Press release

Investment Banking Trading Services Market 2024 Top Trends, Growth Rate And Forecast To 2033

The Business Research Company has recently revised its global market reports, now incorporating the most current data for 2024 along with projections extending up to 2033.Investment Banking Trading Services Global Market Report 2024 by The Business Research Company offers comprehensive market insights, empowering businesses with a competitive edge. It includes detailed estimates for numerous segments and sub-segments, providing valuable strategic guidance.

The Market Size Is Expected To Reach $574.8 billion In 2028 At A CAGR Of 9.2%.

The investment banking trading services market size has grown strongly in recent years. It will grow from $372.39 billion in 2023 to $404.29 billion in 2024 at a compound annual growth rate (CAGR) of 8.6%. The growth in the historic period can be attributed to rise of derivatives and structured products, regulatory changes post-financial crisis, market globalization and interconnectedness, introduction of algorithmic trading, emergence of electronic trading.

The investment banking trading services market size is expected to see strong growth in the next few years. It will grow to $574.8 billion in 2028 at a compound annual growth rate (CAGR) of 9.2%. The growth in the forecast period can be attributed to expansion of high-frequency trading (hft), market volatility and risk mitigation, augmented reality and virtual trading environments, increasing focus on derivatives trading, global expansion of financial markets. Major trends in the forecast period include adoption of algorithmic trading, rise of esg investing, integration of artificial intelligence (ai), expansion of cryptocurrency trading, shift towards remote trading environments.

Request A Sample Of This Report -

https://www.thebusinessresearchcompany.com/sample.aspx?id=9144&type=smp

Investment Banking Trading Services Market Major Segments

The investment banking trading services market covered in this report is segmented -

1) By Service Type: Equity Underwriting And Debt Underwriting Services, Trading And Related Services, Financial Advisory, Other Service Types

2) By Industry Vertical: BFSI, Healthcare, Manufacturing, Energy And Utilities, IT And Telecom, Retail And Consumer Goods, Media And Entertainment, Other Industry Vertical

Key Driver - Surging Demand For Advisory And Consultancy Services Fuels Growth In Investment Banking And Trading Services Market

The need for advisory and consultancy services is expected to propel the growth of the investment banking and trading services market going forward. Advisory services are consulting services performed by a CPA to develop findings, conclusions, and recommendations for a client whereas a consulting service is the provision of expertise or strategic advice for consideration and decision-making. Investment banking and trading services provide advisory services including IPOs for companies who wanted to go public, merger and acquisition advisory services, and other services. For instance, in March 2023, according to Statistics Canada, a Canada-based government agency, the management, scientific, and technical consulting services reported $29.2 billion in operating revenue in 2021, an increase of 9.7% from the previous year. Therefore, the need for advisory and consultancy services is driving the growth of the investment banking and trading services

Customise This Report As Per Your Requirements -

https://www.thebusinessresearchcompany.com/Customise?id=9144&type=smp

Prominent Trend - Technological Advancements In Investment Banking With Financial Cloud For Data

Technological advancements have emerged as a key trend gaining popularity in the investment banking trading services market. Major companies operating in the investment banking trading services market are focused on developing cloud-based solutions. For instance, in November 2021, in partnership with Amazon Web Services, Inc. (AWS), Goldman Sachs, a US-based investment banking company launched Goldman Sachs Financial Cloud for Data. It offers financial institutions cloud-based data and analytics solutions. Investing firms will be able to access advanced quantitative analytics across global markets much more easily due to this solution. Goldman Sachs Financial Cloud for Data will also offer more streamlined and secure access to best-in-class financial data. Goldman Sachs Financial Cloud for Data provides hedge funds, asset managers, and other institutional clients with cloud-native financial data management and analytics.

Investment Banking Trading Services Market Players

Major companies operating in the investment banking trading services market report are Bank of America Corporation, Barclays Bank PLC, Citigroup Inc., Credit Suisse Group AG, Deutsche Bank AG, Goldman Sachs, JPMorgan Chase & Co., Morgan Stanley, UBS Group AG, Wells Fargo & Company, HSBC Holdings PLC., BNP Paribas S.A, Societe Generale Group, ABN AMRO Bank N.V., AllianceBernstein Holding L.P., BofA Securities Inc., RBC Capital Markets, Mizuho Financial Group, Nomura Holdings Inc., The Royal Bank of Scotland Group plc, Macquarie Group Limited, Lazard Ltd., Rothschild & Co., Evercore Partners Inc., Jefferies Group LLC, Piper Jaffray Companies, Sumitomo Mitsui Financial Group Inc., SunTrust Robinson Humphrey Inc., Truist Securities Inc., UniCredit SpA, VTB Capital plc .

View The Full Report Here -

https://www.thebusinessresearchcompany.com/report/investment-banking-trading-services-global-market-report

Largest And Fastest Growing Region In The Market

Asia-Pacific was the largest region in the investment banking trading services market in 2023. The regions covered in the investment banking trading services market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa

The Table Of Content For The Market Report Include:

1. Executive Summary

2. Investment Banking Trading Services Market Report Structure

3. Investment Banking Trading Services Market Trends And Strategies

4. Investment Banking Trading Services Market - Macro Economic Scenario

5. Investment Banking Trading Services Market Size And Growth

…..

27. Investment Banking Trading Services Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Investment Banking Trading Services Market 2024 Top Trends, Growth Rate And Forecast To 2033 here

News-ID: 3533870 • Views: …

More Releases from The Business research company

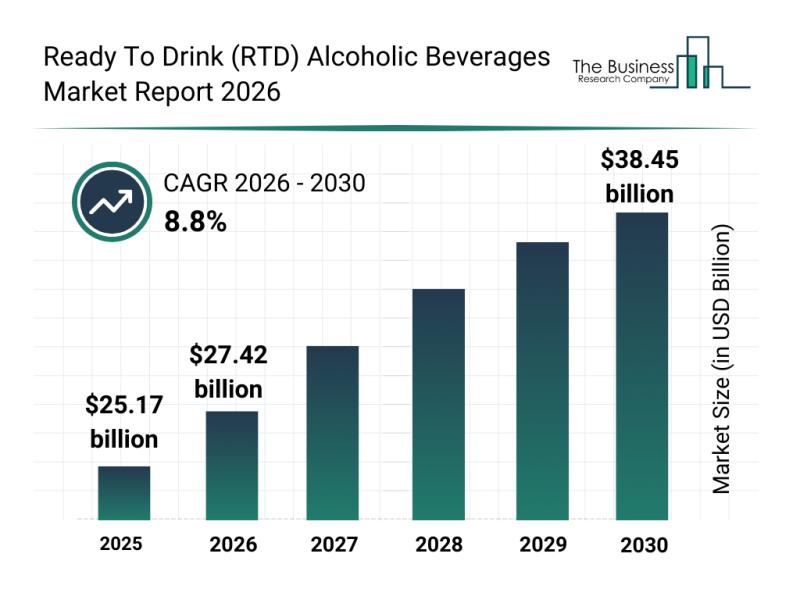

Outlook for the Ready To Drink (RTD) Alcoholic Beverages Market: Major Segments, …

The ready-to-drink (RTD) alcoholic beverages market is on track to experience significant growth over the coming years, driven by evolving consumer preferences and industry innovations. This sector is rapidly expanding as more consumers seek premium, convenient, and sustainable options in their alcoholic beverage choices. Let's explore the market's projected size, key drivers, major players, emerging trends, and segmentation details shaping its future.

Projected Expansion and Market Size of the Ready To…

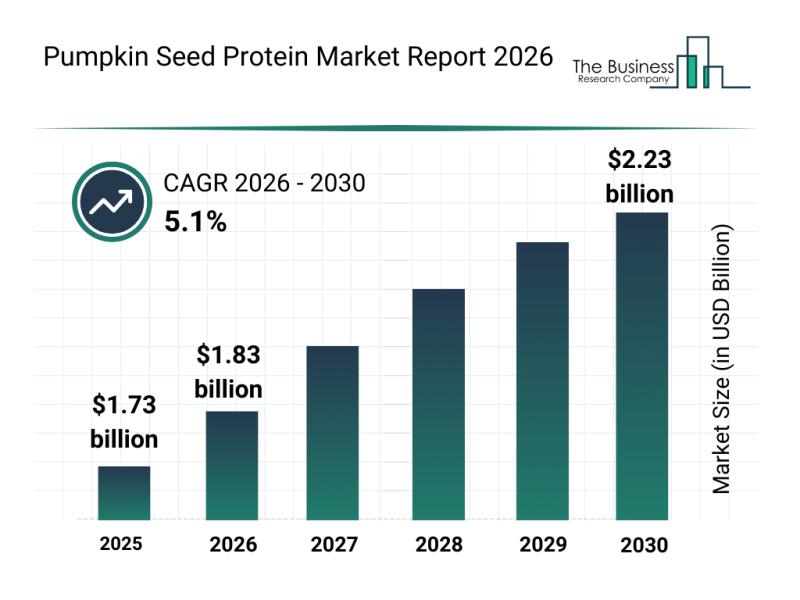

Emerging Sub-Segments Transforming the Pumpkin Seed Protein Market Landscape

The pumpkin seed protein market is emerging as a promising sector within the broader landscape of plant-based proteins. With increasing consumer interest in alternative, allergen-free protein sources and sustainable nutrition, this market is set to witness substantial growth and innovation. Let's explore the market size projections, key players, current trends, and major product segments shaping the future of pumpkin seed protein.

Projected Market Valuation and Growth Expectations for Pumpkin Seed Protein…

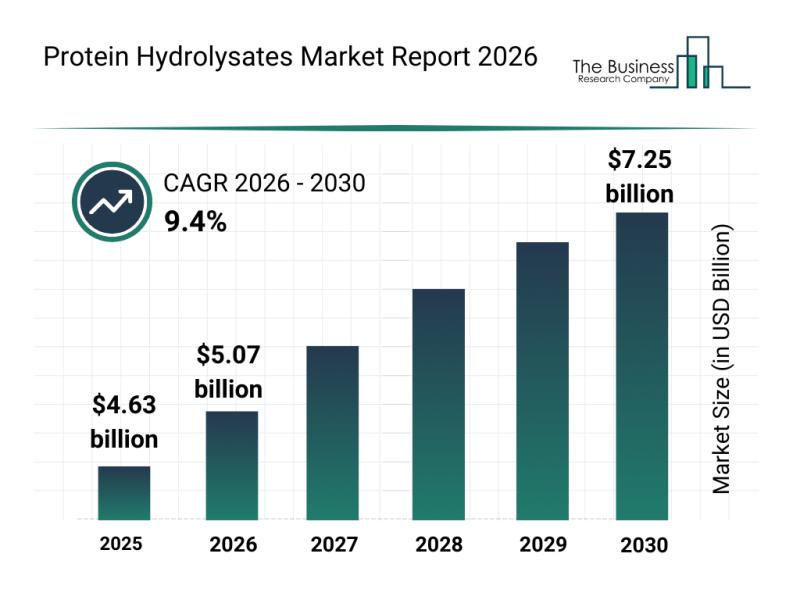

Top Players and Market Competition in the Protein Hydrolysates Industry

The protein hydrolysates market is positioned for significant expansion in the coming years as consumer preferences and nutritional science continue to evolve. With increasing attention on tailored nutrition solutions and the rise of plant-based options, this market is gearing up for robust growth and innovation.

Protein Hydrolysates Market Size Projections Through 2030

The protein hydrolysates market is forecasted to grow substantially, reaching a value of $7.25 billion by 2030. This…

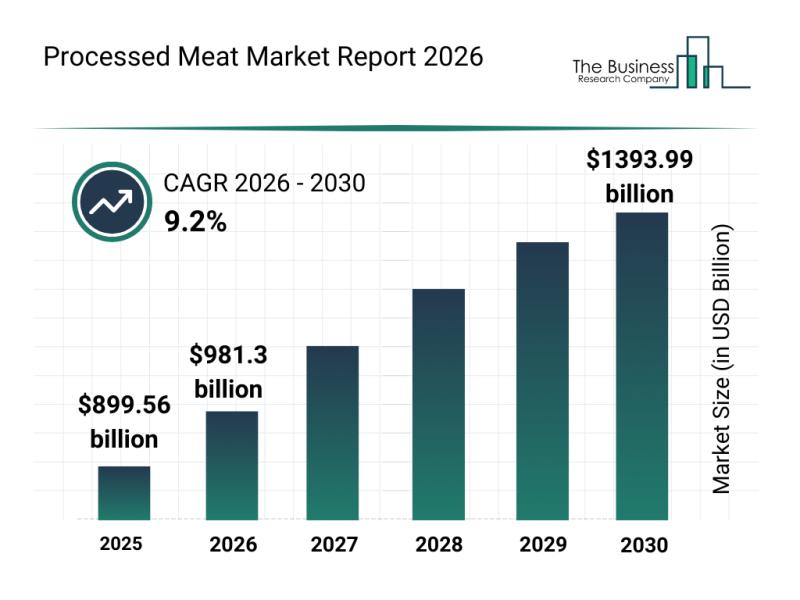

Processed Meat Market Overview: Major Segments, Strategic Developments, and Lead …

The processed meat industry is positioned for substantial expansion over the coming years, driven by evolving consumer preferences and technological advancements. As the market adapts to changing demands and regulatory landscapes, it is expected to reach impressive valuation milestones. Let's explore the current market size, key players, emerging trends, and detailed segment analyses shaping this sector's future.

Forecasted Market Size and Growth Trajectory of the Processed Meat Market

The processed…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…