Press release

Peer to Peer (P2P) Lending Market : Exploring Growth Drivers and Overcoming Challenges to Reach US$ 1,223.0 Billion by 2032

IMARC Group's report titled "Peer to Peer (P2P) Lending Market Report by Loan Type (Consumer Lending, Business Lending), Business Model (Marketplace Lending, Traditional Lending), End User (Consumer (Individual/Households), Small Businesses, Large Businesses, Real Estate, and Others), and Region 2024-2032". The global peer to peer (P2P) lending market size reached US$ 188.1 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 1,223.0 Billion by 2032, exhibiting a growth rate (CAGR) of 22.4% during 2024-2032.For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/peer-to-peer-lending-market/requestsample

Factors Affecting the Growth of the Peer to Peer (P2P) Lending Industry:

● Rise of Digital Platforms and User Accessibility:

The proliferation of digital platforms that enhance user accessibility is supporting the market growth. These platforms leverage advanced technologies like artificial intelligence (AI) and machine learning (ML) to simplify the borrowing process, making it more efficient and user-friendly. By digitizing credit profiling and risk assessment, peer-to-peer (P2P) platforms can offer quicker loan approvals compared to traditional banking systems. This efficiency attracts a broader user base, including individuals and small businesses seeking alternative financing solutions. Furthermore, the integration of mobile technology allows users to access services conveniently from anywhere, enhancing the appeal of P2P lending.

● Regulatory Evolution and Market Trust:

Governing bodies and financial regulators in many countries are recognizing the need to monitor and regulate P2P platforms to prevent fraud, ensure transparency, and maintain financial stability. Regulations help in establishing clear guidelines on issues, such as lender and borrower rights, data protection, and anti-money laundering standards. By creating a safer and more reliable environment, these regulatory measures help in enhancing user confidence and credibility in P2P platforms. This regulatory endorsement not only attracts more participants by reducing perceived risks but also encourages institutional investors to explore P2P lending as a viable investment.

● Low Operational Costs and Higher Returns:

P2P platforms operate online, which reduces the need for physical infrastructure and associated costs like staffing and maintenance. These savings allow P2P platforms to offer higher returns to investors and lower interest rates to borrowers, making them competitive alternatives to conventional banks. The attractive returns on investments (ROI) draw more lenders to the platform, which in turn increases the funding pool available for borrowers. This is further supported by the ability of P2P to cater to niche markets, including those typically underserved by traditional banks, such as small and medium-sized enterprises (SMEs) or individuals with non-standard credit histories, enhancing the overall ecosystem.

Leading Companies Operating in the Global Peer to Peer (P2P) Lending Industry:

● Avant Inc.

● Commonbond Inc.

● Funding Circle Ltd.

● LendingClub Corporation

● Lendingtree Inc. (InterActiveCorp and Tree.com Inc.)

● On Deck Capital Inc.

● Prosper Marketplace Inc.

● Retail Money Market Ltd.

● Social Finance Inc.

● Upstart Network Inc.

● Zopa Limited

Explore the full report with table of contents: https://www.imarcgroup.com/peer-to-peer-lending-market

Peer to Peer (P2P) Lending Market Report Segmentation:

By Loan Type:

● Consumer Lending

● Business Lending

Business lending exhibits a clear dominance in the market due to the rising demand for capital among enterprises to expand operations and invest in growth opportunities.

By Business Model:

● Marketplace Lending

● Traditional Lending

Traditional lending represents the largest segment, attributed to the reliance on established lending practices and frameworks, which are preferred by many borrowers and lenders for their reliability and familiarity.

By End User:

● Consumer (Individual/Households)

● Small Businesses

● Large Businesses

● Real Estate

● Others

Small businesses account for the majority of the market share, as these entities often have limited access to traditional banking services and seek alternative financing options.

Regional Insights:

● North America: (United States, Canada)

● Asia Pacific: (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe: (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America: (Brazil, Mexico, Others)

● Middle East and Africa

North America dominates the market, attributed to the advanced financial infrastructure, rising penetration of technology, and the presence of a large number of market players in this region.

Global Peer to Peer (P2P) Lending Market Trends:

P2P lending platforms are diversifying their product offerings beyond traditional personal and business loans to include niche segments, such as student loans, real estate financing, and green lending, catering to a wider range of borrower needs and preferences. P2P lending platforms are leveraging artificial intelligence (AI) and big data analytics to enhance credit scoring, risk assessment, and underwriting processes, improving loan decision-making accuracy, reducing default rates, and enhancing investor returns.

P2P lending is recognized as a tool for promoting financial inclusion by extending credit to underserved populations, including individuals and small businesses with limited access to traditional banking services. Platforms are partnering with governments, NGOs, and microfinance institutions to address financial inclusion challenges.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARCs information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the companys expertise.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Peer to Peer (P2P) Lending Market : Exploring Growth Drivers and Overcoming Challenges to Reach US$ 1,223.0 Billion by 2032 here

News-ID: 3552295 • Views: …

More Releases from IMARC Group

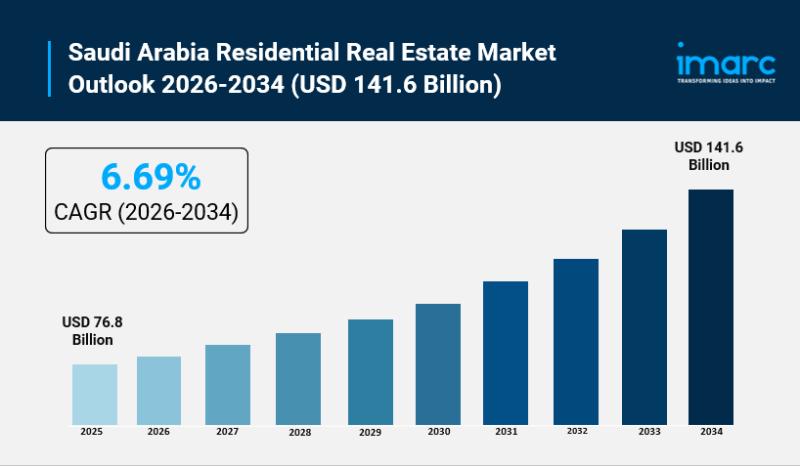

Saudi Arabia Residential Real Estate Market Size to Worth USD 141.6 Billion by 2 …

Saudi Arabia Residential Real Estate Market Overview

Market Size in 2025: USD 76.8 Billion

Market Forecast in 2034: USD 141.6 Billion

Market Growth Rate 2026-2034: 6.69%

According to IMARC Group's latest research publication, "Saudi Arabia Residential Real Estate Market Report by Type (Condominiums and Apartments, Villas and Landed Houses), and Region 2026-2034", the Saudi Arabia residential real estate market size reached USD 76.8 Billion in 2025. Looking forward, IMARC Group expects the market to…

Fuel Oil Prices See Strong Upside Momentum Across Key International Markets

Northeast Asia Fuel Oil Prices Movement January 2026:

Northeast Asia fuel oil prices in January 2026 were recorded at USD 0.84/kg, rising by 5.0% due to higher regional demand and limited supply. The fuel oil price trend showed upward momentum, while the fuel oil price index strengthened moderately. The fuel oil price chart reflected a clear price increase. The fuel oil price forecast suggests continued firmness in the short term.

Get the…

Citric Acid Production Plant (DPR) 2026: Industry Trends, CapEx/OpEx and Market …

The global citric acid manufacturing industry is experiencing steady growth driven by the rapidly expanding food and beverage sector and increasing demand for natural preservatives and acidulants. At the heart of this expansion lies a critical industrial ingredient-citric acid. As consumers worldwide increasingly seek clean-label products and manufacturers prioritize natural food additives over synthetic alternatives, establishing a citric acid production plant presents a strategically compelling business opportunity for entrepreneurs and…

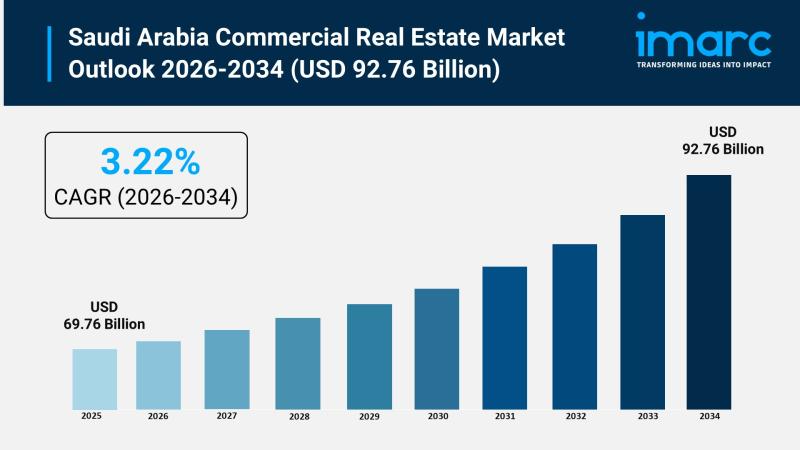

Saudi Arabia Commercial Real Estate Market is Booming with a CAGR of 3.22% by 20 …

Saudi Arabia Commercial Real Estate Market Overview

Market Size in 2025: USD 69.76 Billion

Market Size in 2034: USD 92.76 Billion

Market Growth Rate 2026-2034: 3.22%

According to IMARC Group's latest research publication, "Saudi Arabia Commercial Real Estate Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia commercial real estate market size was valued at USD 69.76 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD…

More Releases for P2P

Millennials fuel P2P investment surge

According to the latest research, Robocash's core audience consists of millennial men with an average investment of up to €5,000. At the same time, the platform is becoming more appealing to a broader demographic, as well as geographically.

Robocash analysts studied how the profile of the platform's investors has changed over the past year.

Currently, the majority of investors on Robocash are aged 29-44. However, since 2024, the share…

P2P Content Delivery Network (P2P CDN) Market to Witness Growth by 2024-2031

The P2P Content Delivery Network (P2P CDN) market has emerged as a transformative force in the digital content distribution landscape. P2P CDNs leverage peer-to-peer technology to distribute content efficiently, reducing the strain on centralized servers and enhancing delivery speeds. This market has experienced substantial growth due to the increasing demand for high-quality video streaming, online gaming, and other content-rich applications. P2P CDNs enable more scalable and cost-effective content delivery, making…

P2P Content Delivery Network (P2P CDN) Market is Touching New Development Level …

The latest independent research document on P2P Content Delivery Network (P2P CDN) examines investment in Market. It describes how companies deploying these technologies across various industry verticals aim to explore their potential to become major business disrupters. The P2P Content Delivery Network (P2P CDN) study eludes very useful reviews & strategic assessments including the generic market trends, emerging technologies, industry drivers, challenges, and regulatory policies that propel the market growth,…

Revving Up Indonesia's P2P Lending Market: 3 Catalyst Driving the Indonesia's P2 …

Indonesia has witnessed a rapid increase in internet and smartphone usage, leading to greater accessibility and creating a conducive environment for P2P lending platforms to reach a large customer base.

Introduction

The peer-to-peer (P2P) lending market in Indonesia has experienced significant growth in recent years, driven by various factors. P2P lending platforms, also known as financial technology (FinTech) platforms, provide an alternative financing option for individuals and businesses, particularly those who are…

P2P Content Delivery Network (P2P CDN) Market to See Huge Demand by 2030: Alibab …

2022-2030 World P2P Content Delivery Network (P2P CDN) Market Report Professional Analysis 2022 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the P2P Content Delivery Network (P2P CDN) Market. Some of the key players profiled…

P2P Content Delivery Network (P2P CDN) Market to see Booming Worldwide | Major G …

A Qualitative Research Study accomplished by HTF MI Titled on Global P2P Content Delivery Network (P2P CDN) Industry Market Report-Development Trends, Threats, Opportunities and Competitive Landscape in 2020 with detailed information of Product Types [Video & Non-video], Applications [Media and Entertainment, Gaming, Retail and eCommerce, Education, Healthcare & Others] & Key Players Such as Streamroot, Alibaba Group, Viblast, Globecast, Edgemesh, Peer5, Akamai, Qumu Corporation & CDNvideo etc. The Study provides…