Press release

How big is Usage-Based Insurance Market?

The Global Usage-Based Insurance Market is expected to grow at a CAGR of 24.1% during the forecasting period (2023-2030)The objectives outlined in the report are multifaceted and aimed at offering a comprehensive understanding of the Usage-Based Insurance market dynamics. These objectives encompass a meticulous analysis and forecast of the market's dimensions, encompassing both its value and volume aspects. Additionally, the report seeks to discern and delineate the market shares held by major segments within the Usage-Based Insurance industry, providing stakeholders with a nuanced perspective on market dynamics.

Furthermore, the report endeavours to provide a panoramic overview of the Usage-Based Insurance market's evolution across diverse geographical regions globally, capturing the nuances of regional variations in market trends and developments. It also aims to conduct a granular examination of micro-markets within the Usage-Based Insurance domain, scrutinizing their contributions to the overarching market landscape and elucidating their growth trajectories and distinctive trends.

Click Here to Get Sample Copy of Usage-Based Insurance Market Report :- https://datamintelligence.com/download-sample/usage-based-insurance-market

**If you have any special requirements, please let us know and we will provide you with the report as you wish. **

Competitive Analysis:

This section evaluates the competitive landscape of the Usage-Based Insurance market by focusing on the key players.

Key players:

Allianz SE, AXA, Aviva, Allstate Corporation, Insure The Box Limited, Liberty Mutual Insurance, Progressive Corporation.

Conclusion: Competitive analysis reveals the dynamic environment of the Usage-Based Insurance market with each key player adopting unique strategies to secure their position. Market leaders face pressure from agile new entrants, making innovation and adaptability key to continued success.

Market Segmentation:

This section categorizes the Usage-Based Insurance market into segments based on various criteria such as analysis type, industry, region, etc.

By Type (Pay-as-You-Drive (PAYD), Pay-How-You-Drive (PHYD), Manage-How-You-Drive (MHYD), Distance-Based Insurance, Others), By Vehicle Type (Passenger Vehicles, Commercial Vehicles), By Technology (OBD I-II, Smartphones, Black Box, Hybrid, Others), By Application (IoT Based Fleet Management, Semi-Autonomous & Autonomous Car, Artificial Intelligence and HMI in Transportation, Others).

Key Regions and Countries:

This section of the report provides key insights regarding various regions and the key players operating in each region. Economic, social, environmental, technological, and political factors have been taken into consideration while assessing the growth of the particular region/country. The readers will also get their hands on the value and sales data of each region and country for the period 2024-2031.

North America

United States

Canada

Europe

Germany

France

Get Customization in the report as per your requierments: https://datamintelligence.com/customize/usage-based-insurance-market

Key Features Of The Study:-

ᗒ This report provides in-depth analysis of the global Usage-Based Insurance market, and provides market size (us$ million) and cagr for the forecast period (2024-2030), considering 2022 as the base year.

ᗒ This report profiles key players in the global Usage-Based Insurance market based on the following parameters - company details (found date, headquarters, manufacturing bases), products portfolio, Usage-Based Insurance sales data, market share and ranking.

ᗒ This report elucidates potential market opportunities across different segments and explains attractive investment proposition matrices for this market.

ᗒ This report illustrates key insights about market drivers, restraints, opportunities, market trends, regional outlook.

ᗒ The global Usage-Based Insurance market report caters to various stakeholders in this industry including investors, suppliers, product manufacturers, distributors, new entrants, and financial analysts.

Access full Report Description, TOC, Table of Figure, Chart, etc. @ https://datamintelligence.com/research-report/usage-based-insurance-market

This Usage-Based Insurance Market Research/Analysis Report Contains Answers to your following Questions

What are the global trends in the Usage-Based Insurance market?

Would the market witness an increase or decline in the demand in the coming years?

What is the estimated demand for different types of products in Usage-Based Insurance ?

What are the upcoming industry applications and trends for the Usage-Based Insurance market?

What Are Projections of Global Usage-Based Insurance Industry Considering Capacity, Production and Production Value?

What Will Be the Estimation of Cost and Profit?

What Will Be Market Share, Supply and Consumption?

What about Import and Export?

Where will the strategic developments take the industry in the mid to long-term?

What are the factors contributing to the final price of Usage-Based Insurance ?

How big is the opportunity for the Usage-Based Insurance market?

How will the increasing adoption of Usage-Based Insurance for mining impact the growth rate of the overall market?

How much is the global Usage-Based Insurance market worth?

What was the value of the market In 2023?

Who are the major players operating in the Usage-Based Insurance market? Which companies are the front runners?

Which are the recent industry trends that can be implemented to generate additional revenue streams?

What Should Be Entry Strategies, Countermeasures to Economic Impact, and Marketing Channels for Usage-Based Insurance Industry?

Usage-Based Insurance Market - Covid-19 Impact and Recovery Analysis:

We were monitoring the direct impact of COVID-19 in this market, further to the indirect impact from different industries. This document analyzes the effect of the pandemic on the Usage-Based Insurance market from an international and nearby angle. The document outlines the marketplace size, marketplace traits, and market increase for the Usage-Based Insurance industry, categorized with the aid of using kind, utility, and patron sectors. Further, it provides a complete evaluation of additives concerned with marketplace improvement in advance of and after the COVID-19 pandemic. The report did a pastel evaluation within the business enterprise to study key influencers and boundaries to entry.

Our studies analysts will assist you in getting custom-designed info for your report, which may be changed in phrases of a particular region, utility or any statistical info. In addition, we're constantly inclined to conform with the study, which is triangulated together along with your very own statistics to make the marketplace studies extra complete for your perspective.

TO KNOW HOW COVID-19 PANDEMIC AND RUSSIA UKRAINE WAR WILL IMPACT THIS MARKET - https://datamintelligence.com/download-sample/usage-based-insurance-market

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How big is Usage-Based Insurance Market? here

News-ID: 3525680 • Views: …

More Releases from DataM Intelligence 4market Research LLP

North America Surgical LED Lights Market Growth Outlook 2024-2031 | Top Companie …

The North America Surgical Led Lights market was reached at a high CAGR from 2024 to 2031.

Surgical LED Lights are specialized lighting devices used in operating rooms and surgical settings to provide bright, focused illumination during surgical procedures. These lights utilize Light Emitting Diode (LED) technology, which offers several advantages over traditional lighting sources, including improved energy efficiency, reduced heat generation, and longer lifespans. Surgical LED lights can be adjusted…

Respiratory Monitoring Devices Market to Reach US$38.14 Billion by 2033 at 8.2% …

The global respiratory monitoring devices market size was US$ 18.80 Billion in 2024 and is expected to reach US$ 38.14 Billion by 2033, growing at a CAGR of 8.2% from 2025 to 2033. as healthcare providers increase adoption of advanced monitoring solutions to improve diagnosis, management, and care of respiratory conditions.

Growth is supported by rising demand across key product types such as wearable sensors, capnography systems, spirometers, and…

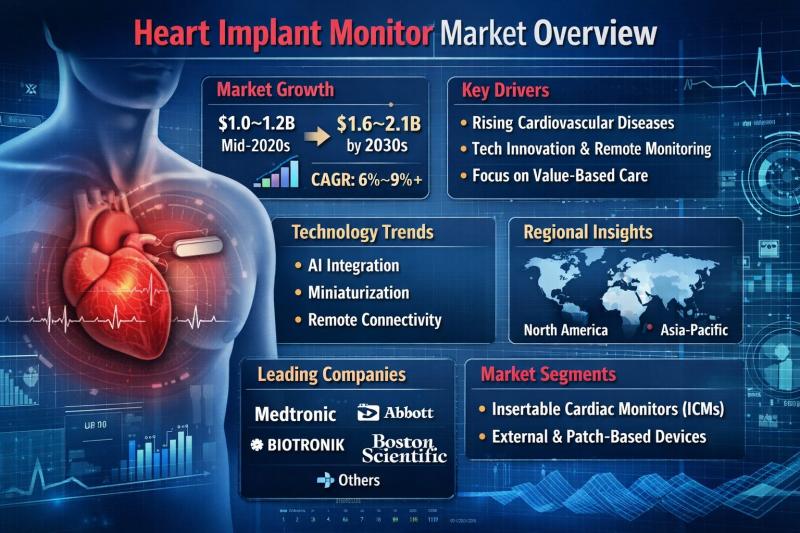

Heart Implant Monitor Market: Comprehensive Industry Analysis, Trends, and Futur …

The global Heart Implant Monitor Market, also known as the implantable cardiac monitor (ICM) or insertable cardiac monitor market, represents a rapidly evolving segment within the broader cardiac diagnostics industry. These devices are small, minimally invasive monitors implanted under the skin to continuously track heart rhythm abnormalities over extended periods. They play a critical role in detecting arrhythmias, unexplained syncope, atrial fibrillation (AF), and cryptogenic stroke.

With cardiovascular diseases (CVDs) remaining…

Cardiac Catheters and Guidewires Market to Reach US$64.09 Billion by 2033 at 7.7 …

The cardiac catheters and guidewires was valued at US$ 14.53 Billion. The global Cardiac Catheters and Guidewires market size reached US$ 15.54 Billion in 2024 and is expected to reach US$ 64.09 Billion by 2033, growing at a CAGR of 7.7% from 2025-2033. as the global burden of cardiovascular diseases rises and minimally invasive interventional procedures become more widely adopted.

Growth is supported by increasing demand across key product types such…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…