Press release

Empowering Consumers: Insurance Platforms to Grow at 13.7% CAGR, Offering Comprehensive Policy Information and Insights

The "Digital Insurance Platform Market" is a dynamic and rapidly evolving sector, with significant advancements and growth anticipated by 2031. Comprehensive market research reveals a detailed analysis of market size, share, and trends, providing valuable insights into its expansion. This report delves into segmentation and definition, offering a clear understanding of market components and drivers. Employing SWOT and PESTEL analyses, the study evaluates the market's strengths, weaknesses, opportunities, and threats, alongside political, economic, social, technological, environmental, and legal factors. Expert opinions and recent developments highlight the geographical distribution and forecast the market's trajectory, ensuring a robust foundation for strategic planning and investment.What is the projected market size & growth rate of the Digital Insurance Platform Market?

Market Analysis and Insights

Global Digital Insurance Platform Market

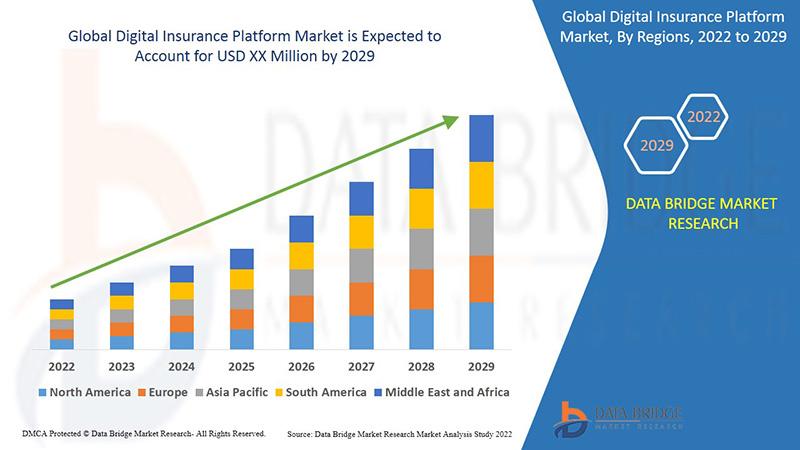

Data Bridge Market Research analyses that the digital insurance platform market will exhibit a CAGR of 13.7% for the forecast period of 2022-2029.

The insurance platform is a collection of websites that provide information about insurance policies as well as other relevant information. The digital insurance platform, in particular, is created and developed to help customers prepare for the challenges posed by quickly evolving technology entering the insurance industry. Consumers can easily get insurance information with the use of digital technology. By focusing on the demands of individual clients and addressing those needs through digital insurance platforms, insurers are able to focus on emerging technology. The digital insurance platform is a piece of software or a technology that assists a business in monitoring, creating, managing, and controlling the digital insurance ecosystem. It assists businesses in incorporating digitization into the insurance process. A digital insurance platform is a piece of software or a technology that allows an insurance company or managing general agent (MGA) to keep track of, manage, and regulate the digital insurance ecosystem. Companies can use digital insurance platforms to incorporate digitization across the insurance process. In the digital insurance ecosystem, these platforms combine diverse modules/silos and heterogeneous systems. Policy implementation, claim management, reinsurance management, regulatory filing, and billing and premium accounting are all examples of these modules or systems. These platforms also provide policyholders with a portal that allows them to view customer databases easily and remotely.

The digital insurance platform market is being driven by the rising adoption of IoT products. The upsurge in the adoption rate of underwater acoustic modems in naval defense is a major factor driving the market's growth. The changing insurer's focus from product-based to consumer-centric strategies is driving up demand for digital insurance platform equipment market. Other significant factors such as rising awareness amongst insurers towards digital channels, and technological advancement will cushion the growth rate of digital insurance platform market. Furthermore, upsurge in the adoption rate of cloud-based digital solutions by the insurers to obtain the high scalability will accelerate the growth rate of digital insurance platform market for the forecast period mentioned above.

Moreover, increasing awareness amongst insurers to access a broader segment of the market and emerging new markets will boost the beneficial opportunities for the digital insurance platform market growth.

However, difficulties involved in the integration of insurance platforms with legacy systems will act as major retrain and further impede the market's growth. The dearth of skilled workforce will challenge the growth of the digital insurance platform market.

This digital insurance platform market report provides details of new recent developments, trade regulations, import export analysis, production analysis, value chain optimization, market share, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographical expansions, technological innovations in the market. To gain more info on digital insurance platform market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Browse Detailed TOC, Tables and Figures with Charts which is spread across 350 Pages that provides exclusive data, information, vital statistics, trends, and competitive landscape details in this niche sector.

This research report is the result of an extensive primary and secondary research effort into the Digital Insurance Platform market. It provides a thorough overview of the market's current and future objectives, along with a competitive analysis of the industry, broken down by application, type and regional trends. It also provides a dashboard overview of the past and present performance of leading companies. A variety of methodologies and analyses are used in the research to ensure accurate and comprehensive information about the Digital Insurance Platform Market.

Get a Sample PDF of Report - https://www.databridgemarketresearch.com/request-a-sample/?dbmr=global-digital-insurance-platform-market

Which are the driving factors of the Digital Insurance Platform market?

The driving factors of the Digital Insurance Platform market include technological advancements that enhance product efficiency and user experience, increasing consumer demand driven by changing lifestyle preferences, and favorable government regulations and policies that support market growth. Additionally, rising investment in research and development and the expanding application scope of Digital Insurance Platform across various industries further propel market expansion.

Digital Insurance Platform Market - Competitive and Segmentation Analysis:

Global Digital Insurance Platform Market, By Component (Tools, Services), End-User (Insurance Companies, Third-Party Administrators and Brokers, Aggregators), Insurance Application (Automotive and Transportation, Home and Commercial Buildings, Life and Health, Business and Enterprise, Consumer Electronics and Industrial Machines, Travel), Deployment Type (On-Premises and Cloud), Organization Size (Large Enterprises, Small and Medium-Sized Enterprises), Country (U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, Italy, U.K., France, Spain, Netherlands, Belgium, Switzerland, Turkey, Russia, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa) Industry Trends and Forecast to 2031.

How do you determine the list of the key players included in the report?

With the aim of clearly revealing the competitive situation of the industry, we concretely analyze not only the leading enterprises that have a voice on a global scale, but also the regional small and medium-sized companies that play key roles and have plenty of potential growth.

Which are the top companies operating in the Digital Insurance Platform market?

Some of the major players operating in the digital insurance platform market are Tata Consultancy Services Limited, DXC Technology Company, Infosys Limited, Pegasystems Inc., Appian, Mindtree Ltd., Prima Solutions, FINEOS, Cognizant, Inzura Limited, Cogitate Technology Solutions, Inc., Duck Creek Technologies, Bolt Solutions, Majesco, EIS Group, iPipeline, Inc., Vertafore, Inc., eBaoTech Corporation, IBM, Microsoft, oracle, and SAP SE, among others.

Short Description About Digital Insurance Platform Market:

The Global Digital Insurance Platform market is anticipated to rise at a considerable rate during the forecast period, between 2024 and 2031. In 2023, the market is growing at a steady rate and with the rising adoption of strategies by key players, the market is expected to rise over the projected horizon.

North America, especially The United States, will still play an important role which can not be ignored. Any changes from United States might affect the development trend of Digital Insurance Platform. The market in North America is expected to grow considerably during the forecast period. The high adoption of advanced technology and the presence of large players in this region are likely to create ample growth opportunities for the market.

Europe also play important roles in global market, with a magnificent growth in CAGR During the Forecast period 2024-2031.

Digital Insurance Platform Market size is projected to reach Multimillion USD by 2031, In comparison to 2024, at unexpected CAGR during 2024-2031.

Despite the presence of intense competition, due to the global recovery trend is clear, investors are still optimistic about this area, and it will still be more new investments entering the field in the future.

This report focuses on the Digital Insurance Platform in global market, especially in North America, Europe and Asia-Pacific, South America, Middle East and Africa. This report categorizes the market based on manufacturers, regions, type and application.

Get a Sample Copy of the Digital Insurance Platform Report 2024

What are your main data sources?

Both Primary and Secondary data sources are being used while compiling the report. Primary sources include extensive interviews of key opinion leaders and industry experts (such as experienced front-line staff, directors, CEOs, and marketing executives), downstream distributors, as well as end-users. Secondary sources include the research of the annual and financial reports of the top companies, public files, new journals, etc. We also cooperate with some third-party databases.

Geographically, the detailed analysis of consumption, revenue, market share and growth rate, historical data and forecast (2024-2031) of the following regions are covered in Chapters

What are the key regions in the global Digital Insurance Platform market?

North America (United States, Canada and Mexico)

Europe (Germany, UK, France, Italy, Russia and Turkey etc.)

Asia-Pacific (China, Japan, Korea, India, Australia, Indonesia, Thailand, Philippines, Malaysia and Vietnam)

South America (Brazil, Argentina, Columbia etc.)

Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

This Digital Insurance Platform Market Research/Analysis Report Contains Answers to your following Questions

What are the global trends in the Digital Insurance Platform market?

Would the market witness an increase or decline in the demand in the coming years?

What is the estimated demand for different types of products in Digital Insurance Platform?

What are the upcoming industry applications and trends for Digital Insurance Platform market?

What Are Projections of Global Digital Insurance Platform Industry Considering Capacity, Production and Production Value? What Will Be the Estimation of Cost and Profit? What Will Be Market Share, Supply and Consumption? What about Import and Export?

Where will the strategic developments take the industry in the mid to long-term?

What are the factors contributing to the final price of Digital Insurance Platform?

What are the raw materials used for Digital Insurance Platform manufacturing?

How big is the opportunity for the Digital Insurance Platform market?

How will the increasing adoption of Digital Insurance Platform for mining impact the growth rate of the overall market?

How much is the global Digital Insurance Platform market worth? What was the value of the market In 2020?

Who are the major players operating in the Digital Insurance Platform market? Which companies are the front runners?

Which are the recent industry trends that can be implemented to generate additional revenue streams?

What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Digital Insurance Platform Industry?

Customization of the Report

Can I modify the scope of the report and customize it to suit my requirements? Yes. Customized requirements of multi-dimensional, deep-level and high-quality can help our customers precisely grasp market opportunities, effortlessly confront market challenges, properly formulate market strategies and act promptly, thus to win them sufficient time and space for market competition.

Inquire more and share questions if any before the purchase on this report at - https://www.databridgemarketresearch.com/inquire-before-buying/?dbmr=global-digital-insurance-platform-market

Detailed TOC of Global Digital Insurance Platform Market Insights and Forecast to 2031

Introduction

Market Segmentation

Executive Summary

Premium Insights

Market Overview

Digital Insurance Platform Market By Type

Digital Insurance Platform Market By Function

Digital Insurance Platform Market By Material

Digital Insurance Platform Market By End User

Digital Insurance Platform Market By Region

Digital Insurance Platform Market: Company Landscape

SWOT Analysis

Company Profiles

Continued...

Purchase this report - https://www.databridgemarketresearch.com/checkout/buy/singleuser/global-digital-insurance-platform-market

Browse More Reports:

https://dbmr2210.blogspot.com/2024/06/liquid-milk-replacers-market-size.html

https://dbmr2210.blogspot.com/2024/06/automotive-human-machine-interfaces-hmi.html

https://dbmr2210.blogspot.com/2024/06/digital-marketing-software-market.html

Data Bridge Market Research:

Today's trends are a great way to predict future events!

Data Bridge Market Research is a market research and consulting company that stands out for its innovative and distinctive approach, as well as its unmatched resilience and integrated methods. We are dedicated to identifying the best market opportunities, and providing insightful information that will help your business thrive in the marketplace. Data Bridge offers tailored solutions to complex business challenges. This facilitates a smooth decision-making process. Data Bridge was founded in Pune in 2015. It is the product of deep wisdom and experience.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC: +653 1251 975

Email:- corporatesales@databridgemarketresearch.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Empowering Consumers: Insurance Platforms to Grow at 13.7% CAGR, Offering Comprehensive Policy Information and Insights here

News-ID: 3538492 • Views: …

More Releases from Data Bridge Market Research

Fire Resistant Glass Market Advances with Intumescent Coatings, Hybrid Laminates …

Fire resistant glass market is growing at a high CAGR during the forecast period 2024-2031.

Fire Resistant Glass Market is positioned for robust growth, and shifting market dynamics reshaping the competitive landscape. DataM Intelligence's new report provides data-driven insights, SWOT analysis, and marketing-ready intelligence for businesses seeking to improve market penetration and campaign ROI.

Get your exclusive sample report today: (corporate email gets priority access): https://datamintelligence.com/download-sample/fire-resistant-glass-market?vs

Fire Resistant Glass Market Overview &…

Rising Demand for Advanced Treatments to Propel Obliterative Bronchiolitis Marke …

The Obliterative Bronchiolitis Market is undergoing a significant transformation, with industry forecasts predicting rapid expansion and cutting-edge technological innovations by 2032. As businesses continue to embrace digital advancements and strategic shifts, the sector is set to experience unprecedented growth, driven by rising demand, market expansion, and evolving industry trends.

A recent in-depth market analysis sheds light on key factors propelling the Obliterative Bronchiolitis market forward, including increasing market share, dynamic segmentation,…

Medical-Social Working Services Market Industry Trends and Forecast to 2030

This Medical-Social Working Services Market report has been prepared by considering several fragments of the present and upcoming market scenario. The market insights gained through this market research analysis report facilitates more clear understanding of the market landscape, issues that may interrupt in the future, and ways to position definite brand excellently. It consists of most-detailed market segmentation, thorough analysis of major market players, trends in consumer and…

Global Marine Insurance Market to Grow at 4.50% CAGR, Reaching USD 39.87 Billion …

The Marine Insurance Market is undergoing a significant transformation, with industry forecasts predicting rapid expansion and cutting-edge technological innovations by 2032. As businesses continue to embrace digital advancements and strategic shifts, the sector is set to experience unprecedented growth, driven by rising demand, market expansion, and evolving industry trends.

A recent in-depth market analysis sheds light on key factors propelling the Marine Insurance market forward, including increasing market share, dynamic segmentation,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…