Press release

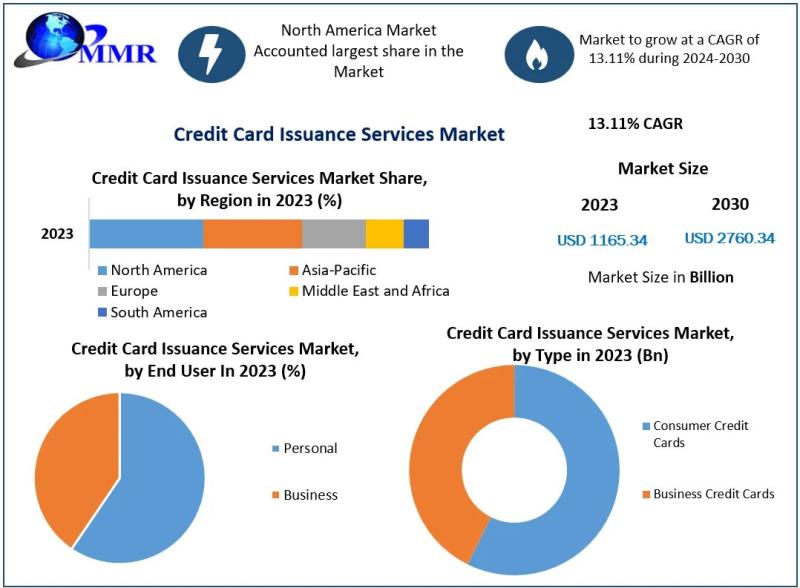

Credit Card Issuance Services Market Size Surges to USD 2760.34 Billion by 2030

Anticipated Growth in Revenue:Credit Card Issuance Services Market expected to hit USD 2760.34 Bn by 2030 from USD 1165.34 Bn in 2023 at a CAGR of 7.9 % during the forecast period.

Credit Card Issuance Services Market Overview:

The credit card issuance services market has witnessed significant growth in recent years, driven by the increasing adoption of cashless transactions, technological advancements, and the rising demand for convenient payment options globally. Companies operating in this market offer a wide range of services including credit card processing, issuing, and management solutions to financial institutions, retailers, and businesses. With the proliferation of e-commerce and digital payment platforms, there is a growing emphasis on security and fraud prevention, prompting issuers to invest in innovative technologies such as biometrics and tokenization to safeguard transactions. Moreover, the emergence of mobile payment solutions and the integration of artificial intelligence are expected to further propel the growth of the credit card issuance services market in the foreseeable future.

Get Free Access to Our Sample Report:https://www.maximizemarketresearch.com/request-sample/186182

Credit Card Issuance Services Market Trends:

The credit card issuance services market is experiencing several notable trends shaping its landscape. Firstly, there's a growing emphasis on enhancing security measures, with issuers increasingly adopting advanced authentication methods like biometrics and tokenization to combat fraud and safeguard transactions. Secondly, the rise of digital wallets and mobile payment solutions is driving a shift towards contactless payments, prompting issuers to prioritize the development of compatible cards and platforms. Additionally, there's a rising demand for personalized and tailored credit card offerings, with issuers leveraging data analytics and machine learning to better understand consumer preferences and behavior, thereby enhancing customer loyalty and retention. Lastly, environmental sustainability is gaining prominence, with issuers exploring eco-friendly card materials and promoting paperless billing options to reduce their carbon footprint and meet evolving consumer expectations.

What are Credit Card Issuance Services Market Dynamics?

The dynamics of the credit card issuance services market are multifaceted, influenced by various factors. Market growth is propelled by increasing consumer demand for convenient payment methods, coupled with the expanding global economy and rising disposable incomes. Technological advancements, such as the integration of artificial intelligence and blockchain, are revolutionizing the industry by enhancing security measures, streamlining processes, and enabling innovative card features. Regulatory changes and compliance requirements also play a significant role, shaping the competitive landscape and influencing the strategies of market players. Additionally, evolving consumer preferences, demographic shifts, and the emergence of new market entrants further contribute to the dynamic nature of the credit card issuance services market.

Request For Free Inquiry Report:https://www.maximizemarketresearch.com/inquiry-before-buying/186182

Credit Card Issuance Services Market Opportunities:

Opportunities abound in the credit card issuance services market, driven by several factors. Firstly, the increasing penetration of smartphones and internet connectivity presents a fertile ground for the expansion of mobile payment solutions, creating opportunities for issuers to develop innovative digital offerings and tap into the growing demand for seamless transactions. Secondly, the rise of emerging markets offers untapped potential, with millions of underserved consumers seeking access to formal financial services, presenting issuers with the chance to expand their customer base and capture new market segments. Furthermore, partnerships and collaborations with fintech startups and other industry stakeholders enable issuers to leverage technological advancements and diversify their service offerings, enhancing their competitiveness and market presence in an increasingly dynamic landscape.

What is Credit Card Issuance Services Market Regional Insight?

The regional landscape of the credit card issuance services market varies significantly, with distinct trends and dynamics shaping each region. In mature markets like North America and Europe, saturation in credit card penetration has prompted issuers to focus on innovation and differentiation, leading to the development of premium card offerings and enhanced rewards programs. Meanwhile, emerging economies in Asia-Pacific and Latin America are witnessing rapid adoption of cashless payments, driven by factors such as urbanization, rising middle-class incomes, and government initiatives to promote digital financial inclusion. These regions present immense growth opportunities for issuers, who are expanding their presence through strategic partnerships, tailored product offerings, and investments in technological infrastructure to meet the evolving needs of consumers in these markets.

Get An Exclusive Sample Of The Credit Card Issuance Services Market Report At This Link (Get The Higher Preference For Corporate Email ID): -https://www.maximizemarketresearch.com/request-sample/186182

What is Credit Card Issuance Services Market Segmentation?

by Type

1. Consumer Credit Cards

2. Business Credit Cards

by Issuers

1. Banks

2. Credit Unions

3. NBFCs

by End User

1.Personal

2. Business

Some of the current players in the Credit Card Issuance Services Market are:

1. Fiserv Inc.

2. Marqeta Inc.

3. Stripe Inc.

4. Giesecke+Devrient GmbH

5. Entrust Corporation.

6. GPUK LLP.

7. Nium Pte. Ltd.

8. Fis

9. Thales

10. American Express Company

11. SBI

12. IDFC Bank

13. HDFC Bank

14. Standard Chartered

15. CITI Bank

16. VISA

17. CHASE

18. Capital One

19. Discover Bank

Know More About The Report:https://www.maximizemarketresearch.com/market-report/credit-card-issuance-services-market/186182/

Key Offerings:

• Past Market Size and Competitive Landscape

• Credit Card Issuance Services Market Size, Share, Size & Forecast by different segment

• Market Dynamics - Growth Drivers, Restraints, Opportunities, and Key Trends by region

• Credit Card Issuance Services Market Segmentation - A detailed analysis by Product

• Competitive Landscape - Profiles of selected key players by region from a strategic perspective

• Competitive landscape - Market Leaders, Market Followers, Regional player

• Competitive benchmarking of key players by region

• PESTLE Analysis

• PORTER's analysis

• Value chain and supply chain analysis

• Legal Aspects of business by region

• Lucrative business opportunities with SWOT analysis

• Recommendations

For additional reports on related topics, visit our website:

Aircraft ACMI Leasing Market https://www.maximizemarketresearch.com/market-report/aircraft-acmi-leasing-market/148300/

Paraffin Inhibitors Market https://www.maximizemarketresearch.com/market-report/paraffin-inhibitors-market/147995/

Natural Stone and Marble Market https://www.maximizemarketresearch.com/market-report/natural-stone-and-marble-market/148185/

Builder Hardware Market https://www.maximizemarketresearch.com/market-report/builder-hardware-market/148421/

Desiccant Market https://www.maximizemarketresearch.com/market-report/desiccant-market/148807/

Contact Maximize Market Research:

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

🌐 www.maximizemarketresearch.com

About Maximize Market Research:

Maximize Market Research is one of the fastest-growing market research and business consulting firms serving clients globally. Our revenue impact and focused growth-driven research initiatives make us a proud partner of majority of the Fortune 500 companies. We have a diversified portfolio and serve a variety of industries such as IT & telecom, chemical, food & beverage, aerospace & defense, healthcare and others.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Credit Card Issuance Services Market Size Surges to USD 2760.34 Billion by 2030 here

News-ID: 3526720 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD

Silage Films Market Trends 2032: Advanced Agricultural Packaging Fuels Global De …

The Silage Films Market size was valued at USD 2.39 Billion in 2024 and the total Silage Films revenue is expected to grow at a CAGR of 4.80% from 2025 to 2032, reaching nearly USD 3.49 Billion. Market to Expand Steadily as Modern Livestock Practices Drive Demand

The Silage Films Market is gaining strong momentum as livestock farmers increasingly adopt advanced forage preservation solutions to improve feed quality, reduce spoilage, and…

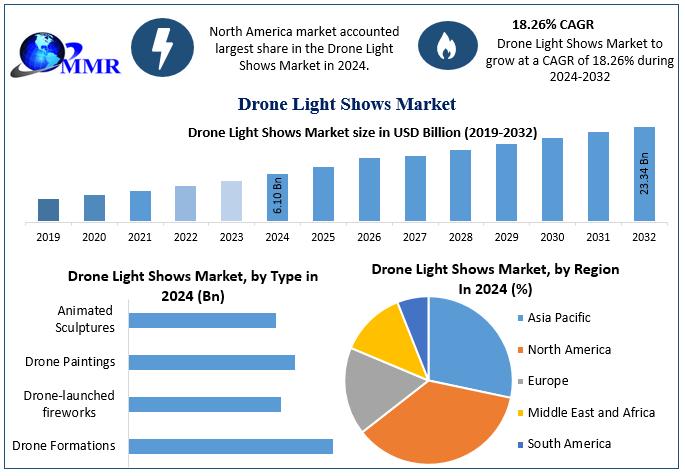

Drone Light Shows Market to Soar to USD 23.34 Billion by 2032 : Industry Overvie …

According to Maximize Market Research, the Global Drone Light Shows Market was valued at USD 6.10 billion in 2024 and is expected to reach USD 23.34 billion by 2032, expanding at a CAGR of 18.26% during 2025-2032 - indicating significant growth driven by innovation, sustainability and rising demand for immersive experiences.

Market Overview

The Drone Light Shows Market is transforming the global entertainment and events industry by replacing traditional fireworks with sophisticated…

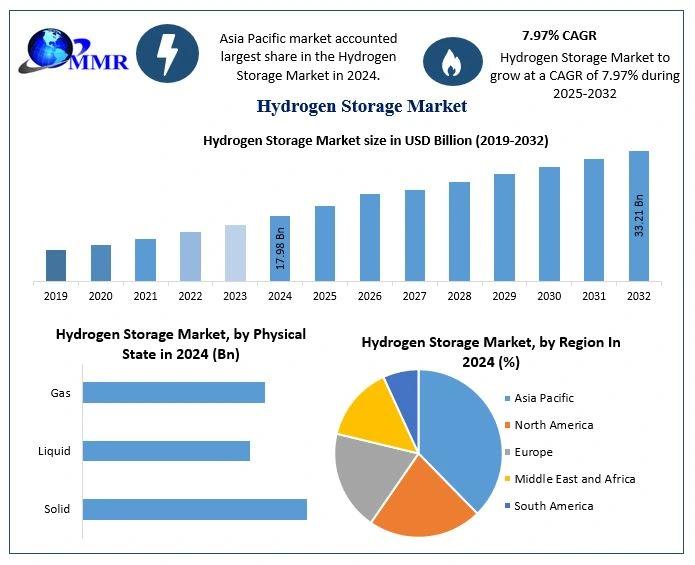

Hydrogen Storage Industry Outlook 2032 | Market Size, Competitive Landscape & Em …

The Global Hydrogen Storage Market was valued at USD 17.98 Billion in 2024 and is projected to reach USD 33.21 Billion by 2032, growing at a CAGR of 7.97% from 2025 to 2032.

Market Overview

The Global Hydrogen Storage Market is rapidly emerging as a critical backbone of the clean energy infrastructure, enabling safe and efficient containment of hydrogen - a key energy carrier driving decarbonization across industries. Hydrogen storage systems are…

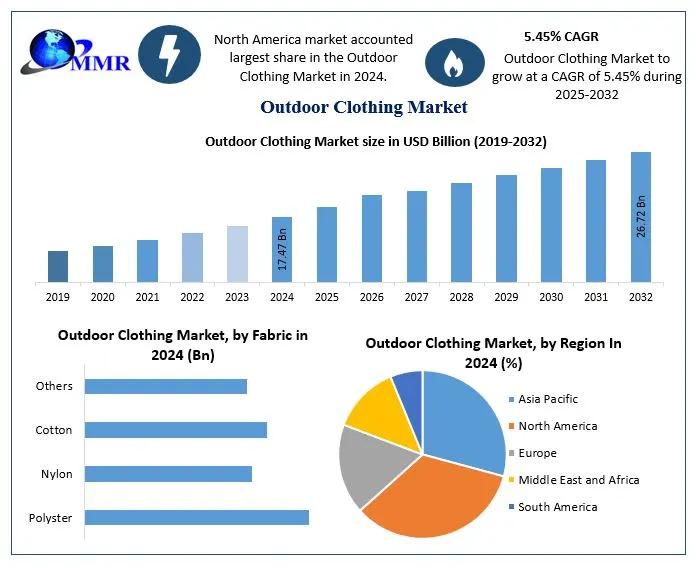

Outdoor Clothing Market Size to Reach USD 26.72 Billion by 2032 | Growth Drivers …

The Global Outdoor Clothing Market was valued at USD 17.47 Billion in 2024 and is projected to expand at a CAGR of 5.45% between 2025 and 2032, reaching approximately USD 26.72 Billion by 2032.

Market Overview

The Outdoor Clothing Market consists of specialized apparel designed for outdoor and adventure activities such as hiking, camping, skiing, climbing, and fishing. These garments are engineered to provide durability, superior comfort, enhanced performance, and weather resistance…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…