Press release

Algorithmic Trading Market Size & Share, Statistics Report 2024-2033

The new report published by The Business Research Company, titled Algorithmic Trading Software Global Market Report 2024 - Market Size, Trends, And Global Forecast 2024-2033, delivers an in-depth analysis of the leading size and forecasts, investment opportunities, winning strategies, market drivers and trends, competitive landscape, and evolving market trends.As per the report, the algorithmic trading software market size has grown strongly in recent years. It will grow from $2.28 billion in 2023 to $2.50 billion in 2024 at a compound annual growth rate (CAGR) of 9.7%. The algorithmic trading software market size is expected to see rapid growth in the next few years. It will grow to $3.66 billion in 2028 at a compound annual growth rate (CAGR) of 10%.

Download Free Sample Report @

https://www.thebusinessresearchcompany.com/sample.aspx?id=15305&type=smp

Market Liquidity Boosting Growth of Algorithmic Trading Software Market

The rising market liquidity is expected to propel the growth of the algorithmic trading software market going forward. Market liquidity refers to the process by which assets can be bought or sold in a market without causing significant price changes. The rise in market liquidity can be attributed to increased trading activity, improved market infrastructure, enhanced transparency, and regulatory reforms promoting market efficiency and facilitating faster and more efficient order execution. Algorithmic trading software relies on market liquidity to execute trades swiftly and efficiently. Market liquidity enables algorithmic traders to deploy various trading strategies, including market making, statistical arbitrage, trend following, and volatility trading. For instance, in August 2023, according to the International Monetary Fund, a US-based financial agency, trading volume by institutional investors in crypto exchanges surged over 1700% from around $25 billion to over $450 billion between the second quarters of 2020 and 2021. Therefore, the increasing market liquidity is driving the algorithmic trading software market.

Advancements In Algorithmic Trading Is Enhancing Trade Execution And Performance

Major companies operating in the algorithmic trading software market are focusing on developing generation algorithmic trading platforms. A next-generation algorithmic trading platform is an advanced software system designed to execute automated trading strategies in financial markets. For instance, in September 2022, Scotiabank, a Canada-based multinational banking and financial services company, collaborated with BestEx Research Group LLC, a US-based company that provides algorithmic trading solutions, launched a next-generation algorithmic trading platform. This platform features state-of-the-art technology explicitly tailored to meet the unique needs of Canadian market participants. The platform aims to provide Scotiabank clients with market-leading algorithmic execution quality and top-tier trading performance, leveraging research-driven logic to reduce costs for institutional investors. This cutting-edge platform, part of Scotiabank's suite of electronic trading products called ScotiaRED, offers state-of-the-art technology tailored to meet the unique needs of the Canadian equities market. The platform aims to provide institutional investors with a single-ticket order experience across the Americas, offering research-driven logic to reduce costs and deliver top-tier trading performance for clients.

The algorithmic trading software market covered in this report is segmented -

1) By Component: Solutions, Services

2) By Product: Algorithmic Trading Software, Algorithmic Trading Platforms

3) By Deployment: Cloud Based, On Premise

4) By Application: Investment Banks, Funds, Personal Investors, Other Application

Buy Now & Get Exclusive Discount on this Report, Checkout link @

https://www.thebusinessresearchcompany.com/Discount?id=15305&type=discount

Major companies operating in the algorithmic trading software market are AlgoTrader AG, Interactive Brokers LLC, Virtu Financial, Flow Traders Ltd., DRW Holdings LLC, TradeStation Group Inc., Tower Research Capital LLC, Hudson River Trading LLC, Jump Trading LLC, FlexTrade Systems Inc., NinjaTrader Group LLC, Trading Technologies International Inc., MetaQuotes Software Corp., Teza Technologies, RSJ Group, Quantlab Financial LLC , Tradebot Systems Inc, Tethys Technology Inc., IQBroker LLC, QuantRocket, Sierra Chart, QuantConnect Corporation, StockSharp, Wealth-Lab, Python Quants GmbH

Contents of the report:

1. Executive Summary

2. Algorithmic Trading Software Market Report Structure

3. Algorithmic Trading Software Market Trends And Strategies

4. Algorithmic Trading Software Market - Macro Economic Scenario

5. Algorithmic Trading Software Market Size And Growth

…..

27. Algorithmic Trading Software Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Explore the report store to make a direct purchase of the report @

https://www.thebusinessresearchcompany.com/report/algorithmic-trading-software-global-market-report

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Algorithmic Trading Market Size & Share, Statistics Report 2024-2033 here

News-ID: 3562911 • Views: …

More Releases from The Business research company

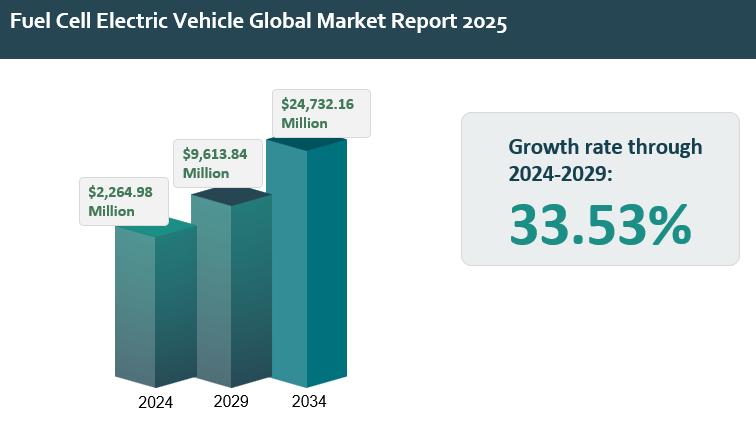

Global Fuel Cell Electric Vehicle Market Outlook 2025-2034: Growth Acceleration, …

The fuel cell electric vehicle report outlines and analyzes the fuel cell electric vehicle market, covering the historic period 2019-2024 and the forecast periods 2024-2029 and 2034F. The report assesses the market across regions and the major economies within each region.

The global fuel cell electric vehicle market was valued at $2.26498 billion in 2024, increasing at a CAGR of 6.88% since 2019. The market is projected to rise from $2.26498…

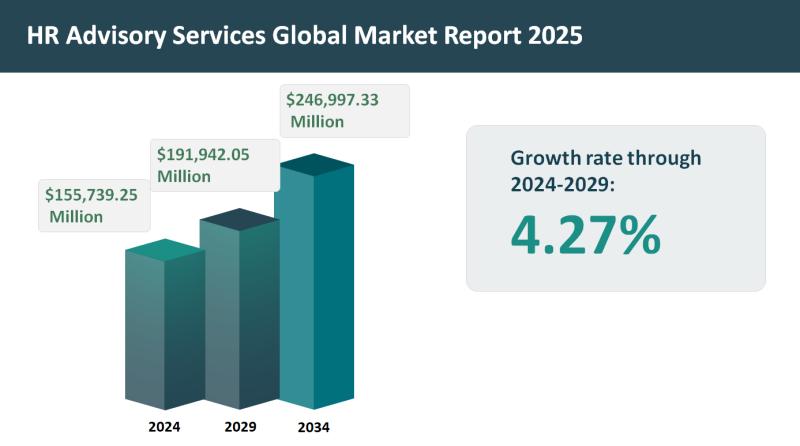

Global HR Advisory Services Market Set for 4.27% Growth, Projected to Reach $191 …

The HR advisory services report outlines and analyzes the HR advisory services market across 2019-2024 (historic period) and 2024-2029, 2034F (forecast period). It examines market performance across global regions and key economies.

The global HR advisory services market was valued at approximately $155.73925 billion in 2024, increasing at a CAGR of 4.22% since 2019. The market is anticipated to rise from $155.73925 billion in 2024 to $191.94205 billion in 2029, reflecting…

Evolving Market Trends In The Integrated Geophysical Services Industry: Enhancin …

The Integrated Geophysical Services Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Integrated Geophysical Services Market Size During the Forecast Period?

The integrated geophysical services market has experienced consistent growth in recent years, expected to rise from $2.35 billion in 2024 to…

Global HR Advisory Services Market: Key Trends, Market Share, Growth Drivers, An …

The HR advisory services market report describes and explains the HR advisory services market and covers 2019-2024, termed the historic period, and 2024-2029, 2034F termed the forecast period. The report evaluates the market across each region and for the major economies within each region.

The global HR advisory services market reached a value of nearly $155.74 billion in 2024, having grown at a compound annual growth rate (CAGR) of 4.22% since…

More Releases for Trading

Algorithmic Trading Market Showing Impressive Growth : Hudson River Trading, Jum …

The competitive landscape which incorporates the Algorithmic Trading Market ranking of the major players, along with new service/product launches, partnerships, business expansions and acquisitions in the past five years of companies profiled are also highlighted in the Algorithmic Trading Market report. Extensive company profiles comprising of company overview, company insights, product benchmarking and SWOT analysis for the major Algorithmic Trading Market players.

Top 10 key companies…

Increasing Awareness about Algorithmic Trading Market In Coming Years By Virtu F …

Global Algorithmic Trading Industry 2019 Research report provides information regarding market size, share, trends, growth, cost structure, capacity, revenue and forecast 2025. This report also includes the overall and comprehensive study of the Algorithmic Trading market with all its aspects influencing the growth of the market. This report is exhaustive quantitative analyses of the Algorithmic Trading industry and provides data for making Strategies to increase the market growth and effectiveness.

Algorithmic…

Algorithmic Trading Market 2024 SWOT Analysis by Key Players like Virtu Financia …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time. Algorithmic Trading are mainly used in investment banks, pension funds, mutual funds, hedge funds, etc.

Key trend which will predominantly effect the market in coming…

Automated Trading Market By Top Key Players- Citadel, KCG, Optiver, DRW Trading, …

The report "Automated Trading Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2016 - 2024", has been prepared based on an in-depth market analysis with inputs from industry experts.

An automated trading system, also referred to as mechanical trading system or algorithmic trading system, enables vendors to set up specific rules for money management, trade entries, and trade exits. Automated trading systems are generally programmed in a way…

Search4Research Announced Algorithmic Trading Market Forecast to 2024 - Virtu Fi …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time.

Algorithmic Trading Market provides a detail overview of latest technologies and in-depth analysis that reflect top vendor’s portfolios and technology; examines the strategic planning, challenges…

Algorithmic Trading Market 2019 | Flow Traders, Jump Trading, Spot Trading, DRW …

Global Algorithmic Trading market is also presented to the readers as a holistic snapshot of the competitive landscape within the given forecast period. The report also educates about the market strategies that are being adopted by your competitors and leading organizations. The report also focuses on all the recent industry trends. It presents a comparative detailed analysis of the all regional and player segments, offering readers a better knowledge of…