Press release

IoT Insurance Market: Revolutionizing Insurance with Key Trends, Market Analysis, and Competitive Insights for a Connected Future

The Business Research Company has recently revised its global market reports, now incorporating the most current data for 2024 along with projections extending up to 2033.IoT Insurance Global Market Report 2024 by The Business Research Company offers comprehensive market insights, empowering businesses with a competitive edge. It includes detailed estimates for numerous segments and sub-segments, providing valuable strategic guidance.

The Market Size Is Expected To Reach $612.55 billion In 2028 At A CAGR Of 56.7%.

The iot insurance market size has grown exponentially in recent years. It will grow from $65.55 billion in 2023 to $101.64 billion in 2024 at a compound annual growth rate (CAGR) of 55.0%. The growth in the historic period can be attributed to risk prevention and mitigation, enhanced customer engagement, home automation devices, health and wearable devices, smart property devices, cybersecurity concerns..

The iot insurance market size is expected to see exponential growth in the next few years. It will grow to $612.55 billion in 2028 at a compound annual growth rate (CAGR) of 56.7%. The growth in the forecast period can be attributed to regulatory support, emergence of insurtech startups, smart city initiatives, customized premiums, climate and environmental monitoring.. Major trends in the forecast period include integration of connected devices, telematics in auto insurance, smart home and property insurance, cyber insurance with iot security, blockchain for data security, data analytics and predictive modeling..

Request A Sample Of This Report - https://www.thebusinessresearchcompany.com/sample.aspx?id=9229&type=smp

IoT Insurance Market Major Segments

The iot insurance market covered in this report is segmented -

1) By Component: Solution, Service

2) By Insurance Type: Life And Health Insurance, Property And Casualty Insurance, Other Insurance Types

3) By Application: Automotive Transportation And Logistics, Life And Health, Commercial And Residential Buildings, Business And Enterprise, Agriculture, Other Applications

Key Driver - IOT Adoption Drives IOT Insurance Market Growth

Growing usage of the Internet of Things (IoT) is significantly contributing to the growth of the IoT insurance market going forward. The Internet of Things (IoT) refers to a network of physical items having sensors, software, and other technologies installed with the purpose of connecting and exchanging information with other hardware and software over the internet. IoT technology solutions help insurance companies determine risks more precisely and establish better customer relationships. For instance, according to a 2022 report from Fieldforce Inc., a US-based software development and network platform company, IoT adoption had a year-on-year growth of 61% from 2020 to 2021. Therefore, growing usage of the Internet of Things (IoT) will drive the IoT insurance market.

Customise This Report As Per Your Requirements - https://www.thebusinessresearchcompany.com/Customise?id=9229&type=smp

Prominent Trend - Technological Revolution Drives Innovation In IOT Insurance

Technological advancement is the key trend gaining popularity in the IoT insurance market. Major companies operating in the IoT insurance market are focusing on developing new technologies to advance IoT applications in the insurance sector. For instance, in December 2022, ARMD, a UK-based InsureTech company that uses technology to provide insurance to tradespeople, launched a new Smart Van Alarm and Tracker, an IoT technology that improves tradespeople's protection, provides insurers with better underwriting data, and decreases bogus claims. The ARMD app is used to control the IoT device, which is self-installed and does not require any technical expertise. As a result, tool inventory, security, insurance, and van location are all centralized. This greatly speeds up claim payments from many weeks to a few days and simplifies the entire procedure for craftsmen and insurers. In the event of a break-in, customers are now immediately contacted. The gadget also functions as a car tracker, providing crucial information for claim and underwriting purposes.

IoT Insurance Market Players

Major companies operating in the iot insurance market report are SAP SE, Cisco Systems Inc., Alphabet Inc., International Business Machines Corporation, Microsoft Corporation, Oracle Corporation, Aeris Group Ltd., Concirrus Ltd., Telit Communications plc, Verisk Analytics Inc., Allerin Pvt. Ltd., ForMotiv LLC, Wipro Limited, Webfleet Solutions BV, Intel Corporation, Google LLC, Capgemini SE, Allstate Insurance Company, Liberty Mutual Insurance Company, State Farm Mutual Automobile Insurance Company, Progressive Corporation, The Travelers Companies Inc., Nationwide Mutual Insurance Company, American International Group Inc., Zurich Insurance Group AG, Chubb Limited, The Hartford Financial Services Group Inc., Farmers Insurance Group of Companies, Munich Re Group, Swiss Re AG, Berkshire Hathaway Inc., AXA SA, Generali Group, Ping An Insurance (Group) Company of China Ltd., China Life Insurance Company Limited, Samsung Fire & Marine Insurance Co Ltd., Sompo Holdings Inc. .

View The Full Report Here - https://www.thebusinessresearchcompany.com/report/iot-insurance-global-market-report

Largest And Fastest Growing Region In The Market

North America was the largest region in the IoT insurance market in 2023. The regions covered in the iot insurance market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

The Table Of Content For The Market Report Include:

1. Executive Summary

2. IoT Insurance Market Report Structure

3. IoT Insurance Market Trends And Strategies

4. IoT Insurance Market - Macro Economic Scenario

5. IoT Insurance Market Size And Growth

…..

27. IoT Insurance Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release IoT Insurance Market: Revolutionizing Insurance with Key Trends, Market Analysis, and Competitive Insights for a Connected Future here

News-ID: 3535047 • Views: …

More Releases from The Business research company

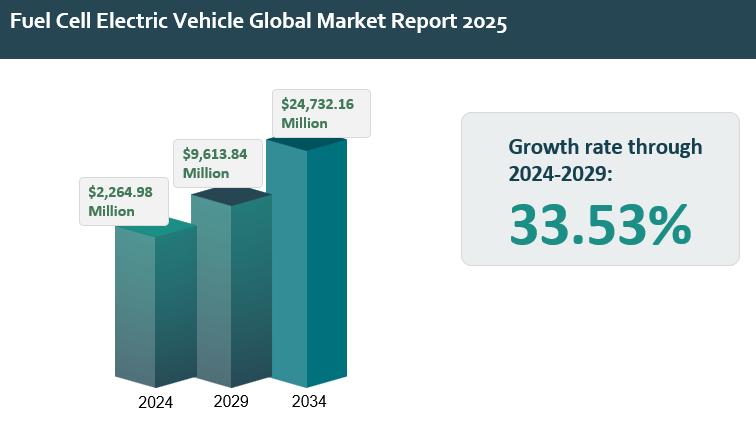

Global Fuel Cell Electric Vehicle Market Outlook 2025-2034: Growth Acceleration, …

The fuel cell electric vehicle report outlines and analyzes the fuel cell electric vehicle market, covering the historic period 2019-2024 and the forecast periods 2024-2029 and 2034F. The report assesses the market across regions and the major economies within each region.

The global fuel cell electric vehicle market was valued at $2.26498 billion in 2024, increasing at a CAGR of 6.88% since 2019. The market is projected to rise from $2.26498…

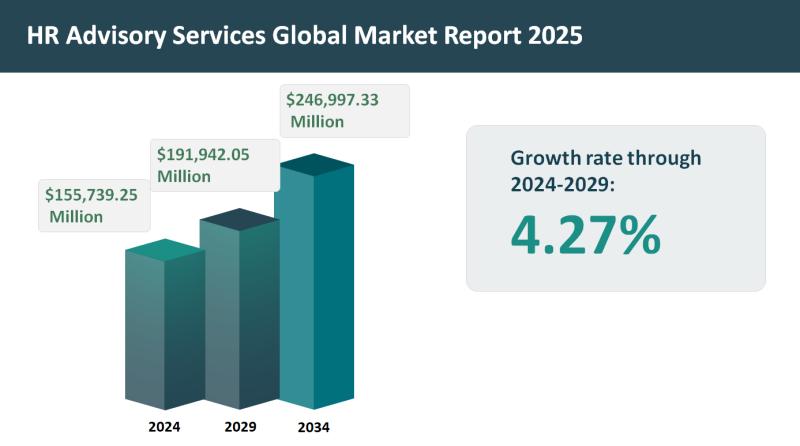

Global HR Advisory Services Market Set for 4.27% Growth, Projected to Reach $191 …

The HR advisory services report outlines and analyzes the HR advisory services market across 2019-2024 (historic period) and 2024-2029, 2034F (forecast period). It examines market performance across global regions and key economies.

The global HR advisory services market was valued at approximately $155.73925 billion in 2024, increasing at a CAGR of 4.22% since 2019. The market is anticipated to rise from $155.73925 billion in 2024 to $191.94205 billion in 2029, reflecting…

Evolving Market Trends In The Integrated Geophysical Services Industry: Enhancin …

The Integrated Geophysical Services Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Integrated Geophysical Services Market Size During the Forecast Period?

The integrated geophysical services market has experienced consistent growth in recent years, expected to rise from $2.35 billion in 2024 to…

Global HR Advisory Services Market: Key Trends, Market Share, Growth Drivers, An …

The HR advisory services market report describes and explains the HR advisory services market and covers 2019-2024, termed the historic period, and 2024-2029, 2034F termed the forecast period. The report evaluates the market across each region and for the major economies within each region.

The global HR advisory services market reached a value of nearly $155.74 billion in 2024, having grown at a compound annual growth rate (CAGR) of 4.22% since…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…