Press release

Precious Metals Market to Reach US$ 474.65 Bn. by 2030 | 9.1 percentage CAGR

Anticipated Growth in Revenue:Precious Metals Market size was valued at US$ 257.98 Bn in 2023 and the total revenue is expected to grow at 9.1 % through 2024 to 2030, reaching nearly US$ 474.65 Bn.

Precious Metals Market Overview:

The precious metals market is experiencing a dynamic shift as economic uncertainties, geopolitical tensions, and inflation concerns drive investor interest. Gold, often viewed as a safe haven asset, has seen fluctuations in demand amidst changing monetary policies and market sentiment. Silver, valued for its industrial applications alongside its investment appeal, has witnessed increased attention amid supply constraints and growing demand from sectors like electronics and renewable energy. Platinum and palladium, vital components in automotive catalysts, are influenced by global automotive production, environmental regulations, and supply disruptions.

Unlock Insights: Request a Free Sample of Our Latest Report Now: https://www.maximizemarketresearch.com/request-sample/65161/

Precious Metals Market Trends:

In the precious metals market, several key trends are shaping investor sentiment and market dynamics. Gold continues to attract interest as a hedge against inflation and economic uncertainty, with investors closely monitoring central bank policies and geopolitical tensions for signals on its future trajectory. Silver, often referred to as "poor man's gold," is gaining traction not only as an investment vehicle but also due to its increasing industrial usage in sectors such as electronics and green energy, further bolstering its demand. The platinum group metals, particularly platinum and palladium, are closely tied to automotive production, with shifts towards electric vehicles influencing demand dynamics. Additionally, environmental regulations and supply disruptions in major producing regions impact the supply side of these metals, adding complexity to their market outlook.

What are Precious Metals Market Dynamics?

Precious metals market dynamics encompass a complex interplay of various factors influencing supply, demand, and pricing of gold, silver, platinum, and palladium. On the demand side, economic indicators, geopolitical tensions, and investor sentiment drive the desire for safe-haven assets like gold, while industrial applications in sectors such as electronics and automotive manufacturing contribute to the demand for silver and platinum group metals. Supply dynamics are affected by factors such as mining output, recycling rates, and geopolitical disruptions in major producing regions. Moreover, fluctuations in currency values, interest rates, and macroeconomic trends influence the attractiveness of precious metals as alternative investments. These intricate dynamics create a volatile yet compelling landscape for investors, who must navigate uncertainties and capitalize on opportunities in the ever-evolving precious metals market.

Need More Information? Inquire About Sample + Graphs Here: https://www.maximizemarketresearch.com/inquiry-before-buying/65161/

Precious Metals Market Opportunities:

In the precious metals market, various opportunities arise for investors amidst evolving market dynamics. With the resurgence of inflation concerns and geopolitical tensions, gold presents itself as a traditional safe-haven asset, offering potential gains during times of uncertainty. Silver, on the other hand, stands out not only as a monetary hedge but also due to its increasing industrial demand in emerging technologies like renewable energy and electric vehicles, providing investors with diverse avenues for growth. Additionally, platinum and palladium offer opportunities driven by their crucial roles in automotive catalysts, particularly as global efforts towards stricter emissions regulations intensify. Furthermore, the growing interest in sustainable investing has spurred demand for ethically sourced metals, opening doors for investments in responsible mining operations.

What is Precious Metals Market Regional Insight?

The regional dynamics of the precious metals market showcase diverse factors influencing supply, demand, and pricing across different geographical areas. Traditionally, regions such as North America, Europe, and Asia-Pacific have been significant consumers and producers of precious metals, each with its unique market drivers. North America, particularly the United States, often sets the tone for global market sentiment due to its economic indicators, investor behavior, and central bank policies. Europe, with its strong industrial base and historical affinity for gold, plays a crucial role in both consumption and trading of precious metals. Meanwhile, Asia-Pacific, led by countries like China and India, accounts for a substantial portion of global demand, driven by cultural preferences, jewelry consumption, and industrial growth. Emerging economies in Latin America and Africa also contribute to the market through mining activities and growing investor interest.

FREE |Get a Copy of Sample Report Now! @ https://www.maximizemarketresearch.com/request-sample/65161/

What is Precious Metals Market Segmentation?

by Type

Gold

Silver

Platinum

Palladium

Osmium

Iridium

Ruthenium

Rhodium

by Applications

Jewellery

Industrial

Electronics

Automotive industry

Chemical

Medical

Others

by End User Industry

Aerospace

Others

Some of the current players in the Precious Metals Market are:

1. Anglo American

2. Barrick Gold

3. Impala Platinum

4. Lonmin

5. Newmont Mining

6. Johnson Matthey

7. Goldcorp

8. Norilsk Nickel

9. Northam Platinum

10.North American Palladium

11.Freeport-McMoRan

12.First Quantum Minerals

13.Fresnillo plc

14.Pan American Silver Corporation

15.Kinross Gold

16.Randgold Resources

17.Southern Copper Corporation

18.Evolution Mining Ltd

19.Newcrest Mining

Get to Know More About This Market Study: https://www.maximizemarketresearch.com/market-report/global-precious-metals-market/65161/

Key Offerings:

Past Market Size and Competitive Landscape

Precious Metals Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Precious Metals Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Explore our top-performing reports on the latest trends:

♦ Payment Security Market: https://www.maximizemarketresearch.com/market-report/payment-security-market/12831/

♦ Farm Tire Market: https://www.maximizemarketresearch.com/market-report/global-farm-tire-market/20029/

♦ Synthetic Musk Market: https://www.maximizemarketresearch.com/market-report/synthetic-musk-market/215565/

♦ Holographic TV Market: https://www.maximizemarketresearch.com/market-report/holographic-tv-market/215687/

♦ Tamanu Oil Market: https://www.maximizemarketresearch.com/market-report/tamanu-oil-market/218788/

♦ Maize Bran Market: https://www.maximizemarketresearch.com/market-report/maize-bran-market/187473/

♦ Automatic Shot Blasting Market: https://www.maximizemarketresearch.com/market-report/automatic-shot-blasting-market/189568/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Precious Metals Market to Reach US$ 474.65 Bn. by 2030 | 9.1 percentage CAGR here

News-ID: 3535823 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

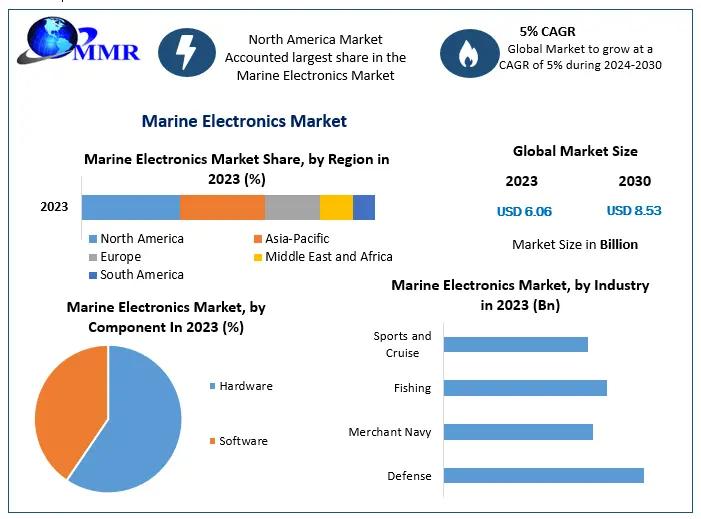

Marine Electronics Market Expected to Reach USD 8.53 Bn by 2030 - Growth Forecas …

Marine Electronics Market Size: According to Maximize Market Research, the Global Marine Electronics Market was valued at US$ 6.06 billion in 2023 and is expected to reach US$ 8.53 billion by 2030, growing at a CAGR of around 5% during 2024-2030.

Market Overview

The Global Marine Electronics Market encompasses electronic devices and systems designed specifically for marine environments. These include navigation systems, communication devices, safety equipment, sonar & radar, vessel management systems,…

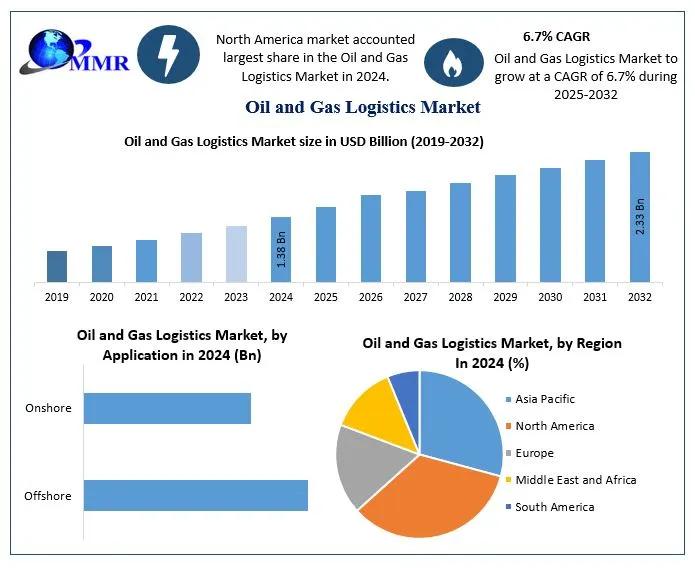

Oil and Gas Logistics Market to Reach USD 2.33 Billion by 2032 | Growth, Trends, …

The Oil and Gas Logistics Market was valued at USD 1.38 Billion in 2024 and is forecasted to grow to USD 2.33 Billion by 2032, exhibiting a CAGR of 6.7% during 2025 to 2032, driven by rising global energy demand, technological innovation, and expanding upstream and downstream supply chain activities.

Market Overview

The oil and gas logistics market encompasses the transportation, storage, handling, and distribution of crude oil, refined products, natural gas,…

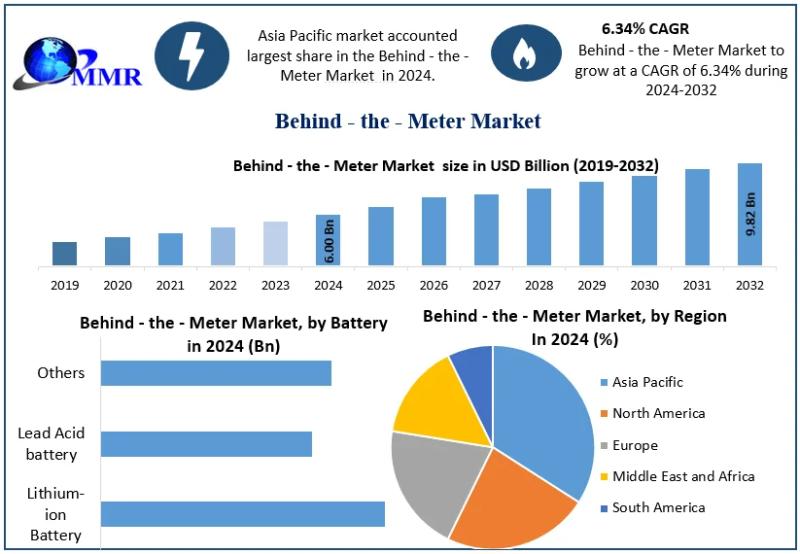

Behind the Meter Market to Surge to USD 9.82 Billion by 2032 - Unmatched Growth …

According to Maximize Market Research, the Global Behind the Meter Market was valued at USD 6.00 Billion in 2024 and is projected to reach USD 9.82 Billion by 2032 at a 6.34 % CAGR, driven by growth in residential, commercial, and industrial energy storage adoption.

Market Overview

The Behind the Meter Market consists of energy storage systems installed on the consumer side of the utility meter. These systems store electricity generated from…

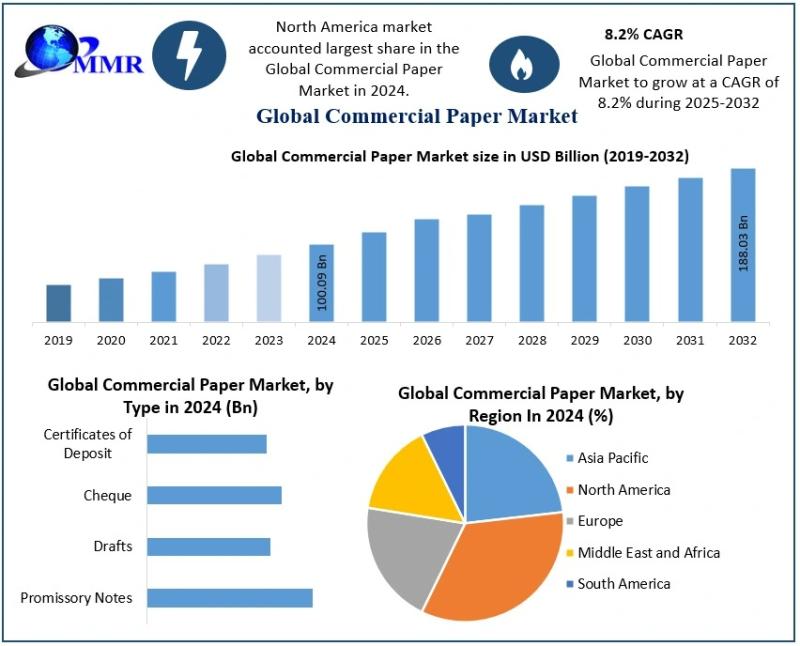

Commercial Paper Market Expected to Witness Steady Growth Driven by Short-Term C …

The Commercial Paper Market size was valued at USD 100.09 Billion in 2024 and the total Commercial Paper revenue is expected to grow at a CAGR of 8.2% from 2025 to 2032, reaching nearly USD 188.03 Billion.

Curious to peek inside? Grab your sample copy of this report now: https://www.maximizemarketresearch.com/request-sample/199690/

The Commercial Paper Market is gaining strong momentum as corporations, financial institutions, and large enterprises increasingly rely on short-term unsecured debt instruments…

More Releases for Precious

Colloidal Precious Metals Market Trends, Size & Forecast 2025-2032 | Nanomateria …

The Colloidal Precious Metals industry has witnessed accelerated innovation driven by applications spanning medical, electronic, and chemical sectors. Recent advancements in nanotechnology and catalytic efficiency have propelled the adoption of colloidal precious metals in high-value manufacturing and healthcare products, contributing to dynamic shifts within the industry. The Global Colloidal Precious Metals Market size is estimated to be valued at USD 2.8 billion in 2025 and is expected to reach USD…

Precious Metal Mesh Market Size Report 2025

Global Info Research's report is a detailed and comprehensive analysis for global Precious Metal Mesh market. Both quantitative and qualitative analyses are presented by manufacturers, by region & country, by Type and by Application. As the Precious Metal Mesh market is constantly changing, this report explores the competition, supply and demand trends, as well as key factors that contribute to its changing demands across many markets. Company profiles and product…

Discover MyRatna's Latest Collection of Precious Gemstones

MyRatna, India's trusted name in 100% original and lab-certified gemstones, proudly unveils its latest collection of premium precious gemstones, including the stunning Pukhraj (Yellow Sapphire), vibrant Panna (Emerald), and powerful Neelam (Blue Sapphire) stones. With a perfect fusion of Vedic tradition and royal Rajasthani craftsmanship, this collection also celebrates the art of Mewar Gem Art - a heritage style known for intricate detailing and timeless beauty.

Highlights of the New Collection:

🔸…

Precious Metal Market Scope and Competitive Analysis Forecast through 2024-2031 …

The Precious Metal Market study by DataM Intelligence provides a comprehensive analysis of the market, delivering valuable insights, detailed statistics, historical trends, and industry-backed market data. The report explores the competitive landscape, focusing on key players in the industry. It evaluates aspects such as product offerings, pricing models, financial performance, product portfolios, growth strategies, and regional expansion to offer a thorough understanding of market dynamics and future trends.

Get a Free…

Precious and Base Metals Market Splendor and Strength: Unveiling the Precious an …

Precious and Base Metals Market to reach over USD 2,300.9 billion by the year 2031 - Exclusive Report by InsightAce Analytic

"Precious and Base Metal Market" in terms of revenue was estimated to be worth $915.4 billion in 2023 and is poised to reach $2,300.9 billion by 2031, growing at a CAGR of 12.34% from 2023 to 2031 according to a new report by InsightAce Analytic.

Get Free Sample Report @…

Precious Pairs: Global Disaster Relief Campaign

Precious Pairs, a non-profit organization based in San Francisco, has announced its active engagement in global emergency disaster relief efforts. Founded recently, the organization is dedicating its resources to provide immediate support in response to natural disasters around the world, a mission that is both urgent and capital-intensive.

Given the resource-heavy nature of emergency disaster relief, Precious Pairs is reaching out for support. Contributions are vital for procuring supplies, managing logistics,…