Press release

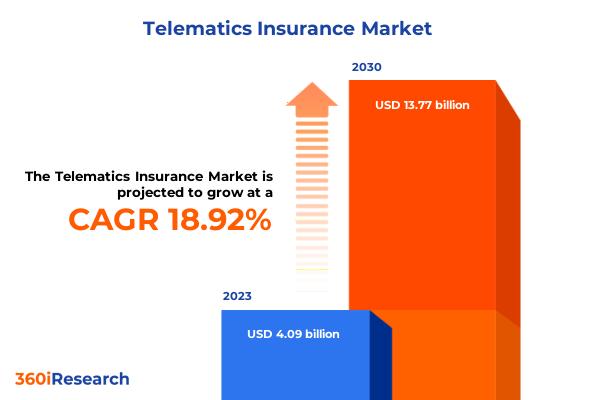

Telematics Insurance Market worth $13.77 billion by 2030, growing at a CAGR of 18.92% - Exclusive Report by 360iResearch

The "Telematics Insurance Market by Offering (Hardware, Services, Software), Type (Manage-How-You- Drive (MHYD), Pay-As-You-Drive (PAYD), Pay-How-You-Drive (PHYD)), Organization Size, Vehicle Type, Distribution Channel - Global Forecast 2024-2030" report has been added to 360iResearch.com's offering.Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/telematics-insurance?utm_source=openpr&utm_medium=referral&utm_campaign=sample

"Key Drivers Powering Growth in the E-commerce Fulfillment Services Market"

As consumer demand for personalized insurance products surges, telematics insurance, which tailors policies based on individual driving behavior, is gaining traction. Unlike traditional models relying on broad demographic data, telematics leverages real-time vehicle data, offering consumers policies that more accurately reflect their driving habits and potential for cost savings. Supportive regulatory policies are also fostering this shift, with governments promoting digital transformation and reinforcing data privacy and security standards, building trust among consumers. The prevalence of connected vehicles further accelerates growth, enabling widespread data collection essential for telematics insurance. Strategic partnerships between insurers, automotive manufacturers, and tech firms enhance product offerings and operational efficiency by integrating telematics technology into vehicles. The adoption of telematics insurance is expanding across major segments, including fleet operators and individual drivers, who benefit from improved safety features and lower premiums. Additionally, the economic advantages and advanced data analytics offered by telematics insurance are proving more cost-effective and valuable, ensuring enhanced road safety and accident prevention for safety-conscious consumers.

"Market Dynamics Pose Challenges for Widespread Adoption of Telematics Insurance"

The telematics insurance market faces significant challenges that hinder its widespread adoption, primarily due to the high costs associated with implementing these solutions. The financial investment required for installing telematics devices in vehicles and deploying sophisticated data analysis software can serve as a substantial barrier for both providers and consumers. In addition, the lack of universal product standardization creates market confusion and inconsistencies, making it difficult for consumers to effectively compare products and for regulators to enforce consumer protection standards. Competition from emerging technologies, such as autonomous vehicles and connected car services, further diverts interest and investment from traditional telematics solutions. Compatibility issues between telematics devices and various vehicle models also limit the market's reach, potentially compromising data accuracy and policy reliability. Moreover, concerns over data privacy and security add another layer of complexity, as consumers may be reluctant to share personal driving data due to fears of breaches and misuse. These dynamics present notable obstacles that must be addressed for telematics insurance to achieve broader market acceptance.

"Unveiling New Horizons: Opportunities in the Expanding Telematics Insurance Market"

As the telematics insurance market continues to expand, several key opportunities are emerging that promise to reshape the industry landscape. Advancements in telematics technology, including precise GPS systems and advanced data analytics, are enabling insurers to offer more accurate risk assessments and personalized policies. Increased research and development efforts are fostering innovative products tailored to evolving consumer needs, thereby enhancing customer satisfaction and market reach. Entering new market segments, such as commercial vehicle fleets or developing countries, offers significant growth potential. Strategic collaborations with automotive manufacturers, tech firms, and governmental bodies can facilitate the creation of sophisticated telematics solutions and improve market penetration. Supportive government policies that mandate data transparency and protect consumer rights can accelerate telematics insurance adoption, fostering a trustworthy market environment. Additionally, the rise of tech start-ups focusing on telematics innovation presents incumbents with opportunities to acquire new technologies and drive competitive differentiation. Finally, implementing enhanced data security measures can address privacy concerns, build consumer trust, and boost adoption rates, further driving market growth.

"Navigating the Challenges in Telematics Insurance: Complexities, Counterfeiting, Integration, Skill Shortages, and Environmental Impact"

The telematics insurance industry faces several significant challenges that impact its development and adoption. The complexities involved in product development and manufacturing arise from the need to integrate sophisticated hardware and software seamlessly into vehicles, ensure data security with advanced encryption methods, and maintain high quality assurance standards under diverse driving conditions. Counterfeit products present a major issue, leading to unreliable data, erosion of market trust, and regulatory compliance difficulties. Integration and deployment challenges include ensuring vehicle compatibility, scalability without service degradation, and comprehensive user education. There is also a shortage of skilled professionals, which hampers innovation and implementation, alongside the need for ongoing training and retention strategies due to high industry demand. Lastly, while promoting safer driving, telematics insurance also poses environmental concerns such as electronic waste, significant energy consumption, and the necessity for sustainable life cycle management of telematics devices.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/telematics-insurance?utm_source=openpr&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Telematics Insurance Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Offering, market is studied across Hardware, Services, and Software.

Based on Type, market is studied across Manage-How-You- Drive (MHYD), Pay-As-You-Drive (PAYD), and Pay-How-You-Drive (PHYD).

Based on Organization Size, market is studied across Large Enterprises and Small & Medium-sized Enterprises.

Based on Vehicle Type, market is studied across New Vehicles and Used Vehicles.

Based on Distribution Channel, market is studied across Brokers/Agents and Direct:.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom.

Key Company Profiles:

The report delves into recent significant developments in the Telematics Insurance Market, highlighting leading vendors and their innovative profiles. These include Agero, Inc., Aioi Nissay Dowa Insurance Company of Europe SE, Allianz SE, Allstate Insurance Company, Axa S.A., Cambridge Mobile Telematics, Inc., DriveQuant by FairConnect, IMETRIK Global Inc, Insurance & Mobility Solutions by Trak Global Group, Lemonade, Inc., LexisNexis Risk Solutions, Liberty Mutual Insurance Company, Masternaut Limited by Michelin Group, Meta System S.p.A., MiX Telematics International (Pty) Ltd., Octo Telematics S.p.A., Sierra Wireless by Semtech Corporation, The Floow Limited by otonomo Technologies Ltd., The Progressive Group of Insurance Companies, TomTom International BV. by Bridgestone Corporation, Towergate Insurance, Trimble Inc., Verizon Communications Inc., Vodafone Group Plc, and Zubie, Inc..

Introducing Query Query: Revolutionizing Market Intelligence with AI-Powered Insights for the Telematics Insurance Market

We proudly unveil Query Query, a cutting-edge AI product designed to transform how businesses interact with the Telematics Insurance Market. Query Query stands out as your premier market intelligence partner, delivering unparalleled insights with the power of artificial intelligence. Whether deciphering market trends or offering actionable intelligence, Query Query is engineered to provide precise, relevant answers to your most critical business questions. This revolutionary tool is more than just an information source; it's a strategic asset that empowers your decision-making with up-to-the-minute data, ensuring you stay ahead in the fiercely competitive Telematics Insurance Market. Embrace the future of market analysis with Query Query, where informed decisions lead to remarkable growth.

Ask Question to Query Query @ https://www.360iresearch.com/library/intelligence/telematics-insurance?utm_source=openpr&utm_medium=referral&utm_campaign=query

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Telematics Insurance Market, by Offering

7. Telematics Insurance Market, by Type

8. Telematics Insurance Market, by Organization Size

9. Telematics Insurance Market, by Vehicle Type

10. Telematics Insurance Market, by Distribution Channel

11. Americas Telematics Insurance Market

12. Asia-Pacific Telematics Insurance Market

13. Europe, Middle East & Africa Telematics Insurance Market

14. Competitive Landscape

15. Competitive Portfolio

Read More @ https://www.360iresearch.com/library/intelligence/telematics-insurance?utm_source=openpr&utm_medium=referral&utm_campaign=analyst

Contact 360iResearch

Mr. Ketan Rohom

Sales & Marketing,

Office No. 519, Nyati Empress,

Opposite Phoenix Market City,

Vimannagar, Pune, Maharashtra,

India - 411014.

sales@360iresearch.com

+1-530-264-8485

+91-922-607-7550

About 360iResearch

360iResearch is a market research and business consulting company headquartered in India, with clients and focus markets spanning the globe.

We are a dynamic, nimble company that believes in carving ambitious, purposeful goals and achieving them with the backing of our greatest asset - our people.

Quick on our feet, we have our ear to the ground when it comes to market intelligence and volatility. Our market intelligence is diligent, real-time and tailored to your needs, and arms you with all the insight that empowers strategic decision-making.

Our clientele encompasses about 80% of the Fortune Global 500, and leading consulting and research companies and academic institutions that rely on our expertise in compiling data in niche markets. Our meta-insights are intelligent, impactful and infinite, and translate into actionable data that support your quest for enhanced profitability, tapping into niche markets, and exploring new revenue opportunities.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Telematics Insurance Market worth $13.77 billion by 2030, growing at a CAGR of 18.92% - Exclusive Report by 360iResearch here

News-ID: 3536317 • Views: …

More Releases from 360iResearch

Rising Incidence of Human Metapneumovirus in Vulnerable Populations Boosts Globa …

In recent years, the silent ascent of human metapneumovirus (HMPV) infections has begun to capture significant attention within the realm of infectious diseases. As we advance in medical science, unraveling complexities of age-old pathogens like common influenza or emerging illnesses like COVID-19, a critical discourse has been emerging around HMPV. Particularly, there seems to be a burgeoning acknowledgment of its growing impact on vulnerable global populations, propelling an increased demand…

The Meat Alternatives Market size was estimated at USD 9.39 billion in 2023 and …

From Appetite to Advocacy: The Rising Demand for Meat Alternatives

In recent years, the global food industry has been undergoing a remarkable transformation, driven primarily by an increasing consumer demand for healthier, sustainable, and ethically sourced food products. This seismic shift has brought traditional meat alternatives and high-protein plant-based foods into the spotlight. As the world becomes more conscious of the implications of meat consumption on health and the environment, the…

The Mobility-as-a-Service Market size was estimated at USD 264.80 billion in 202 …

Unpacking the Surge in Investments and Collaborations to Bolster Mobility-as-a-Service

In recent years, as urban landscapes continually evolve, a transformative shift known as Mobility-as-a-Service (MaaS) has reshaped the way we perceive transportation. Marked by the integration of various forms of transport services into a single accessible on-demand mobility solution, MaaS is rapidly gaining traction across global cities. As an emerging paradigm, it's not just shaping the future of travel but also…

The Data Center Services Market size was estimated at USD 56.65 billion in 2023 …

Smart City Revolutions: Why Data Center Colocation is the Future Backbone

In the era of digital transformation, urban landscapes across the globe are undergoing a seismic shift toward becoming "smart cities." The concept of a smart city revolves around using digital technology, IoT (Internet of Things), AI, and data analytics at an unprecedented scale to improve urban infrastructure, manage resources efficiently, and enhance the quality of life for citizens. A vital…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…