Press release

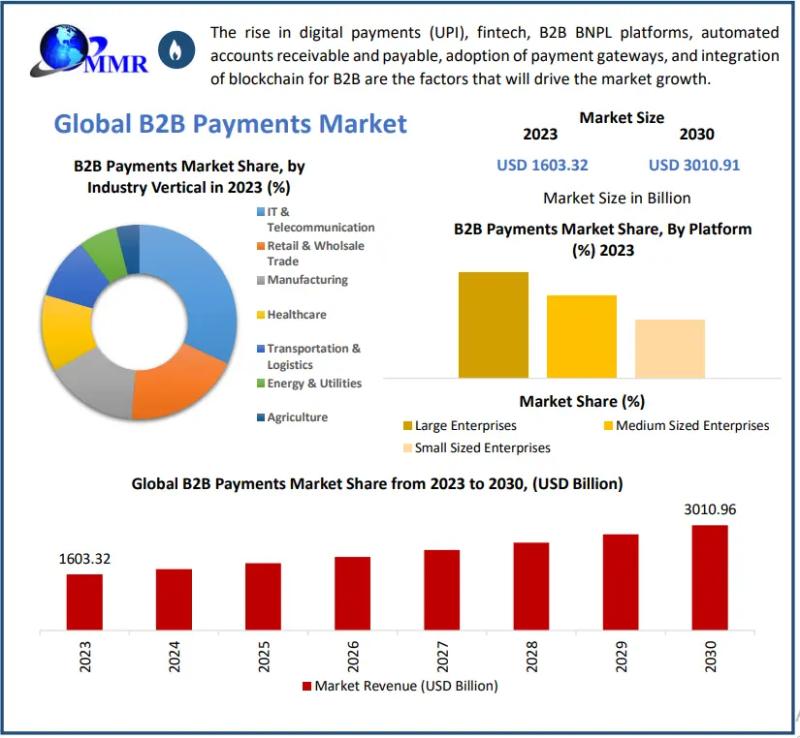

B2B Payments Market is projected to grow at a CAGR of 9.42 percentage from 2024 to 2030

Anticipated Growth in Revenue:B2B Payments Market size was valued at USD 1603.32 Billion in 2023 and the total B2B Payments revenue is expected to grow at a CAGR of 9.42% from 2024 to 2030, reaching nearly USD 3010.91 Billion by 2030.

B2B Payments Market Overview:

The B2B payments market is undergoing significant transformation driven by technological advancements and evolving customer expectations. Businesses are increasingly adopting digital solutions to streamline and automate payment processes, aiming to reduce costs, improve efficiency, and enhance transparency. Key trends include the rise of cloud-based platforms offering integrated payment capabilities, such as invoicing and reconciliation, and the growing adoption of mobile and contactless payments. Additionally, blockchain technology is gaining traction for its potential to provide secure and transparent transactions. Regulatory changes and global economic shifts are also shaping the landscape, prompting businesses to seek flexible and scalable payment solutions that can adapt to dynamic market conditions while ensuring compliance and risk management.

Get Free Access to Our Sample Report:https://www.maximizemarketresearch.com/request-sample/228416/

B2B Payments Market Trends:

The B2B payments market is witnessing several key trends that are reshaping the industry. One significant trend is the acceleration towards digitalization and automation of payment processes, driven by the demand for efficiency and cost savings. Businesses are increasingly adopting cloud-based platforms and software solutions that integrate payment functionalities with invoicing, reconciliation, and financial reporting. Another prominent trend is the shift towards real-time payments and faster transaction processing, enabled by advancements in payment technologies and infrastructure. Moreover, there is a growing emphasis on enhanced security measures, including biometric authentication and blockchain technology, to mitigate fraud risks and ensure data integrity. Regulatory developments, such as PSD2 in Europe, are also influencing market dynamics by promoting competition and innovation among payment service providers. These trends collectively indicate a move towards more efficient, secure, and transparent B2B payment systems globally.

What are B2B Payments Market Dynamics?

The dynamics of the B2B payments market are shaped by various factors influencing how businesses transact financially. Key dynamics include the increasing demand for faster and more efficient payment processing, driven by advancements in technology and customer expectations for seamless transactions. Businesses are also navigating regulatory landscapes that impact payment methods and security standards, such as GDPR and PSD2 in Europe, which promote transparency and consumer protection. Moreover, the market is witnessing a shift towards integrated solutions that combine payment functionalities with other business processes like invoicing and accounting, aiming to streamline operations and reduce costs. Emerging technologies like artificial intelligence and blockchain are further disrupting the market by offering innovative solutions for improving transaction speed, security, and traceability. These dynamics collectively underscore the evolving nature of B2B payments, emphasizing adaptability and responsiveness to technological advancements and regulatory changes.

Request For Free Inquiry Report:https://www.maximizemarketresearch.com/inquiry-before-buying/228416/

B2B Payments Market Opportunities:

The B2B payments market presents several compelling opportunities for innovation and growth. One significant opportunity lies in the advancement of digital and mobile payment solutions tailored specifically for businesses, facilitating faster transaction processing and enhancing convenience. Additionally, there is increasing demand for integrated financial management platforms that offer seamless integration of payment functionalities with other business operations such as accounting and supply chain management. Emerging markets and sectors traditionally underserved by traditional banking systems represent another area ripe for expansion, where innovative fintech solutions can bridge gaps in access to efficient payment services. Moreover, the adoption of blockchain technology holds promise for improving transparency, security, and efficiency in cross-border transactions, offering new avenues for collaboration and partnership among financial institutions and technology providers. These opportunities underscore the potential for B2B payment providers to capitalize on technological advancements and market demand to drive significant business growth and market penetration.

What is B2B Payments Market Regional Insight?

The B2B payments market exhibits regional variations influenced by economic development, regulatory frameworks, and technological adoption. In North America, the market is characterized by a strong emphasis on digitalization and innovation, with widespread adoption of advanced payment technologies such as mobile payments and cloud-based platforms. Europe, influenced by stringent regulatory standards like GDPR and PSD2, fosters a competitive landscape for fintech companies offering secure and compliant payment solutions. In Asia-Pacific, rapid economic growth and increasing digital connectivity drive demand for efficient cross-border payment systems and mobile-first payment solutions. Emerging markets in Latin America and Africa are witnessing a surge in fintech innovation aimed at addressing financial inclusion challenges, leveraging mobile and digital technologies to expand access to B2B payment services. Overall, regional insights highlight diverse market dynamics and opportunities for tailored approaches in addressing specific regulatory, economic, and technological factors shaping the B2B payments landscape globally.

Get An Exclusive Sample Of The B2B Payments Market Report At This Link (Get The Higher Preference For Corporate Email ID): -https://www.maximizemarketresearch.com/request-sample/228416/

What is B2B Payments Market Segmentation?

by Transaction Type

Domestic

Cross Border

by Enterprise Size

Large enterprise

Medium Sized Enterprise

Small Sized Enterprise

by Payment Method

Bank Transfer

Cards

by Industry Vertical

Manufacturing

IT & Telecommunication

Metals & Mining

Energy & Utilities

BSFI

Government

Some of the current players in the B2B Payments Market are:

1. American Express Company

2. Bank of America Corporation

3. Capital One

4. Citigroup Inc.

5. JPMorgan Chase & Co.

6. Mastercard Inc.

7. Payoneer Inc.

8. PayPal Holdings Inc.

9. Paystand Inc.

10. Stripe Inc.

11. Visa Inc.

12. Wise Payments Limited

13. Google LLC

14. ACI Worldline

15. Apple Inc

16. Fiserv Inc

17. Global Payments Inc

18. Square

19. Adyen

20. Bill.com

21. Coupa

22. SAP Ariba

23. Bank of America Merrill Lynch

24. Wells Fargo

25. Intuit QuickBooks

26. Infor

27. FIS (Fidelity National Information Services)

28. Bottomline Technologies

29.Citi Treasury and Trade Solutions

30. Payoneer

31. NetSuite (Oracle NetSuite)

Know More About The Report:https://www.maximizemarketresearch.com/market-report/b2b-payments-market/228416/

Key Offerings:

Past Market Size and Competitive Landscape

B2B Payments Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

B2B Payments Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

For additional reports on related topics, visit our website:

♦ Contact Center as a Service (CCaaS) Market https://www.maximizemarketresearch.com/market-report/global-contact-center-as-a-service-ccaas-market/80407/

♦ Physical Security Information Management Market https://www.maximizemarketresearch.com/market-report/global-physical-security-information-management-market/55313/

♦ Address Verification Software Market https://www.maximizemarketresearch.com/market-report/address-verification-software-market/187921/

♦ Cardiovascular Information System Market https://www.maximizemarketresearch.com/market-report/global-cardiovascular-information-system-market/6407/

♦ Global Real-time Systems Market https://www.maximizemarketresearch.com/market-report/global-real-time-systems-market/108630/

♦ Asia Pacific Digital Therapeutics Market https://www.maximizemarketresearch.com/market-report/asia-pacific-digital-therapeutics-market/7081/

♦ Mobility on Demand Market https://www.maximizemarketresearch.com/market-report/global-mobility-on-demand-market/62872/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release B2B Payments Market is projected to grow at a CAGR of 9.42 percentage from 2024 to 2030 here

News-ID: 3545972 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

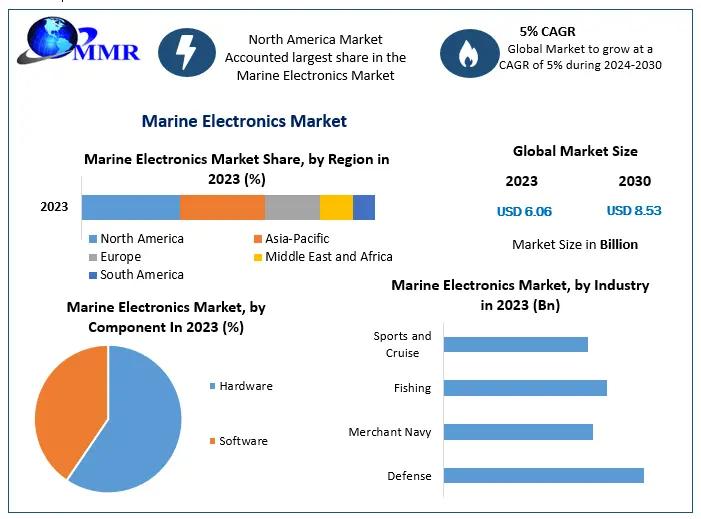

Marine Electronics Market Expected to Reach USD 8.53 Bn by 2030 - Growth Forecas …

Marine Electronics Market Size: According to Maximize Market Research, the Global Marine Electronics Market was valued at US$ 6.06 billion in 2023 and is expected to reach US$ 8.53 billion by 2030, growing at a CAGR of around 5% during 2024-2030.

Market Overview

The Global Marine Electronics Market encompasses electronic devices and systems designed specifically for marine environments. These include navigation systems, communication devices, safety equipment, sonar & radar, vessel management systems,…

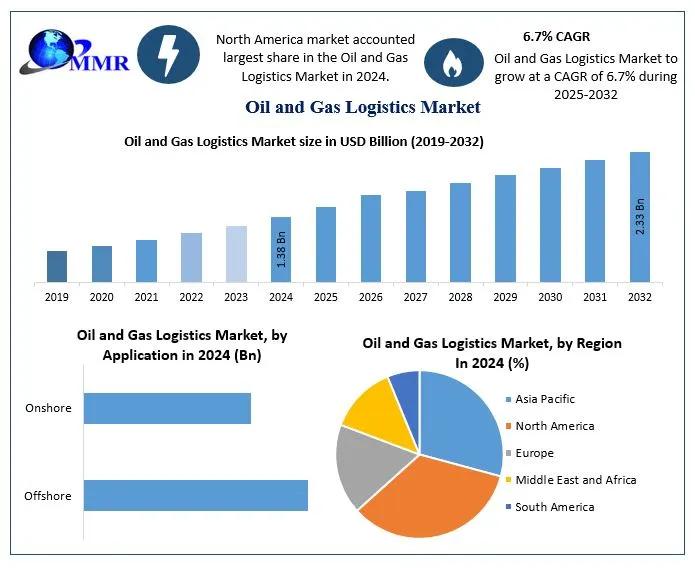

Oil and Gas Logistics Market to Reach USD 2.33 Billion by 2032 | Growth, Trends, …

The Oil and Gas Logistics Market was valued at USD 1.38 Billion in 2024 and is forecasted to grow to USD 2.33 Billion by 2032, exhibiting a CAGR of 6.7% during 2025 to 2032, driven by rising global energy demand, technological innovation, and expanding upstream and downstream supply chain activities.

Market Overview

The oil and gas logistics market encompasses the transportation, storage, handling, and distribution of crude oil, refined products, natural gas,…

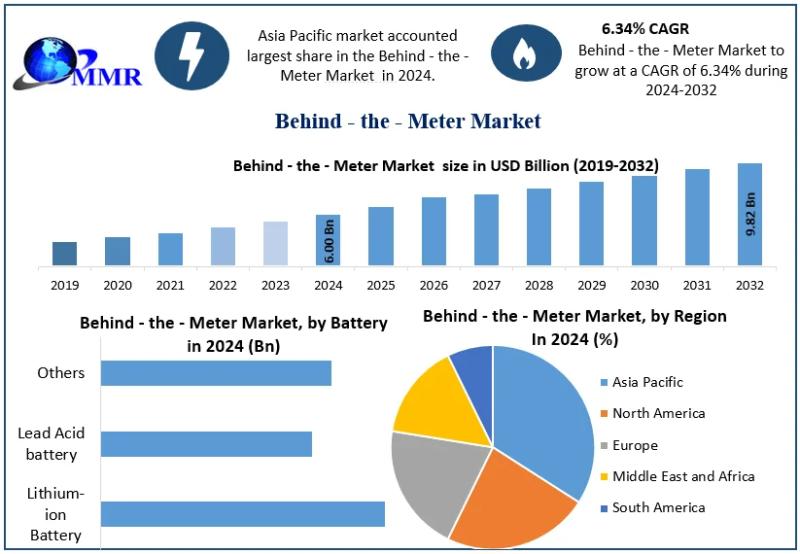

Behind the Meter Market to Surge to USD 9.82 Billion by 2032 - Unmatched Growth …

According to Maximize Market Research, the Global Behind the Meter Market was valued at USD 6.00 Billion in 2024 and is projected to reach USD 9.82 Billion by 2032 at a 6.34 % CAGR, driven by growth in residential, commercial, and industrial energy storage adoption.

Market Overview

The Behind the Meter Market consists of energy storage systems installed on the consumer side of the utility meter. These systems store electricity generated from…

Commercial Paper Market Expected to Witness Steady Growth Driven by Short-Term C …

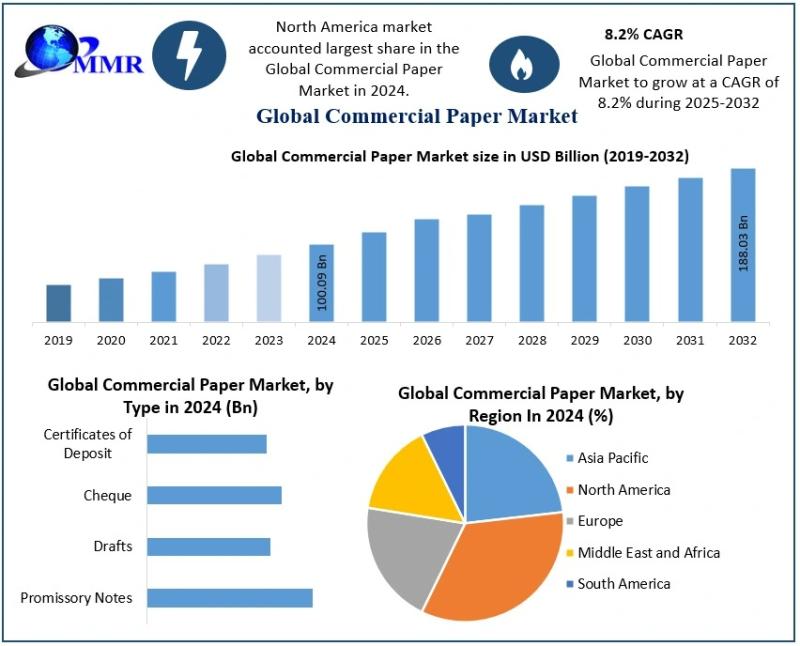

The Commercial Paper Market size was valued at USD 100.09 Billion in 2024 and the total Commercial Paper revenue is expected to grow at a CAGR of 8.2% from 2025 to 2032, reaching nearly USD 188.03 Billion.

Curious to peek inside? Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/199690/

The Commercial Paper Market is gaining strong momentum as corporations, financial institutions, and large enterprises increasingly rely on short-term unsecured debt instruments…

More Releases for B2B

B2B Telecommunication Market Report 2024 - B2B Telecommunication Market Size, Tr …

"The Business Research Company recently released a comprehensive report on the Global B2B Telecommunication Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Global B2B Emails: Premier Destination for Verified B2B Emails and Lead Generati …

Discover how GlobalB2BEmails.com is revolutionizing B2B email acquisition for modern businesses. With a focus on simplicity, affordability, and user satisfaction, GlobalB2BEmails.com empowers businesses to reach their target audience effectively. Experience seamless access to verified B2B emails and unlock new opportunities for growth and success with GlobalB2BEmails.com.

In the digital age, where marketing plays a pivotal role in driving business growth, access to verified B2B emails is essential for success. Amidst the…

B2B Marketplace

All set to redefine India's growing e-commerce sector, DIAL42 is making its way into the B2B marketplace by providing services in four major domains: Transport and Logistics, B2B e-commerce and services, Medical services, and Foods & Beverages. We provide a highly integrated platform which brings together the country's leading manufacturers, suppliers, wholesalers, dealers and retailers for SMEs, MSMEs, and large-scale businesses.

Based in Gurugram, Haryana, DIAL42 is dedicated to simplifying…

Best B2B Service Providers in United States | United States B2B Market Research …

The market research is a proficient process of gathering information linked to the industry, market trends, customer behaviour, demographics and numerous other relevant information of the marketer’s product and services. Market research is an essential for the important of any business: new and existing. Through the market research you get a thorough understanding of your competition and industry. That’s the reason Ken Research convey you with an extreme market research…

Best B2B Service Providers in United States | United States B2B Market Research …

The world’s toughest economy is led by the policies which enable the freedom to the private segments to underwrite to economic decisions made by the government and set directions for the optimum utilization of the resources. A strength of the country lies in its rich mineral resources and fertile farm soil and coastlines on both the Atlantic and Pacific Oceans makes it robust in the trade. The US has been…

Best B2B Service Providers in Thailand, Thailand B2B Market Research Reports - K …

Thailand has made the remarkable progress in the social and economic improvement, shifting from a low-income to an upper middle-income region in less than a generation. As such, Thailand has been a broadly cited improvement accomplish story, with sustained robust growth and impressive poverty deduction.

In addition, Thailand is renowned for its universal health care program (UHC) and accomplishment in the child nutrition, but quality of education remains a feeble…