Press release

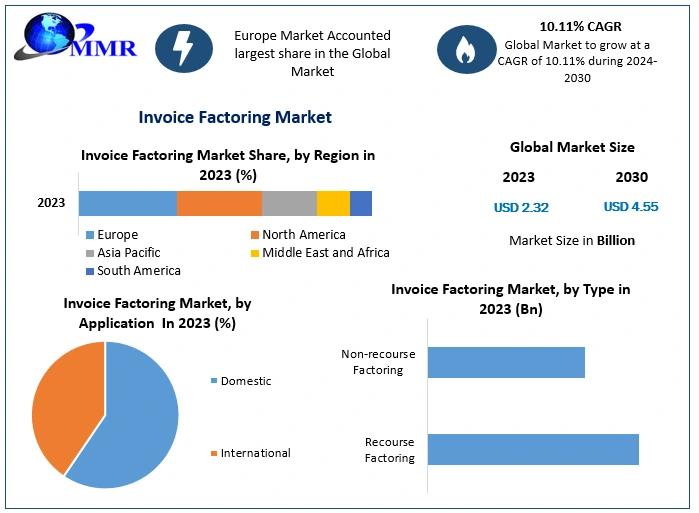

Invoice Factoring Market is forecasted to expand to USD 4.55 Billion by 2030

Anticipated Growth in Revenue:Invoice Factoring Market was valued at USD 2.32 Billion in 2023 and is expected to reach USD 4.55 Billion by 2030, exhibiting a CAGR of 10.11 % during the forecast period (2024-2030).

Invoice Factoring Market Overview:

The invoice factoring market has experienced significant growth in recent years, fueled by the increasing demand for working capital solutions among businesses globally. This growth can be attributed to several factors, including the rise of small and medium-sized enterprises (SMEs) seeking alternative financing options, the need for quick access to cash flow, and the growing popularity of non-traditional lending methods. Additionally, technological advancements have streamlined the invoice factoring process, making it more accessible and efficient for both businesses and factoring companies alike. As a result, the market has become increasingly competitive, with numerous players offering tailored solutions to meet the diverse needs of businesses across various industries.

Get Free Access to Our Sample Report: https://www.maximizemarketresearch.com/request-sample/168342

Invoice Factoring Market Trends:

In the contemporary landscape, several notable trends are shaping the invoice factoring market. One prominent trend is the integration of technology-driven solutions, such as artificial intelligence and machine learning algorithms, to enhance risk assessment and streamline the invoice processing workflow. Additionally, there is a growing emphasis on sustainability and ethical business practices, leading to the emergence of environmentally conscious factoring options. Moreover, the market is witnessing increased collaboration between traditional financial institutions and fintech startups, fostering innovation and expanding the range of available services.

What are Invoice Factoring Market Dynamics?

The dynamics of the invoice factoring market encompass a range of factors that influence its growth, evolution, and competitiveness. Market dynamics include the fluctuating demand for working capital among businesses, which is influenced by economic conditions, industry trends, and business cycles. Additionally, regulatory changes and financial policies can impact the operational landscape for invoice factoring companies, shaping their lending practices and risk management strategies. Moreover, technological advancements and innovations play a crucial role in driving efficiency and scalability within the market, with automation and digital platforms becoming increasingly integral to the invoice factoring process. Furthermore, market dynamics are also influenced by competitive pressures, mergers and acquisitions, and shifts in customer preferences, all of which contribute to the overall trajectory and development of the invoice factoring industry.

Request For Free Inquiry Report: https://www.maximizemarketresearch.com/inquiry-before-buying/168342

Invoice Factoring Market Opportunities:

The invoice factoring market presents a multitude of opportunities for both businesses and financial service providers alike. One significant opportunity lies in the untapped potential within niche industries and underserved markets, where tailored factoring solutions can address specific needs and unlock new revenue streams. Furthermore, the expansion of global trade and e-commerce presents a vast opportunity for invoice factoring companies to cater to businesses operating in international markets, facilitating cross-border transactions and mitigating associated risks. Additionally, the integration of innovative technologies such as blockchain and smart contracts offers the opportunity to enhance transparency, security, and efficiency within the invoice factoring process, thereby improving customer satisfaction and attracting new clients.

What is Invoice Factoring Market Regional Insight?

The regional insight into the invoice factoring market reveals a diverse landscape characterized by varying levels of adoption, regulatory frameworks, and economic conditions across different geographical regions. In developed economies such as North America and Europe, invoice factoring is well-established, driven by a robust SME sector and favorable business environment. These regions also showcase a high level of technological integration, with digital platforms and fintech innovations playing a significant role in streamlining the factoring process. Conversely, in emerging markets like Asia-Pacific and Latin America, there is a growing demand for alternative financing solutions fueled by the expansion of small businesses and the need for working capital. However, factors such as regulatory constraints, cultural norms, and infrastructure challenges may pose barriers to the widespread adoption of invoice factoring in these regions.

Get An Exclusive Sample Of The Invoice Factoring Market Report At This Link (Get The Higher Preference For Corporate Email ID): - https://www.maximizemarketresearch.com/request-sample/168342

What is Invoice Factoring Market Segmentation?

by Type

Recourse Factoring

Non-recourse Factoring

by Application

Domestic

International

by Enterprise Size

Large Enterprises

Small and Medium-sized Enterprises

by Provider

Banks

NBFCs

by Industry Vertical

Construction

Manufacturing

Healthcare

Transportation and Logistics

Energy and Utilities

IT and Telecom

Staffing

Others

Some of the current players in the Invoice Factoring Market are:

1.Porter Capital

2. Adobe

3. Barclays Bank UK PLC

4. ICBC

5. Intuit Inc.

6. American Express Company

7. Lloyds Bank

8. Sonovate

9. Waddle

10. Velotrade

11. eCapital

12. Triumph Business Capital

13. Breakout Capital

14. Nav

15.altLINE

16. Riviera Finance

17. RTS Financial

18. Fundbox

19.Paragon Financial Group

Know More About The Report: https://www.maximizemarketresearch.com/market-report/invoice-factoring-market/168342/

Key Offerings:

Past Market Size and Competitive Landscape

Invoice Factoring Market Size, Share, Size & Forecast by different segment

Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

Invoice Factoring Market Segmentation - A detailed analysis by Product

Competitive Landscape - Profiles of selected key players by region from a strategic perspective

Competitive landscape - Market Leaders, Market Followers, Regional player

Competitive benchmarking of key players by region

PESTLE Analysis

PORTER's analysis

Value chain and supply chain analysis

Legal Aspects of business by region

Lucrative business opportunities with SWOT analysis

Recommendations

For additional reports on related topics, visit our website:

♦ Femtocell Market: https://www.maximizemarketresearch.com/market-report/global-femtocell-market/13100/

♦ Identity as a Service Market: https://www.maximizemarketresearch.com/market-report/global-identity-as-a-service-market/32424/

♦ Software Asset Management Market: https://www.maximizemarketresearch.com/market-report/global-software-asset-management-market/2808/

♦ Global Incident Response Market: https://www.maximizemarketresearch.com/market-report/global-incident-response-market/11644/

♦ Global Database Automation Market: https://www.maximizemarketresearch.com/market-report/global-database-automation-market-key-trends/6650/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Invoice Factoring Market is forecasted to expand to USD 4.55 Billion by 2030 here

News-ID: 3530908 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

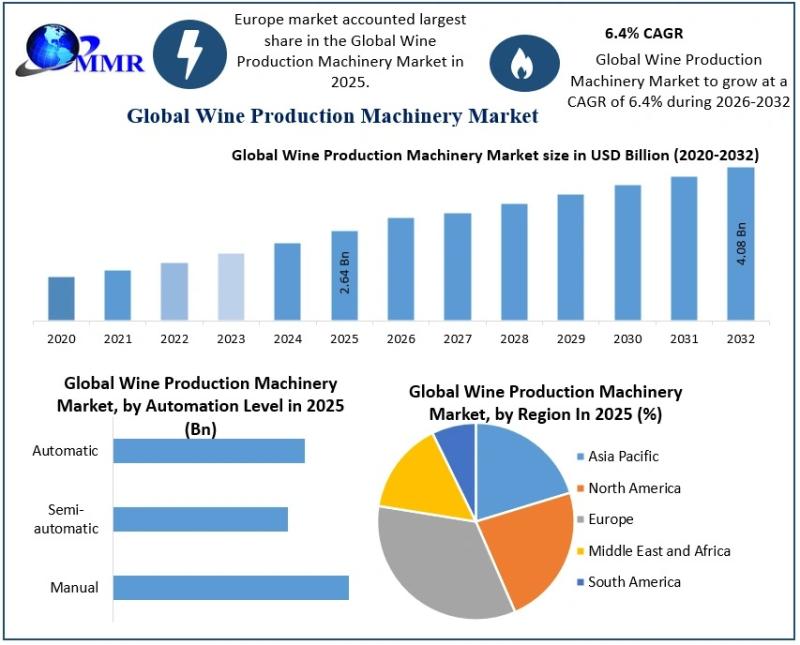

Wine Production Machinery Market Growing at a Robust CAGR of 6.4% Driven by Auto …

The Wine Production Machinery Market size was valued at USD 2.64 Billion in 2025 and the total Wine Production Machinery revenue is expected to grow at a CAGR of 6.4% from 2026 to 2032, reaching nearly USD 4.08 Billion by 2032.

Wine Production Machinery Market Overview:

The Wine Production Machinery Market is witnessing steady transformation as wineries across the globe increasingly adopt modern equipment to enhance efficiency, consistency, and product quality. From…

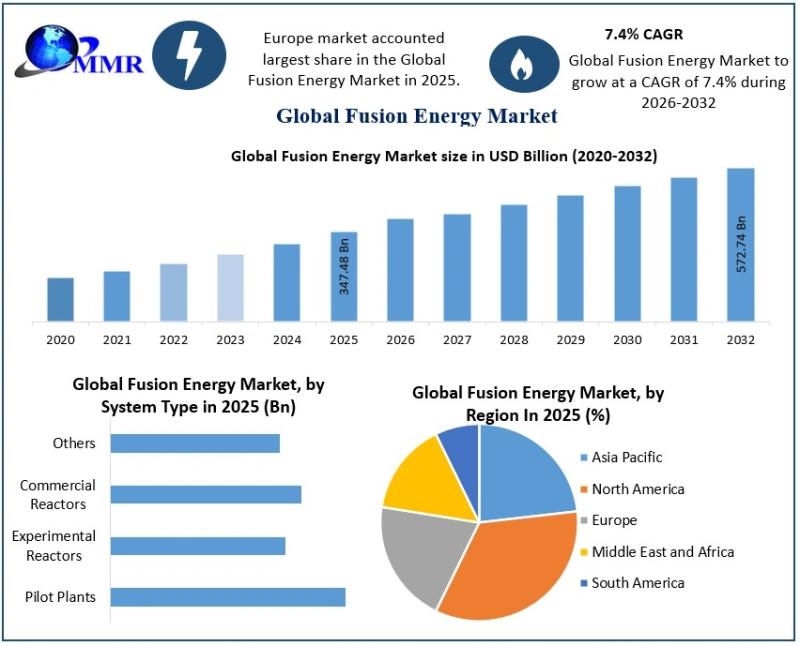

Fusion Energy Market Outlook Highlights Strong Growth at 7.4% CAGR

The Fusion Energy Market size was valued at USD 347.48 Billion in 2025 and the total Fusion Energy revenue is expected to grow at a CAGR of 7.4% from 2026 to 2032, reaching nearly USD 572.74 Billion by 2032.

Fusion Energy Market Overview:

The Fusion Energy Market is gaining global attention as nations, industries, and researchers intensify efforts to develop cleaner and more sustainable power alternatives for the future. Fusion energy is…

India Gold Loan Market Shows Strong Momentum Driven by Trust, Technology, and Fi …

The India Gold Loan Market size was valued at USD 67.40 Billion in 2024 and the total India Gold Loan Market is expected to grow at a CAGR of 12.30 % from 2025 to 2032, reaching nearly USD 170.49 Billion.

India Gold Loan Market Overview:

The India Gold Loan Market has steadily evolved into a trusted financial solution for individuals and small businesses seeking quick access to funds without liquidating their long-term…

Coffee Beans Market Trends Highlight Rising Demand for Specialty, Sustainable, a …

The Coffee Beans Market size was valued at USD 36.41 Billion in 2024 and the total Coffee Beans revenue is expected to grow at a CAGR of 6.8% from 2025 to 2032, reaching nearly USD 61.64 Billion.

Coffee Beans Market Overview:

The Coffee Beans Market reflects a complex ecosystem that begins at farms and extends to global distribution networks. Coffee beans are cultivated across diverse climatic regions, each contributing unique taste profiles…

More Releases for Factoring

Growing Reverse Factoring Adoption Boosts Market Growth: Critical Driver Shaping …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Reverse Factoring Market Size Valuation Forecast: What Will the Market Be Worth by 2025?

Over the past few years, the reverse factoring market has seen significant growth. It is expected to increase from $539.41 billion in 2024 up to $592.1 billion in 2025, representing a compound annual growth rate…

Factoring Market Next Big Thing | Major Giants BNP Paribas, HSBC, Deutsche Facto …

HTF MI just released the Global Factoring Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

Major Giants in Factoring Market are:

BNP Paribas, HSBC, Deutsche Factoring Bank, Eurobank,…

What's Driving the Reverse Factoring Market 2025-2034: Growing Reverse Factoring …

What Are the Projections for the Size and Growth Rate of the Reverse Factoring Market?

The market size of reverse factoring has seen significant growth over the last few years. It is projected to expand from $539.41 billion in 2024 to $592.1 billion in 2025, displaying a compound annual growth rate (CAGR) of 9.8%. The growth trajectory in the past can be linked to the increased awareness of supply chain finance…

Reverse Factoring Market

The reverse factoring market has been experiencing significant growth, with its market size accounted for USD 530.8 billion in 2022. It is projected to achieve a remarkable market size of USD 1,452.1 billion by 2032, growing at a compound annual growth rate (CAGR) of 10.8% from 2023 to 2032. This substantial growth is driven by various market trends, emerging opportunities, and a competitive landscape that is continuously evolving.

Download Free Reverse…

Factoring Market Outlook 2024-2030: Trends and Opportunities|BNP Paribas, Deutsc …

Infinity Business Insights is providing qualitative and informative knowledge by adding the title factoring Market to recognize, describe and forecast the global market. The report provides systematic consideration analysis along with forecasts for market players. The report aims to facilitate understanding of the global factoring market forecast through statistical and numerical data in the form of tables, graphs, and charts. The study provides a calculated assessment of new recent developments,…

Factoring Services Market is Booming Worldwide | Deutsche Factoring Bank, Euroba …

The Latest Released Factoring Services market study has evaluated the future growth potential of Global Factoring Services market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers,…