Press release

First-Party Cyber Liability Insurance Market Moving in the Right Direction: Beazley, Chubb, AIG

HTF Market Intelligence published a new research document of 150+pages on "First-Party Cyber Liability Insurance Market Insights, to 2030" with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the First-Party Cyber Liability Insurance market was mainly driven by the increasing R&D spending by leading and emerging player, however latest scenario and economic slowdown have changed complete market dynamics.Some of the key players profiled in the study are AXA XL (United States), CNA Insurance (United States), Beazley (United Kingdom), Chubb (United States), AIG (United States), Hartford (United States), Travelers (United States), BCS Financial (United States), HSB (United States), AmTrust Financial (United States).

According to HTF Market Intelligence, the Global First-Party Cyber Liability Insurance market to witness a CAGR of 24.9% during forecast period of 2024-2030. Global First-Party Cyber Liability Insurance Market Breakdown by Application (Healthcare, Retails, BFSI, IT & Telecommunication, Manufacturing, Others) by Coverage Type (First Party, Lability coverage, Others) by Enterprise size (SMEs, Large Enterprise) and by Geography (North America, South America, Europe, Asia Pacific, MEA). The First-Party Cyber Liability Insurance market size is estimated to increase by USD 50.79 Billion at a CAGR of 24.9% from 2023 to 2030. The report includes historic market data from 2019 to 2023E. Currently, market value is pegged at USD 12.83 Billion.

Make an enquiry to understand outline of study and further possible customization in offering @ https://www.htfmarketintelligence.com/enquiry-before-buy/global-first-party-cyber-liability-insurance-market?utm_source=Alefiya_OpenPR&utm_id=Alefiya

Definition:

First-party cyber liability insurance is a type of insurance policy that provides coverage to a business or organization for losses and damages incurred as a result of a cyber attack or data breach. It is designed to protect the policyholder's own assets, data, and reputation rather than the assets of third parties.

Market Trends:

• Growing Popularity of Digital Channels Among Consumers Due to 27x7

Market Drivers:

• Cyber Security Risk Associated With Online Platform That Hampers The Market.

Market Opportunities:

• Requirement of Ocean Marine Insurance for Sea Vessels that Docks or Offloads in American Ports

The titled segments and sub-section of the market are illuminated below:

The Study Explore the Product Types of First-Party Cyber Liability Insurance Market: First Party, Lability coverage, Others

Key Applications/end-users of First-Party Cyber Liability Insurance Market: Healthcare, Retails, BFSI, IT & Telecommunication, Manufacturing, Others

Book Latest Edition of Global First-Party Cyber Liability Insurance Market Study @ https://www.htfmarketintelligence.com/buy-now?format=1&report=2300?utm_source=Alefiya_OpenPR&utm_id=Alefiya

With this report you will learn:

• Who the leading players are in First-Party Cyber Liability Insurance Market?

• What you should look for in a First-Party Cyber Liability Insurance

• What trends are driving the Market

• About the changing market behaviour over time with strategic view point to examine competition

Also included in the study are profiles of 15 First-Party Cyber Liability Insurance vendors, pricing charts, financial outlook, swot analysis, products specification &comparisons matrix with recommended steps for evaluating and determining latest product/service offering.

List of players profiled in this report: AXA XL (United States), CNA Insurance (United States), Beazley (United Kingdom), Chubb (United States), AIG (United States), Hartford (United States), Travelers (United States), BCS Financial (United States), HSB (United States), AmTrust Financial (United States)

Who should get most benefit from this report insights?

• Anyone who are directly or indirectly involved in value chain cycle of this industry and needs to be up to speed on the key players and major trends in the market for First-Party Cyber Liability Insurance

• Marketers and agencies doing their due diligence in selecting a First-Party Cyber Liability Insurance for large and enterprise level organizations

• Analysts and vendors looking for current intelligence about this dynamic marketplace.

• Competition who would like to benchmark and correlate themselves with market position and standings in current scenario.

Check for discount on Immediate Purchase @ https://www.htfmarketintelligence.com/request-discount/global-first-party-cyber-liability-insurance-market?utm_source=Alefiya_OpenPR&utm_id=Alefiya

Quick Snapshot and Extracts from TOC of Latest Edition

Overview of First-Party Cyber Liability Insurance Market

First-Party Cyber Liability Insurance Size (Sales Volume) Comparison by Type (2024-2030)

First-Party Cyber Liability Insurance Size (Consumption) and Market Share Comparison by Application (2024-2030)

First-Party Cyber Liability Insurance Size (Value) Comparison by Region (2024-2030)

First-Party Cyber Liability Insurance Sales, Revenue and Growth Rate (2024-2030)

First-Party Cyber Liability Insurance Competitive Situation and Current Scenario Analysis

Strategic proposal for estimating sizing of core business segments

Players/Suppliers High Performance Pigments Manufacturing Base Distribution, Sales Area, Product Type

Analyse competitors, including all important parameters of First-Party Cyber Liability Insurance

First-Party Cyber Liability Insurance Manufacturing Cost Analysis

Latest innovative headway and supply chain pattern mapping of leading and merging industry players

Get Detailed TOC and Overview of Report @ https://www.htfmarketintelligence.com/report/global-first-party-cyber-liability-insurance-market

Thanks for reading this article, you can also make sectional purchase or opt-in for regional report by limiting the scope to only North America, ANZ, Europe or MENA Countries, Eastern Europe or European Union.

Contact Us:

Nidhi Bhavsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketintelligence.com

About Us:

HTF Market Intelligence is a leading market research company providing end-to-end syndicated and custom market reports, consulting services, and insightful information across the globe. HTF MI integrates History, Trends, and Forecasts to identify the highest value opportunities, cope with the most critical business challenges and transform the businesses. Analysts at HTF MI focuses on comprehending the unique needs of each client to deliver insights that are most suited to his particular requirements.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release First-Party Cyber Liability Insurance Market Moving in the Right Direction: Beazley, Chubb, AIG here

News-ID: 3517040 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Gold Resources Market Seeking Excellent Growth | Wheaton Precious Metals, Royal …

The Gold Resources Market refers to the global industry involved in the exploration, extraction, processing, refining, trading, and investment of gold resources. It encompasses upstream mining activities, midstream refining operations, and downstream distribution across jewelry, investment, central banking, and industrial applications.

Gold resources include both primary gold deposits (mined from underground and open-pit operations) and secondary sources (recycled gold, electronics, and industrial waste). The market is influenced by geological reserves, mining…

Tourism Digitalization Market Is Going to Boom | Major Giants Amadeus IT Group, …

The Tourism Digitalization Market refers to the global industry focused on the adoption, integration, and commercialization of digital technologies across the travel and tourism value chain to enhance operational efficiency, customer experience, marketing effectiveness, and revenue generation.

Tourism digitalization involves the use of advanced technologies such as cloud computing, artificial intelligence (AI), big data analytics, Internet of Things (IoT), blockchain, mobile applications, and digital payment systems to transform how tourism services…

Daily Newsletters Market Hits New High | Major Giants Mailchimp, Sendinblue, Get …

The Daily Newsletters Market refers to the global industry focused on the creation, distribution, monetization, and management of email-based news publications that are delivered to subscribers on a daily basis. These newsletters curate timely content such as news updates, industry insights, financial reports, marketing trends, technology developments, lifestyle topics, and opinion pieces, tailored to specific audience segments.

Key Players in This Report Include: Mailchimp (USA), Constant Contact (USA), HubSpot (USA), Sendinblue…

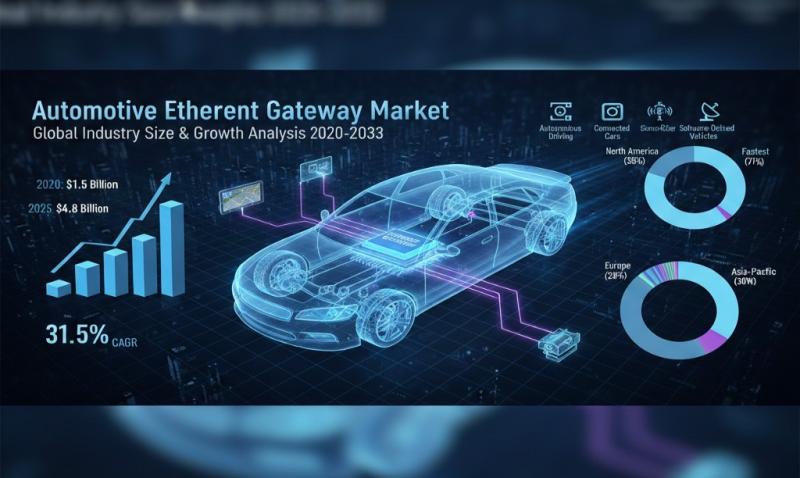

Automotive Ethernet Gateway Market - Global Industry Size & Growth Analysis 2020 …

The latest study released on the Global Automotive Ethernet Gateway Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Automotive Ethernet Gateway study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Consider…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…