Press release

Mobile Money Market Hits USD 810.6 Billion in 2032, Forecasts 22.4% CAGR (2023-2032)

The mobile money market has been experiencing exponential growth over the past decade, revolutionizing the way financial transactions are conducted globally. According to recent statistics, the global mobile money market revenue is projected to reach an astounding USD 810.6 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 22.4% from 2023 to 2032. This rapid growth is indicative of the increasing reliance on digital financial solutions and the widespread adoption of mobile technology across various regions and sectors.Download Sample Report Copy of This Report from Here: https://www.acumenresearchandconsulting.com/request-sample/381

Regional Insights

Asia-Pacific: A Dominant Force

The Asia-Pacific region has emerged as a dominant player in the mobile money market, with its market value surpassing USD 43 billion in 2022. This region's significant market share can be attributed to the high penetration of smartphones, a large unbanked population, and the proactive measures taken by governments to promote financial inclusion. Countries like China, India, and Indonesia are at the forefront of this growth, leveraging technological advancements to offer innovative mobile money services that cater to the diverse needs of their populations.

North America: Steady and Significant Growth

North America is also experiencing robust growth in the mobile money market, with an anticipated CAGR of more than 19% from 2023 to 2032. The region's growth is driven by the widespread adoption of mobile payment solutions, a tech-savvy population, and the presence of key market players such as Apple Pay, Google Wallet, and PayPal. Moreover, the integration of mobile money services with other financial systems and the increasing use of proximity payments are fueling this growth, making mobile money an integral part of the financial ecosystem in North America.

Mobile Money Market Segmentation

Mobile Money Market By Transaction Mode

• NFC/Smart Card

• Direct Mobile Billing

• Mobile Web/WAP Payments

• SMS

• STK/USSD

• Mobile Apps

• IVRS

• QR Codes

• Others

Mobile Money Market By Nature Of Payment

• Person to Person (P2P)

• Person to Business (P2B)

• Business to Person (B2P)

• Business to Business (B2B)

Mobile Money Market By Type of Payments

• Remote Payments

• Proximity Payments

Mobile Money Market By Application

• Money transfers

• Bill Payments

• Airtime Transfer and Top-Ups

• Travel and Ticketing

• Merchandise

• Coupons

Mobile Money Market By Industry Vertical

• BFSI

• Telecom and IT

• Media and entertainment

• Healthcare

• Retail

• Travel and hospitality

• Transportation and logistics

• Energy and utilities

• Others

Trends and Innovations

Integration with Financial Services

One of the most significant trends in the mobile money market is the integration with other financial services. This integration is enhancing the functionality and appeal of mobile money platforms, allowing users to access a wider range of financial services such as savings accounts, insurance, and loans. For instance, mobile money platforms are increasingly being linked with microfinance institutions, enabling small businesses and individuals to access credit facilities more easily. This trend is not only driving the adoption of mobile money but also contributing to economic growth by empowering users financially.

Emergence of Super Apps

Another notable trend is the emergence of super apps, which offer a comprehensive suite of services within a single platform. These apps combine mobile payments, e-commerce, ride-hailing, food delivery, and various other services, providing users with a seamless and integrated experience. In regions like Southeast Asia and China, super apps such as Grab and WeChat have gained immense popularity, driving the growth of the mobile money market by offering unparalleled convenience and functionality.

Blockchain and Cryptocurrencies

The integration of blockchain technology and cryptocurrencies is also making waves in the mobile money market. Blockchain's inherent security, transparency, and decentralization make it an ideal technology for enhancing the security and efficiency of mobile money transactions. Moreover, the growing acceptance of cryptocurrencies as a payment method is adding a new dimension to the mobile money landscape, providing users with more options and increasing the market's appeal.

Mobile Money Market Players

Some of the global mobile money companies profiled in the report include Bango.net Limited, Dwolla, Inc., Google, Boku, Inc., Judo Payments, Mastercard, Square, Inc., Gemalto, Paypal, Inc., PAYTM, VISA, and WePay, Inc.

Challenges and Opportunities

Regulatory Hurdles

Despite the promising growth prospects, the mobile money market faces several challenges. Regulatory hurdles are one of the primary obstacles, as governments and regulatory bodies strive to keep pace with the rapid technological advancements. Ensuring compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations, while fostering innovation, remains a delicate balance that regulators must maintain.

Security Concerns

Security concerns also pose a significant challenge to the mobile money market. As mobile money transactions become more prevalent, the risk of cyberattacks and fraud increases. Market players must invest in robust security measures, such as encryption, multi-factor authentication, and biometric verification, to protect users' financial information and build trust in mobile money services.

Expanding Financial Inclusion

On the opportunity side, the mobile money market has the potential to significantly expand financial inclusion, particularly in developing regions where access to traditional banking services is limited. By providing a convenient and accessible means of conducting financial transactions, mobile money can empower individuals and businesses, driving economic development and reducing poverty.

Technological Advancements

Technological advancements in artificial intelligence (AI), machine learning, and data analytics are also creating new opportunities for the mobile money market. These technologies can enhance the user experience by offering personalized financial services, detecting and preventing fraud, and optimizing transaction processes. As technology continues to evolve, the capabilities and reach of mobile money services are expected to expand further.

Mobile Money Market Table of Content:

CHAPTER 1. Industry Overview of Mobile Money Market

CHAPTER 2. Research Approach

CHAPTER 3. Market Dynamics And Competition Analysis

CHAPTER 4. Flooring & Wall Panels Plant Analysis

CHAPTER 5. Mobile Money Market By Transaction Mode

CHAPTER 6. Mobile Money Market By Nature Of Payment

CHAPTER 7. Mobile Money Market By Type of Payments

CHAPTER 8. Mobile Money Market By Application

CHAPTER 9. Mobile Money Market By Industry Vertical

CHAPTER 10. North America Mobile Money Market By Country

CHAPTER 11. Europe Mobile Money Market By Country

CHAPTER 12. Asia-Pacific Mobile Money Market By Country

CHAPTER 13. Latin America Mobile Money Market By Country

CHAPTER 14. Middle East & Africa Mobile Money Market By Country

CHAPTER 15. Player Analysis Of Mobile Money Market

CHAPTER 16. Company Profile

Conclusion

The global mobile money market is on a trajectory of rapid growth, driven by technological advancements, increasing smartphone penetration, and the growing demand for digital financial solutions. With a projected market revenue of USD 810.6 billion by 2032 and a CAGR of 22.4% from 2023 to 2032, the future of mobile money looks promising. Key regions like Asia-Pacific and North America are leading the charge, while trends such as the integration with other financial services, the rise of super apps, and the adoption of blockchain technology are shaping the market landscape.

However, challenges such as regulatory compliance and security concerns must be addressed to ensure sustainable growth. By leveraging technological innovations and focusing on expanding financial inclusion, the mobile money market can continue to transform the global financial ecosystem, making financial services more accessible, efficient, and secure for everyone.

Ask Query Here: Richard@acumenresearchandconsulting.com or sales@acumenresearchandconsulting.com

To Purchase this Premium Report@ https://www.acumenresearchandconsulting.com/buy-now/0/381

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Mobile Money Market Hits USD 810.6 Billion in 2032, Forecasts 22.4% CAGR (2023-2032) here

News-ID: 3538988 • Views: …

More Releases from Acumen Research and Consulting

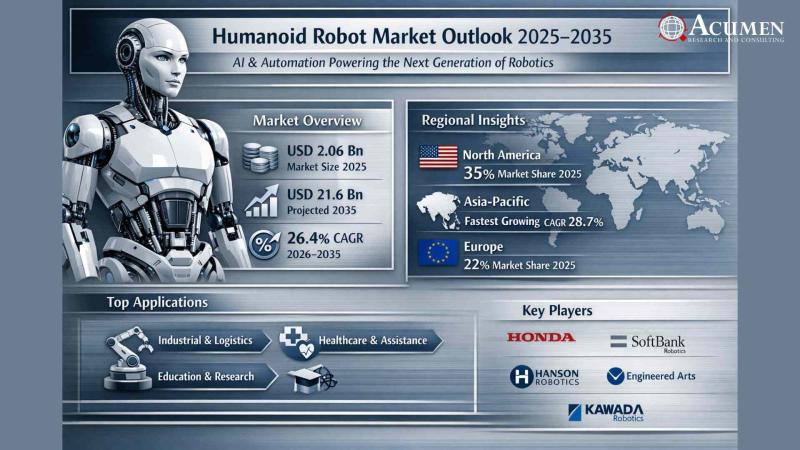

Humanoid Robot Market to Reach USD 21.6 Billion by 2035 | AI & Automation Drive …

Humanoid Robot Market to Surpass USD 21.6 Billion by 2035: AI-Driven Automation Unlocks a New Era of Human-Machine Collaboration

The Humanoid Robot Market is undergoing a transformative boom, reflecting a seismic shift in how industries leverage robotics, artificial intelligence (AI), and automation to meet the growing demands of a rapidly evolving global economy.

According to Acumen Research and Consulting, the global Humanoid Robot Market is projected to grow from USD 2,060.4 million…

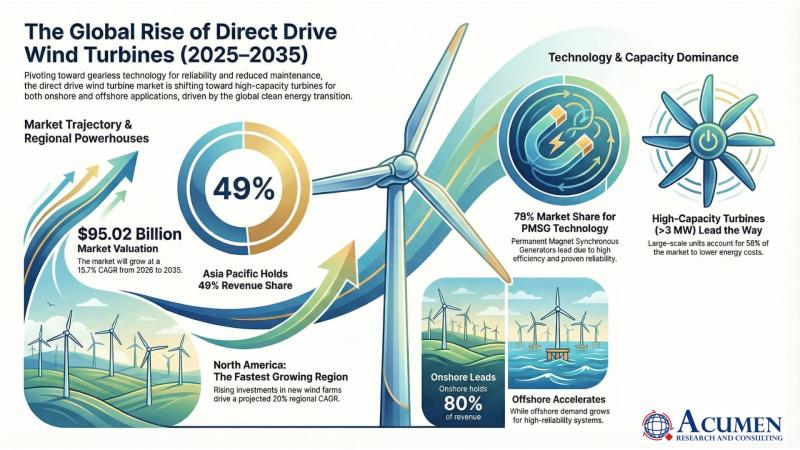

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035 | Acumen Res …

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035, Driven by Global Renewable Expansion and Offshore Innovation | Acumen Research and Consulting

The Direct Drive Wind Turbine Market is witnessing unprecedented growth momentum as the global renewable energy transition accelerates. According to a new report by Acumen Research and Consulting, the global Direct Drive Wind Turbine Market size is projected to grow from USD 21.91 billion in 2025…

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

More Releases for Mobile

Global Mobile Wallet Market, Global Mobile Wallet Industry, Market Revenue, Mark …

The digital wallet is the engine of mobile commerce and also agreements an evolutionary path to decrease the friction in the transaction and optimize consumer satisfaction. The users are interested towards gorgeous cash backs and loyalty coupons suggested by dissimilar mobile wallet corporates. The mobile wallet market in the report denotes to payment services functioned under financial regulation and functioned through a mobile device instead of paying with cheques, cash, or credit cards.…

Asia - Mobile Infrastructure and Mobile Broadband

Bharat Book Bureau Provides the Trending Market Research Report on "Asia - Mobile Infrastructure and Mobile Broadband" under Telecom category. The report offers a collection of superior market research, market analysis, competitive intelligence and industry reports.

Executive Summary

Leading Asian nations prepare for 5G rollouts

Asia’s mobile subscriber market is now witnessing moderate growth in a fast maturing market. Whilst there are still developing markets continuing to grow their mobile subscriber base at…

Mobile Virtual Network Operator (MVNO) Market Analysis by Top Key Players Tracfo …

The mobile virtual network operator (MVNO) is also referred to as the mobile other licensed operator (MOLO), or the virtual network operator (VNO), is the remote service of communication which does not claim the remote network infrastructure on which it gives the customer the services.

Get Sample Copy of this Report @ https://www.bigmarketresearch.com/request-sample/2835705?utm_source=RK&utm_medium=OPR

The MVNO goes into the business agreement with the mobile network operator for acquiring more access to…

Mobile Virtual Network Operator (MVNO) Market Comprehensive Study 2018: Boost Mo …

Global Mobile Virtual Network Operator (MVNO) market report provides a thorough synopsis on the study for market and how it is changing the industry. The data and the information regarding the industry are taken from reliable sources such as websites, annual reports of the companies, journals, and others and were checked and validated by the market experts. Mobile Virtual Network Operator (MVNO) Market report includes historic data, present market trends,…

Asia - Mobile Infrastructure And Mobile Broadband

Asian mobile broadband market continues to grow strongly

With 3.9 billion mobile subscribers and over 50% of the mobile subscribers in the world, spread across a diverse range of markets, the region is already rapidly advancing in the adoption of mobile broadband services. Mobile broadband as a proportion of the total Asian mobile broadband subscriber base, has increased from 2% in 2008 to 18% in 2013, 27% in 2014, 33% in…

Mobile Money Market Trends, Public Demand and Worldwide Strategy - Mobile Commer …

The mobile money market report provides an analysis of the global mobile money market for the period 2014 – 2024, wherein 2015 is the base year and the period from 2016 to 2024 is the forecast period. Data for 2014 has been included as historical information. The report covers all the prevalent trends playing a major role in the growth of the mobile money market over the forecast period. It…