Press release

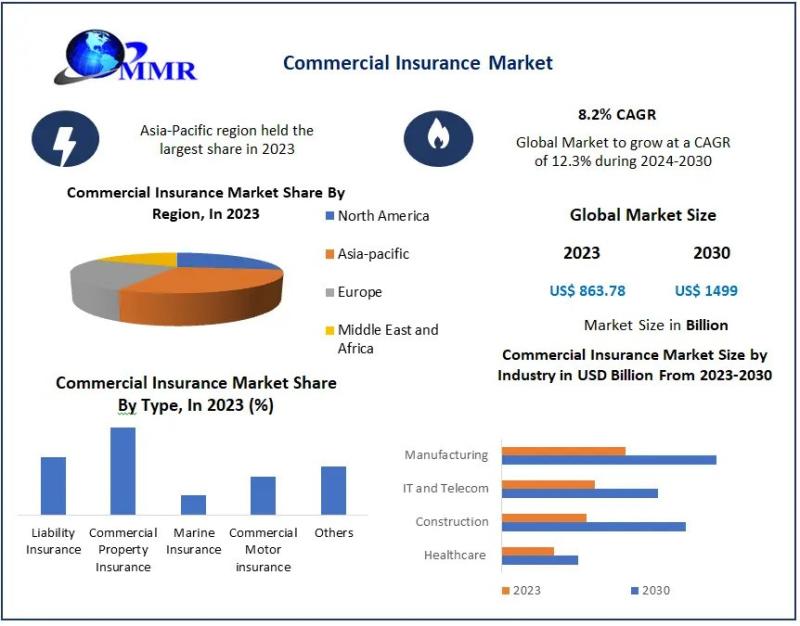

Commercial Insurance Market to grow by 8.2% CAGR during the forecast period to reach 1499 Bn by 2030

Maximize Market Research, a Consumer Goods and Services business research firm has published a report on the "Commercial Insurance Market". The total market opportunity for Commercial Insurance was USD 863.78 Bn in 2023 and is expected to grow at 8.2 percent CAGR through the forecast period by reaching nearly USD 1499 Bn.Commercial Insurance Market Scope and Research Methodology

The main objective of the Commercial Insurance Market report is to describe, define, and forecast the market based on system type, application, end-user, and region. The report provides detailed information on the major factors that influence market growth. For easy understanding, the market is divided into four major segments: type, distribution channel, enterprise size and end-user industry. These major segments of the Commercial Insurance Market are further divided into sub-segments. The research methodology used to estimate and forecast the market begins with capturing the data on the revenues of the key players through secondary research sources such as the websites of the companies. The other secondary sources include press releases, annual reports, investor presentations of companies, articles from recognized directories, authors and databases, and certified publications and white papers. To arrive at the overall market size of the Global Commercial Insurance Market, the bottom-up procedure was used.

Request For Free Sample Report : https://www.maximizemarketresearch.com/request-sample/208754/

Commercial Insurance Market Dynamics

The Commercial Insurance Market is growing due to increasing business risks, growing awareness of insurance, technological advancements, and increasing cyber threats. The global commercial insurance market plays a crucial role in providing financial protection and risk management solutions to businesses worldwide

Commercial Insurance Market Regional Insights

Asia-Pacific Commercial Insurance Market dominated the global market in 2023 with rapid economic development, expanding urbanization, and increasing knowledge of risk management in businesses. In the region, China, India, Japan, and Australia have emerged as key markets for Commercial Insurance.

Get Full TOC : https://www.maximizemarketresearch.com/market-report/commercial-insurance-market/208754/

Commercial Insurance Market Segmentation

By type

• Commercial Motor Insurance

• Commercial Property Insurance

• Liability Insurance

• Marine Insurance

• Others

By Distribution Channel

• Agents & Brokers

• Direct Response

• Others

By Enterprise Size

• Large Enterprise

• Medium- Sized Enterprise

• Small-Sized Enterprise

By End-Use Industry

• Manufacturing

• Construction

• It & Telecom

• Healthcare

• Energy and Utilities

• Transportation & logistics

• Others

Request Sample Copy of this Report : https://www.maximizemarketresearch.com/request-sample/208754/

Commercial Insurance Market's Key Competitors include:

1. Allianz SE

2. AXA Group

3. Chubb Limited

4. Zurich Insurance Group

5. Berkshire Hathaway Specialty Insurance

6. Liberty Mutual Insurance

7. Travelers Companies Inc

8. Munich Re Group

9. Swiss Re

10. Generali Group

11. Aviva plc

12. Nationwide Mutual Insurance Company

13. Marsh & McLennan Companies Inc.

14. Aon plc

15. CNA Financial Corporation

16. Tokio Marine Holdings Inc

17. Sompo Holdings

18. QBE Insurance Group

19. Hiscox Ltd.

20. SCOR

21. MS&AD Insurance Group Holdings Inc.

Frequently Asked Questions (FAQ)

1. How big is the commercial insurance market?

2. What is the growth rate of the Global Commercial Insurance market during the forecast period?

3. What is the Expected growth of the Global Commercial Insurance Market size from 2023 to 2030?

4. What are the leading market players in the Global Commercial Insurance Market?

5. What are the major trends that would shape the future Global Commercial Insurance market?

6. What are the driving factors and opportunities in the market?

7. What are the segments of the Commercial Insurance market?

8. Which region is dominating the Commercial Insurance market?

Key Offerings:

• Market Share, Size & Forecast by Revenue 2024-2030

• Market Dynamics - Growth Drivers, Restraints, Investment Opportunities, and Key Trends

• Market Segmentation - A detailed analysis by Route of administration, Application, Facility of use, and Region and Region

• Competitive Landscape - Top Key Vendors and Other Prominent Vendors

• Key Findings

• Industry Recommendations

Maximize Market Research is leading a Consumer Goods and Services research firm, has also published the following reports:

The Property Insurance Market size was valued at USD 1.71 trillion in 2023. The total Property Insurance Market size is expected to grow at a CAGR of 7.5 % from 2024 to 2030, reaching nearly USD 2.85 trillion in 2030. North America dominates the Property Insurance Market, which holds the largest market share accounting in 2023

The Home Insurance Market size was valued at USD 278.22 Billion in 2023 and the total Home Insurance Market size is expected to grow at a CAGR of 8.05 % from 2023 to 2030, reaching nearly USD 492.49 Billion in 2030. North America dominated the home insurance market in 2023 and is expected to grow in the forecast period. United Stated is major market for home insurance.

Contact Maximize Market Research:

3rd Floor, Navale IT Park Phase 2,

Pune Banglore Highway, Narhe Pune,

Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is a consulting and advisory firm focused on helping clients reach their business transformation objectives with advisory services and strategic business. The company's vision is to be an integral part of the client's business as a strategic knowledge partner. Stellar Market Research provides end-to-end solutions that go beyond key research technologies to help executives in any organization achieve their mission-critical goals. The company uses its extensive industry knowledge, strong network, and know-how to provide complete insights that give clients a competitive advantage. Its strong emphasis on symptomatic science and analysis of a market, buyer behaviour, product usage, pricing pattern, and industry facet equips a strategy maker with an arsenal of data that will enable their organisation to maintain its stronghold or plan strategies and take actions that will result in remarkable growth and increase their market position.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Commercial Insurance Market to grow by 8.2% CAGR during the forecast period to reach 1499 Bn by 2030 here

News-ID: 3558654 • Views: …

More Releases from Maximzemarketresearch

Water-Based Inks Market to Reach USD 21.72 Billion by 2030

◉ Global Water-Based Inks Market to Reach USD 21.72 Billion by 2030, Driven by Sustainable Packaging Demand

The global water-based inks market is projected to grow significantly, reaching nearly USD 21.72 billion by 2030, with a robust CAGR of 7.2% during the forecast period. This growth is fueled by increasing demand for eco-friendly printing solutions, particularly in flexible packaging, and heightened environmental and safety concerns.

Download your sample copy of this…

Rising Demand for Usage-Based Insurance Driven by Telematics and Consumer Demand …

Usage Based Insurance Market size was valued at USD 29.46 Billion in 2023 and the total Usage Based Insurance Market revenue is expected to grow at a CAGR of 23.4% from 2024 to 2030, reaching nearly USD 128.36 Billion by 2030.

Usage Based Insurance Market Overview

The global Usage-Based Insurance (UBI) Market is gaining significant traction as insurers leverage telematics and data analytics to offer more tailored and flexible insurance solutions. With…

Biopsy Market Growth Driven by Rising Cancer Cases and Advances in Minimally Inv …

Biopsy Market size is expected to grow from US$ 32.38 Bn in 2023 to US$ 67.83 Bn by 2030. The Global Biopsy Market is expected to grow at a CAGR of 11.14% through the forecast period (2024 to 2030).

Biopsy Market Overview

The global Biopsy Market is experiencing robust growth as healthcare providers increasingly adopt biopsy procedures for early and accurate cancer diagnosis. Biopsies, crucial for detecting and monitoring various cancers, are…

Growing Demand for Nut Products Driven by Health Trends and Versatile Applicatio …

Nut Products Market size was valued at US$ 1.76 Billion in 2023 and the total revenue is expected to grow at 5.8% through 2024 to 2030, reaching nearly US$ 2.62 Billion.

Nut Products Market Overview

The global Nut Products Market is noticing an exponential growth. This growth is fueled by increased health awareness and rising demand for plant-based food alternatives. The report published by Maximize Market Research explains the projected growth by…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…