Press release

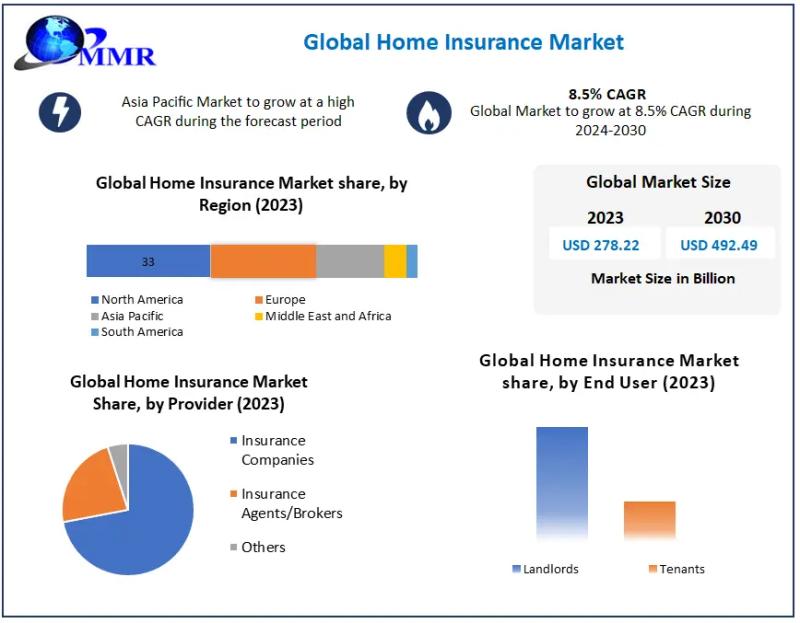

Home Insurance Market Demand Will Reach a Value of USD 492.49 Billion by the Year 2030, At a CAGR of 8.5 percentage

Anticipated Growth in Revenue:Home Insurance Market size was valued at USD 278.22 Bn in 2023 and is expected to reach USD 492.49 Bn by 2030, at a CAGR of 8.5%.

Home Insurance Market Overview:

The home insurance market is a dynamic sector within the insurance industry that provides financial protection to homeowners against various risks such as fire, theft, natural disasters, and liability claims. With a significant portion of homeowners opting for insurance to safeguard their properties, the market is characterized by a diverse range of policies tailored to meet different needs and budgets. Insurance providers compete by offering varied coverage options, deductibles, and premiums, aiming to attract customers through personalized services and digital innovations. Regulatory frameworks play a crucial role in shaping market dynamics, ensuring fair practices and consumer protection. As homeowners increasingly recognize the importance of mitigating financial risks associated with owning property, the home insurance market continues to evolve with advancements in technology and changing consumer preferences.

Get Free Access to Our Sample Report:https://www.maximizemarketresearch.com/request-sample/209436/

Home Insurance Market Trends:

The home insurance market is witnessing several notable trends shaping its landscape. One prominent trend is the integration of technology, with insurers leveraging data analytics and smart home devices to assess risks more accurately and offer personalized policies. Another significant trend is the increasing prevalence of climate-related risks, driving insurers to reassess their underwriting strategies and coverage options in response to more frequent and severe weather events. Moreover, there is a growing demand for customizable insurance products that cater to diverse consumer needs and lifestyles, such as coverage for home offices and high-value items. Additionally, digitalization is streamlining the customer experience, from quote comparison to claims processing, thereby enhancing customer satisfaction and retention in an increasingly competitive market.

What are Home Insurance Market Dynamics?

Home insurance market dynamics encompass a range of factors influencing the industry's behavior and growth. These dynamics include the fluctuation of premiums based on risk assessments, which are influenced by factors such as location, property value, and claims history. Insurers continually adjust their underwriting practices and coverage offerings in response to changing regulatory requirements and market conditions. Consumer behavior also plays a crucial role, with evolving preferences towards digital platforms for policy management and claims processing driving insurers to innovate their service delivery models. Competitive pressures within the market compel insurers to differentiate themselves through customized coverage options, bundling of services, and value-added benefits. Overall, the home insurance market is characterized by its responsiveness to economic trends, technological advancements, regulatory changes, and shifting consumer expectations, shaping a dynamic and evolving landscape.

Request For Free Inquiry Report:https://www.maximizemarketresearch.com/inquiry-before-buying/209436/

Home Insurance Market Opportunities:

The home insurance market presents several significant opportunities for insurers looking to capitalize on current trends and consumer needs. One key opportunity lies in expanding coverage options to include emerging risks such as cybersecurity for smart home devices and protection against identity theft. Moreover, there is a growing demand for sustainable and eco-friendly home insurance products that incentivize energy-efficient upgrades and environmentally responsible practices. Insurers can also leverage advanced data analytics and AI-driven technologies to enhance risk assessment accuracy, optimize pricing strategies, and improve operational efficiencies. Additionally, the shift towards digital platforms offers opportunities to enhance customer engagement through user-friendly interfaces, personalized policy recommendations, and seamless claims processing experiences. By embracing these opportunities, insurers can not only attract new customers but also strengthen loyalty among existing policyholders in a competitive market landscape.

What is Home Insurance Market Regional Insight?

The regional insights into the home insurance market highlight significant variations and trends across different geographical areas. In regions prone to natural disasters like hurricanes or earthquakes, there is typically a higher demand for comprehensive coverage against such risks, influencing pricing and policy offerings. Urban areas often see higher premiums due to increased property values and risks like theft or vandalism. Conversely, rural regions might experience lower premiums but face unique challenges such as limited access to emergency services. Regulatory environments also vary, impacting insurers' operations and the extent of coverage required by law. Cultural factors and economic conditions further shape consumer behaviors and preferences, influencing insurers to tailor products that resonate with local needs and expectations. As such, understanding these regional nuances is crucial for insurers aiming to effectively penetrate and navigate the diverse landscape of the home insurance market.

Get An Exclusive Sample Of The Home Insurance Market Report At This Link (Get The Higher Preference For Corporate Email ID): -https://www.maximizemarketresearch.com/request-sample/209436/

What is Home Insurance Market Segmentation?

by Coverage

Comprehensive Coverage

Dwelling Coverage

Content Coverage

Others

by Provider

Insurance Companies

Insurance Agents/Brokers

Others

by End User

Landlords

Tenants

Some of the current players in the Home Insurance Market are:

1. Allianz (Germany)

2. Admiral Group Plc (United Kingdom)

3. American International Group, Inc(US)

4. AXA(France)

5. Allstate Insurance Company(US)

6. Chubb(Switzerland)

7. State Farm Mutual Automobile Insurance Company(US)

8. Liberty Mutual Insurance(US)

9. Nationwide Mutual Insurance Company(US)

10. Travelers Indemnity Company(US)

11. PICC R(China)

12. Zurich Insurance Group(Switzerland)

13. MetLife Services and Solutions(US)

14. State Farm(US)

15. Farmers Insurance Group(US)

16. USAA(US)

17. Nationwide Mutual Insurance Company(US)

18. Progressive Corporation(US)

19. Erie Insurance Group(US)

20. Hartford Financial Services Group(US)

21. Assurant, Inc. (US)

22. CNA Financial Corporation(US)

23. Hanover Insurance Group(US)

24. Mercury General Corporation(US)

25. Auto-Owners Insurance Group(US)

Know More About The Report :https://www.maximizemarketresearch.com/market-report/home-insurance-market/209436/

Key Offerings:

Past Market Size and Competitive Landscape

Home Insurance Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Home Insurance Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

For additional reports on related topics, visit our website:

♦ GIS Market https://www.maximizemarketresearch.com/market-report/global-gis-market/28729/

♦ Packaged Food Market https://www.maximizemarketresearch.com/market-report/packaged-food-market/122151/

♦ Programmable Ethernet Switch Market https://www.maximizemarketresearch.com/market-report/programmable-ethernet-switch-market/187978/

♦ Wood Flooring Market https://www.maximizemarketresearch.com/market-report/global-wood-flooring-market/22978/

♦ India Chocolate Market https://www.maximizemarketresearch.com/market-report/india-chocolate-market/24126/

♦ Premium Spirits Market https://www.maximizemarketresearch.com/market-report/premium-spirits-market/183198/

♦ Global Silicon Carbide Fiber Market https://www.maximizemarketresearch.com/market-report/global-silicon-carbide-fiber-market/44732/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Home Insurance Market Demand Will Reach a Value of USD 492.49 Billion by the Year 2030, At a CAGR of 8.5 percentage here

News-ID: 3539244 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

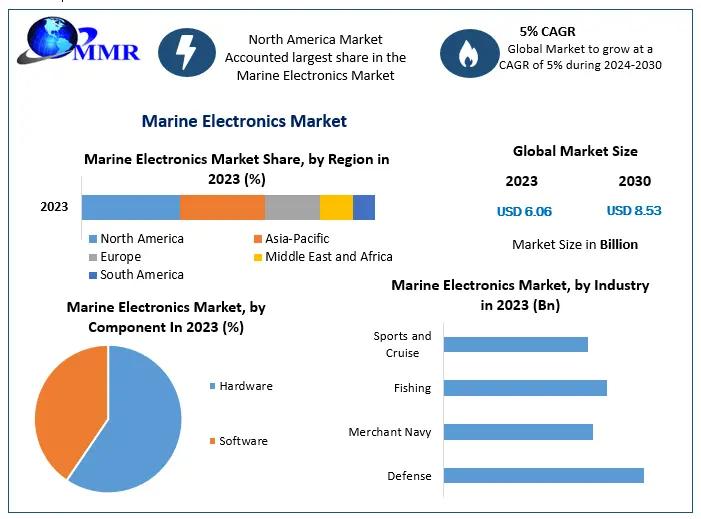

Marine Electronics Market Expected to Reach USD 8.53 Bn by 2030 - Growth Forecas …

Marine Electronics Market Size: According to Maximize Market Research, the Global Marine Electronics Market was valued at US$ 6.06 billion in 2023 and is expected to reach US$ 8.53 billion by 2030, growing at a CAGR of around 5% during 2024-2030.

Market Overview

The Global Marine Electronics Market encompasses electronic devices and systems designed specifically for marine environments. These include navigation systems, communication devices, safety equipment, sonar & radar, vessel management systems,…

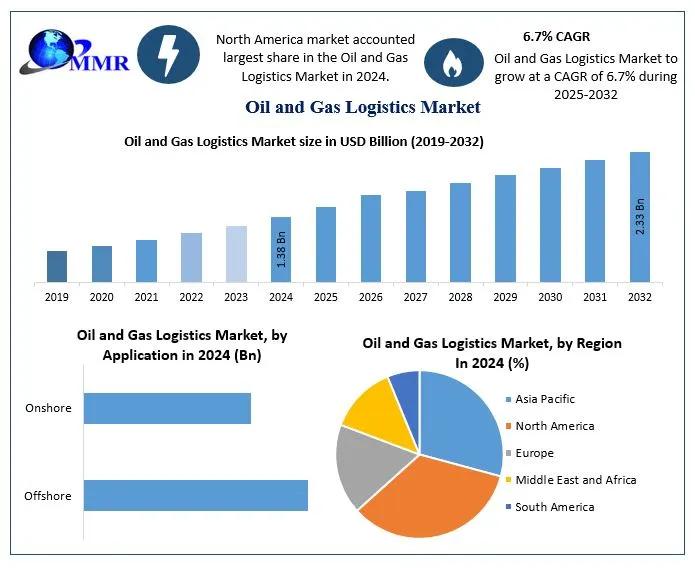

Oil and Gas Logistics Market to Reach USD 2.33 Billion by 2032 | Growth, Trends, …

The Oil and Gas Logistics Market was valued at USD 1.38 Billion in 2024 and is forecasted to grow to USD 2.33 Billion by 2032, exhibiting a CAGR of 6.7% during 2025 to 2032, driven by rising global energy demand, technological innovation, and expanding upstream and downstream supply chain activities.

Market Overview

The oil and gas logistics market encompasses the transportation, storage, handling, and distribution of crude oil, refined products, natural gas,…

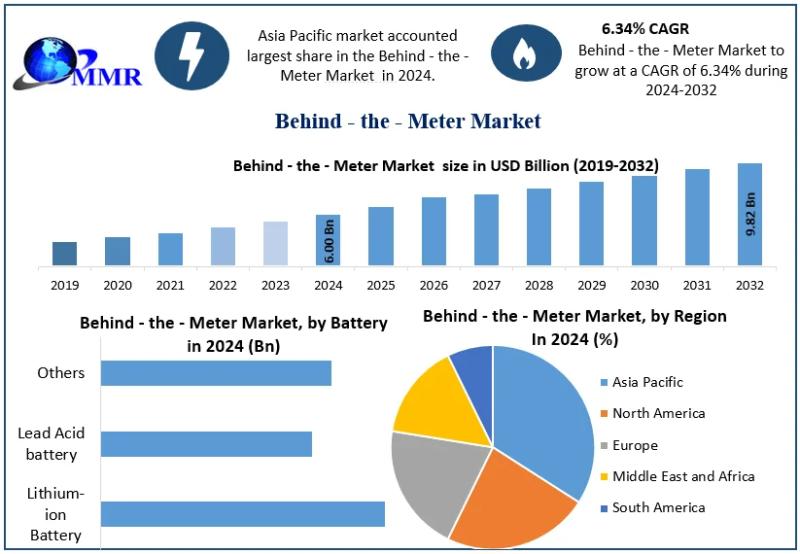

Behind the Meter Market to Surge to USD 9.82 Billion by 2032 - Unmatched Growth …

According to Maximize Market Research, the Global Behind the Meter Market was valued at USD 6.00 Billion in 2024 and is projected to reach USD 9.82 Billion by 2032 at a 6.34 % CAGR, driven by growth in residential, commercial, and industrial energy storage adoption.

Market Overview

The Behind the Meter Market consists of energy storage systems installed on the consumer side of the utility meter. These systems store electricity generated from…

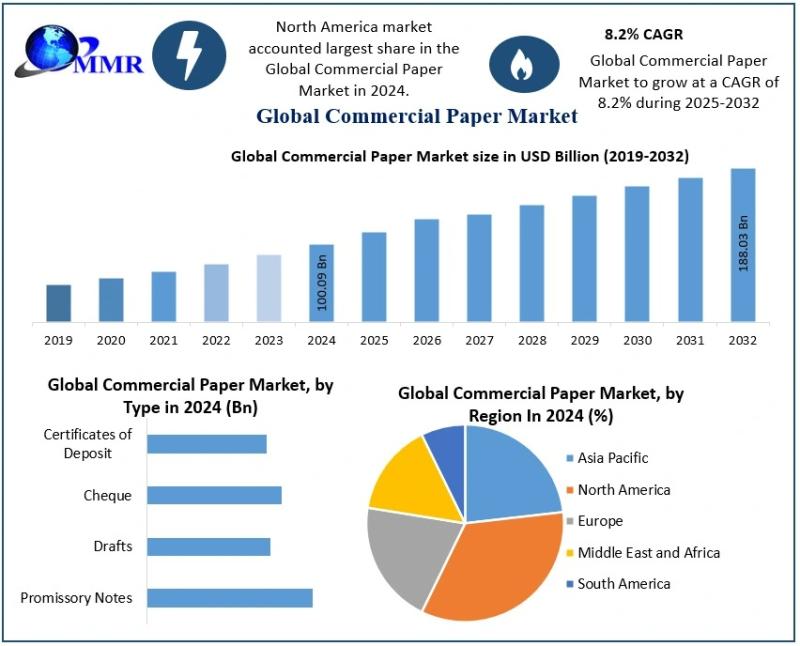

Commercial Paper Market Expected to Witness Steady Growth Driven by Short-Term C …

The Commercial Paper Market size was valued at USD 100.09 Billion in 2024 and the total Commercial Paper revenue is expected to grow at a CAGR of 8.2% from 2025 to 2032, reaching nearly USD 188.03 Billion.

Curious to peek inside? Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/199690/

The Commercial Paper Market is gaining strong momentum as corporations, financial institutions, and large enterprises increasingly rely on short-term unsecured debt instruments…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…