Press release

Advanced Authentication in Financial Services Market is expected to represent Significant CAGR of +15% by 2031 | Thales, NEC Corporation, Dell Inc.

Advanced authentication in financial services refers to the use of sophisticated methods to verify the identity of users accessing financial systems or conducting transactions. This is crucial for enhancing security and preventing unauthorized access or fraudulent activities. Common advanced authentication methods include biometric authentication (such as fingerprint or facial recognition), multi-factor authentication (combining two or more authentication factors like passwords, tokens, or biometrics), and behavioral analytics (analyzing user behavior patterns to detect anomalies). These methods provide an additional layer of security beyond traditional username and password systems, making it more difficult for cybercriminals to gain unauthorized access. Implementing advanced authentication in financial services helps safeguard sensitive financial information, protect against identity theft, and ensure compliance with regulatory requirements.The global Advanced Authentication in Financial Services Market to Rise at an CAGR of +3% during forecast period (2024-2031).

Get the PDF Sample Copy (Including FULL TOC, Graphs and Tables) of this report @: https://www.researchcognizance.com/sample-request/235497

This market research report gives an in-depth idea about the global Advanced Authentication in Financial Services market. It highlights the recent market scenario, growth in the past few years, and opportunities present for manufacturers in the future. In this research for the completion of both primary and secondary details, methods and tools are used. Also, investments instigated by organizations, government, non-government bodies, and institutions are projected in details for better understanding about the market.

Top Key Players in Global Advanced Authentication in Financial Services Market:

Thales, NEC Corporation, Dell Inc., mastercard, SecurEnvoy Ltd, Absolute software corporation, ValidSoft Group, Fujitsu, Ping Identity, Broadcom Inc

The study presents an evaluation of the factors that are expected to inhibit or boost the progress of the global Advanced Authentication in Financial Services market. The global Advanced Authentication in Financial Services market has been examined thoroughly on the basis of key criteria such as end user, application, product, technology, and region. An analysis has been provided in the report of the key geographical segments and their share and position in the market. The estimated revenue and volume growth of the global Advanced Authentication in Financial Services market has also been offered in the report.

Advanced Authentication in Financial Services Market Growth analysis:

The global Advanced Authentication in Financial Services Market growth analysis involves a comprehensive examination of trends, patterns, and factors influencing the expansion of a specific market over time. By gathering and analyzing data from various sources, including market research reports, industry publications, and competitive intelligence, we can identify key drivers of growth, assess historical performance, and forecast future trajectories. Through segmentation analysis, trend monitoring, and competitive landscape assessment, we gain valuable insights into market dynamics and opportunities for expansion.

The global Advanced Authentication in Financial Services Market report provides insights on the following pointers:

• Market Penetration: Comprehensive information on the product portfolios of the top players in the Advanced Authentication in Financial Services Market.

• Product Development/Innovation: Detailed insights on the upcoming technologies, R&D activities, and product launches in the market.

• Competitive Assessment: In-depth assessment of the market strategies, geographic and business segments of the leading players in the market.

• Market Development: Comprehensive information about emerging markets. This report analyzes the market for various segments across geographies.

• Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the Advanced Authentication in Financial Services Market.

Advanced Authentication in Financial Services Market Trends:

The global Advanced Authentication in Financial Services Market trends provide valuable insights into the direction and dynamics of a particular industry or market segment. By analyzing trends, businesses can anticipate shifts in consumer behavior, identify emerging opportunities, and adapt their strategies accordingly. From technological advancements to changing consumer preferences, market trends encompass a wide range of factors that shape the competitive landscape and influence business decision-making.

For Any Query or Customization: https://www.researchcognizance.com/inquiry/235497

As the global Advanced Authentication in Financial Services market is segmented based on various parameters, an in-depth classification of the market is also mentioned; elements impacting the market's growth are studied in detail to understand the report precisely. Moreover this, profiles of some of the leading players operating in the global Advanced Authentication in Financial Services market are included in the report. Using SWOT analysis, their weaknesses and strengths are analyzed. It helps the study deliver visions into the opportunities and threats that companies may face during the forecast period.

Global Advanced Authentication in Financial Services Market Segmentation:

Market Segmentation: By Type

Single-factor Authentication

Multi-factor Authentication

Market Segmentation: By Application

Large Enterprises

Small and Medium-sized Enterprises

Advanced Authentication in Financial Services Market Drivers:

Market drivers are the key factors and forces that shape the growth and direction of a particular market or industry. These drivers can include a wide range of economic, social, technological, and regulatory factors that influence demand, supply, and overall market dynamics. By understanding the primary market drivers, businesses can anticipate trends, identify opportunities, and make informed strategic decisions. Examples of market drivers may include changes in consumer preferences, advancements in technology, shifts in regulatory policies, fluctuations in economic conditions, and competitive pressures.

Advanced Authentication in Financial Services Market Restraints:

The global Advanced Authentication in Financial Services Market restraints can arise from various sources, including regulatory constraints, economic challenges, technological limitations, competitive pressures, and shifts in consumer behavior. Market restraints may impede market expansion, constrain profitability, and create obstacles for businesses seeking to enter or operate within a particular market segment

Table of Contents

Global Advanced Authentication in Financial Services Market Research Report 2024 - 2031

Chapter 1 Advanced Authentication in Financial Services Market Overview

Chapter 2 Global Economic Impact on Industry

Chapter 3 Global Market Competition by Manufacturers

Chapter 4 Global Production, Revenue (Value) by Region

Chapter 5 Global Supply (Production), Consumption, Export, Import by Regions

Chapter 6 Global Production, Revenue (Value), Price Trend by Type

Chapter 7 Global Market Analysis by Application

Chapter 8 Manufacturing Cost Analysis

Chapter 9 Industrial Chain, Sourcing Strategy and Downstream Buyers

Chapter 10 Marketing Strategy Analysis, Distributors/Traders

Chapter 11 Market Effect Factors Analysis

Chapter 12 Global Advanced Authentication in Financial Services Market Forecast

Buy Exclusive Report: https://www.researchcognizance.com/checkout/235497/single_user_license

If you have any special requirements, please let us know and we will offer you the report as you want.

"

"Contact Us:

Neil Thomas

116 West 23rd Street 4th Floor New York City, New York 10011

sales@researchcognizance.com

+1 (718) - 509 - 9713

https://www.researchcognizance.com

"

"About Research Cognizance:

Research Cognizance is an India-based market research Company, registered in Pune. Research Cognizance aims to provide meticulously researched insights into the market. We offer high-quality consulting services to our clients and help them understand prevailing market opportunities. Our database presents ample statistics and thoroughly analyzed explanations at an affordable price.

"

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Advanced Authentication in Financial Services Market is expected to represent Significant CAGR of +15% by 2031 | Thales, NEC Corporation, Dell Inc. here

News-ID: 3534539 • Views: …

More Releases from Research Cognizance

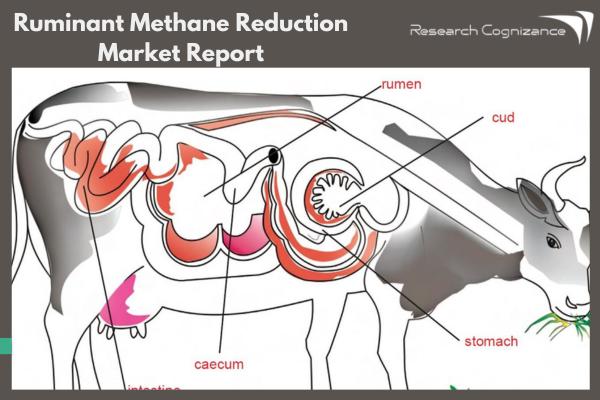

Ruminant Methane Reduction Market to Witness Huge Growth by 2031 | Alltech, CH4 …

Ruminant Methane Reduction Market is growing at a Robust CAGR of +7% during the forecast period 2024-2031. The increasing interest of the individuals in this industry is that the major reason for the expansion of this market

Ruminant methane reduction refers to the strategies and practices aimed at decreasing the amount of methane gas produced by ruminant animals such as cows, sheep, and goats. These animals produce methane during the process…

Retail Core Banking Systems Market to Flourish at an Impressive CAGR of 10% by 2 …

Retail core banking systems are the backbone of financial institutions, providing essential services for retail customers. These systems integrate various banking functions, including deposits, withdrawals, transfers, and account management, into a centralized platform. They offer real-time processing capabilities, enabling customers to access their accounts and conduct transactions conveniently. Retail core banking systems also support multiple delivery channels such as branches, ATMs, online banking, and mobile apps, ensuring a seamless customer…

Nitrile Gloves Market Report Covers Future Trends With Research 2024 to 2031 - H …

Nitrile gloves are synthetic rubber gloves widely used in various industries, including healthcare, food handling, and automotive, due to their superior puncture resistance and chemical resistance compared to latex gloves. Made from a compound called nitrile, these gloves offer excellent protection against pathogens and chemicals, making them ideal for medical professionals and laboratory workers. They are latex-free, reducing the risk of allergic reactions, and come in various sizes to ensure…

Precision Medicine Market to Flourish at an Impressive CAGR of 11% by 2031 | Joh …

Precision medicine is a groundbreaking approach to healthcare that tailors medical treatment and interventions to individual characteristics, such as genetic makeup, environment, and lifestyle. By analyzing a patient's unique genetic profile, along with other factors, precision medicine aims to provide more accurate diagnoses and personalized treatment plans. This approach enables healthcare providers to better predict which treatments will be most effective for each patient, minimizing adverse reactions and optimizing outcomes.…

More Releases for Authentication

Battery Authentication ICs Market

Battery Authentication ICs Market Analysis:

The global Battery Authentication ICs Market size was estimated at USD 635 million in 2023 and is projected to reach USD 1183.35 million by 2030, exhibiting a CAGR of 9.30% during the forecast period.

North America Battery Authentication ICs market size was USD 165.46 million in 2023, at a CAGR of 7.97% during the forecast period of 2025 through 2030.

To Read Full Market Report -

https://semiconductorinsight.com/report/battery-authentication-ics-market/

Battery Authentication ICs…

Key Trend Reshaping the Fast Identity Online (FIDO) Authentication Market in 202 …

What combination of drivers is leading to accelerated growth in the fast identity online (fido) authentication market?

The upsurge in cyber threats is likely to fuel the expansion of the fast identity online (FIDO) authentication market in the future. These cyber threats encompass the potential dangers or vulnerabilities created by malicious activities that aim to harm data through different activities and strategies aimed at computer systems, networks, and digital information. FIDO…

Key Trend Reshaping the Fast Identity Online (FIDO) Authentication Market in 202 …

What Are the Projections for the Size and Growth Rate of the Fast Identity Online (FIDO) Authentication Market?

The Fast Identity Online (FIDO) authentication market has grown exponentially in recent years. It is projected to increase from $1.93 billion in 2024 to $2.39 billion in 2025, at a compound annual growth rate (CAGR) of 23.8%. The growth can be attributed to password vulnerabilities, increasing cybersecurity threats, consumer demand for user-friendly security,…

Multi-Factor Authentication to Dominate Global Authentication Software Market by …

[San Francisco, USA] - As businesses continue to digitize their operations, the need for reliable authentication software has become paramount. A recent market research report added on Trouve360Reports analyzes the global authentication software market and provides insights into its size, growth, and key players.

Authentication software is a security technology that ensures that users or devices are who they claim to be before granting access to a network or application. The…

Luxury Authentication Service Market Is Booming Worldwide | Komehyo, TheRealReal …

The Latest research study released by HTF MI “Luxury Authentication Service Market” with 100+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint and status. Understanding the segments helps in identifying the importance of different factors that aid the market growth. Some of the Major Companies covered in this Research…

Out of band Authentication Market Dynamic Business Environment during 2018 - 202 …

Global Out of Band Authentication Market: Overview

The global out-of-band authentication market is likely to display monumental growth in the near future. Spanning outside the defined band for telecommunications frequency, out-of-band is an activity mainly used for protection from false decode in telecommunication systems.

Get Sample Copy of the Report @ https://www.tmrresearch.com/sample/sample?flag=B&rep_id=5040

To define, out of band authentication (OOBA) refers to a process where authentication is carried out using two different signals using…