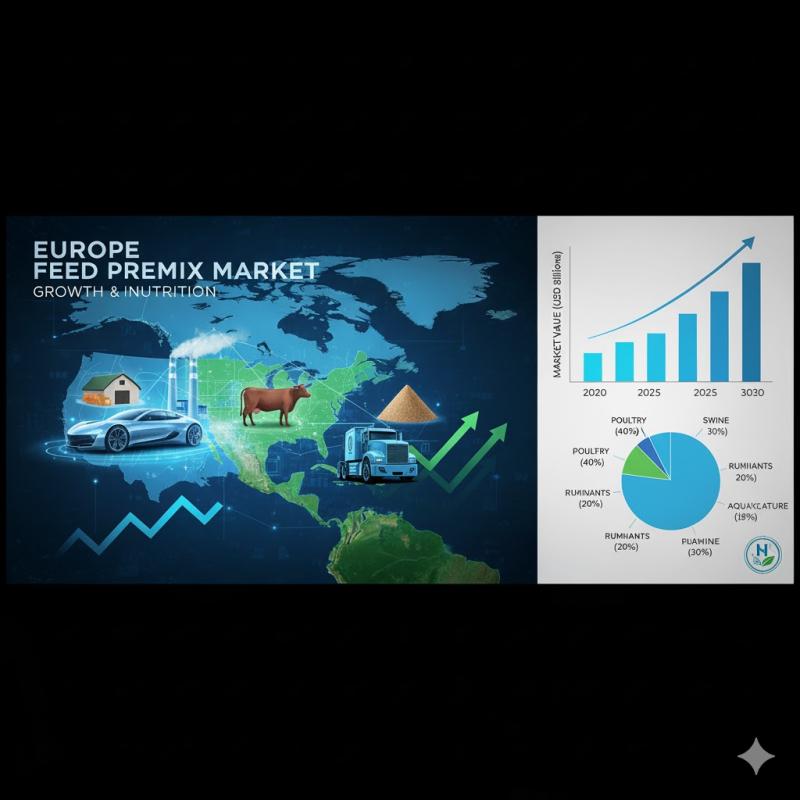

Europe Feed Premix Market to Reach USD 7.31 Billion by 2030, Growing at a 4.32% …

The Europe Feed Premix Market is estimated to grow from USD 5.92 billion in 2025 to USD 7.31 billion by 2030, registering a CAGR of 4.32% during the forecast period, according to DataM Intelligence. The market's growth is driven by increasing demand for nutrient-rich animal feed formulations, expanding livestock production, and a rising preference for high-quality, antibiotic-free animal products. Feed premixes-comprising essential vitamins, minerals, amino acids, and other additives-are vital…

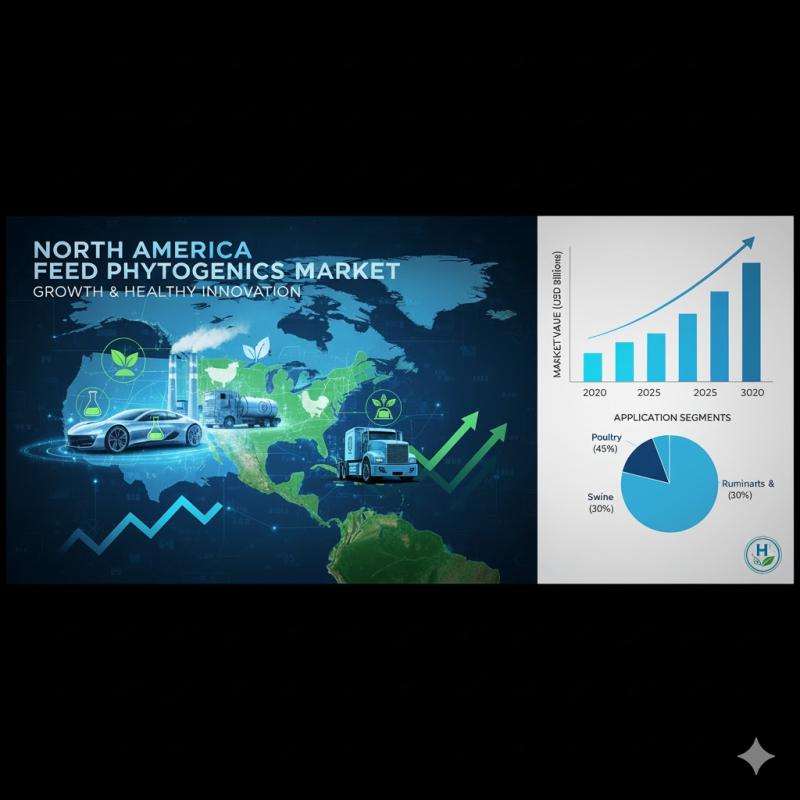

North America Feed Phytogenics Market to Reach USD 500.6 Million by 2030, Growin …

The North America Feed Phytogenics Market is projected to grow from USD 383.10 million in 2025 to USD 500.60 million by 2030, at a CAGR of 5.5% during the forecast period, according to DataM Intelligence. The market is witnessing robust growth due to rising demand for high-quality animal-derived products and increasing regulatory restrictions on antibiotics in livestock production. As a result, plant-based feed solutions have gained widespread adoption for improving…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…