Press release

Digital Payment Market 2024 Growth, Industry Trend, Sales Revenue, Size by Regional Forecast to 2030

Digital Payment Market is poised to reshape the future of global commerce.Digital Payment Market Overview:

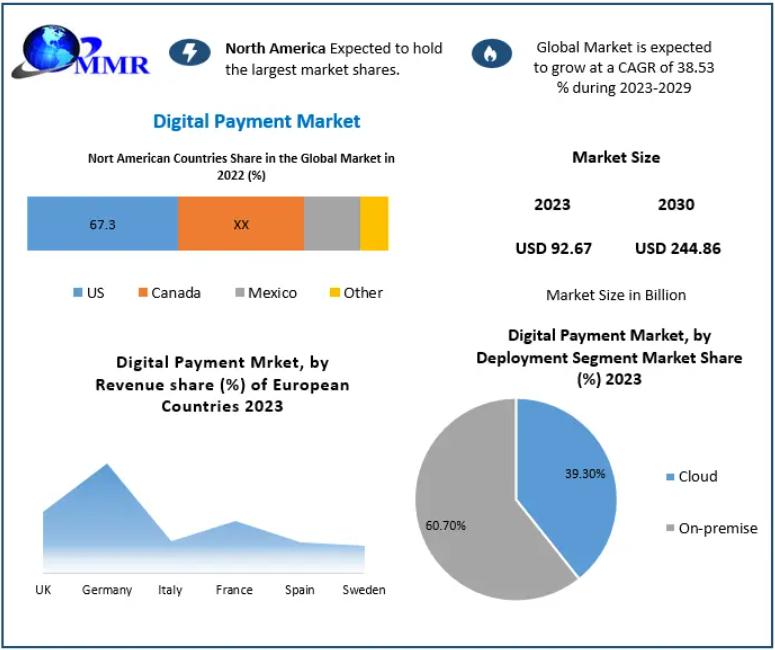

In a significant development, the global digital payment market, valued at USD 92.67 billion in 2023, is projected to expand at a robust CAGR of 14.89% through 2030, potentially reaching close to USD 244.86 billion. This meteoric growth trajectory underscores the escalating preference for digital transactions across the globe.

Digital payments, facilitated through online platforms without physical currency exchange, have revolutionized financial transactions. This method, also known as electronic payments (e-payments), involves transferring value between accounts using digital devices like smartphones, computers, or cards. Key methods include UPI, NEFT, mobile wallets, and PoS terminals, with UPI emerging as the frontrunner with transactions surpassing USD 1 trillion. The shift towards digital payments offers compelling advantages, particularly in enhancing transaction speed, security, and efficiency for both consumers and businesses. Eliminating the need for cash mitigates risks associated with theft and reduces operational costs, bolstering market growth. Moreover, digital transactions promote transparency, streamline accounting processes, and facilitate tax compliance.

Market Dynamics

Initiatives Driving Market Growth: Governments worldwide are driving digital payment adoption through initiatives aimed at automating payment processes. In India, initiatives like Digital India and the Unified Payments Interface (UPI) have been pivotal in catalyzing market expansion. Similarly, countries such as Singapore and Australia are advancing digital payment projects to enhance financial inclusion and efficiency.

Expanding Financial Inclusion: Efforts to connect underserved populations, particularly in rural and remote areas, are significantly expanding financial inclusion. Government-led initiatives, such as India's push to increase bank account penetration, have successfully reduced the number of unbanked individuals. Globally, efforts to broaden access to financial services are enhancing market accessibility and driving adoption of digital wallets and payment solutions.

Challenges: Despite rapid growth, the digital payment market faces challenges, notably from cyber threats. The proliferation of digital transactions has escalated cyber risks, including theft and fraud. Cyber-attacks targeting digital payment systems pose significant financial risks, necessitating stringent security measures and regulatory compliance to safeguard transactions.

Click Here for Your Free Sample + Report Graphs: Uncover Key Insights: https://www.maximizemarketresearch.com/request-sample/16835/

Digital Payment Market Scope and Methodology:

This report aims to deliver a thorough understanding of the Digital Payment market, emphasizing market-centric strategies. It identifies key trends, growth drivers, challenges, and potential opportunities. Data is collected through both primary and secondary research methods. Primary data is gathered from interviews and surveys with key industry stakeholders such as manufacturers, suppliers, distributors, customers, and experts. Secondary data is sourced from industry reports, market analyses, corporate websites, annual reports, trade journals, government publications, and databases.

The report offers a detailed analysis of the business strategies of top companies, including partnerships, mergers, acquisitions, and collaborations. A SWOT analysis evaluates the market position of these companies, highlighting strengths, weaknesses, opportunities, and threats. The Digital Payment market is examined using feasibility studies, investment return analyses, and Porter's Five Forces framework. Global and regional Digital Payment market sizes are calculated using a bottom-up approach.

Digital Payment Market Regional Insights:

North America leads the global digital payment market, driven by technological advancements and widespread adoption in sectors like smart parking and unmanned retail establishments. Europe is poised for substantial growth, supported by initiatives for a unified payments system. The Asia-Pacific region, particularly China, dominates in digital wallet usage and mobile proximity payments, reflecting rapid market expansion and diverse consumer preferences.

Experience the Data: Request a Sample Report: https://www.maximizemarketresearch.com/request-sample/16835/

Market Segmentation:

Discover how the Digital Payment market is segmented and gain insights into each segment's performance and growth potential.

By Component

Solution

Service

By Deployment

Cloud

On-premise

By Vertical

BFSI

Media & Entertainment

IT & Telecommunication

Hospitality

Healthcare

In terms of end users, the BFSI sector dominated the market in 2023, accounting for more than 23.0% of worldwide revenue. Over the projection period, an increase in remittances to low- and middle-income countries is expected to be one of the key drivers of new market growth opportunities. Banks are expanding their capacity to compete with digital payment solution providers such as Google, Amazon, and Facebook. In June 2019, Bank of America, for example, introduced a digital debit card to make life easier for its customers.

Market Key Players:

Identify the leading companies and their portfolios in the Digital Payment market.

North America:

1. Total System Services, Inc.

2. PayPal Holdings Inc

3. ACI Worldwide Inc

4. Dwolla

5. FattMerchant

Europe:

1. Wirecard AG.

2. Novetti Group Limited

3. Adyen N.V.

4. Aurus

5. Worldline

Asia Pacific:

1. Lianta Payments

2. Alipay

3. PayU

Global:

1. Apple Pay

2. Paysafe

3. PayTrace

4. Spreedly

5. WEX

Explore Detailed Report Insights: https://www.maximizemarketresearch.com/market-report/digital-payment-market/16835/

Future Outlook:

The global digital payment market is on a trajectory of exponential growth, fueled by technological advancements, government initiatives, and evolving consumer preferences for convenient, secure, and efficient payment solutions. As the market expands, stakeholders must navigate regulatory landscapes, enhance cybersecurity measures, and innovate to capitalize on emerging opportunities in the digital economy.

Table of Content: Digital Payment Market

Part 01: Executive Summary

Part 02: Scope of the Transmission Sales Report

Part 03: Transmission Sales Landscape

Part 04: Transmission Sales Sizing

Part 05: Transmission Sales Segmentation by Type

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

Key questions answered in the Digital Payment Market include:

• Who are the leading companies and what are their portfolios in the Digital Payment Market?

• What segments are covered in the Digital Payment Market?

• Who are the key players in the Digital Payment market?

• Which application holds the highest potential in the Digital Payment market?

• What are the key challenges and opportunities in the Digital Payment market?

• What is Digital Payment?

• What was the Digital Payment market size in 2023?

• What will be the CAGR at which the Digital Payment market will grow?

• What is the growth rate of the Digital Payment Market?

• Which factors are expected to drive the Digital Payment market growth?

• What are the different segments of the Digital Payment Market?

• What growth strategies are players considering to increase their presence in Digital Payment?

• What are the upcoming industry applications and trends for the Digital Payment Market?

• What recent industry trends can be implemented to generate additional revenue streams for the Digital Payment Market?

Key Offerings:

• Historical Market Size and Competitive Landscape (2018 to 2022)

• Historical Pricing and Price Trends by Region (2018 to 2022)

• Market Size, Share, and Forecast by Different Segments (2024-2030)

• Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by Region

• Market Segmentation - Detailed Analysis by Segment and Sub-Segment by Region

• Competitive Landscape - Profiles of Key Players by Region from a Strategic Perspective

• Competitive Landscape - Market Leaders, Market Followers, Regional Players

• Competitive Benchmarking of Key Players by Region

• PESTLE Analysis

• PORTER's Analysis

• Value Chain and Supply Chain Analysis

• Legal Aspects of Business by Region

• Lucrative Business Opportunities with SWOT Analysis

• Recommendations

Click Here to Explore Additional Reports on Related Topics:

Global Digital Body Thermometer Market https://www.maximizemarketresearch.com/market-report/global-digital-body-thermometer-market/109860/

Global Semiconductor Clock Market https://www.maximizemarketresearch.com/market-report/global-semiconductor-clock-market/89913/

Global Cultivator and Tiller Machinery Market https://www.maximizemarketresearch.com/market-report/global-cultivator-and-tiller-machinery-market/22787/

Global Electrophotographic Printing Market https://www.maximizemarketresearch.com/market-report/global-electrophotographic-printing-market/30488/

Global Virtual Retinal Display Market https://www.maximizemarketresearch.com/market-report/global-virtual-retinal-display-market/64894/

Global NonDirectional Radio Beacon Market https://www.maximizemarketresearch.com/market-report/global-non-directional-radio-beacon-market/34899/

Downhole Cables Market https://www.maximizemarketresearch.com/market-report/global-downhole-cables-market/66137/

Global SerDes Market https://www.maximizemarketresearch.com/market-report/global-serdes-market/64519/

Global Battery Free RFID Sensor Market https://www.maximizemarketresearch.com/market-report/global-battery-free-rfid-sensor-market/34364/

Global Robotic Fruit Picker Market https://www.maximizemarketresearch.com/market-report/global-robotic-fruit-picker-market/21897/

Contact Us:

Maximize Market Research Pvt. Ltd.

3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

Phone: +91 9607365656

Email: sales@maximizemarketresearch.com

Website: www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is a versatile market research and consulting firm with experts from various industries. We cover sectors such as medical devices, pharmaceuticals, science and engineering, electronic components, industrial equipment, technology and communication, automobiles, chemicals, general merchandise, beverages, personal care, and automated systems. We offer market-verified industry estimates, technical trend analysis, critical market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Payment Market 2024 Growth, Industry Trend, Sales Revenue, Size by Regional Forecast to 2030 here

News-ID: 3541132 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Ready-to-Drink Beverages Market Size to Reach USD 1,227.81 Billion by 2032

Ready-to-Drink Beverages Market is poised for substantial growth over the forecast period, driven by changing consumer lifestyles, rising disposable income, expanding urbanization, and increasing demand for convenient beverage solutions. According to recent industry analysis, the global Ready-to-Drink Beverages Market was valued at USD 766.69 Billion in 2024 and is projected to grow at a compound annual growth rate (CAGR) of 6.22% from 2025 to 2032, reaching nearly USD 1,227.81 Billion…

Second hand Product Market Set to Surpass USD 1451.34 Billion by 2032, Expanding …

Second hand Product Market was valued at USD 594.45 Billion in 2025 and is projected to grow at a robust CAGR of 13.6% from 2025 to 2032, reaching nearly USD 1451.34 Billion by 2032. The rapid expansion of resale ecosystems, increasing consumer preference for cost-effective purchasing, and rising sustainability awareness are significantly driving the growth of the Second hand Product Market globally.

Market Overview

The Second hand Product Market is undergoing a…

Tungsten Market to Reach USD 10.99 Billion by 2032, Driven by Expanding Aerospac …

The Global Tungsten Market is poised for significant expansion over the coming years, with the market size valued at USD 6.41 Billion in 2025 and projected to grow at a CAGR of 8% from 2025 to 2032, reaching nearly USD 10.99 Billion by 2032. Rising industrial demand, technological advancements in material science, and increasing applications in high-performance sectors are collectively driving this steady growth trajectory.

Tungsten, recognized for its exceptional hardness,…

System-on-Chip (SoC) Market to Reach USD 391.61 Billion by 2032, Driven by 5G, A …

The global System-on-Chip (SoC) Market is poised for significant growth over the forecast period, reflecting the rapid evolution of semiconductor technologies and increasing demand for high-performance, energy-efficient electronic devices. Valued at USD 228.06 Billion in 2025, the market is projected to grow at a CAGR of 8.03% from 2025 to 2032, reaching nearly USD 391.61 Billion by 2032.

♦ Request a Free Sample Copy or View Report Summary:https://www.maximizemarketresearch.com/request-sample/33954/

System-on-Chip (SoC) Market Overview

A…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…