Press release

Digital Lending Platform Market Size and Share Analysis | Industry Overview

Digital Lending Platform Market Scope and OverviewThe Digital Lending Platform Market is witnessing significant growth as financial institutions and lenders embrace digital transformation to streamline lending processes, enhance customer experiences, and mitigate risks. This report provides insights into the competitive landscape, market segmentation, regional outlook, key growth drivers, strengths of the market, impact of economic downturns, key objectives of market research reports, and a conclusion highlighting the trajectory and potential of the Digital Lending Platform market.

The Digital Lending Platform Market is revolutionizing the lending industry by offering end-to-end digital solutions for loan origination, underwriting, servicing, and collections. These platforms leverage technology such as AI, machine learning, and big data analytics to streamline lending processes, improve risk assessment, and enhance the borrower experience. Key drivers of this market include the demand for faster loan approvals, the need for digital transformation in financial services, and the growing preference for online and mobile banking. As financial institutions and alternative lenders embrace digital lending platforms to meet evolving customer expectations and optimize operations, the market continues to grow, offering innovative solutions for consumer and business lending.

Get a Report Sample of Digital Lending Platform Market @ https://www.snsinsider.com/sample-request/1785

Competitive Analysis

The Digital Lending Platform market is characterized by intense competition among major players and emerging startups striving to innovate and capture market share. Key players in the market include Black Knight, Ellie Mae, Finastra, Fis, Fiserv, Intellect Design Arena, Nucleus Software Exports, Tavant, Temenos, Wipro Limited, and several others. These companies offer comprehensive digital lending solutions encompassing business process management, lending analytics, loan management, loan origination, risk & compliance management, and other capabilities. The competition drives product innovation, strategic partnerships, and mergers & acquisitions, accelerating the adoption and evolution of digital lending platforms worldwide.

Market Segmentation

On The Basis of Solution

➤ Business Process Management: Business process management solutions enable financial institutions to automate and optimize lending workflows, from application intake and credit evaluation to underwriting and funding, improving operational efficiency and compliance.

➤ Lending Analytics: Lending analytics solutions leverage data analytics and machine learning to analyze borrower behavior, assess credit risk, and optimize lending decisions, enabling lenders to make data-driven lending decisions and mitigate risks.

➤ Loan Management: Loan management solutions facilitate end-to-end management of loan portfolios, including loan servicing, collections, modifications, and reporting, enabling lenders to streamline loan operations and enhance customer service.

➤ Loan Origination: Loan origination solutions enable lenders to streamline the loan application process, capture applicant data, verify information, and generate loan documents digitally, reducing manual errors and processing time.

➤ Risk & Compliance Management: Risk & compliance management solutions help lenders identify, assess, and mitigate credit, operational, and regulatory risks associated with lending activities, ensuring compliance with industry regulations and internal policies.

➤ Others: Other digital lending platform solutions may include digital identity verification, e-signature integration, document management, and borrower communication tools, enhancing the overall lending experience.

On The Basis of Service

➤ Design and Implementation: Design and implementation services encompass the planning, customization, and deployment of digital lending platforms tailored to the specific needs and requirements of financial institutions and lenders.

➤ Training and Education: Training and education services provide lenders with the knowledge and skills required to effectively utilize digital lending platforms, maximize their capabilities, and optimize lending processes.

➤ Risk Assessment: Risk assessment services help lenders identify and mitigate credit, operational, and compliance risks associated with lending activities, leveraging data analytics, machine learning, and industry best practices.

➤ Consulting: Consulting services offer strategic guidance, industry insights, and expertise to financial institutions and lenders seeking to develop and implement digital lending strategies, initiatives, and roadmaps.

➤ Support and Maintenance: Support and maintenance services provide ongoing technical assistance, troubleshooting, and software updates to ensure the smooth operation and performance of digital lending platforms.

On The Basis of Deployment Mode

➤ Cloud: Cloud deployment mode enables financial institutions to leverage scalable, flexible, and cost-effective cloud infrastructure to host and access digital lending platforms, reducing upfront investments and improving agility.

➤ On-premises: On-premises deployment mode allows financial institutions to deploy and manage digital lending platforms within their own data centers or infrastructure, providing greater control and customization but requiring higher upfront investments and maintenance.

On The Basis of Vertical

➤ Banking: Banking vertical encompasses commercial banks, community banks, and credit unions seeking to digitize lending operations, improve customer experiences, and accelerate loan origination and servicing.

➤ Financial Services: Financial services vertical includes non-bank financial institutions, fintech companies, and alternative lenders offering a wide range of lending products and services, leveraging digital lending platforms to enhance competitiveness and agility.

➤ Insurance: Insurance vertical comprises insurance companies and brokers offering premium financing, consumer loans, and other lending products, leveraging digital lending platforms to streamline underwriting, pricing, and claims processing.

➤ Credit Unions: Credit unions represent member-owned financial cooperatives offering a variety of lending products and services to their members, leveraging digital lending platforms to compete with traditional banks and enhance member satisfaction.

➤ Retail Banking: Retail banking vertical encompasses consumer-facing financial institutions offering retail loans, mortgages, auto loans, and personal loans, leveraging digital lending platforms to attract and retain customers, streamline lending processes, and expand market share.

➤ P2P Lenders: Peer-to-peer (P2P) lending vertical comprises online platforms connecting borrowers with individual or institutional investors seeking to lend money for various purposes, leveraging digital lending platforms to facilitate loan origination, underwriting, and servicing.

Get a Discount @ https://www.snsinsider.com/discount/1785

Key Growth Drivers of the Market

Several factors are driving the growth of the Digital Lending Platform market globally:

➤ Increasing digitization of lending processes, driven by factors such as changing consumer preferences, regulatory pressures, and technological advancements, is driving demand for digital lending platforms to streamline loan origination, underwriting, and servicing.

➤ Rising demand for online and mobile banking services, fueled by factors such as smartphone adoption, internet penetration, and convenience, is driving financial institutions to invest in digital lending platforms to offer seamless and personalized lending experiences to their customers.

➤ Emergence of fintech startups and alternative lenders offering innovative lending products and services, such as peer-to-peer lending, marketplace lending, and digital wallets, is driving adoption of digital lending platforms to compete with traditional banks and financial institutions.

➤ Increasing focus on customer experience and engagement, driven by factors such as competition, customer expectations, and brand differentiation, is driving financial institutions to invest in digital lending platforms to offer personalized, responsive, and frictionless lending experiences to their customers.

➤ Growing emphasis on data-driven decision-making, fueled by factors such as big data analytics, artificial intelligence, and machine learning, is driving demand for digital lending platforms equipped with advanced analytics, predictive modeling, and automation capabilities to optimize lending processes and mitigate risks.

➤ Regulatory compliance requirements and risk management considerations, driven by factors such as consumer protection laws, anti-money laundering regulations, and credit risk management guidelines, are driving financial institutions to invest in digital lending platforms to ensure compliance, transparency, and accountability in lending practices.

Strengths of the Market

The Digital Lending Platform market possesses several strengths that contribute to its growth and resilience:

➤ Digital lending platforms offer scalable and flexible solutions that can be customized to meet the specific needs and requirements of financial institutions and lenders across different verticals, geographies, and business models.

➤ Digital lending platforms enable financial institutions to streamline lending processes, reduce manual errors, and automate repetitive tasks, leading to enhanced operational efficiency, cost savings, and faster time-to-market for new lending products and services.

➤ Digital lending platforms provide borrowers with convenient, seamless, and personalized lending experiences, such as online loan applications, instant approvals, and real-time loan tracking, leading to improved customer satisfaction, loyalty, and retention.

➤ Digital lending platforms enable financial institutions to assess credit risk, monitor borrower behavior, and mitigate lending risks through advanced analytics, predictive modeling, and automated decision-making tools, leading to improved risk management and regulatory compliance.

➤ Digital lending platforms expand access to credit for underserved populations, such as small businesses, startups, and individuals with limited credit history, by leveraging alternative data sources, digital identity verification, and innovative underwriting models, leading to financial inclusion and economic empowerment.

Key Objectives of the Market Research Report

The primary objectives of market research reports on the Digital Lending Platform market are to provide comprehensive insights into market dynamics, trends, growth drivers, challenges, and competitive landscape. These reports aim to analyze market size, segmentation, and regional distribution to identify growth opportunities and emerging market trends. They also seek to assess the competitive landscape and benchmark key players based on factors such as market share, product offerings, technology leadership, and customer satisfaction. Market research reports aim to provide actionable recommendations to stakeholders, including financial institutions, lenders, technology vendors, investors, and regulatory bodies, to help them make informed decisions and formulate effective strategies for success in the Digital Lending Platform market.

Conclusion

In conclusion, the Digital Lending Platform market is experiencing rapid growth and evolution as financial institutions and lenders embrace digital transformation to streamline lending processes, enhance customer experiences, and mitigate risks. The market's segmentation by solution, service, deployment mode, and vertical reflects the diverse needs and priorities of financial institutions and lenders across different sectors and regions. Despite challenges such as economic recessions, regulatory complexities, and technological disruptions, the Digital Lending Platform market's strengths, resilience, and innovation position it for continued growth and competitiveness. As financial institutions and lenders continue to invest in digital lending platforms, partnerships, and fintech collaborations, the market will remain at the forefront of financial innovation, driving financial inclusion, economic growth, and prosperity worldwide.

View Complete Report Details @ https://www.snsinsider.com/reports/digital-lending-platform-market-1785

Table of Contents- Major Key Points

1. Introduction

2. Research Methodology

3. Market Dynamics

3.1. Drivers

3.2. Restraints

3.3. Opportunities

3.4. Challenges

4. Impact Analysis

4.1. Impact of Ukraine- Russia war

4.2. Impact of Ongoing Recession on Major Economies

5. Value Chain Analysis

6. Porter's 5 Forces Model

7. PEST Analysis

8. Digital Lending Platform Market Segmentation, by Solution

8.1. Business Process Management

8.2. Lending Analytics

8.3. Loan Management

8.4. Loan Origination

8.5. Risk & Compliance Management

8.6. Others

9. Digital Lending Platform Market Segmentation, by Service

9.1. Design and Implementation

9.2. Training and Education

9.3. Risk Assessment

9.4. Consulting

9.5. Support and Maintenance

10. Digital Lending Platform Market Segmentation, by Deployment Mode

10.1. Cloud

10.2. On-premises

11. Digital Lending Platform Market Segmentation, by Vertical

11.1. Banking

11.2. Financial Services

11.3. Insurance

11.4. Credit Unions

11.5. Retail Banking

11.6. P2P Lenders

12. Regional Analysis

12.1. Introduction

12.2. North America

12.3. Europe

12.4. Asia-Pacific

12.5. The Middle East & Africa

12.6. Latin America

13. Company Profile

14. Competitive Landscape

14.1. Competitive Benchmarking

14.2. Market Share Analysis

14.3. Recent Developments

15. USE Cases and Best Practices

16. Conclusion

Contact Us:

Akash Anand - Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

Website: https://www.snsinsider.com

Office No. 305-B, Arissa Avenue, Fountain Road, Kharadi, Pune, Maharashtra 411014

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Our staff is dedicated to giving our clients reliable information, and with expertise working in the majority of industrial sectors, we're proud to be recognized as one of the world's top market research firms. We can quickly design and implement pertinent research programs, including surveys and focus groups, and we have the resources and competence to deal with clients in practically any company sector.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Lending Platform Market Size and Share Analysis | Industry Overview here

News-ID: 3524834 • Views: …

More Releases from SNS Insider

Private Cloud Services Market Forecast Predicts Promising Growth Ahead

Private Cloud Services Market Scope and Overview

The Private Cloud Services Market has witnessed significant growth in recent years, fueled by the increasing adoption of cloud computing technologies across various industries. Private clouds offer enhanced security, control, and customization compared to public cloud services, making them a preferred choice for enterprises seeking to leverage cloud capabilities while maintaining data sovereignty and compliance. This report delves into the competitive landscape, market segmentation,…

Video Surveillance Market Analysis Unveils Insights for Growth and Development

Video Surveillance Market Scope and Overview

The Video Surveillance Market has seen significant growth over the past few decades, driven by advancements in technology and an increasing need for security across various sectors. Video surveillance systems, once primarily used for security purposes, have now expanded their applications to include monitoring, analysis, and even preventive measures in various industries. This report provides a comprehensive analysis of the video surveillance market, covering its…

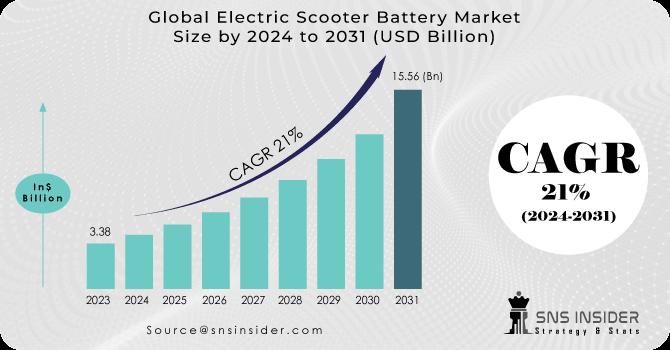

Electric Scooter Battery Market Charges Ahead, Propelling Sustainable Urban Mobi …

The Global Electric Scooter Battery Market is experiencing a remarkable surge, fueled by the rising demand for eco-friendly and convenient transportation solutions in urban environments. As cities around the world grapple with traffic congestion, air pollution, and the need for sustainable mobility, the electric scooter battery market is poised to play a pivotal role in shaping the future of urban transportation. According to a comprehensive market research report, the electric…

Solar-Powered Vehicle Market Accelerates Towards a Sustainable Future, Projected …

The Global Solar-Powered Vehicle Market is rapidly gaining momentum, driven by the urgent need to combat climate change and reduce greenhouse gas emissions. As the world transitions towards a greener and more sustainable future, the adoption of solar-powered vehicles is emerging as a game-changer in the automotive industry. According to a comprehensive market research report, the solar-powered vehicle market, valued at $1.27 billion in 2023, is expected to reach a…

More Releases for Digital

Digital luxury brands Market Is Booming Worldwide | Major Giants Balenciaga Digi …

HTF MI recently introduced Global Digital luxury brands Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2033). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence.

Major companies in Digital luxury brands Market are:

Balenciaga Digital, Louis Vuitton Digital, Gucci Digital, Dolce & Gabbana DGFamily, Prada Virtual,…

Introducing Digital Sales Pro, Inc: Revolutionizing Digital Sales in the Digital …

Digital Sales Pro, Inc. is a company that helps content creators and publishers make money from content and reach a larger audience with their craft.

In today's world, it can be tough for content creators and publishers to make money and connect with their audience.

At, Digital Sales Pro, Inc. we understand these challenges and have created a suite of solutions that help our clients build a strong online presence, monetize…

Digital Twin in Healthcare Market Analysis By Type - Product Digital Twins, Proc …

Introduction

The healthcare industry has seen significant growth and development over the years, with technology playing a critical role in transforming patient care. One such innovative technology that has emerged in recent years is the Global Digital Twin in Healthcare Market. This technology allows healthcare professionals to create a virtual replica of a patient's physical self, enabling them to monitor and analyze patient data in real-time. The Global Digital Twin in…

Digital Twin in Healthcare Market Analysis By Type - Product Digital Twins, Proc …

In 2021, the market for Digital Twin in Healthcare worldwide was worth $6.75 billion US dollars. AMR Group projects that the market will reach US$ 96.5 billion by 2031, growing at a CAGR of 40 percent between 2022 and 2031.

Industry Overview

Digital twins are virtual copies of physical objects or things that data scientist & IT professionals can use to compute simulations prior to developing and deploying the original devices. Digital…

Digital Therapeutics Market, Digital Therapeutics Market Size, Digital Therapeut …

The global digital therapeutics market is expected to reach US$ 8,941.1 Mn by 2025 from US$ 1,993.2 Mn in 2017. The market is estimated to grow with a CAGR of 20.8% during the forecast period from 2018 to 2025.

North America is the largest geographic market and it is expected to be the largest revenue generator during the forecast period, whereas the market is expected to witness growth at a significant…

Digital Display Market Future Growth with Worldwide Players (Digital Virgo, Digi …

Digital Display Industry 2019 Global Market 2025 research report represents the historical overview of current Market situation, size, share, trends, growth, supply, outlook and manufacturers with detailed analysis. It also focuses on Digital Display volume and value at global level, regional level and company level. From a global perspective, this report represents overall Digital Display market size by analyzing historical data and future prospect.

Get Sample Copy of this Report -…