Press release

Travel Insurance Market Set to Surge with 16% Revenue Growth to USD 21 Billion by 2029

Travel Insurance Market piece highlights the significant growth and evolving dynamicsTravel Insurance Market Overview:

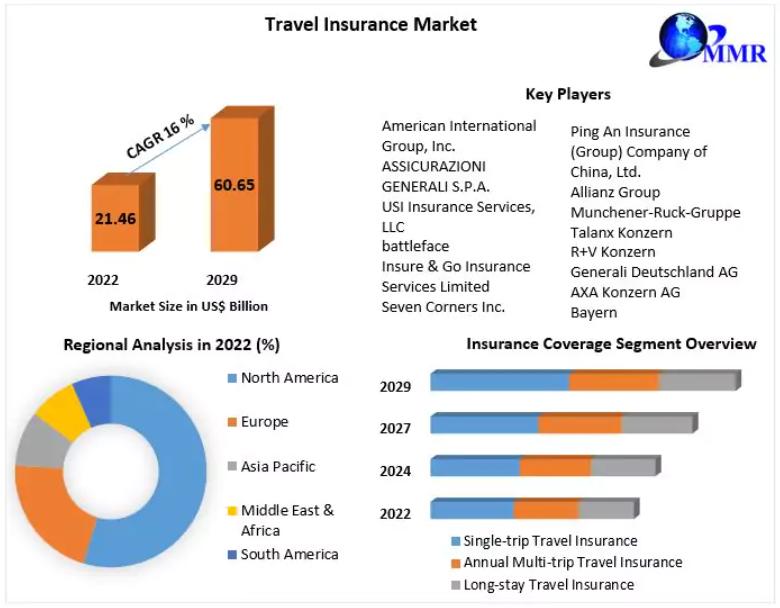

In a post-pandemic world, the global travel insurance market is set for substantial growth, projected to increase by 16% from 2022 to 2029, reaching nearly USD 21 billion. This surge comes as travelers increasingly prioritize protection against unforeseen events like COVID-19-related disruptions, including testing and quarantine expenses. The market, valued at USD 21.46 billion in 2022, is benefiting from rising tourism demand facilitated by easy online bookings and increased disposable income. Travel insurance, which covers risks such as flight cancellations, medical emergencies, and baggage loss, is becoming essential for travelers navigating the uncertainties of modern travel.

Major players in the market, including Allianz Global Assistance, are adapting by offering comprehensive COVID-19 coverage, further driving market expansion. The growth is not only fueled by leisure travelers but also by corporate travelers seeking to mitigate business travel risks. Regions such as Europe, which dominated with a 43.1% market share in 2022, and Asia-Pacific, expected to grow at the fastest rate of 16.7%, are pivotal in driving this global market growth. The market's resilience post-pandemic underscores its vital role in supporting safe and secure international travel. For more insights, the Global Travel Insurance Market report offers detailed analysis on market dynamics, key segments, and regional trends shaping the future of travel insurance.

Click Here for Your Free Sample + Report Graphs: Uncover Key Insights: https://www.maximizemarketresearch.com/request-sample/16133

Travel Insurance Market Scope and Methodology:

This report aims to deliver a thorough understanding of the Travel Insurance market, emphasizing market-centric strategies. It identifies key trends, growth drivers, challenges, and potential opportunities. Data is collected through both primary and secondary research methods. Primary data is gathered from interviews and surveys with key industry stakeholders such as manufacturers, suppliers, distributors, customers, and experts. Secondary data is sourced from industry reports, market analyses, corporate websites, annual reports, trade journals, government publications, and databases.

The report offers a detailed analysis of the business strategies of top companies, including partnerships, mergers, acquisitions, and collaborations. A SWOT analysis evaluates the market position of these companies, highlighting strengths, weaknesses, opportunities, and threats. The Travel Insurance market is examined using feasibility studies, investment return analyses, and Porter's Five Forces framework. Global and regional Travel Insurance market sizes are calculated using a bottom-up approach.

Travel Insurance Market Regional Insights:

The Regional Analysis section offers an overview of the current state of the Travel Insurance market in each participating country. Local perspectives are vital due to the complex nature of the Travel Insurance industry. The market is divided into North America, Europe, Asia-Pacific, Latin America, the Middle East, and Africa. Each region's market size, growth rate, import and export details, and other specifics are examined in detail.

Explore Detailed Report Insights: https://www.maximizemarketresearch.com/request-sample/16133

Market Segmentation:

Discover how the Travel Insurance market is segmented and gain insights into each segment's performance and growth potential.

by Insurance Coverage

• Single-trip Travel Insurance

• Annual Multi-trip Travel Insurance

• Long-stay Travel Insurance

by Distribution Channel

• Insurance Intermediaries

• Insurance Companies

• Banks

• Insurance Brokers

• Insurance Aggregators

by End-Users

• Education Travelers

• Business Travelers

• Senior Citizens

• Family Travelers

• Others

Based on the end users, End-user segments in the market include education travelers, business travelers, senior persons, family travelers, and others. The other sub-segment includes individuals as well as groups. The senior citizen sector had the most revenue in 2022, totaling USD 5,805.5 million, and is predicted to expand at a CAGR of 13.9% over the forecast period. The services offered, such as emergency evacuation, ticket subsidies, trip cancellation coverage, and luggage loss coverage, are driving market expansion in this area. Furthermore, the business travel insurance sector held a substantial market share of USD 2,724.1 million in 2021 and is predicted to grow at the fastest CAGR of 17.6% over the forecast period.

Market Key Players:

Identify the leading companies and their portfolios in the Travel Insurance market.

• American International Group, Inc.

• ASSICURAZIONI GENERALI S.P.A.

• USI Insurance Services, LLC

• battleface

• Insure & Go Insurance Services Limited

• Seven Corners Inc.

• Travel Insured International

• Zurich

• Delphi Financial Group, Inc.

• Ping An Insurance (Group) Company of China, Ltd.

• Allianz Group

• Munchener-Ruck-Gruppe

• Talanx Konzern

• R+V Konzern

• Generali Deutschland AG

• AXA Konzern AG

• Bayern

• Huk-Coburg

• Signal Iduna

• Travelex Insurance Services Inc.

• Berkshire Hathaway Travel Protection

Experience the Data: Request a Sample Report: https://www.maximizemarketresearch.com/request-sample/16133

Key questions answered in the Travel Insurance Market include:

• Who are the leading companies and what are their portfolios in the Travel Insurance Market?

• What segments are covered in the Travel Insurance Market?

• Who are the key players in the Travel Insurance market?

• Which application holds the highest potential in the Travel Insurance market?

• What are the key challenges and opportunities in the Travel Insurance market?

• What is Travel Insurance?

• What was the Travel Insurance market size in 2023?

• What will be the CAGR at which the Travel Insurance market will grow?

• What is the growth rate of the Travel Insurance Market?

• Which factors are expected to drive the Travel Insurance market growth?

• What are the different segments of the Travel Insurance Market?

• What growth strategies are players considering to increase their presence in Travel Insurance?

• What are the upcoming industry applications and trends for the Travel Insurance Market?

• What recent industry trends can be implemented to generate additional revenue streams for the Travel Insurance Market?

Key Offerings:

• Historical Market Size and Competitive Landscape (2018 to 2022)

• Historical Pricing and Price Trends by Region (2018 to 2022)

• Market Size, Share, and Forecast by Different Segments (2024-2030)

• Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by Region

• Market Segmentation - Detailed Analysis by Segment and Sub-Segment by Region

• Competitive Landscape - Profiles of Key Players by Region from a Strategic Perspective

• Competitive Landscape - Market Leaders, Market Followers, Regional Players

• Competitive Benchmarking of Key Players by Region

• PESTLE Analysis

• PORTER's Analysis

• Value Chain and Supply Chain Analysis

• Legal Aspects of Business by Region

• Lucrative Business Opportunities with SWOT Analysis

• Recommendations

Click Here to Explore Additional Reports on Related Topics:

Green Tires Market https://www.maximizemarketresearch.com/market-report/global-green-tires-market/17093/

G-Protein Coupled Receptors (GPCRs) Market https://www.maximizemarketresearch.com/market-report/global-g-protein-coupled-receptors-gpcrs-market/104389/

glass fiber reinforced concrete market https://www.maximizemarketresearch.com/market-report/global-glass-fiber-reinforced-concrete-market/69180/

Gene Therapy Market https://www.maximizemarketresearch.com/market-report/global-gene-therapy-market/85074/

Gas Dryer Market https://www.maximizemarketresearch.com/market-report/global-gas-dryer-market/83048/

Freight and Logistics Market https://www.maximizemarketresearch.com/market-report/global-freight-and-logistics-market/65801/

Fragile X-Syndrome Market https://www.maximizemarketresearch.com/market-report/global-fragile-x-syndrome-market/102731/

Fire Protection Materials Market for Construction https://www.maximizemarketresearch.com/market-report/fire-protection-materials-market/3726/

Film Thickness Measurement Market https://www.maximizemarketresearch.com/market-report/global-film-thickness-measurement-market/8080/

Fertility Supplements Market https://www.maximizemarketresearch.com/market-report/fertility-supplements-market/124137/

Contact Us:

Maximize Market Research Pvt. Ltd.

3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

Phone: +91 9607365656

Email: sales@maximizemarketresearch.com

Website: www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is a versatile market research and consulting firm with experts from various industries. We cover sectors such as medical devices, pharmaceuticals, science and engineering, electronic components, industrial equipment, technology and communication, automobiles, chemicals, general merchandise, beverages, personal care, and automated systems. We offer market-verified industry estimates, technical trend analysis, critical market research, strategic advice, competition analysis, production and demand analysis, and client impact studies.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Travel Insurance Market Set to Surge with 16% Revenue Growth to USD 21 Billion by 2029 here

News-ID: 3532584 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Small Interfering RNA (siRNA) Therapeutics Market Poised for Strong Growth, Expe …

Precision gene silencing, expanded therapeutic indications, and delivery innovations set to redefine RNAi-based medicine by 2026

The global Small Interfering RNA (siRNA) Therapeutics Market is entering a transformative phase, driven by rapid scientific progress, regulatory momentum, and growing clinical validation of RNA interference (RNAi) technologies. According to industry analysis, the market is expected to expand at a robust compound annual growth rate (CAGR) of 17.5% from 2024 to 2030, reaching a…

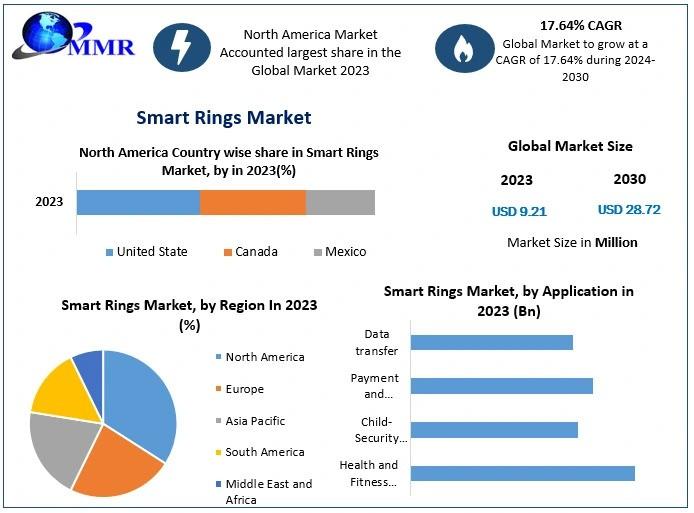

Smart Rings Market Size to Reach USD 39.74 Million by 2032, Growing at 17.64% CA …

Smart Rings Market size was valued at USD 10.83 Million in 2024 and the total Smart Rings revenue is expected to grow at a CAGR of 17.64% from 2025 to 2032, reaching nearly USD 39.74 Million.

The smart ring market is undergoing a rapid transformation from a niche wearable segment into a mainstream health-tech category, significantly bolstered by the entry of major technology giants like Samsung alongside established pioneers such as…

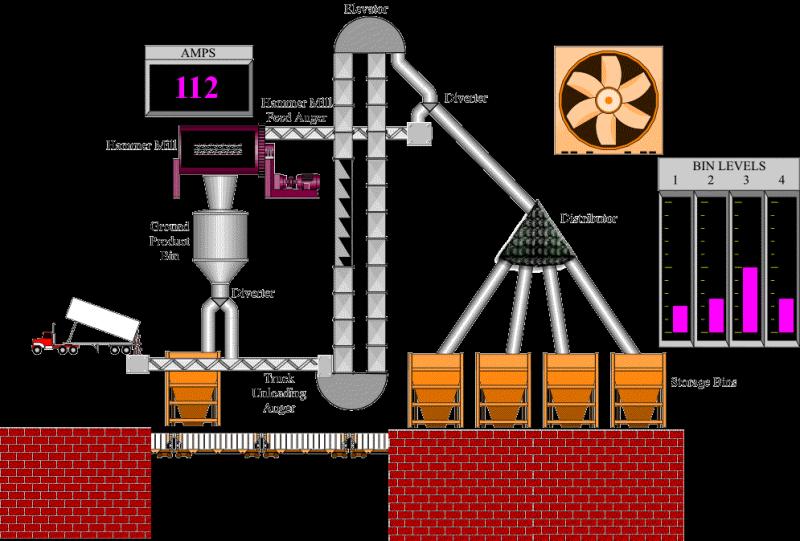

Industrial Automation Market Assessment: Strategic Insights and Competitive Land …

Industrial Automation Market size was valued at USD 184.43 Billion in 2025 and the total Industrial Automation revenue is expected to grow at a CAGR of 8.5% from 2025 to 2032, reaching nearly USD 326.48 Billion by 2032.

The industrial automation market is currently pivoting from traditional mechanization to a highly sophisticated era of "cognitive manufacturing," driven by the global imperative to minimize downtime and optimize resource allocation. As industries face…

Coffee Machine Market Worth $10.72 Billion by 2032: Industry Trends & Analysis

Coffee Machine Market size was valued at USD 6.52 Billion in 2025 and the total Coffee Machine revenue is expected to grow at a CAGR of 7.35% from 2025 to 2032, reaching nearly USD 10.72 Billion by 2032.

The global coffee machine market is experiencing a robust expansion, fundamentally driven by the "third wave" coffee movement which has elevated consumer expectations from simple caffeine consumption to an appreciation of artisanal quality…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…