Press release

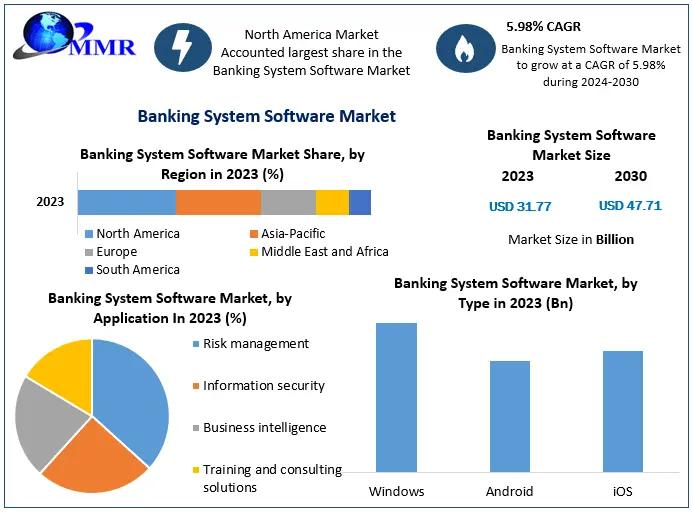

Banking System Software Market is projected to reach a value of US$ 47.71 Billion by 2030

Anticipated Growth in Revenue:Banking System Software Market size is expected to reach US$ 47.71 Bn in year 2030, at a CAGR of 5.98% during the forecast period.

Banking System Software Market Overview:

The banking system software market is experiencing robust growth, driven by the increasing need for advanced digital banking solutions, enhanced security measures, and efficient management of financial transactions. This market is characterized by the adoption of cutting-edge technologies like artificial intelligence, blockchain, and cloud computing, which streamline operations, improve customer service, and ensure regulatory compliance. Financial institutions are investing heavily in innovative software to meet the rising demands for mobile banking, online services, and personalized customer experiences. Additionally, the emphasis on cybersecurity and data protection has heightened, propelling the development of sophisticated software solutions to safeguard sensitive financial information.

Get Free Access to Our Sample Report:https://www.maximizemarketresearch.com/request-sample/16011/

Banking System Software Market Trends:

The banking system software market is witnessing significant trends such as the integration of artificial intelligence (AI) and machine learning (ML) to enhance customer service through chatbots and predictive analytics. Cloud-based solutions are increasingly preferred for their scalability and cost-efficiency, enabling banks to manage operations more effectively. Blockchain technology is also gaining traction for its potential to improve security and transparency in transactions. Additionally, there is a growing focus on open banking and API integration, facilitating better connectivity between banks and third-party financial services. As digital transformation accelerates, the demand for robust cybersecurity measures and compliance with regulatory standards continues to shape the market.

What are Banking System Software Market Dynamics?

The dynamics of the banking system software market are driven by several key factors. Firstly, technological advancements such as artificial intelligence, blockchain, and big data analytics are reshaping the landscape, offering banks opportunities to enhance operational efficiency and customer experience. Secondly, regulatory requirements and compliance standards play a crucial role, influencing the development and adoption of software solutions that ensure data security and regulatory adherence. Thirdly, changing customer expectations and preferences for seamless digital banking experiences are pushing banks to invest in innovative software that supports mobile banking, personalized services, and real-time transaction capabilities. Lastly, the competitive landscape with fintech startups and established software vendors intensifies as they strive to offer differentiated solutions and gain market share in a rapidly evolving industry. These dynamics collectively drive innovation and investment in banking system software, shaping its evolution and adoption across the financial services sector.

Request For Free Inquiry Report:https://www.maximizemarketresearch.com/inquiry-before-buying/16011/

Banking System Software Market Opportunities:

The banking system software market presents several compelling opportunities for growth and innovation. One significant opportunity lies in the expansion of digital banking services, including mobile banking apps, internet banking platforms, and digital payment solutions. As consumer demand for convenient and secure banking experiences increases, there is a ripe opportunity for software providers to develop user-friendly interfaces and robust security features. Another opportunity stems from the integration of emerging technologies such as artificial intelligence, blockchain, and biometrics, which can enhance operational efficiency, reduce costs, and improve decision-making processes within financial institutions. Furthermore, the rise of open banking initiatives and regulatory changes globally creates opportunities for software vendors to develop solutions that facilitate seamless integration with third-party services, driving collaboration and innovation across the industry. Overall, the banking system software market offers numerous avenues for vendors to capitalize on evolving trends and technological advancements, positioning themselves for long-term success in the digital banking era.

What is Banking System Software Market Regional Insight?

The banking system software market exhibits diverse regional insights driven by varying economic conditions, technological adoption rates, and regulatory landscapes. In North America, the market is characterized by high technological sophistication and widespread adoption of advanced banking software solutions, driven by the presence of major financial hubs and a strong emphasis on innovation. Europe follows a similar trajectory with stringent regulatory frameworks like GDPR influencing software development for data protection and compliance. In Asia-Pacific, rapid economic growth and expanding digital infrastructure fuel the demand for banking software, particularly in emerging markets where financial inclusion and mobile banking are on the rise. Meanwhile, Latin America and the Middle East & Africa regions are experiencing increasing investments in banking technology to modernize financial systems and cater to growing populations seeking improved banking services. These regional dynamics underscore the importance of localized strategies for software vendors aiming to capitalize on diverse market opportunities across the global banking sector.

Get An Exclusive Sample Of The Banking System Software Market Report At This Link (Get The Higher Preference For Corporate Email ID): -https://www.maximizemarketresearch.com/request-sample/16011/

What is Banking System Software Market Segmentation?

by Type

Windows

Android

iOS

by Core Banking Software

Temenos Core Banking

MX for Banking

Oracle FLEXCUBE

Plaid

Q2ebanking

Others

by Features of core banking software

Others Recording of transactions

Passbook maintenance

Interest calculations on loans and deposits

Customer records

Balance of payments and withdrawal

Others

by Application

Risk management

Information security

Business intelligence

Training and consulting solutions

Some of the current players in the Banking System Software Market are:

1. Microsoft Corporation

2. IBM Corporation

3. Oracle Corporation

4. SAP SE

5. Tata Consultancy Services Limited.

6. Infosys Limited

7. Capgemini

8. NetSuite Inc.

9. Deltek, Inc.

10. Millennium Information Solution Ltd.

11. Strategic Information Technology Ltd.

12. Aspekt

13. Automated Workflow Pvt. Ltd

14. Canopus EpaySuite

15. Cashbook

16. CoBIS Microfinance Software

17. Probanx Information Systems

18. Megasol Technologies

19. EBANQ Holdings BV

20. Kapowai

21. Crystal Clear Software Ltd.

22. Infrasoft Technologies Ltd.

23. Misys

24. Banking.Systems

25. ABBA d.o.o.

26. SecurePaymentz

27. TEMENOS Headquarters SA

Know More About The Report:https://www.maximizemarketresearch.com/market-report/global-banking-system-software-market/16011/

Key Offerings:

Past Market Size and Competitive Landscape

Banking System Software Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Banking System Software Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

For additional reports on related topics, visit our website:

♦ Education Apps Market https://www.maximizemarketresearch.com/market-report/global-education-apps-market/24428/

♦ Data Visualization Market https://www.maximizemarketresearch.com/market-report/global-data-visualization-market/100013/

♦ Lawful Interception Market https://www.maximizemarketresearch.com/market-report/lawful-interception-market/187746/

♦ Global Evaporative Cooling Market https://www.maximizemarketresearch.com/market-report/global-evaporative-cooling-market/99484/

♦ GIS Market https://www.maximizemarketresearch.com/market-report/global-gis-market/28729/

♦ Email Encryption Market https://www.maximizemarketresearch.com/market-report/global-email-encryption-market/28090/

♦ Global Log Management Market https://www.maximizemarketresearch.com/market-report/global-log-management-market/22019/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Banking System Software Market is projected to reach a value of US$ 47.71 Billion by 2030 here

News-ID: 3545942 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

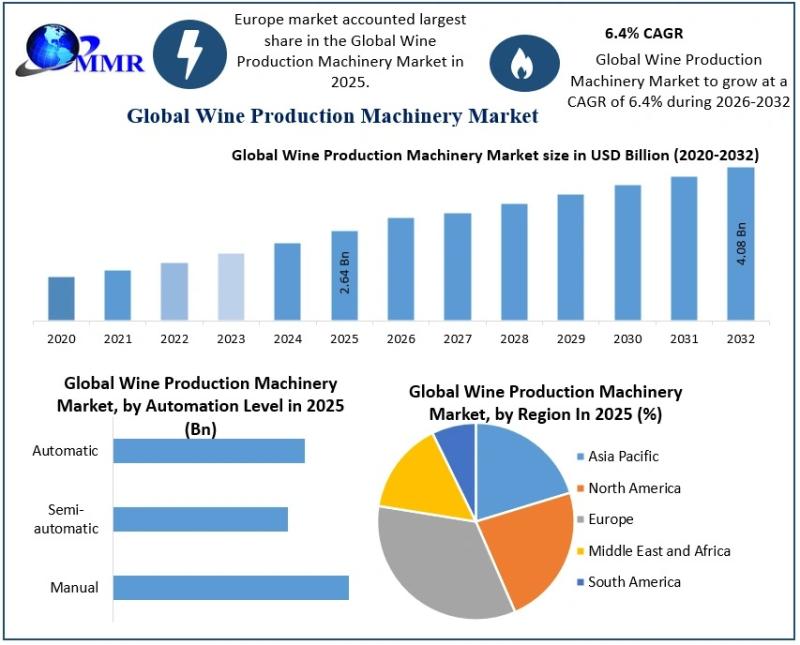

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

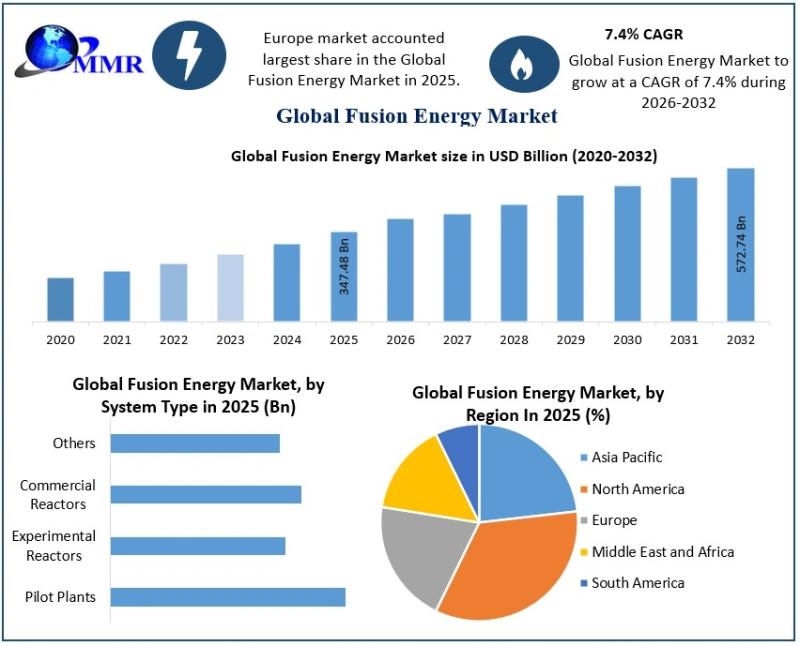

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…