Press release

Digital Banking Platform Market Competitive Landscape | Analyzing Industry Players

Digital Banking Platform Market Scope and OverviewThe banking sector is undergoing a digital revolution, transforming traditional banking processes and customer experiences. Digital banking platforms have emerged as catalysts for this transformation, offering innovative solutions to meet the evolving needs of financial institutions and customers. This report provides a comprehensive analysis of the Digital Banking Platform Market, covering key players, market segmentation, regional outlook, growth drivers, strengths, recession impact, and concludes with insights into the future of the market.

The Digital Banking Platform Market focuses on technology solutions that enable banks and financial institutions to deliver digital banking services to their customers across various channels, including web, mobile, and social media. Digital banking platforms offer features such as online account management, mobile payments, personal financial management, and AI-powered chatbots. Key drivers include the increasing demand for convenient and accessible banking services, the rise of digital-native consumers, and regulatory initiatives promoting financial inclusion and innovation. As banks undergo digital transformation, the market is driven by investments in omnichannel banking solutions, open banking APIs, and cybersecurity measures to ensure a seamless and secure customer experience.

Get a Report Sample of Digital Banking Platform Market @ https://www.snsinsider.com/sample-request/1228

Competitive Analysis

Leading the charge in the digital banking platform market are prominent players such as Appway, FIS Global, Fiserv, nCino, Oracle Corporation, SAP SE, Temenos, and Vsoft Corporation. These companies offer robust platforms and a wide array of services tailored to address the diverse requirements of retail, corporate, and investment banking sectors. Additionally, niche players like COR Financial Solution Ltd and Edgeverve contribute to the market's competitiveness with specialized offerings.

Market Segmentation

By Component:

➤ Platforms: Digital banking platforms form the core infrastructure, providing functionalities for customer engagement, account management, transaction processing, and more.

➤ Services:

✧ Professional Services: Offering consulting, implementation, customization, and integration services to optimize platform performance.

✧ Managed Services: Providing ongoing support, maintenance, and monitoring to ensure seamless operations.

By Deployment Type:

➤ On-premises: Traditional deployment model where the digital banking platform is installed and managed within the bank's premises, offering greater control and security.

➤ Cloud: Leveraging cloud infrastructure for flexible, scalable, and cost-effective deployment, enabling rapid innovation and time-to-market for new features and services.

By Banking Type:

➤ Retail Banking: Catering to the needs of individual consumers, including account management, payments, transfers, and personalized financial services.

➤ Corporate Banking: Serving the banking needs of businesses, offering solutions for cash management, trade finance, lending, and treasury services.

➤ Investment Banking: Providing specialized financial services for corporations, institutional investors, and governments, including underwriting, mergers and acquisitions, and advisory services.

Regional Outlook

The digital banking platform market exhibits a global presence, with North America and Europe leading in terms of market share, driven by early adoption of digital banking solutions and advanced technological infrastructure. However, Asia Pacific presents significant growth opportunities, fueled by increasing internet penetration, smartphone adoption, and government initiatives promoting digital financial inclusion.

Key Growth Drivers

➤ Shifting preferences towards digital channels for banking transactions, driven by convenience, accessibility, and personalized experiences.

➤ Regulatory initiatives promoting open banking, PSD2 compliance, and data security drive investments in digital banking platforms to ensure compliance and competitiveness.

➤ Rapid advancements in technologies such as artificial intelligence, machine learning, blockchain, and API integration enhance the capabilities of digital banking platforms, enabling innovative services and seamless user experiences.

➤ Intensifying competition among banks and fintech disruptors compels incumbents to modernize their banking infrastructure and enhance digital capabilities to retain customers and attract new segments.

➤ Digital banking platforms offer opportunities for cost reduction, process automation, and operational efficiency, enabling banks to streamline operations, reduce manual errors, and improve profitability.

Strengths of the Market

➤ Digital banking platforms offer scalability and flexibility to adapt to evolving business needs, customer preferences, and regulatory requirements, empowering banks to innovate and differentiate in a competitive market landscape.

➤ Personalized, omnichannel experiences delivered through digital banking platforms strengthen customer relationships, drive loyalty, and increase customer lifetime value.

➤ Advanced analytics and reporting capabilities embedded in digital banking platforms provide banks with actionable insights into customer behavior, preferences, and market trends, enabling data-driven decision-making and targeted marketing strategies.

➤ Robust security features, encryption protocols, and compliance controls embedded in digital banking platforms ensure data protection, regulatory compliance, and fraud prevention, instilling trust and confidence among customers and regulators.

➤ Collaboration with fintech startups, technology vendors, and ecosystem partners fosters innovation, accelerates time-to-market for new products and services, and expands the capabilities of digital banking platforms to address emerging market trends and customer needs.

Impact of the Recession

Despite economic uncertainties, the digital banking platform market remains resilient, as banks prioritize digital transformation initiatives to adapt to changing customer preferences, regulatory mandates, and competitive pressures. The pandemic has accelerated the shift towards digital banking, driving increased investments in digital channels, remote account opening, contactless payments, and digital advisory services. However, budget constraints and resource limitations may impact the pace of digital transformation initiatives, emphasizing the need for cost-effective, scalable solutions and strategic partnerships to navigate the challenging economic environment.

Get a Discount @ https://www.snsinsider.com/discount/1228

Key Objectives of Market Research Reports

➤ Providing insights into market trends, drivers, challenges, and opportunities shaping the digital banking platform market landscape.

➤ Assessing the competitive landscape, market positioning, strategies, and offerings of key players to identify strengths, weaknesses, opportunities, and threats.

➤ Analyzing market segments based on component, deployment type, banking type, and geography to understand market size, growth potential, and demand dynamics.

➤ Understanding customer needs, preferences, behaviors, and expectations to guide product development, marketing strategies, and customer engagement initiatives.

➤ Assessing regulatory frameworks, compliance requirements, and industry standards impacting the adoption and deployment of digital banking platforms across different regions and banking segments.

Conclusion

The digital banking platform market represents a paradigm shift in the banking industry, offering transformative solutions to meet the evolving needs of banks and customers in an increasingly digital world. With leading players driving innovation, collaboration, and customer-centricity, the market is poised for sustained growth and expansion. As banks navigate the challenges and opportunities of digital transformation, investing in robust, scalable, and secure digital banking platforms will be crucial to staying competitive, driving customer engagement, and unlocking new revenue streams. Looking ahead, the future of banking lies in embracing digital technologies, harnessing data-driven insights, and delivering seamless, personalized experiences that redefine the banking landscape for the digital age.

View Complete Report Details @ https://www.snsinsider.com/reports/digital-banking-platform-market-1228

Table of Contents- Major Key Points

1. Introduction

2. Research Methodology

3. Market Dynamics

3.1. Drivers

3.2. Restraints

3.3. Opportunities

3.4. Challenges

4. Impact Analysis

4.1. Impact of Ukraine- Russia war

4.2. Impact of Ongoing Recession on Major Economies

5. Value Chain Analysis

6. Porter's 5 Forces Model

7. PEST Analysis

8. Digital Banking Platform Market Segmentation, by component type

8.1. Platforms

8.2. Services

9. Digital Banking Platform Market Segmentation, by deployment type

9.1. On-premises

9.2. Cloud

10. Digital Banking Platform Market Segmentation, By banking type

10.1. Retail Banking

10.2. Corporate Banking

10.3. Investment Banking

11. Regional Analysis

11.1. Introduction

11.2. North America

11.3. Europe

11.4. Asia-Pacific

11.5. The Middle East & Africa

11.6. Latin America

12. Company Profile

13. Competitive Landscape

13.1. Competitive Benchmarking

13.2. Market Share Analysis

13.3. Recent Developments

14. USE Cases and Best Practices

15. Conclusion

Contact Us:

Akash Anand - Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

Website: https://www.snsinsider.com

Office No. 305-B, Arissa Avenue, Fountain Road, Kharadi, Pune, Maharashtra 411014

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Our staff is dedicated to giving our clients reliable information, and with expertise working in the majority of industrial sectors, we're proud to be recognized as one of the world's top market research firms. We can quickly design and implement pertinent research programs, including surveys and focus groups, and we have the resources and competence to deal with clients in practically any company sector.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Platform Market Competitive Landscape | Analyzing Industry Players here

News-ID: 3522646 • Views: …

More Releases from SNS Insider

Private Cloud Services Market Forecast Predicts Promising Growth Ahead

Private Cloud Services Market Scope and Overview

The Private Cloud Services Market has witnessed significant growth in recent years, fueled by the increasing adoption of cloud computing technologies across various industries. Private clouds offer enhanced security, control, and customization compared to public cloud services, making them a preferred choice for enterprises seeking to leverage cloud capabilities while maintaining data sovereignty and compliance. This report delves into the competitive landscape, market segmentation,…

Video Surveillance Market Analysis Unveils Insights for Growth and Development

Video Surveillance Market Scope and Overview

The Video Surveillance Market has seen significant growth over the past few decades, driven by advancements in technology and an increasing need for security across various sectors. Video surveillance systems, once primarily used for security purposes, have now expanded their applications to include monitoring, analysis, and even preventive measures in various industries. This report provides a comprehensive analysis of the video surveillance market, covering its…

Electric Scooter Battery Market Charges Ahead, Propelling Sustainable Urban Mobi …

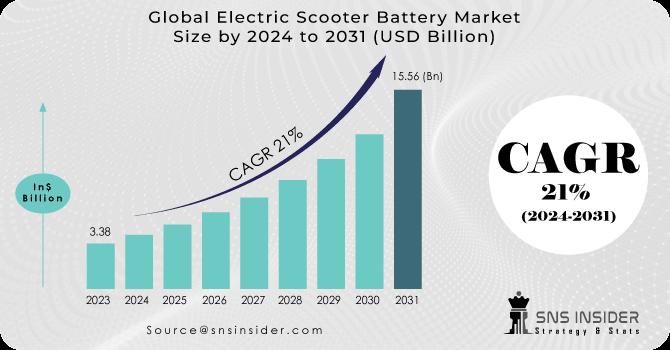

The Global Electric Scooter Battery Market is experiencing a remarkable surge, fueled by the rising demand for eco-friendly and convenient transportation solutions in urban environments. As cities around the world grapple with traffic congestion, air pollution, and the need for sustainable mobility, the electric scooter battery market is poised to play a pivotal role in shaping the future of urban transportation. According to a comprehensive market research report, the electric…

Solar-Powered Vehicle Market Accelerates Towards a Sustainable Future, Projected …

The Global Solar-Powered Vehicle Market is rapidly gaining momentum, driven by the urgent need to combat climate change and reduce greenhouse gas emissions. As the world transitions towards a greener and more sustainable future, the adoption of solar-powered vehicles is emerging as a game-changer in the automotive industry. According to a comprehensive market research report, the solar-powered vehicle market, valued at $1.27 billion in 2023, is expected to reach a…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…