Press release

Automated Financial Advice Set to Dramatically Disrupt the Investment Market

LONDON, August 3, 2016/Low cost, automated investment advice is set to become the core of financial planning services, with a market potential of $19.5 trillion assets under management, according to a new report by Ignition House, the financial services experts, and The Business Research Company. The ‘Robo Advice: Revolution or Evolution?’ report (http://www.thebusinessresearchcompany.com/our-research/finance/robo-advice-revolution-or-evolution/) demonstrates that as awareness of automated financial services options increases and assets under management grow, many consumers and institutions will want to move away from expensive traditional investment advice into low-cost automated options. This will initially be driven mainly at the corporate level, with large institutional client wins by robo offerings. Consumer-focused services will come later.

“The robo advice market is set for explosive growth, and we at Ignition House are excited to be the go-to authority tracking its development” commented Janette Weir of Ignition House, one of the report’s authors.

US Market Leads the Way -

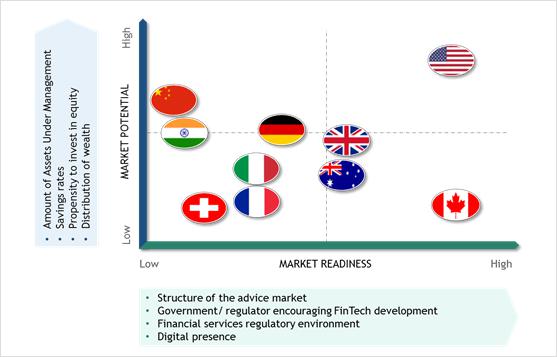

The report shows that the current market for robo advice is dominated by the USA, with an estimated $1.2 trillion under management. The USA's favourable regulatory environment, high propensity to save in equities and the size of its retirement savings market all mean that the USA is the most promising market for robo advice. India and China present long term opportunities but continue to be tied to traditional property, gold and money market fund investments. In Europe the UK looks set for growth, with major pension funds available for investment and a positive environment for fintech.

Customer Focus Is Key -

The Robo Advice report (http://www.thebusinessresearchcompany.com/our-research/finance/robo-advice-revolution-or-evolution/) gives providers many ideas on how to develop their offerings going forward, with best practice examples from companies leading the market. It highlights the importance of targeting specific investment niches, creating a simple, differentiated offering that consumers can understand. Customer-centred approaches will be needed in order to retain customers in such a competitive market. This lesson is yet to be learned: few providers employ Heads of Customer Experience to manage this. Visual stimulus and gamification are ways that companies can increase differentiation and engagement.

From Robo Advice to Artificial Intelligence -

The report argues that robo advice is still in its infancy, and the market will look very different going forward. Industry commentators' consensus is that developments in artificial intelligence and virtual mean that we are less than five years from automated solutions capable of addressing many of today’s financial advice needs. In this new era, they envisage systems learning from each interaction, facilitating more tailored solutions, and encouraging people to share more information. In future Amazon–like recommendations (‘people like you also did this’) will be commonplace and systems will ‘know’ when life events occur that trigger new financial needs (getting married, having a baby) by mining personal information from social media.

Dead as a Robo?

Over 200 companies can be categorized as robos, after huge numbers of service launches over the last three years, but many of these will fail, according to the report. The vast majority of automated investment management offerings are point-in-time, ‘me–too’ product solutions. With little to differentiate them and competition increasing by the day, consolidation and contraction of this part of the market seems inevitable.

About the Robo Advice: Revolution or Evolution? report

The Robo Advice: Revolution or Evolution? report (http://www.thebusinessresearchcompany.com/our-research/finance/robo-advice-revolution-or-evolution/) provides strategists, marketers and senior managers with the critical information they need to assess the rapidly developing market for automated investment and financial advice. Robo advice is one of the most important trends in the financial advice market, and this report gives a comprehensive assessment of the market based on discussions with all the leading players globally.

Reasons to Purchase The Report

• Develop strategies based on what robo advice is and what it means in today’s market.

• Choose your approach to the market based on the industry’s emerging business models.

• Plan innovative strategies based on the ‘What Will The Winners Look Like’ section.

• Facilitate decision making on the basis of forecast market data.

• Benchmark performance against key competitors by understanding their market positioning, offerings, portfolios and workflows.

• Identify investment opportunities.

• Target your key markets with detailed market, competitive, regulatory and trend information for the US, UK, European and Australian markets.

• The report supports your internal and external presentations with reliable high quality data, analysis and 50 attractive and informative graphics.

• To ask for further information or purchase the report please click here or follow the link below:

http://www.thebusinessresearchcompany.com/our-research/finance/robo-advice-revolution-or-evolution/

Scope

• Markets Covered: robo advice, automated financial planning, financial advice, brokerage, fund platforms

• Companies profiled: Betterment, Financial Guard, FutureAdvisor (a BlackRock Company), Intelligent Portfolios from Charles Schwab, Inc., LearnVest Inc., Personal Capital, SigFig Wealth

• Management LLC, Vanguard PAS, Wealthfront, Inc, WiseBanyan, Inc, Easy Folio, eValue (Investment Solutions), Fintego Managed Depot, Ginmon GmbH, Marie Quantier, MoneyFarm, Nutmeg Savings & Investment Limited, Parmenion (Aberdeen Asset Management), Quirion (Quirin Bank AG), Scalable Capital, True Wealth Inc., vaamo Finanz AG, Wealthify, Wealth Objects Limited, Wealth Wizards, Yomoni, Clover.com.au, Decimal Software Ltd, Ignition Wealth (Ignition Direct), QuietGrowth, Stockspot.

• Geographies: USA, Europe, UK, Australia.

• Time series: Current and five years forecast assets under management.

• Infographics: fifty high-quality conceptual and data driven illustrations.

Analysis: Definitions and segmentations, business models, success factor analysis, market drivers, market background, competitive and regulatory characteristics. Company positioning, developments and workflow analysis.

• Research: The report is based on 25+ interviews with many of the leading players in the global robo advice market. It draws on exhaustive secondary research.

• Authors: The report’s authors draw on over 60 years of collective senior research experience in the financial and technology sectors.

Ignition House offers high quality, insightful and actionable research to a range of public and private sector clients executed by experienced, expert people. It is a leading authority on the developing robo advisory market, offering a range of research and advisory services to leading competitors. Click here or follow the below link to contact us.

http://www.ignitionhouse.com/contact.html

The report’s authors included Janette Weir, Edward Ripley and Damon Guirdham.

Janette has more than 20 years research experience and brings a broad range of research and consultancy skills to her work. She is an economist by training, having started her career as an economist at the UK’s Department for Work and Pensions where she spent five years advising ministers and policy makers. She moved to be Chief Economist at the Association of British Insurers. From there, she led a team of analysts covering all aspects of Financial Services as Head of UK Financial Services Research at McKinsey and Company. Now Managing Director of Ignition House Ltd, she has built a solid financial services practice working for a variety of public and private sector clients.

Edward, Research Director at Ignition House, has over ten years’ experience working in the market research and advisory industry as Director for Corporate Strategy and New Business Development at the Corporate Executive Board and Lead Analyst for the Retail Banking team at Datamonitor.

Damon has over 20 years of business analysis and investment management experience giving him a deep knowledge of the financial sector. Most recently Damon was a Partner at Generation Investment Management, a multi billion dollar asset manager. Prior to this he spent nine years at Morgan Stanley as an Investment Analyst/Head. Damon started his career as a graduate trainee with Schroders after obtaining his M.A. from Oxford University.

The Business Research Company is a market research and intelligence company which excels in company, market and consumer research. It has research professionals at its offices in the UK, India and the USA as well a network of trained researchers globally. It has specialist consultants in a wide range of industries including manufacturing, healthcare, financial services and technology.

Click here or follow the link below to contact us.

http://www.thebusinessresearchcompany.com/contact-us/

The Business Research Company

Horizon Avenue,

8-2-603/b/s/1/2

Road Number 10

Banjara Hills

Hyderabad (India) - 500034

Dinesh Kumar

Marketing Consultant

+91 8897263534

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Automated Financial Advice Set to Dramatically Disrupt the Investment Market here

News-ID: 353821 • Views: …

More Releases from The Business research company

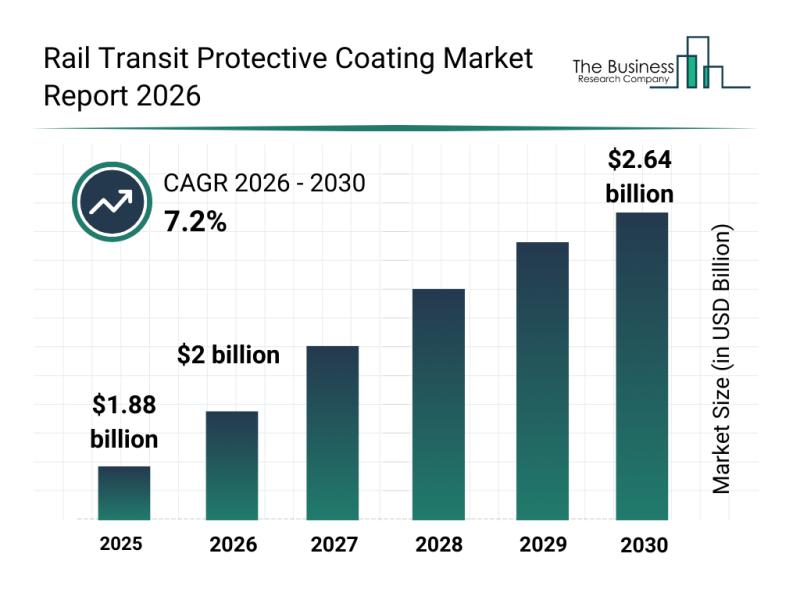

Rail Transit Protective Coating Market Overview: Major Segments, Strategic Devel …

The rail transit protective coating sector is positioned for significant expansion in the coming years, driven by technological advancements and increasing infrastructure investments. This market is evolving rapidly as stakeholders prioritize durability, sustainability, and efficiency in rail transit systems. Let's explore the market's valuation projections, leading companies, emerging trends, and detailed segment analysis to get a clearer understanding of its future trajectory.

Expected Market Size and Growth Outlook for Rail Transit…

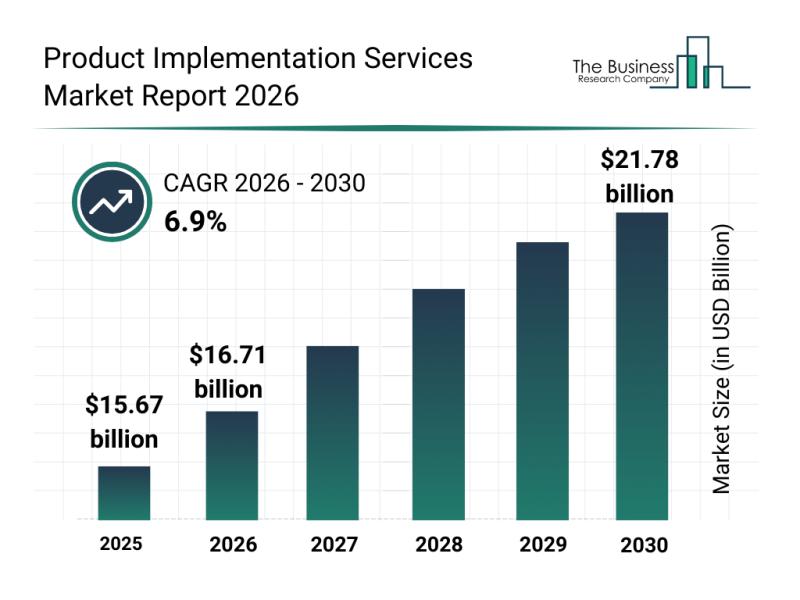

Analysis of Segments and Major Growth Areas in the Product Implementation Servic …

The product implementation services sector is on the verge of significant expansion, driven by evolving technology needs and increasing enterprise adoption of sophisticated systems. Understanding the current market size, key contributors, emerging trends, and segment breakdowns offers valuable insights into what lies ahead for this dynamic industry.

Market Size and Expected Growth Trajectory in the Product Implementation Services Market

The product implementation services market is projected to experience strong growth…

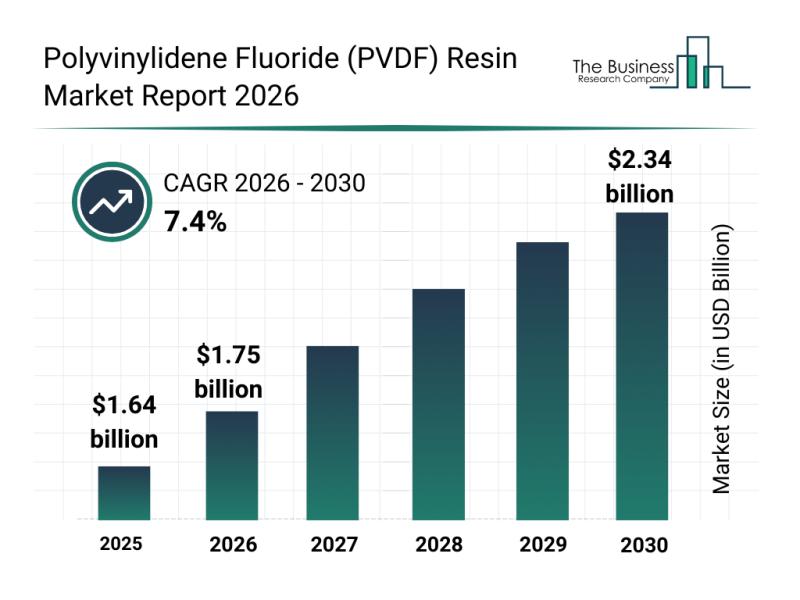

Key Strategic Developments and Emerging Changes Shaping the Polyvinylidene Fluor …

The polyvinylidene fluoride (PVDF) resin market is on track for significant expansion over the coming years. Driven by various technological advances and rising demands across multiple industries, this sector is expected to evolve rapidly. Let's explore the anticipated market growth, influential players, key trends, and detailed segmentation shaping the future of PVDF resin.

Projected Growth and Market Size of the Polyvinylidene Fluoride Resin Market

The PVDF resin market is forecasted…

Leading Companies Fueling Innovation and Growth in the Partyline Intercom System …

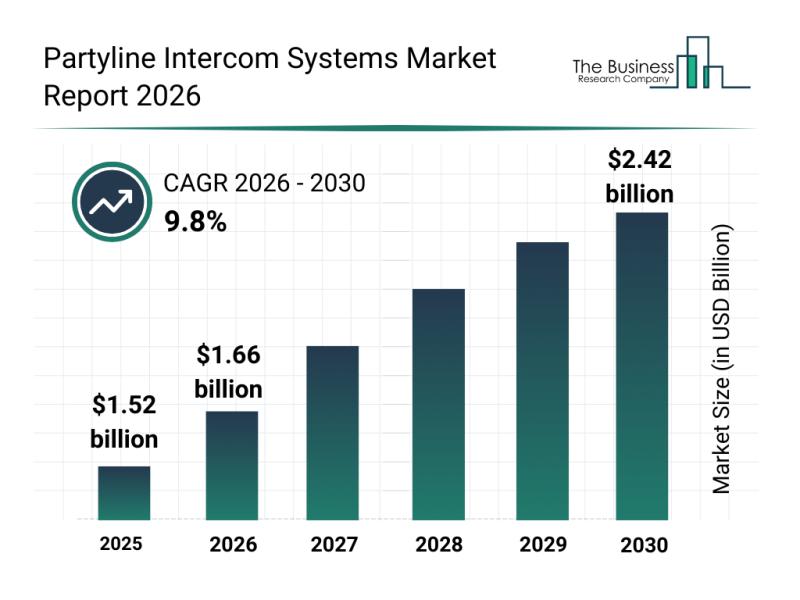

The partyline intercom systems market is gearing up for significant expansion as communication needs evolve across various industries. With increasing demand for more versatile and efficient communication tools, this sector is set to witness rapid advancements and growing adoption over the coming years. Let's explore the market size projections, key drivers, major players, emerging trends, and important segments shaping this dynamic industry.

Projected Market Size and Growth Trajectory of the Partyline…

More Releases for Robo

Robo Advisory Market is Rising

According to the latest research report published by Market Data Forecast, the global robo advisory market is expected to grow at a CAGR of 54.2% from 2024 to 2029, and the global market size is anticipated to be worth USD 154.6 billion by 2029 from USD 17.73 billion in 2024.

The robo advising market is expanding rapidly, fueled by technical developments and rising demand for automated financial solutions. These platforms use…

Global Robo-Advisory Market, Global Robo-Advisory Industry, Covid-19 Impact Glob …

The Robo-advisory market is expected to grow from USD X.X million in 2020 to USD X.X million by 2026, at a CAGR of X.X% during the forecast period. The Global Robo-Advisory Market report is a comprehensive research that focuses on the overall consumption structure, development trends, sales models and sales of top countries in the global Robo-advisory market. The report focuses on well-known providers in the global Robo-advisory industry, market…

Global Robo-Advisory Market (2015-2023)

Global robo-advisory market

Robo-advisors are independent financial planning services driven by algorithms and supported by a digital platform with no human intervention. They collect information from their customers at first through an online survey to understand their financial situations and ultimate goals. With this information they make portfolios of investments by calculating their risk and returns along with profits for long-term. The global robo-advisory market is expected to grow at an…

Global Robo-advisory Market (2015-2023)

Market Research Report Store offers a latest published report on Robo-advisory Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report. This report focuses on the key global Robo-advisory players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years.To analyze the Robo-advisory with respect to individual growth trends, future…

Robo-Advisors: Mapping The Competitive Landscape

The wealth management industry has long been resilient to the digitization process observed in the wider financial services space. This has started to change, however, with interest in robo-advice platforms increasing in 2015. The automated investment management space is hence becoming ever-more competitive as new entrants launch propositions. Supported by software developers, traditional wealth managers have also started exploring the digital advice market. Competition will thus increase further, although robo-advisors…

Robo-Advisors: Mapping the Competitive Landscape

Summary

The wealth management industry has long been resilient to the digitization process observed in the wider financial services space. This has started to change, however, with interest in robo-advice platforms increasing in 2015. The automated investment management space is hence becoming ever-more competitive as new entrants launch propositions. Supported by software developers, traditional wealth managers have also started exploring the digital advice market. Competition will thus increase further, although robo-advisors…