Press release

Anti-Money Laundering Software Market Revenue Surges: Acumen Research Projection

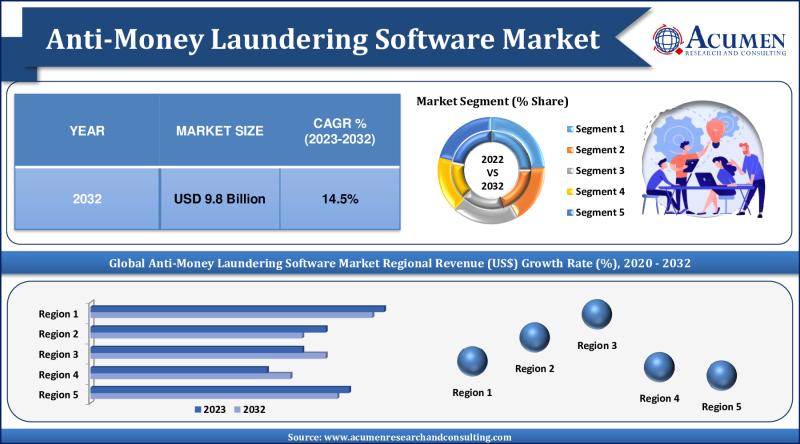

The global anti-money laundering (AML) software market is on an impressive growth trajectory, with revenue projected to reach USD 9.8 billion by 2032, reflecting a compound annual growth rate (CAGR) of 14.5% from 2023 to 2032. This significant expansion underscores the increasing importance of robust financial security measures in a rapidly evolving digital economy. Let's delve into the key factors driving this growth, regional market dynamics, and notable trends shaping the AML software landscape.Download Sample Report Copy of This Report from Here: https://www.acumenresearchandconsulting.com/request-sample/2500

Market Dynamics and Growth Drivers

The global push for stringent regulatory compliance and the rising incidences of financial fraud have been primary catalysts for the burgeoning AML software market. Financial institutions are under constant pressure to enhance their fraud detection and prevention capabilities. Consequently, the demand for advanced AML software that offers comprehensive monitoring, real-time detection, and efficient reporting solutions is escalating.

North America: A Leading Market

North America has been at the forefront of the AML software market, with its market value reaching approximately USD 884 million in 2022. The region's dominance can be attributed to its well-established financial sector, stringent regulatory framework, and the early adoption of advanced technologies. Financial institutions in North America are investing heavily in AML solutions to comply with regulations such as the Bank Secrecy Act (BSA) and the USA PATRIOT Act, which mandate robust anti-money laundering protocols.

Asia-Pacific: Rapid Growth Potential

The Asia-Pacific region is poised for remarkable growth, with an anticipated CAGR of over 16% from 2023 to 2032. This surge is driven by the increasing adoption of digital banking, a rise in financial crimes, and proactive regulatory measures across countries like China, India, and Japan. The region's burgeoning economic landscape and expanding financial sector create a fertile ground for AML software providers. Governments and regulatory bodies in Asia-Pacific are increasingly aware of the need for stringent AML practices, further propelling market growth.

Anti-Money Laundering Software Market Segmentation

Anti-Money Laundering AML Software Market By Component

• Software

• Service

Anti-Money Laundering AML Software Market By Product

• Transaction Monitoring

• Currency Transaction Reporting

• Customer Identity Management

• Compliance Management

• Others (Sanction Screening Software and Case Management Software)

Anti-Money Laundering AML Software Market By Deployment Type

• Cloud

• On-Premise

Anti-Money Laundering AML Software Market By End-Use Industries

• IT and Telecommunications

• Healthcare

• BFSI

• Transportation and Logistics

• Manufacturing

• Defense and Government

• Retail

• Energy and Utilities

• Others

Trends Fueling Market Demand

One of the prominent trends driving the AML software market is the incorporation of innovative features and the continual improvement of AML software capabilities. These advancements are crucial in addressing the evolving techniques employed by financial criminals. Modern AML solutions leverage AI and ML to enhance their predictive capabilities, allowing for more accurate risk assessments and quicker response times to potential threats.

Another notable trend is the integration of AML software with other financial systems, such as customer relationship management (CRM) and enterprise resource planning (ERP) platforms. This integration facilitates seamless data flow and provides a holistic view of customer activities, enhancing the overall efficiency of AML processes.

The Role of Regulatory Frameworks

Regulatory frameworks play a pivotal role in shaping the AML software market. Compliance with global and regional regulations is non-negotiable for financial institutions, driving them to adopt advanced AML solutions. For instance, the European Union's Fourth and Fifth Anti-Money Laundering Directives (4AMLD and 5AMLD) and the Financial Action Task Force (FATF) recommendations set stringent standards for AML compliance, prompting financial institutions to invest in cutting-edge software solutions.

In North America, the Financial Crimes Enforcement Network (FinCEN) and the Office of Foreign Assets Control (OFAC) impose rigorous AML requirements, necessitating the adoption of comprehensive AML systems. Similarly, in Asia-Pacific, regulatory bodies are increasingly implementing stringent AML regulations, further boosting the demand for advanced AML software.

Anti-Money Laundering Software Market Players

Some of the top anti-money laundering software companies offered in our report includes 3i Infotech Ltd., Accuity Birst Inc., Fiserv Inc., IBM, Infosys, NICE Actimize Inc., Norkom Technologies Ltd, Oracle Corporation, SAS Institute Inc., and TCS.

Future Outlook

The future of the AML software market looks promising, with continuous technological advancements and increasing global regulatory scrutiny acting as primary growth drivers. As financial crimes become more sophisticated, the need for innovative AML solutions that can adapt to new threats will only intensify. The integration of advanced technologies such as blockchain for enhanced transparency and security in financial transactions is expected to be a significant development in the coming years.

Moreover, the increasing focus on customer experience and operational efficiency is likely to drive further innovations in AML software. Financial institutions are seeking solutions that not only ensure compliance but also streamline operations and enhance the customer experience. This dual focus on security and efficiency will shape the future landscape of the AML software market.

Anti-Money Laundering Software Market Table of Content:

CHAPTER 1. Industry Overview of Anti-Money Laundering Software Market

CHAPTER 2. Research Approach

CHAPTER 3. Market Dynamics And Competition Analysis

CHAPTER 4. Manufacturing Plant Analysis

CHAPTER 5. Anti-Money Laundering Software Market By Component

CHAPTER 6. Anti-Money Laundering Software Market By Product

CHAPTER 7. Anti-Money Laundering Software Market By Deployment Type

CHAPTER 8. Anti-Money Laundering Software Market By End-Use Industry

CHAPTER 9. North America Anti-Money Laundering Software Market By Country

CHAPTER 10. Europe Anti-Money Laundering Software Market By Country

CHAPTER 11. Asia Pacific Anti-Money Laundering Software Market By Country

CHAPTER 12. Latin America Anti-Money Laundering Software Market By Country

CHAPTER 13. Middle East & Africa Anti-Money Laundering Software Market By Country

CHAPTER 14. Player Analysis Of Anti-Money Laundering Software Market

CHAPTER 15. Company Profile

Conclusion

The global anti-money laundering software market is poised for substantial growth, driven by the need for robust financial security measures, regulatory compliance, and technological advancements. North America continues to lead the market, while the Asia-Pacific region shows immense growth potential. With ongoing innovations and the integration of advanced technologies, the AML software market is set to play a crucial role in safeguarding the global financial system against money laundering and financial crimes.

Ask Query Here: Richard@acumenresearchandconsulting.com or sales@acumenresearchandconsulting.com

To Purchase this Premium Report@ https://www.acumenresearchandconsulting.com/buy-now/0/2500

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition. With the team size of 100+ Analysts and collective industry experience of more than 200 years, Acumen Research and Consulting assures to deliver a combination of industry knowledge along with global and country level expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Anti-Money Laundering Software Market Revenue Surges: Acumen Research Projection here

News-ID: 3517743 • Views: …

More Releases from Acumen Research and Consulting

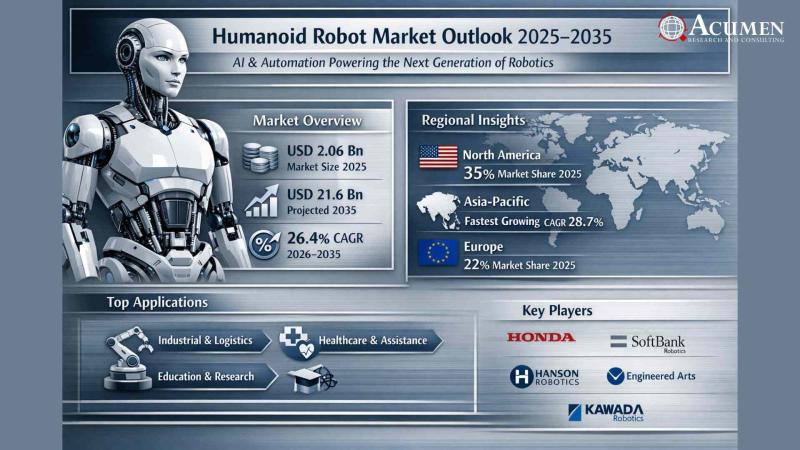

Humanoid Robot Market to Reach USD 21.6 Billion by 2035 | AI & Automation Drive …

Humanoid Robot Market to Surpass USD 21.6 Billion by 2035: AI-Driven Automation Unlocks a New Era of Human-Machine Collaboration

The Humanoid Robot Market is undergoing a transformative boom, reflecting a seismic shift in how industries leverage robotics, artificial intelligence (AI), and automation to meet the growing demands of a rapidly evolving global economy.

According to Acumen Research and Consulting, the global Humanoid Robot Market is projected to grow from USD 2,060.4 million…

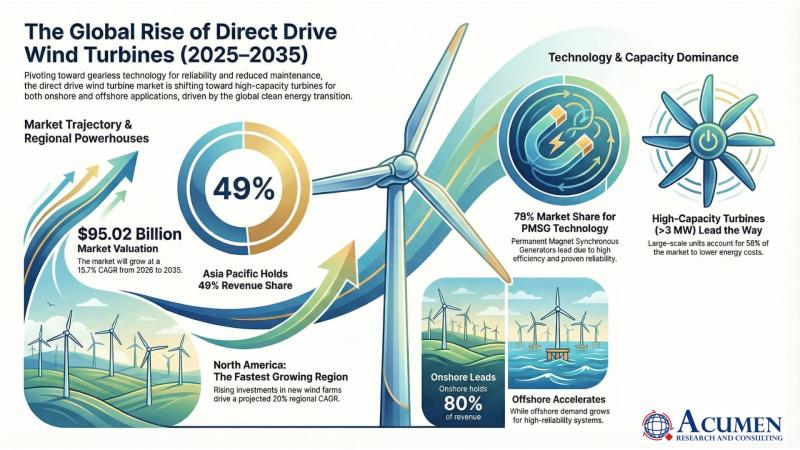

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035 | Acumen Res …

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035, Driven by Global Renewable Expansion and Offshore Innovation | Acumen Research and Consulting

The Direct Drive Wind Turbine Market is witnessing unprecedented growth momentum as the global renewable energy transition accelerates. According to a new report by Acumen Research and Consulting, the global Direct Drive Wind Turbine Market size is projected to grow from USD 21.91 billion in 2025…

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

More Releases for AML

Xepeng Emphasizes AML Screening in Platform Security

Platform details AML measures, including counterparty checks, to support secure conversions for merchants.

Denpasar, Bali, Indonesia, 30th Dec 2025 -- As digital value conversion systems evolve, enterprises like Xepeng recognize that robust anti-money laundering (AML) practices are essential to maintaining trust, safeguarding merchants, and aligning with regulatory expectations. AML encompasses a set of policies and practices intended to prevent, detect, and respond to financial activity that may be linked to illicit…

Top Trends Transforming the Hemato Oncology Testing Market Landscape in 2025: Ne …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

What Will the Hemato Oncology Testing Industry Market Size Be by 2025?

There has been a swift expansion in the hemato oncology testing market in the past few years. The market, which was valued at $3.5 billion in 2024, is predicted to surge to $3.96 billion in 2025, reflecting…

AML BitCoin Founder Asks President Trump to release their AML BITCOIN Classified …

The DOJ and the FBI should practice tough love while also providing financial incentives for government employees that uphold the constitution and obey the law. AG Bondi and Director Patel should ask President Trump for access to some of the billions of dollars that DOGE has saved us and utilize it for pay raises. Their employees need to be taken care of financially, or their hardships will make them the…

Anti-Money Laundering (AML) Software Market Is Booming So Rapidly with Thomson R …

The Latest published market study on Global Anti-Money Laundering (AML) Software Market provides an overview of the current market dynamics in the Anti-Money Laundering (AML) Software space, as well as what our survey respondents all outsourcing decision-makers predict the market will look like in 2032. The study breaks the market by revenue and volume (wherever applicable) and price history to estimate the size and trend analysis and identify gaps and…

Global Anti Money Laundering (AML) Software Market Size, Share and Forecast By K …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the Market Research Intellect, the global Anti Money Laundering (AML) Software market is projected to grow at a robust compound annual growth rate (CAGR) of 14.78% from 2024 to 2031. Starting with a valuation of 7.83 Billion in 2024, the market is expected to reach approximately 17.9 Billion by 2031, driven by factors such as Anti Money Laundering (AML) Software and Anti Money Laundering (AML)…

What is AML Verification? A Detailed Guide

With the rise of cryptocurrencies and the increasing adoption of digital assets, regulatory frameworks have become a critical component for ensuring that the cryptocurrency space remains secure and compliant. One of the most important elements in this regulatory framework is AML verification, which stands for Anti-Money Laundering.

Image: https://revbit.net/wp-content/uploads/2024/10/aml-in-crypto-3-1024x640.png

What is AML Verification?

AML (Anti-Money Laundering) verification [https://revbit.net/] refers to a set of procedures and regulations designed to prevent illegal activities such as…