Press release

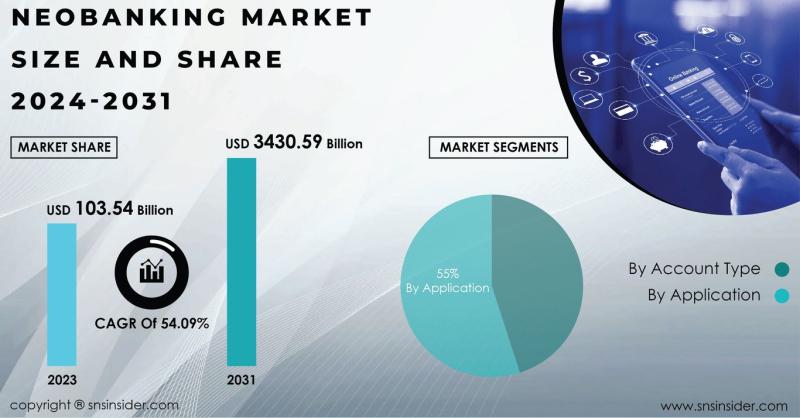

Neobanking Market Soars as Consumers Seek Digital-Only Banking Services for Convenience and Innovation

Neobanking Market Scope and OverviewThe Neobanking Market is revolutionizing the traditional banking landscape, offering innovative, digital-only banking solutions that cater to the needs of modern consumers and businesses. Neobanks, or digital-only banks, operate without physical branches, leveraging technology to provide seamless and efficient banking services. Major players in this market, including Atom Bank, BBVA, BMTX, Chime Financial, Citigroup, Dave, Deutsche Bank AG, Digibank (DBS Bank Ltd.), Equitable Bank, and HSBC Holdings, are at the forefront of this transformation, delivering enhanced customer experiences through user-friendly mobile apps and online platforms.

The Neobanking Market is revolutionizing the financial industry by offering digital-first banking solutions that cater to the needs of tech-savvy customers. Neobanks, also known as digital or challenger banks, operate exclusively online without traditional brick-and-mortar branches. They provide a range of banking services, including account management, payments, savings, and loans, through user-friendly mobile apps and websites. These banks leverage advanced technologies to offer seamless, cost-effective, and personalized banking experiences. As consumers increasingly seek convenience, transparency, and enhanced customer service, the demand for neobanking solutions is surging. The Neobanking Market is set for robust growth, driven by the ongoing digital transformation of the financial sector.

Get a Report Sample of Neobanking Market @ https://www.snsinsider.com/sample-request/1257

Competitive Analysis

The neobanking market is highly competitive, characterized by the presence of both established financial institutions and agile fintech startups. Traditional banks such as Citigroup, Deutsche Bank AG, and HSBC Holdings are increasingly embracing digital transformation to retain their customer base and compete with neobanks. These incumbents leverage their vast resources, extensive customer data, and regulatory expertise to develop robust digital banking platforms.

Major Key Players Studied in this Report are:

➤ Atom Bank

➤ BBVA

➤ BMTX

➤ Chime Financial

➤ Citigroup

➤ Dave

➤ Deutsche Bank AG

➤ Digibank (DBS Bank Ltd.)

➤ Equitable Bank

➤ HSBC Holdings

➤ Others

Market Segmentation

The neobanking market can be segmented based on account type and application.

By Account Type

➤ Business Account: Neobanks offer business accounts designed to meet the specific needs of small and medium-sized enterprises (SMEs), freelancers, and startups. These accounts typically provide features such as expense management, invoicing, payroll services, and integration with accounting software. Neobanks catering to businesses often focus on simplifying banking processes and providing cost-effective solutions that enhance operational efficiency.

➤ Saving Account: Personal savings accounts offered by neobanks are designed to attract individual customers with features like high-interest rates, zero fees, and easy access through mobile apps. These accounts often come with budgeting tools, savings goals, and automatic saving features that help customers manage their finances more effectively. Neobanks leverage advanced analytics and personalized insights to offer tailored financial advice and incentives for saving.

By Application

➤ Personal: Personal banking applications provided by neobanks focus on delivering a seamless, user-friendly experience for individual customers. These applications include a range of services such as checking and savings accounts, peer-to-peer payments, personal loans, and investment options. Neobanks prioritize features like instant account setup, real-time transaction tracking, and personalized financial management tools to attract and retain customers.

➤ Enterprises: Neobanking solutions for enterprises are tailored to meet the diverse needs of businesses, from startups to large corporations. These applications encompass services such as multi-currency accounts, automated invoicing, cash flow management, and integration with enterprise resource planning (ERP) systems. Neobanks targeting enterprises often emphasize security, scalability, and compliance with regulatory requirements to ensure seamless and secure financial operations.

Key Growth Drivers of the Market

Several factors are driving the growth of the neobanking market:

➤ Rapid advancements in technology, including artificial intelligence, machine learning, blockchain, and cloud computing, are enabling neobanks to offer innovative and efficient banking solutions. These technologies enhance customer experience, improve operational efficiency, and enable personalized financial services.

➤ The shift towards digital banking is driven by changing consumer preferences for convenience, speed, and accessibility. Consumers, especially younger demographics, prefer digital-only banks that offer seamless, mobile-first experiences and value-added services.

➤ Regulatory frameworks in various regions are evolving to promote competition, innovation, and consumer protection in the banking sector. Initiatives like PSD2 in Europe and Open Banking in the UK facilitate the entry and growth of neobanks by ensuring a level playing field and fostering transparency.

➤ Neobanks operate with lower overhead costs compared to traditional banks, as they do not maintain physical branches. This cost efficiency allows them to offer competitive pricing, zero-fee accounts, and higher interest rates on deposits, attracting cost-conscious consumers and businesses.

➤ Neobanks play a crucial role in enhancing financial inclusion by providing accessible and affordable banking services to underserved populations. Their digital-first approach enables them to reach remote and rural areas, offering financial services to those who previously had limited or no access to banking.

➤ The COVID-19 pandemic accelerated the adoption of digital banking solutions as consumers and businesses increasingly turned to online channels for financial transactions. This shift in behavior has provided a significant boost to the neobanking market, with many neobanks reporting increased customer acquisition and transaction volumes.

Strengths of the Market

The neobanking market exhibits several strengths that contribute to its growth and resilience:

➤ Neobanks prioritize customer experience by offering intuitive, user-friendly interfaces and personalized services. Their ability to quickly adapt to customer feedback and innovate continuously enhances customer satisfaction and loyalty.

➤ Unlike traditional banks, neobanks are not burdened by legacy systems and processes. This agility allows them to innovate rapidly, launch new products and services, and respond quickly to market changes and customer needs.

➤ Neobanks leverage advanced security technologies, such as biometric authentication, encryption, and real-time fraud detection, to protect customer data and transactions. Their focus on security builds trust and confidence among customers.

➤ Neobanks harness the power of big data and analytics to gain insights into customer behavior, preferences, and needs. This data-driven approach enables them to offer personalized financial advice, targeted marketing, and customized product offerings.

➤ Neobanks often collaborate with fintech companies, technology providers, and traditional banks to enhance their offerings and expand their reach. These partnerships enable them to integrate advanced features and leverage established infrastructure and regulatory expertise.

Get a Discount @ https://www.snsinsider.com/discount/1257

Key Objectives of the Market Research Report

The primary objectives of the neobanking market research report include:

➤ To provide a comprehensive analysis of the neobanking market, including market size, growth trends, key players, competitive landscape, and emerging opportunities.

➤ To offer detailed insights into market segmentation based on account type and application, helping stakeholders understand the diverse needs and preferences of different market segments.

➤ To analyze regional market trends, growth drivers, and opportunities, enabling stakeholders to identify lucrative markets and tailor their strategies to regional dynamics.

➤ To identify and analyze emerging technologies and trends shaping the neobanking market, such as AI, blockchain, and cloud computing, helping stakeholders anticipate market developments and leverage innovative solutions.

➤ To understand the needs, preferences, and pain points of neobanking customers, including consumers and businesses, helping vendors tailor their products, services, and marketing strategies to meet customer expectations.

➤ To provide an overview of the regulatory landscape governing neobanking, including data privacy regulations, industry standards, and compliance requirements, helping organizations ensure compliance and mitigate risks.

➤ To identify key market opportunities and challenges shaping the growth trajectory of the neobanking market, enabling stakeholders to capitalize on emerging trends and address potential obstacles.

Conclusion

The neobanking market is poised for significant growth and transformation, driven by technological advancements, changing consumer preferences, regulatory support, and the need for cost-effective and efficient banking solutions. Major players in the market, including Atom Bank, BBVA, BMTX, Chime Financial, Citigroup, Dave, Deutsche Bank AG, Digibank (DBS Bank Ltd.), Equitable Bank, and HSBC Holdings, are leading this digital revolution, offering innovative and customer-centric banking experiences.

As organizations navigate evolving regulatory landscapes, increasing digital adoption, and growing consumer demand for convenient banking solutions, the demand for robust neobanking services will continue to rise. By leveraging the insights provided in market research reports, stakeholders can make informed decisions, capitalize on emerging opportunities, and drive continued success in the dynamic neobanking market.

View Complete Report Details @ https://www.snsinsider.com/reports/neobanking-market-1257

Table of Contents- Major Key Points

1. Introduction

2. Research Methodology

3. Market Dynamics

3.1. Drivers

3.2. Restraints

3.3. Opportunities

3.4. Challenges

4. Impact Analysis

4.1. Impact of Ukraine- Russia war

4.2. Impact of Ongoing Recession on Major Economies

5. Value Chain Analysis

6. Porter's 5 Forces Model

7. PEST Analysis

8. Neo banking Market, by Account type

8.1. Business Account

8.2. Savings Account

9. Neo banking Market, by Application

9.1. Personal

9.2. Enterprises

10. Regional Analysis

10.1. Introduction

10.2. North America

10.3. Europe

10.4. Asia-Pacific

10.5. The Middle East & Africa

10.6. Latin America

11. Company Profile

12. Competitive Landscape

12.1. Competitive Benchmarking

12.2. Market Share Analysis

12.3. Recent Developments

13. USE Cases and Best Practices

14. Conclusion

Contact Us:

Akash Anand - Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

Website: https://www.snsinsider.com

Office No. 305-B, Arissa Avenue, Fountain Road, Kharadi, Pune, Maharashtra 411014

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Our staff is dedicated to giving our clients reliable information, and with expertise working in the majority of industrial sectors, we're proud to be recognized as one of the world's top market research firms. We can quickly design and implement pertinent research programs, including surveys and focus groups, and we have the resources and competence to deal with clients in practically any company sector.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Neobanking Market Soars as Consumers Seek Digital-Only Banking Services for Convenience and Innovation here

News-ID: 3528873 • Views: …

More Releases from SNS Insider

Private Cloud Services Market Forecast Predicts Promising Growth Ahead

Private Cloud Services Market Scope and Overview

The Private Cloud Services Market has witnessed significant growth in recent years, fueled by the increasing adoption of cloud computing technologies across various industries. Private clouds offer enhanced security, control, and customization compared to public cloud services, making them a preferred choice for enterprises seeking to leverage cloud capabilities while maintaining data sovereignty and compliance. This report delves into the competitive landscape, market segmentation,…

Video Surveillance Market Analysis Unveils Insights for Growth and Development

Video Surveillance Market Scope and Overview

The Video Surveillance Market has seen significant growth over the past few decades, driven by advancements in technology and an increasing need for security across various sectors. Video surveillance systems, once primarily used for security purposes, have now expanded their applications to include monitoring, analysis, and even preventive measures in various industries. This report provides a comprehensive analysis of the video surveillance market, covering its…

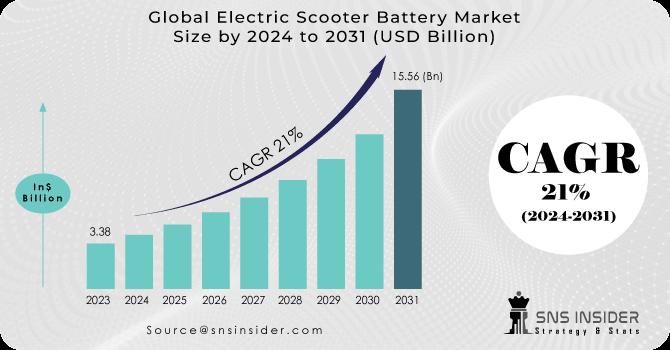

Electric Scooter Battery Market Charges Ahead, Propelling Sustainable Urban Mobi …

The Global Electric Scooter Battery Market is experiencing a remarkable surge, fueled by the rising demand for eco-friendly and convenient transportation solutions in urban environments. As cities around the world grapple with traffic congestion, air pollution, and the need for sustainable mobility, the electric scooter battery market is poised to play a pivotal role in shaping the future of urban transportation. According to a comprehensive market research report, the electric…

Solar-Powered Vehicle Market Accelerates Towards a Sustainable Future, Projected …

The Global Solar-Powered Vehicle Market is rapidly gaining momentum, driven by the urgent need to combat climate change and reduce greenhouse gas emissions. As the world transitions towards a greener and more sustainable future, the adoption of solar-powered vehicles is emerging as a game-changer in the automotive industry. According to a comprehensive market research report, the solar-powered vehicle market, valued at $1.27 billion in 2023, is expected to reach a…

More Releases for Neo

Horizon Neo ANC Earbuds Review 2022:(Must Read!) Facts about Horizon Neo ANC Ear …

To illustrate how far technology has come, think of earphones. However, that is not all. Small wireless earphones with strong batteries have also been developed and are widely used.

The development of active noise cancellation (ANC) technology has progressed the technological field and allowed manufacturers to produce earbuds that allow users to block out background noise and enjoy the finer details of their favourite music or noises.

The Horizon Neo ANC Earbuds…

Smart Intelligent Lithium NEO-Q ENG Battery| NEO SEMITECH

NEO SEMITECH Co., Ltd. is a smart factory-based IoT, ICT application technology company, and Smart Multi Sensing Technology (SMST) Series, Semiconductor measuring equipment, and semiconductor facilities such as the Analog-Digital Converter (ADC) and the Ion Decay Time Analyzer.

NEO SEMITECH Solution: Detects and analyzes all situations that may occur during the operation of a precise and sensitive semiconductor facility. Real-time monitoring and control are possible by applying state-of-the-art information and communication…

NEO Q Battery Pack Product | NEO SEMITECH

NEO SEMITECH CO., LTD. is a smart factory-based company specialized in IoT, ICT application technology. The semiconductor equipment is its main product that consists of Smart Multi Sensing Technology (SMST) Series products, and semiconductor facilities such as the Analog-Digital Converter (ADC) and the Ion Decay Time Analyzer.

Based on its advanced research facilities, excellent research personnel, abundant experience, and accumulated technology, it promises to continue to do its best to…

NEO Q Battery Pack Product | NEO SEMITECH

NEO SEMITECH CO., LTD. is a smart factory-based company specialized in IoT, ICT application technology. The semiconductor equipment is its main product that consists of Smart Multi Sensing Technology (SMST) Series products, and semiconductor facilities such as the Analog-Digital Converter (ADC) and the Ion Decay Time Analyzer.

Based on its advanced research facilities, excellent research personnel, abundant experience, and accumulated technology, it promises to continue to do its best to…

NEO Q Battery Pack Product | NEO SEMITECH

NEO SEMITECH CO., LTD. is a smart factory-based company specialized in IoT, ICT application technology. The semiconductor equipment is its main product that consists of Smart Multi Sensing Technology (SMST) Series products, and semiconductor facilities such as the Analog-Digital Converter (ADC) and the Ion Decay Time Analyzer.

Based on its advanced research facilities, excellent research personnel, abundant experience, and accumulated technology, it promises to continue to do its best to…

Neo and Challenger Bank Market by Type of Bank (Neo Bank and Challenger Bank)

Neo and Challenger Bank Market is registering a CAGR of 50.6% during the forecast period 2016-2020. Neo and challenger bank market has witnessed healthy growth rate in terms of customer base over the past few years, and is expected to witness optimistic growth in the near future.

Access Full Report: https://www.alliedmarketresearch.com/neo-and-challenger-bank-market

The global market is driven by factors such as government regulations, convenience offered to consumers, and low interest rates as compared…