Press release

Algorithmic Trading Market Demand Will Reach a Value of USD 31.90 Bn. by the Year 2030, At a CAGR of 10.6 percentage

Anticipated Growth in Revenue:Algorithmic Trading Market size was valued at USD 15.76 Bn. in 2023 and the total Algorithmic Trading revenue is expected to grow by 10.6 % from 2024 to 2030, reaching nearly USD 31.90 Bn.

Algorithmic Trading Market Overview:

Algorithmic trading, also known as algo-trading or automated trading, has revolutionized financial markets by leveraging computer algorithms to execute trades at high speeds and frequencies. This approach allows for the rapid analysis of vast amounts of market data, identifying opportunities and executing orders with minimal human intervention. Algorithmic trading strategies range from simple to highly complex, encompassing statistical arbitrage, trend following, and market-making techniques. The growth of algorithmic trading has been fueled by advancements in technology, providing institutions and individual traders with the ability to achieve better pricing, reduced transaction costs, and increased liquidity.

Unlock Insights: Request a Free Sample of Our Latest Report Now: https://www.maximizemarketresearch.com/request-sample/29843/

Algorithmic Trading Market Trends:

In recent years, algorithmic trading has seen notable trends shaping the market landscape. One significant trend is the rise of machine learning and artificial intelligence (AI) techniques applied to trading algorithms, enhancing their predictive capabilities and adaptability to changing market conditions. Moreover, there has been a growing emphasis on integrating alternative data sources, such as social media sentiment analysis and satellite imagery, into trading strategies to gain informational advantages. Additionally, regulatory developments continue to evolve, focusing on transparency, fairness, and risk management in algorithmic trading practices. These trends reflect a broader shift towards more sophisticated, data-driven trading approaches that seek to optimize performance while navigating regulatory complexities in global financial markets.

What are Algorithmic Trading Market Dynamics?

Algorithmic trading market dynamics encompass a range of factors that influence the operation and evolution of automated trading strategies. Key dynamics include the continuous advancement of technology, which drives the development of faster and more efficient trading algorithms capable of processing large volumes of data in real-time. Market liquidity and volatility also play crucial roles, as algorithmic strategies seek to capitalize on price discrepancies and execute trades swiftly across various asset classes. Regulatory changes and compliance requirements shape the framework within which algorithmic trading operates, influencing strategy development and risk management practices. Moreover, the increasing adoption of algorithmic trading by institutional investors and the proliferation of retail algorithmic trading platforms contribute to market liquidity and efficiency while introducing new competition dynamics.

Need More Information? Inquire About Sample + Graphs Here: https://www.maximizemarketresearch.com/inquiry-before-buying/29843/

Algorithmic Trading Market Opportunities:

The algorithmic trading market presents several compelling opportunities amidst its dynamic evolution. One significant opportunity lies in the ability of algorithms to harness big data and advanced analytics, enabling traders to uncover hidden patterns and market inefficiencies that may not be evident through traditional analysis. Moreover, the global reach of algorithmic trading platforms allows market participants to access multiple exchanges and asset classes simultaneously, facilitating diversified trading strategies and enhanced portfolio management. Another promising opportunity arises from the growing demand for customized algorithmic solutions tailored to specific investor preferences and risk profiles, thereby catering to a broader range of client needs. Furthermore, the integration of artificial intelligence and machine learning algorithms continues to expand, promising further improvements in predictive accuracy and adaptive trading strategies.

What is Algorithmic Trading Market Regional Insight?

The algorithmic trading market exhibits diverse regional insights driven by varying regulatory environments, technological adoption rates, and market structures. In North America, particularly in the United States, algorithmic trading dominates due to sophisticated financial markets, advanced technological infrastructure, and a high concentration of institutional investors. Europe follows closely, with major financial hubs like London contributing significantly to algorithmic trading activity, supported by stringent regulatory frameworks aimed at balancing innovation and market stability. In Asia-Pacific, countries such as Japan and Hong Kong are witnessing rapid growth in algorithmic trading, driven by technological advancements and increasing institutional participation. Emerging markets in Latin America and Africa are gradually adopting algorithmic trading strategies, albeit at a slower pace, influenced by regulatory reforms and infrastructure development.

FREE |Get a Copy of Sample Report Now! @ https://www.maximizemarketresearch.com/request-sample/29843/

What is Algorithmic Trading Market Segmentation?

by Component

Solutions

Platforms

Software Tools

Services

Professional Services

Managed Services

by Trading Type

Foreign Exchange (FOREX)

Stock Markets

Exchange-Traded Fund (ETF)

Bonds

Cryptocurrencies

Others

by Deployment Mode

ON-PREMISE

CLOUD

by Enterprise Size

SME's

Large Enterprises

Some of the current players in the Algorithmic Trading Market are:

1. Algo Trader GmbH (Switzerland)

2. Trading Technologies (USA)

3. Info Reach (USA)

4. Tethys Technology (USA)

5. Lime Brokerage LLC (USA)

6. Flex Trade Systems (USA)

7. Tower Research Capital (USA)

8. Virtu Financial (USA)

9. Hudson River Trading (USA)

10. Citadel (USA)

11. Technologies International (USA)

12. Argo Software Engineering (USA)

13. Automated Trading Soft-Tech (India)

14. Kuberre Systems (USA)

15. Meta Quotes Software Corp. (Cyprus)

16. Software AG (Germany)

17. Thomson Reuters Corporation (Canada)

18. uTrade (India)

19. Vela Trading Systems LLC (USA)

For More Information About This Research Please Visit: https://www.maximizemarketresearch.com/market-report/global-algorithmic-trading-market/29843/

Key Offerings:

Past Market Size and Competitive Landscape

Algorithmic Trading Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Algorithmic Trading Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Explore our top-performing reports on the latest trends:

♦ Global Smart Office Market: https://www.maximizemarketresearch.com/market-report/global-smart-office-market/24179/

♦ Government Cloud Market: https://www.maximizemarketresearch.com/market-report/global-government-cloud-market/4007/

♦ Innovation Management Market: https://www.maximizemarketresearch.com/market-report/global-innovation-management-market/92520/

♦ Customer Data Platform Market: https://www.maximizemarketresearch.com/market-report/customer-data-platform-market/14397/

♦ The smartphone market: https://www.maximizemarketresearch.com/market-report/global-smartphone-market/43099/

♦ silicon wafer market: https://www.maximizemarketresearch.com/market-report/global-silicon-wafer-market/35534/

♦ Glboal Luxury Perfume Market: https://www.maximizemarketresearch.com/market-report/global-luxury-perfume-market/38622/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Algorithmic Trading Market Demand Will Reach a Value of USD 31.90 Bn. by the Year 2030, At a CAGR of 10.6 percentage here

News-ID: 3539109 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

Ammonia Market Forecast Indicates 2.05% CAGR Driven by Industrial and Agricultur …

The Ammonia Market size was valued at USD 189372.96 kilotons in 2024 and the total Ammonia revenue is expected to grow at a CAGR of 2.05% from 2025 to 2032, reaching nearly USD 222752.22 kilotons.

Ammonia Market Overview:

The Ammonia Market plays a critical role in supporting modern industry, agriculture, and energy systems by acting as a foundational chemical used across multiple value chains. It is widely relied upon for fertilizer production,…

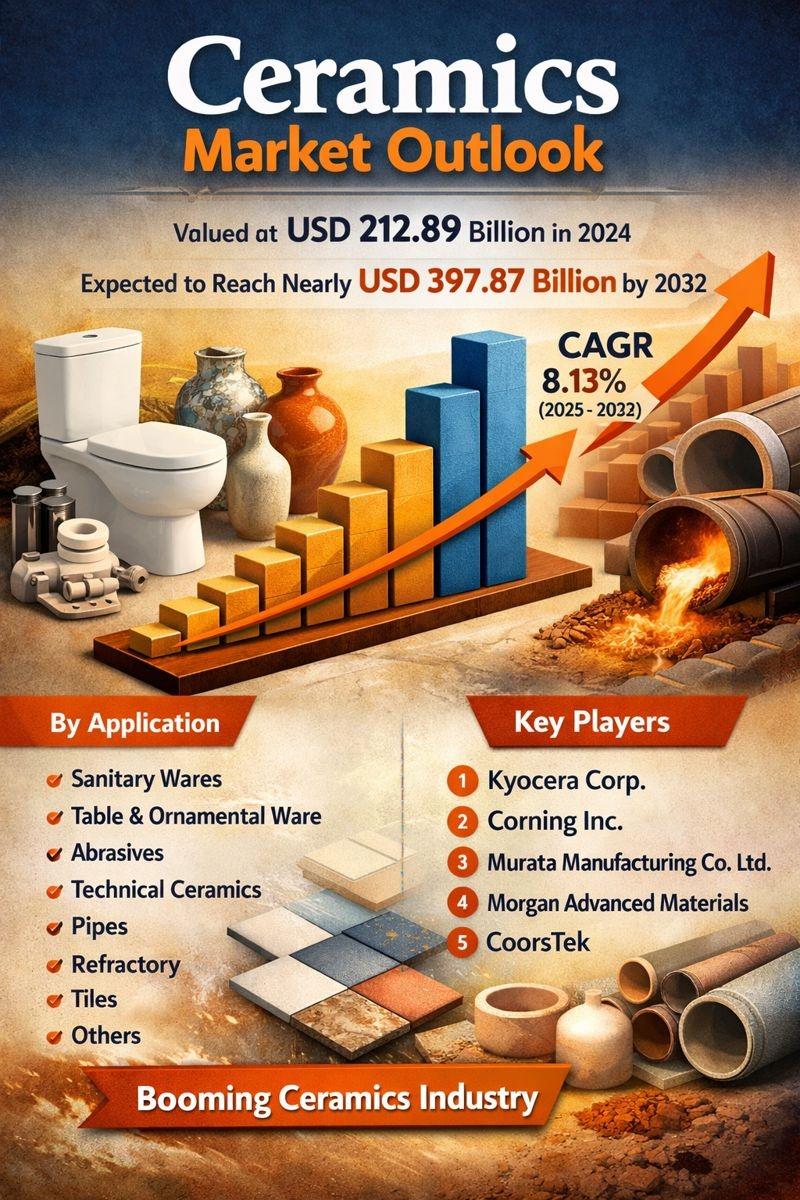

Ceramics Market Witnesses Strong Transformation Driven by Innovation and Expandi …

The Ceramics Market size was valued at USD 212.89 Billion in 2024 and the total Ceramics revenue is expected to grow at a CAGR of 8.13% from 2025 to 2032, reaching nearly USD 397.87 Billion.

Ceramics Market Overview:

The Ceramics Market encompasses a wide range of products, including traditional ceramics such as tiles, sanitary ware, and tableware, as well as advanced ceramics used in specialized industrial and medical applications. This diversity allows…

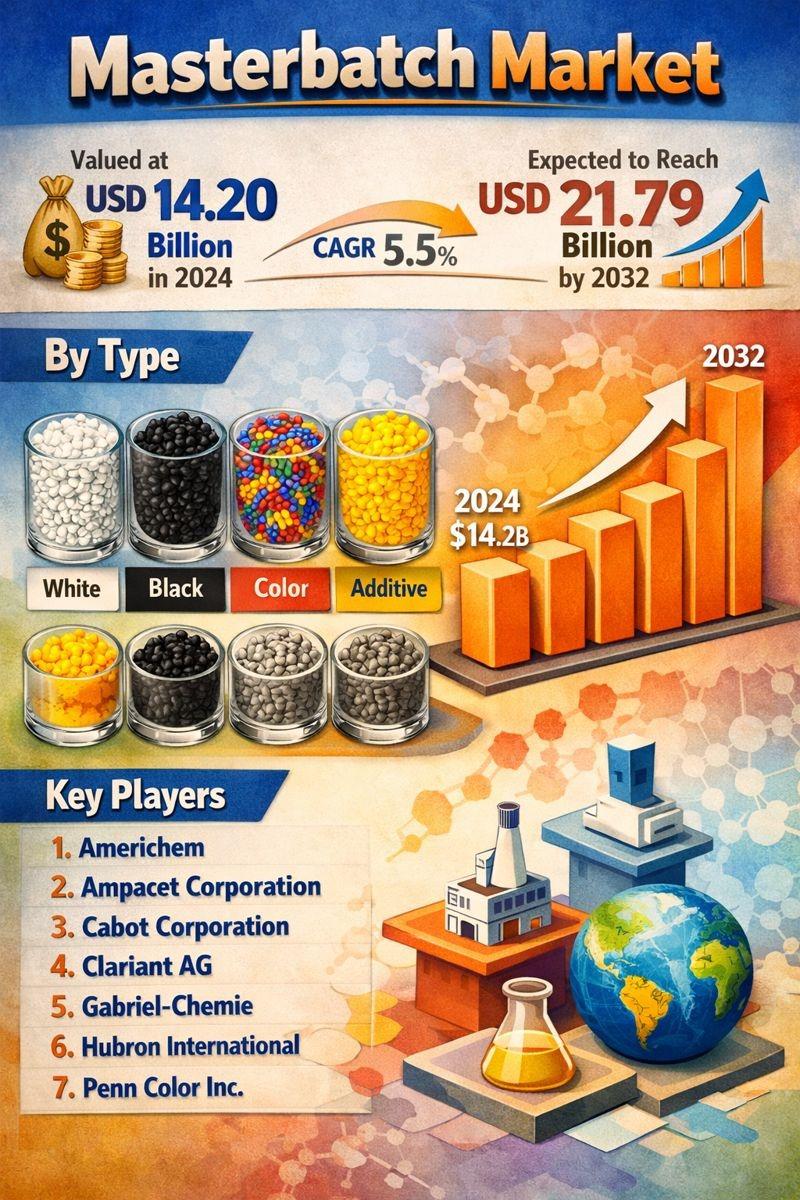

Masterbatch Market Shows Strong Momentum Driven by Innovation and Sustainability

The Masterbatch Market size was valued at USD 14.20 Billion in 2024 and the total Masterbatch revenue is expected to grow at a CAGR of 5.5% from 2025 to 2032, reaching nearly USD 21.79 Billion.

Masterbatch Market Overview:

The Masterbatch Market continues to gain attention as manufacturers across plastics, packaging, automotive, consumer goods, and construction industries increasingly focus on product differentiation and visual appeal. Color masterbatches play a vital role in enhancing…

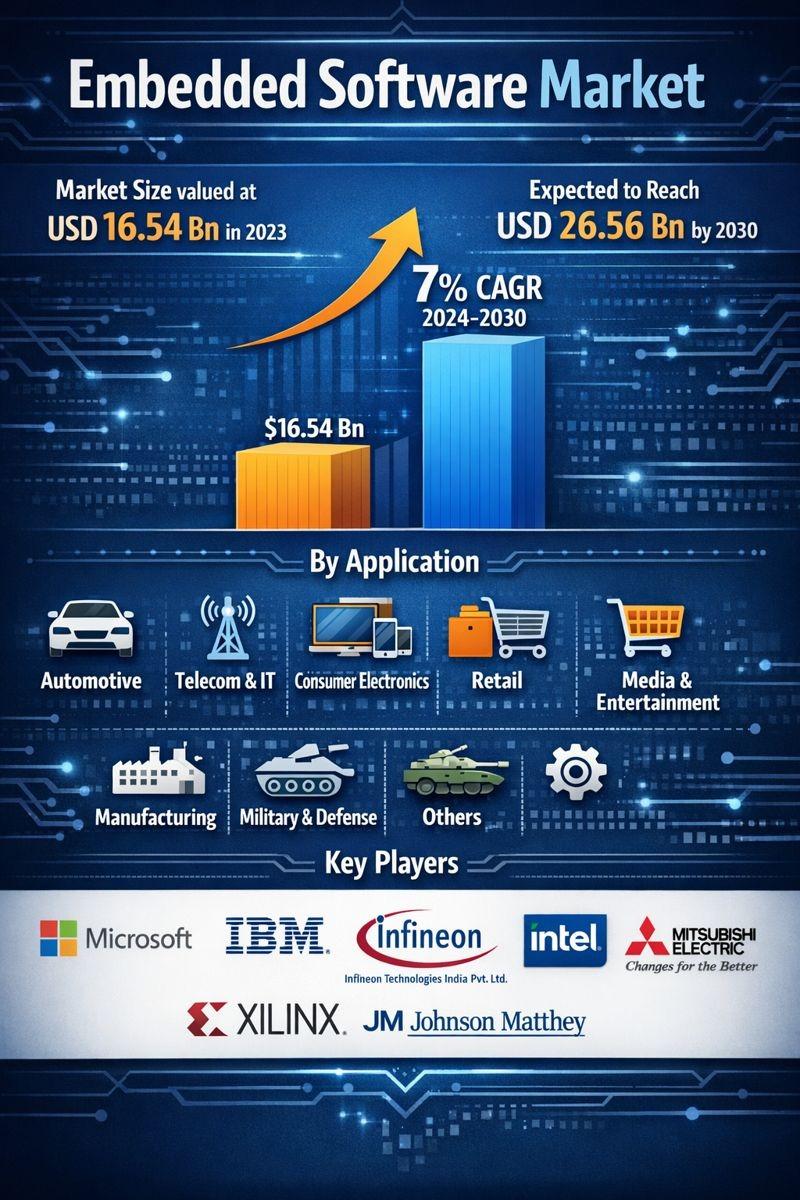

Embedded Software Market Poised for Intelligent, Connected, and Real-Time Growth …

Embedded Software Market size was valued at USD 16.54 Bn. in 2023 and the total Embedded Software revenue is expected to grow at 7% from 2024 to 2030, reaching nearly USD 26.56 Bn. The Market is witnessing strong momentum as industries increasingly adopt smart, connected, and automated systems across manufacturing, automotive, consumer electronics, healthcare, and industrial applications. Embedded software acts as the core intelligence inside hardware devices, enabling real-time processing,…

More Releases for Trading

Algorithmic Trading Market Showing Impressive Growth : Hudson River Trading, Jum …

The competitive landscape which incorporates the Algorithmic Trading Market ranking of the major players, along with new service/product launches, partnerships, business expansions and acquisitions in the past five years of companies profiled are also highlighted in the Algorithmic Trading Market report. Extensive company profiles comprising of company overview, company insights, product benchmarking and SWOT analysis for the major Algorithmic Trading Market players.

Top 10 key companies…

Increasing Awareness about Algorithmic Trading Market In Coming Years By Virtu F …

Global Algorithmic Trading Industry 2019 Research report provides information regarding market size, share, trends, growth, cost structure, capacity, revenue and forecast 2025. This report also includes the overall and comprehensive study of the Algorithmic Trading market with all its aspects influencing the growth of the market. This report is exhaustive quantitative analyses of the Algorithmic Trading industry and provides data for making Strategies to increase the market growth and effectiveness.

Algorithmic…

Algorithmic Trading Market 2024 SWOT Analysis by Key Players like Virtu Financia …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time. Algorithmic Trading are mainly used in investment banks, pension funds, mutual funds, hedge funds, etc.

Key trend which will predominantly effect the market in coming…

Automated Trading Market By Top Key Players- Citadel, KCG, Optiver, DRW Trading, …

The report "Automated Trading Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2016 - 2024", has been prepared based on an in-depth market analysis with inputs from industry experts.

An automated trading system, also referred to as mechanical trading system or algorithmic trading system, enables vendors to set up specific rules for money management, trade entries, and trade exits. Automated trading systems are generally programmed in a way…

Search4Research Announced Algorithmic Trading Market Forecast to 2024 - Virtu Fi …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time.

Algorithmic Trading Market provides a detail overview of latest technologies and in-depth analysis that reflect top vendor’s portfolios and technology; examines the strategic planning, challenges…

Algorithmic Trading Market 2019 | Flow Traders, Jump Trading, Spot Trading, DRW …

Global Algorithmic Trading market is also presented to the readers as a holistic snapshot of the competitive landscape within the given forecast period. The report also educates about the market strategies that are being adopted by your competitors and leading organizations. The report also focuses on all the recent industry trends. It presents a comparative detailed analysis of the all regional and player segments, offering readers a better knowledge of…