Press release

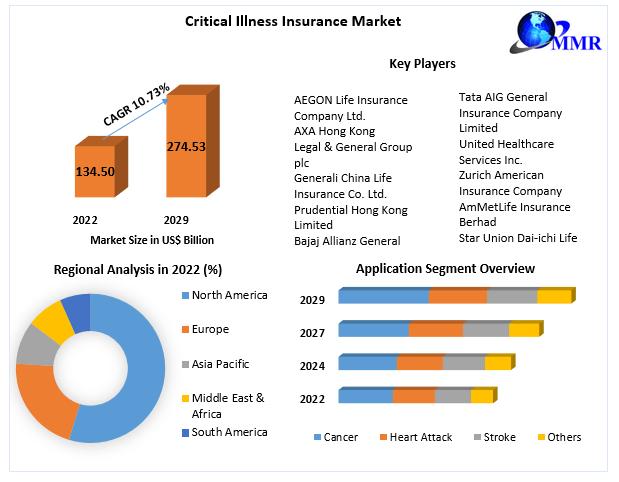

Critical Illness Insurance Market Demand Will Reach a Value of US$ 134.50 Billion by the Year 2029, At a CAGR of 10.73 percentage

Anticipated Growth in Revenue:Critical Illness Insurance Market size was valued at USD 134.50 Bn. in 2023 and the total Critical Illness Insurance revenue is expected to grow by 10.73% from 2023 to 2029

Critical Illness Insurance Market Overview:

The Critical Illness Insurance market provides financial protection to policyholders by offering lump-sum payments upon diagnosis of specified serious illnesses. This insurance type has gained traction globally due to rising healthcare costs and increasing prevalence of critical illnesses such as cancer, heart disease, and stroke. The market is characterized by diverse offerings tailored to meet varying consumer needs, including standalone policies and riders to existing life insurance plans. Factors such as aging populations, lifestyle changes, and advancements in medical diagnostics contribute to market growth. Insurers are expanding their product portfolios and enhancing policy features to attract a broader customer base, while regulatory frameworks play a crucial role in ensuring transparency and consumer protection within the market.

𝐔𝐧𝐥𝐨𝐜𝐤 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬: 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐚 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐨𝐟 𝐎𝐮𝐫 𝐋𝐚𝐭𝐞𝐬𝐭 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰: https://www.maximizemarketresearch.com/request-sample/126758/

Critical Illness Insurance Market Trends:

In the Critical Illness Insurance market, several notable trends are shaping its trajectory. One significant trend is the increasing customization of insurance products to cater to diverse consumer needs and preferences. Insurers are offering more flexible coverage options and additional benefits such as wellness programs and rehabilitation services to differentiate their offerings. Another key trend is the integration of technology to streamline insurance processes, from policy issuance to claims management, enhancing customer experience and operational efficiency. Moreover, there is a growing emphasis on preventative healthcare and early detection, with insurers promoting initiatives that encourage policyholders to adopt healthier lifestyles. Additionally, collaborations between insurers and healthcare providers are becoming more prevalent, aiming to improve access to specialized treatments and services for insured individuals facing critical illnesses.

What are Critical Illness Insurance Market Dynamics?

The Critical Illness Insurance market dynamics are driven by a combination of factors influencing its growth and evolution. Key drivers include rising healthcare costs and increasing awareness among individuals about the financial risks associated with critical illnesses such as cancer, heart disease, and stroke. As a result, there is growing demand for policies that provide lump-sum payouts upon diagnosis, offering financial security to policyholders and their families during challenging times. Insurers are responding by expanding their product portfolios and enhancing policy features to meet evolving consumer needs, including more comprehensive coverage and flexible payment options. Regulatory frameworks also play a crucial role in shaping market dynamics, ensuring transparency, and consumer protection. Additionally, advancements in medical technology and treatment options contribute to the market's development, influencing insurers' underwriting practices and claims management strategies.

𝐍𝐞𝐞𝐝 𝐌𝐨𝐫𝐞 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧? 𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐀𝐛𝐨𝐮𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 + 𝐆𝐫𝐚𝐩𝐡𝐬 𝐇𝐞𝐫𝐞: https://www.maximizemarketresearch.com/inquiry-before-buying/126758/

Critical Illness Insurance Market Opportunities:

The Critical Illness Insurance market presents significant opportunities driven by several key factors. One major opportunity lies in expanding market penetration globally, particularly in emerging economies where healthcare infrastructure and insurance penetration are growing. Insurers can capitalize on increasing consumer awareness about the importance of financial protection against critical illnesses, leveraging educational campaigns and targeted marketing strategies. Moreover, there is potential for innovation in product development, such as designing policies that cater to specific demographics or offering hybrid insurance solutions that combine critical illness coverage with other types of insurance. Additionally, partnerships with healthcare providers and digital platforms offer opportunities to enhance customer engagement and streamline insurance processes. As the market continues to evolve, embracing technological advancements and adapting to regulatory changes will be crucial in unlocking new growth avenues and improving overall market competitiveness.

What is Critical Illness Insurance Market Regional Insight?

The Critical Illness Insurance market exhibits diverse regional dynamics influenced by varying healthcare landscapes, socio-economic factors, and regulatory environments. In North America and Europe, mature markets dominate with high insurance penetration rates and comprehensive coverage options. These regions benefit from robust healthcare systems and increasing consumer awareness about critical illness risks, driving demand for supplementary insurance products. In contrast, Asia-Pacific presents significant growth opportunities fueled by expanding middle-class populations, rising disposable incomes, and increasing healthcare expenditures. Insurers in this region are focusing on innovative product offerings tailored to local market needs and leveraging digital platforms to enhance accessibility and customer engagement. Latin America and the Middle East & Africa show emerging market potential, with insurers exploring partnerships and regulatory frameworks to expand market presence and improve insurance penetration rates amidst evolving healthcare reforms and economic developments.

𝐅𝐑𝐄𝐄 𝐆𝐞𝐭 𝐚 𝐂𝐨𝐩𝐲 𝐨𝐟 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐍𝐨𝐰! @ https://www.maximizemarketresearch.com/request-sample/126758/

What is Critical Illness Insurance Market Segmentation?

by Type

Disease Insurance

Medical insurance

Income protection insurance.

by Application

Cancer

Heart Attack

Stroke

Others

by Premium Mode

Monthly

Quarterly

Half Yearly

Yearly

Some of the current players in the Critical Illness Insurance Market are:

1. AEGON Life Insurance Company Ltd.

2. AXA Hong Kong

3. Legal & General Group plc

4. Generali China Life Insurance Co. Ltd.

5. Prudential Hong Kong Limited

6. Bajaj Allianz General Insurance Co. Ltd.

7. Tata AIG General Insurance Company Limited

8. United Healthcare Services Inc.

9. Zurich American Insurance Company

10.AmMetLife Insurance Berhad

11.Star Union Dai-ichi Life Insurance Company Limited

12.Sun Life Assurance Company of Canada.

13.AFLAC INCORPORATED

14.Liberty General Insurance Ltd.

15.HCF

16.Future Generali India Insurance Company Ltd.

17.Religare Health Insurance Company Limited

18.Cigna.

19.The Guardian Life Insurance Company of America

20.Mutual of Omaha Insurance Company

𝐅𝐨𝐫 𝐌𝐨𝐫𝐞 𝐈𝐧𝐟𝐨𝐫𝐦𝐚𝐭𝐢𝐨𝐧 𝐀𝐛𝐨𝐮𝐭 𝐓𝐡𝐢𝐬 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐏𝐥𝐞𝐚𝐬𝐞 𝐕𝐢𝐬𝐢𝐭: https://www.maximizemarketresearch.com/market-report/critical-illness-insurance-market/126758/

Key Offerings:

Past Market Size and Competitive Landscape

Critical Illness Insurance Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Critical Illness Insurance Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Explore our top-performing reports on the latest trends:

Fuel Oxygenates Market: https://www.maximizemarketresearch.com/market-report/fuel-oxygenates-market/73621/

Global Wood Cement Boards Market: https://www.maximizemarketresearch.com/market-report/global-wood-cement-boards-market/87394/

Assistive Devices Market: https://www.maximizemarketresearch.com/market-report/assistive-devices-market/152687/

Global Warehouse Execution System Market: https://www.maximizemarketresearch.com/market-report/global-warehouse-execution-system-market/114065/

Mung Bean Protein Market: https://www.maximizemarketresearch.com/market-report/mung-bean-protein-market/145967/

Dental Carpule Market: https://www.maximizemarketresearch.com/market-report/global-dental-carpule-market/54102/

Global Urothelial Carcinoma Treatment Market https://www.maximizemarketresearch.com/market-report/global-urothelial-carcinoma-treatment-market/66148/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Critical Illness Insurance Market Demand Will Reach a Value of US$ 134.50 Billion by the Year 2029, At a CAGR of 10.73 percentage here

News-ID: 3561865 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

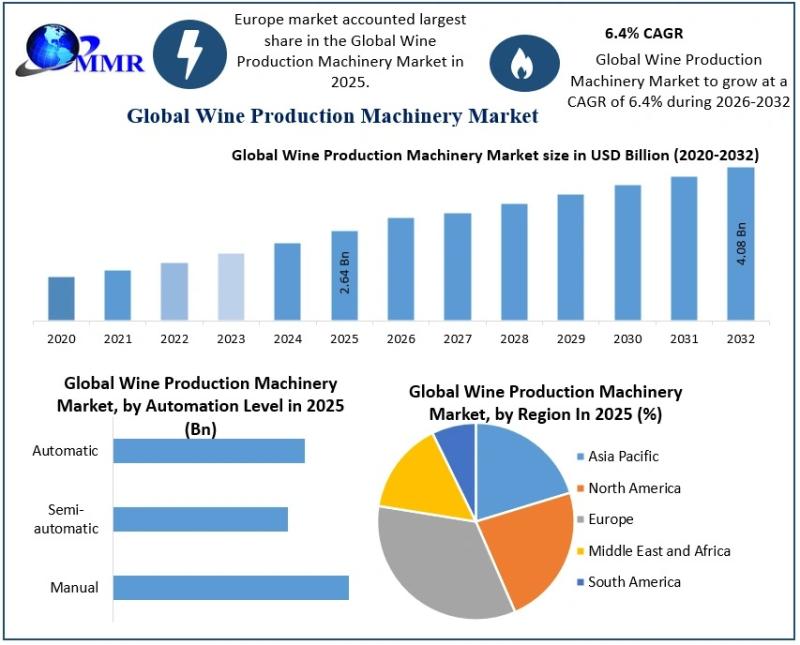

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

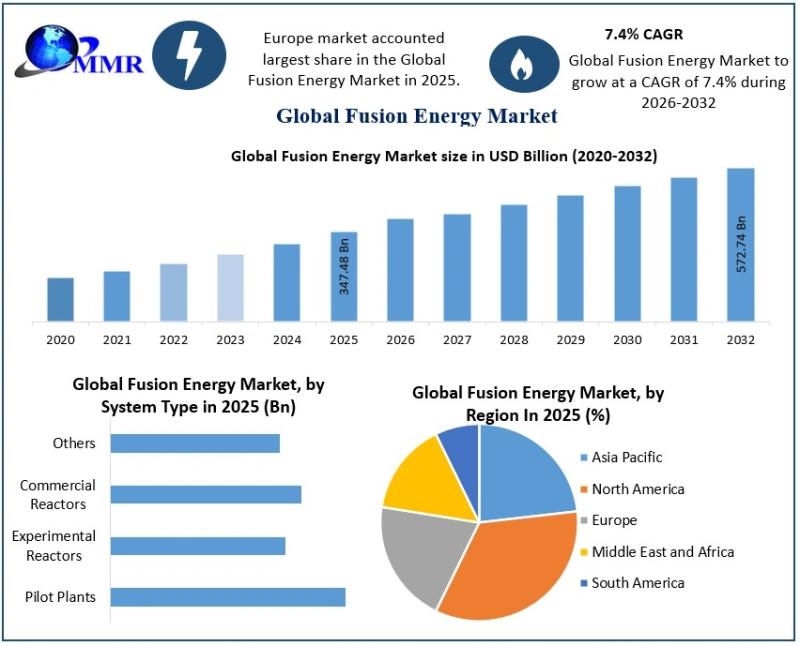

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…