Press release

ATM Market Opportunities and Strengths | A Detailed Overview

ATM Market Scope and OverviewAutomated Teller Machines (ATMs) have revolutionized banking by providing convenient access to financial services anytime, anywhere. As digital banking continues to evolve, ATMs remain integral to the banking ecosystem, offering a range of services from cash withdrawals to fund transfers. This report delves into a comprehensive analysis of the ATM Market, covering key players, market segmentation, regional outlook, growth drivers, strengths, recession impact, objectives of market research reports, and concludes with insights into the future of the market.

The ATM (Automated Teller Machine) Market involves the deployment and operation of self-service banking terminals that enable customers to perform various financial transactions, such as cash withdrawals, deposits, transfers, and account inquiries. Despite the rise of digital banking channels, ATMs remain an essential component of the banking infrastructure, providing convenient access to cash and basic banking services. Key drivers include the demand for convenient banking services, financial inclusion initiatives, and technological advancements in ATM functionality, such as contactless payments, biometric authentication, and interactive touchscreens. As banks modernize their ATM networks, the market is driven by investments in next-generation ATMs, software upgrades, and security enhancements to meet evolving customer expectations and regulatory requirements.

Get a Report Sample of ATM Market @ https://www.snsinsider.com/sample-request/1281

Competitive Analysis

The ATM market is characterized by fierce competition among key players such as Diebold Nixdorf, Euronet Worldwide, Fujitsu Ltd, GRG Banking Equipment, and NCR Corporation. These companies lead the market with innovative solutions and a global presence. Additionally, players like Hess Cash Systems GmbH, Hitachi-Omron Terminal Solutions, NHAUSA, Source Technologies, and Triton Systems of Delaware LLC contribute to market competitiveness with specialized offerings and regional expertise.

Market Segmentation

On The Basis of Solution:

✦ Deployment:

✧ Onsite ATM: Installed within bank branches or retail locations, offering traditional banking services.

✧ Offsite ATM: Located outside bank branches in public areas such as malls, airports, and convenience stores, providing convenient access to cash and basic banking services.

✧ Worksite ATM: Deployed in corporate offices, factories, and workplaces to cater to the banking needs of employees.

✧ Mobile ATM: Mobile units deployed at events, festivals, and remote locations to serve temporary banking needs.

✦ Managed Service: Outsourced ATM management services including installation, maintenance, cash replenishment, and monitoring, allowing banks to focus on core banking operations.

On The Basis of Type:

✦ Conventional/Bank ATMs: Traditional ATMs offered by banks, providing a wide range of banking services including cash withdrawals, deposits, balance inquiries, and fund transfers.

✦ Brown ATMs: Independently operated ATMs deployed by non-banking entities such as retail stores, gas stations, and convenience stores, offering limited banking services.

✦ White ATMs: Privately operated ATMs deployed by independent service providers, allowing customers to access cash and perform basic transactions.

✦ Cash Dispenser ATM: Specialized ATMs designed primarily for cash withdrawals, offering fast and efficient cash dispensing services.

✦ Smart ATMs: Advanced ATMs equipped with features such as biometric authentication, contactless card readers, and multi-function capabilities for enhanced security and user experience.

Regional Outlook

The ATM market exhibits a global footprint, with North America and Europe leading in terms of market share, driven by established banking infrastructure and high ATM penetration rates. However, emerging economies in Asia Pacific, Latin America, and Africa present lucrative growth opportunities, fueled by increasing banking penetration, rising disposable incomes, and government initiatives promoting financial inclusion.

Key Growth Drivers

➤ ATMs play a crucial role in extending banking services to unbanked and underbanked populations, enabling access to cash, payments, and other financial services in remote and underserved areas.

➤ Integration of advanced technologies such as biometrics, NFC, and AI enhances the functionality and security of ATMs, offering a seamless and personalized user experience.

➤ ATMs streamline cash management operations for banks, reducing operational costs, optimizing cash logistics, and minimizing cash handling risks through advanced monitoring and forecasting capabilities.

➤ ATMs provide convenient access to banking services 24/7, catering to the needs of customers seeking instant cash withdrawals, account inquiries, and other transactions without visiting bank branches.

➤ Regulatory initiatives promoting financial inclusion, consumer protection, and ATM security drive investments in modernizing ATM infrastructure and compliance with industry standards and regulations.

Strengths of the Market

➤ Extensive ATM networks established by banks and independent service providers ensure broad geographic coverage, enhancing customer accessibility and convenience.

➤ Continuous advancements in ATM technology improve functionality, security, and user experience, driving customer adoption and satisfaction.

➤ Collaboration between banks, ATM manufacturers, payment networks, and technology providers fosters innovation, expands service offerings, and enhances interoperability in the ATM ecosystem.

➤ ATMs have earned the trust of customers as reliable channels for accessing cash and banking services, reinforcing brand loyalty and customer satisfaction.

➤ ATMs automate routine banking transactions, reducing queue times, minimizing operational costs, and optimizing resource utilization for banks and financial institutions.

Get a Discount @ https://www.snsinsider.com/discount/1281

Impact of the Recession

During economic downturns, the ATM market remains resilient, as cash continues to play a crucial role as a medium of exchange and store of value. Despite the shift towards digital payments, ATMs remain essential for cash withdrawals, especially in times of financial uncertainty and liquidity constraints. However, the recession may impact ATM deployment and usage patterns, leading to changes in consumer behavior, transaction volumes, and revenue streams for ATM operators and banks.

Key Objectives of Market Research Reports

➤ Providing insights into the current market size, growth trends, and future projections for the ATM market, including installed base, transaction volumes, and revenue forecasts.

➤ Evaluating the strategies, market positioning, and offerings of key players in the ATM industry, including market share analysis, SWOT analysis, and competitive benchmarking.

➤ Analyzing market segments based on solution, type, deployment, and geography to identify growth opportunities, market trends, and customer preferences.

➤ Tracking advancements in ATM technology, including biometrics, contactless payments, and AI, to understand emerging market trends and technological innovations shaping the future of the ATM industry.

➤ Assessing regulatory frameworks, compliance requirements, and industry standards impacting ATM deployment, security, and operations across different regions and markets.

Conclusion

The ATM market continues to evolve, driven by technological innovation, regulatory mandates, and changing consumer preferences. As banks and ATM operators adapt to digital transformation initiatives and regulatory requirements, investments in modernizing ATM infrastructure, enhancing security, and improving user experience will be crucial to maintaining competitiveness and driving market growth. Despite the rise of digital payments, ATMs remain indispensable for cash access and financial inclusion, serving as vital touchpoints for banks and customers in an increasingly digital world. Looking ahead, the future of the ATM market lies in leveraging emerging technologies, partnerships, and customer-centric strategies to deliver convenient, secure, and innovative banking experiences that meet the evolving needs of customers globally.

View Complete Report Details @ https://www.snsinsider.com/reports/atm-market-1281

Table of Contents- Major Key Points

1. Introduction

2. Research Methodology

3. Market Dynamics

3.1. Drivers

3.2. Restraints

3.3. Opportunities

3.4. Challenges

4. Impact Analysis

4.1. Impact of Ukraine- Russia war

4.2. Impact of Ongoing Recession on Major Economies

5. Value Chain Analysis

6. Porter's 5 Forces Model

7. PEST Analysis

8. ATM Market Segmentation, by Solution

8.1. Deployment

8.2. Managed Service

9. ATM Market Segmentation, by Type

9.1. Conventional/Bank ATMs

9.2. Brown ATMs

9.3. White ATMs

9.4. Cash Dispenser ATM

9.5. Smart ATMs

10. Regional Analysis

10.1. Introduction

10.2. North America

10.3. Europe

10.4. Asia-Pacific

10.5. The Middle East & Africa

10.6. Latin America

11. Company Profile

12. Competitive Landscape

12.1. Competitive Benchmarking

12.2. Market Share Analysis

12.3. Recent Developments

13. USE Cases and Best Practices

14. Conclusion

Contact Us:

Akash Anand - Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

Website: https://www.snsinsider.com

Office No. 305-B, Arissa Avenue, Fountain Road, Kharadi, Pune, Maharashtra 411014

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Our staff is dedicated to giving our clients reliable information, and with expertise working in the majority of industrial sectors, we're proud to be recognized as one of the world's top market research firms. We can quickly design and implement pertinent research programs, including surveys and focus groups, and we have the resources and competence to deal with clients in practically any company sector.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release ATM Market Opportunities and Strengths | A Detailed Overview here

News-ID: 3522648 • Views: …

More Releases from SNS Insider

Private Cloud Services Market Forecast Predicts Promising Growth Ahead

Private Cloud Services Market Scope and Overview

The Private Cloud Services Market has witnessed significant growth in recent years, fueled by the increasing adoption of cloud computing technologies across various industries. Private clouds offer enhanced security, control, and customization compared to public cloud services, making them a preferred choice for enterprises seeking to leverage cloud capabilities while maintaining data sovereignty and compliance. This report delves into the competitive landscape, market segmentation,…

Video Surveillance Market Analysis Unveils Insights for Growth and Development

Video Surveillance Market Scope and Overview

The Video Surveillance Market has seen significant growth over the past few decades, driven by advancements in technology and an increasing need for security across various sectors. Video surveillance systems, once primarily used for security purposes, have now expanded their applications to include monitoring, analysis, and even preventive measures in various industries. This report provides a comprehensive analysis of the video surveillance market, covering its…

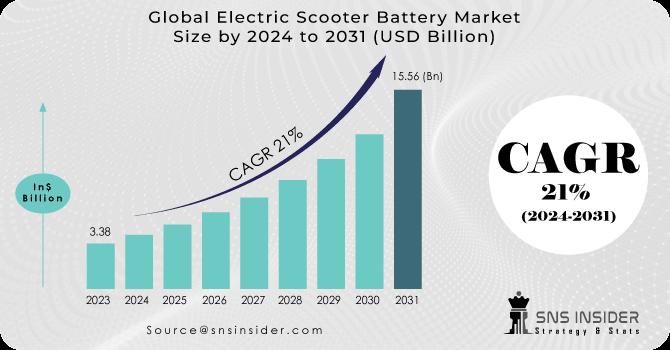

Electric Scooter Battery Market Charges Ahead, Propelling Sustainable Urban Mobi …

The Global Electric Scooter Battery Market is experiencing a remarkable surge, fueled by the rising demand for eco-friendly and convenient transportation solutions in urban environments. As cities around the world grapple with traffic congestion, air pollution, and the need for sustainable mobility, the electric scooter battery market is poised to play a pivotal role in shaping the future of urban transportation. According to a comprehensive market research report, the electric…

Solar-Powered Vehicle Market Accelerates Towards a Sustainable Future, Projected …

The Global Solar-Powered Vehicle Market is rapidly gaining momentum, driven by the urgent need to combat climate change and reduce greenhouse gas emissions. As the world transitions towards a greener and more sustainable future, the adoption of solar-powered vehicles is emerging as a game-changer in the automotive industry. According to a comprehensive market research report, the solar-powered vehicle market, valued at $1.27 billion in 2023, is expected to reach a…

More Releases for ATM

ATM Managed Services Market Expands: AI, Cloud & ATM-as-a-Service Drive Transfor …

ATM Managed Services Market size was valued at USD 10.5 Billion in 2024 and is projected to reach USD 16.2 Billion by 2033, exhibiting a CAGR of 5.2% from 2026 to 2033.

What are the potential factors contributing to the growth of the ATM Managed Services Market?

The ATM Managed Services Market is experiencing growth due to several key factors. The increasing demand for cost-effective banking operations is a major driver, as…

Prominent Automatic Teller Machine (ATM) Security Market Trend for 2025: Innovat …

"Which drivers are expected to have the greatest impact on the over the automatic teller machine (atm) security market's growth?

The surge in automated teller machine (ATM) fraud incidents is projected to fuel the expansion of the automated teller machine (ATM) security market in the future. An ATM is a specific type of computerized device that allows individuals to conduct a range of banking activities without requiring human assistance or a…

Global ATM Market by Types(On-site ATM,Off-site ATM,Work Site ATM,Mobile Site AT …

The global ATM market has the potential to grow with xx million USD with growing CAGR in the forecast period from 2021f to 2026f.

Global ATM Market Overview

This market research report consists of a number of sections that provide data on the current state of the market, industry trends, and future prospects. It also includes analysis of key players and their positions in the market. The increasing adoption…

Contactless ATM (Cardless ATM) Market: Industry Future Developments, Competitive …

The Contactless ATM (Cardless ATM) market research report is proficient and top to bottom research by specialists on the current state of the industry. This statistical surveying report gives the most up to date industry information and industry future patterns, enabling you to distinguish the items and end clients driving income development and benefit. It centres around the real drivers and restrictions for the key players and present challenge status…

Global Contactless ATM (Cardless ATM) Industry Professional Market Size Survey b …

This report also researches and evaluates the impact of Covid-19 outbreak on the Contactless ATM (Cardless ATM)�industry, involving potential opportunity and challenges, drivers and risks. We present the impact assessment of Covid-19 effects on Contactless ATM (Cardless ATM)�and market growth forecast based on different scenario (optimistic, pessimistic, very optimistic, most likely etc.).

�

Scope of the Report:

The report presents the market outlook for the Indian Phospho Gypsum product from the year 2019…

Global Contactless ATM (Cardless ATM) Market Expected to Witness a Sustainable G …

LP INFORMATION offers a latest published report on Contactless ATM (Cardless ATM) Market Analysis and Forecast 2019-2025 delivering key insights and providing a competitive advantage to clients through a detailed report.

This intelligence Contactless ATM (Cardless ATM) Market report by LP INFORMATION includes investigations based on the current scenarios, historical records, and future predictions. An accurate data of various aspects such as type, size, application, and end user have been scrutinized…