Press release

Voice Banking Market Projected to Hit USD 3.04 Billion by 2030

Anticipated Growth in Revenue:Voice Banking Market was valued at USD 1.48 Billion in 2024 globally and is expected to reach USD 3.04 Billion by 2030, exhibiting a CAGR of 10.81 % during the forecast period (2024-2030)

Voice Banking Market Overview:

The voice banking market has witnessed remarkable growth in recent years, driven by the increasing integration of voice recognition technology in various sectors. With the rising adoption of smart speakers, virtual assistants, and voice-activated devices, consumers are becoming more accustomed to using their voices to interact with technology. This trend has spurred the demand for voice banking solutions, allowing users to conduct financial transactions, check balances, and manage accounts through voice commands. Moreover, advancements in natural language processing and artificial intelligence have enhanced the accuracy and efficiency of voice banking systems, further fueling market growth.

Unlock Insights: Request a Free Sample of Our Latest Report Now: https://www.maximizemarketresearch.com/request-sample/169729/

Voice Banking Market Trends:

In the dynamic landscape of the voice banking market, several trends are shaping its trajectory. Firstly, there's a notable shift towards personalized and conversational banking experiences, with institutions leveraging voice technology to offer tailored solutions and proactive assistance to customers. Secondly, there's a growing emphasis on security and privacy, with the implementation of biometric authentication and robust encryption protocols to safeguard sensitive financial data transmitted via voice interactions. Additionally, the integration of voice banking with other emerging technologies such as artificial intelligence, machine learning, and blockchain is driving innovation and enabling new functionalities like predictive analytics and smart financial insights.

What are Voice Banking Market Dynamics?

The dynamics of the voice banking market encompass a complex interplay of various factors that influence its growth and evolution. Key drivers include the increasing consumer demand for seamless and intuitive banking experiences, prompting financial institutions to invest in voice-enabled technologies to enhance customer engagement and satisfaction. Additionally, the proliferation of smart devices and the growing acceptance of voice recognition technology are expanding the potential user base for voice banking services. Moreover, regulatory initiatives aimed at promoting innovation and competition in the financial sector are encouraging industry players to explore new avenues such as voice-enabled transactions and customer support. However, challenges such as concerns over security and privacy, interoperability issues, and the need for continuous technological advancements pose significant hurdles to the widespread adoption of voice banking solutions.

Need More Information? Inquire About Sample + Graphs Here: https://www.maximizemarketresearch.com/inquiry-before-buying/169729/

Voice Banking Market Opportunities:

The voice banking market presents a multitude of opportunities for innovation and growth, driven by the convergence of technology trends and evolving consumer preferences. One significant opportunity lies in the expansion of voice banking services to underserved demographics, including the elderly and individuals with disabilities, who may benefit greatly from the accessibility and convenience offered by voice-enabled interfaces. Moreover, the integration of voice technology with other emerging technologies such as augmented reality and virtual reality opens up new avenues for immersive and interactive banking experiences, allowing users to visualize and manage their finances in novel ways. Furthermore, the global reach of voice-enabled devices presents an opportunity for financial institutions to tap into new markets and extend their services to geographically diverse populations, fostering financial inclusion and expanding their customer base.

What is Voice Banking Market Regional Insight?

The regional insight into the voice banking market reveals a diverse landscape shaped by varying levels of technological adoption, regulatory frameworks, and cultural preferences across different geographic regions. In developed economies such as North America and Europe, robust infrastructure, high smartphone penetration, and a tech-savvy consumer base have fueled early adoption of voice banking services, driving market growth. Moreover, stringent data protection regulations in these regions have spurred the development of secure and privacy-compliant voice banking solutions, enhancing consumer trust and confidence. Meanwhile, in emerging markets like Asia-Pacific and Latin America, rapid urbanization, expanding middle-class populations, and increasing smartphone affordability are driving the uptake of voice banking services, albeit at a slower pace due to infrastructure challenges and regulatory constraints.

FREE |Get a Copy of Sample Report Now! @ https://www.maximizemarketresearch.com/request-sample/169729/

What is Voice Banking Market Segmentation?

by Component

Solution

Services

by Deployment Mode

On-Premise

Cloud

by Technology

Large Enterprises

Small and Medium-sized Enterprises

by Application

Banks

NBFCs

Credit Unions

Others

by Technology

Machine Learning

Deep Learning

Natural Language Processing

Others

Some of the current players in the Voice Banking Market are:

1. U.S. Bank (US)

2. Citigroup (US)

3. Axis Bank(India)

4. HSBC (UK)

5. NatWest Group (UK)

6. IndusInd Bank (India)

7. BankBuddy (India)

8. Central 1 Credit Union (Canada)

9. ICICI bank (India)

10. United Bank of India (India)

11. DBS Bank (Singapore)

12. Acapela Group. (Belgium)

13. Emirates NBD Bank (UAE)

Get to Know More About This Market Study: https://www.maximizemarketresearch.com/market-report/voice-banking-market/169729/

Key Offerings:

Past Market Size and Competitive Landscape

Voice Banking Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Voice Banking Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

Explore our top-performing reports on the latest trends:

♦ Government Cloud Market: https://www.maximizemarketresearch.com/market-report/global-government-cloud-market/4007/

♦ Innovation Management Market: https://www.maximizemarketresearch.com/market-report/global-innovation-management-market/92520/

♦ Customer Data Platform Market: https://www.maximizemarketresearch.com/market-report/customer-data-platform-market/14397/

♦ The smartphone market: https://www.maximizemarketresearch.com/market-report/global-smartphone-market/43099/

♦ silicon wafer market: https://www.maximizemarketresearch.com/market-report/global-silicon-wafer-market/35534/

♦ Glboal Luxury Perfume Market: https://www.maximizemarketresearch.com/market-report/global-luxury-perfume-market/38622/

♦ Smart Pills Market: https://www.maximizemarketresearch.com/market-report/global-smart-pills-market/20942/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Voice Banking Market Projected to Hit USD 3.04 Billion by 2030 here

News-ID: 3535792 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

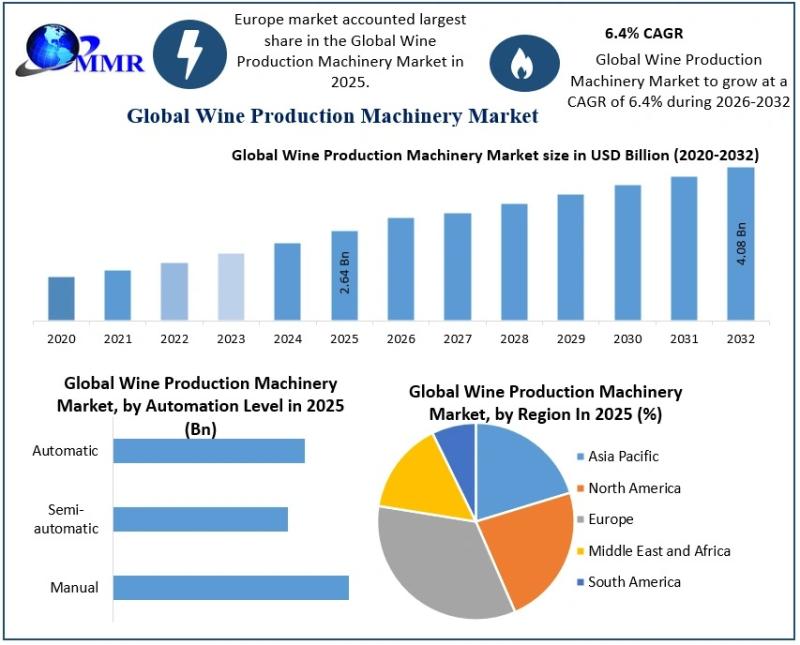

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

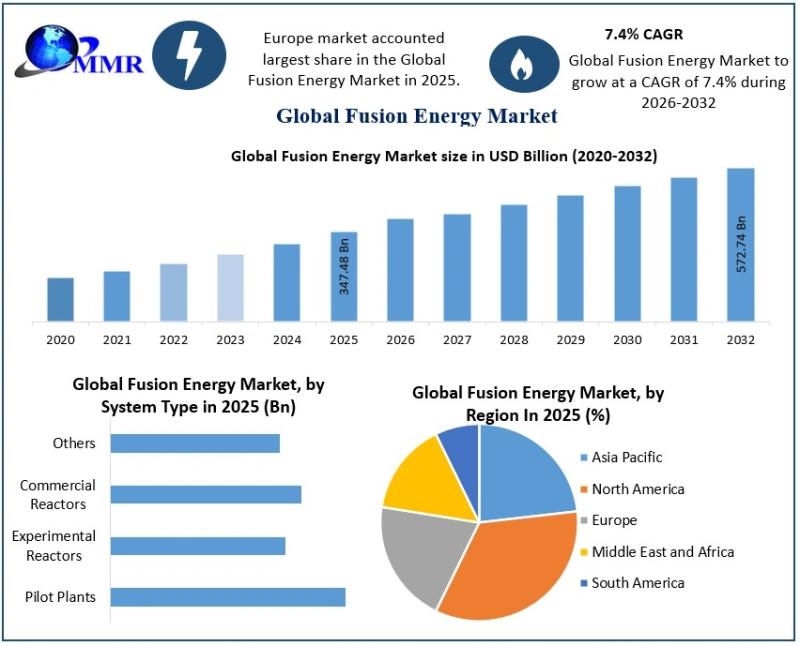

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…