Press release

Asset Finance Software Market Forecast 2024-2033: Projected CAGR, Key Drivers, And Trends

The Business Research Company has recently revised its global market reports, now incorporating the most current data for 2024 along with projections extending up to 2033.Asset Finance Software Global Market Report 2024 by The Business Research Company offers comprehensive market insights, empowering businesses with a competitive edge. It includes detailed estimates for numerous segments and sub-segments, providing valuable strategic guidance.

The Market Size Is Expected To Reach $5.47 billion In 2028 At A CAGR Of 8.3% :

The asset finance software market size has grown strongly in recent years. It will grow from $3.63 billion in 2023 to $3.97 billion in 2024 at a compound annual growth rate (CAGR) of 9.5%. The growth in the historic period can be attributed to increasing demand for automation, globalization of businesses, regulatory compliance requirements, rise in asset-backed financing, growing complexity of financial transactions.

The asset finance software market size is expected to see strong growth in the next few years. It will grow to $5.47 billion in 2028 at a compound annual growth rate (CAGR) of 8.3%. The growth in the forecast period can be attributed to increased emphasis on cybersecurity, shift to cloud-based solutions, focus on sustainable finance, cross-industry collaboration, integration with ERP systems. Major trends in the forecast period include technological advancements, blockchain technology adoption, AI and machine learning integration, data analytics and business intelligence, cybersecurity measures, globalization and market expansion.

Request A Sample Of This Report -

https://www.thebusinessresearchcompany.com/sample.aspx?id=10799&type=smp

Asset Finance Software Market Major Segments

The asset finance software market covered in this report is segmented -

1) By Asset Type: Hard Assets, Soft Assets

2) By Deployment: Cloud, On-Premise

3) By Enterprise Type: Large Enterprises, Small And Medium Enterprises

4) By End-User: Transportation, Information Technology (IT) And Related Services, Construction, Agriculture, Medical Equipment, Banks, Industrial And Manufacturing Equipment, Other End Users

Key Driver - Business Expansion And New Finance Models Fueling Asset Finance Software Market Growth

The expansion of new business finance models is expected to propel the growth of the asset finance software market going forward. Business expansion occurs when real gross domestic product (GDP) increases for two or more consecutive quarters, going from a low point to a high point. Asset finance software helps branded equipment, and new commercial models help businesses find the right equipment for their needs by providing information about different types of equipment, including their features, prices, and availability. For instance, in May 2023, according to the Finance & Leasing Association (FLA), a UK-based industry association representing the asset finance and leasing sectors, total asset finance new business reported a 14% increase in March 2023 compared to the corresponding month in 2022. Further, in Q1 2023, new business showed a 14% rise compared to Q1 2022. In addition, the business new car and commercial vehicle finance sectors witnessed substantial growth, with new business soaring by 54% and 23%, respectively, compared to March 2022. Therefore, the rise in demand for branded equipment and new commercial models is driving the growth of the asset finance software market.

Customise This Report As Per Your Requirements -

https://www.thebusinessresearchcompany.com/Customise?id=10799&type=smp

Prominent Trend - Tech Advancements Propel Innovation In Asset Finance Software

Technological advancements are a key trend gaining popularity in the asset finance software market. Major companies operating in the asset finance software market are adopting new technologies to sustain their position in the market. For instance, in September 2022, Alfa Systems, a UK-based software provider, launched Version 5.7 of Alfa Systems, an asset finance software platform. The Alfa System adopts a cloud-based technology approach and introduces new features in key areas, including user experience, charging, billing, and configuration. Additionally, the platform has undergone updates to enhance existing functionalities such as wholesale, integration, and reporting solutions. Alfa Systems aims to facilitate seamless integration with other software systems and smooth data exchange across different platforms by leveraging cloud technology.

Asset Finance Software Market Players

Major companies operating in the asset finance software market report are General Electric Company, The Boeing Company, International Business Machines Corporation, Oracle Corporation, ABB, CGI Inc., Bytzsoft Technologies Pvt. Ltd., Lufthansa Technik AG, Sopra Steria, CHG-MERIDIAN, IFS AB (Industrial and Financial Systems), ieDigital, NXGrowth, Odessa Technologies, Swiss Aviation Software, Alfa Financial Software Limited, Banqsoft, Ramco Systems, NetSol Technologies, Flatirons Solutions Inc., Pacer Systems, Lendscape Limited, Rusada Aviation Software, Ausloans Finance Group, Core Systems, Tracware Limited, Financial Software & Solutions, FIS, Aviation InterTec Services, Aerosoft Systems Inc.

View The Full Report Here -

https://www.thebusinessresearchcompany.com/report/asset-finance-software-global-market-report

Largest And Fastest Growing Region In The Market

North America was the largest region in the global asset finance software market size in 2023. Asia-Pacific is expected to be the fastest-growing region in the forecast period. The regions covered in the asset finance software market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

The Table Of Content For The Market Report Include:

1. Executive Summary

2. Asset Finance Software Market Report Structure

3. Asset Finance Software Market Trends And Strategies

4. Asset Finance Software Market - Macro Economic Scenario

5. Asset Finance Software Market Size And Growth

…..

27. Asset Finance Software Market Competitor Landscape And Company Profiles

28. Key Mergers And Acquisitions

29. Future Outlook and Potential Analysis

30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Learn More About The Business Research Company

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. With a global presence, TBRC's consultants specialize in diverse industries such as manufacturing, healthcare, financial services, chemicals, and technology, providing unparalleled insights and strategic guidance to clients worldwide.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Asset Finance Software Market Forecast 2024-2033: Projected CAGR, Key Drivers, And Trends here

News-ID: 3511609 • Views: …

More Releases from The Business Research Company

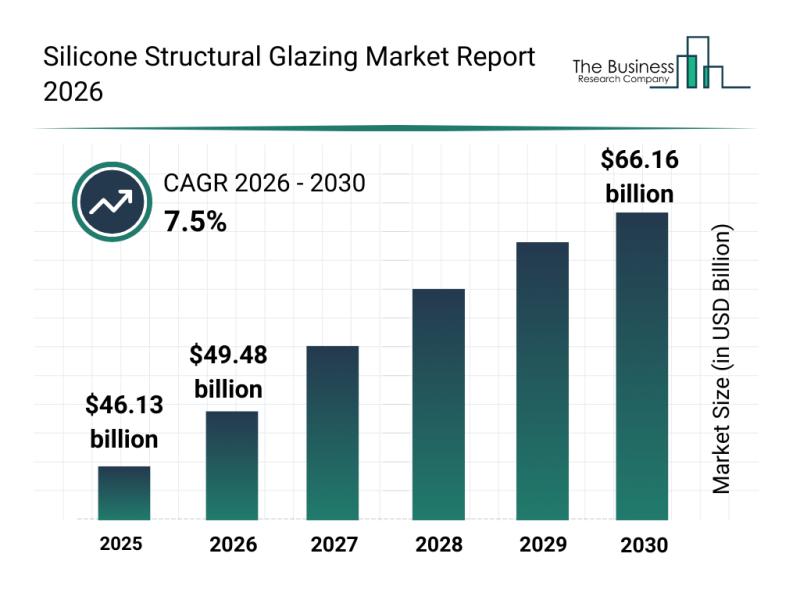

Leading Companies Solidify Their Presence in the Silicone Structural Glazing Mar …

The silicone structural glazing market is positioned for significant expansion in the coming years, driven by advances in building technology and increased environmental awareness. This sector is evolving rapidly as demand grows for more energy-efficient and aesthetically appealing architectural solutions. Let's explore the market's current size, key players, emerging trends, and the main segments that are shaping its future.

Silicone Structural Glazing Market Value Forecast Through 2030

The market for silicone…

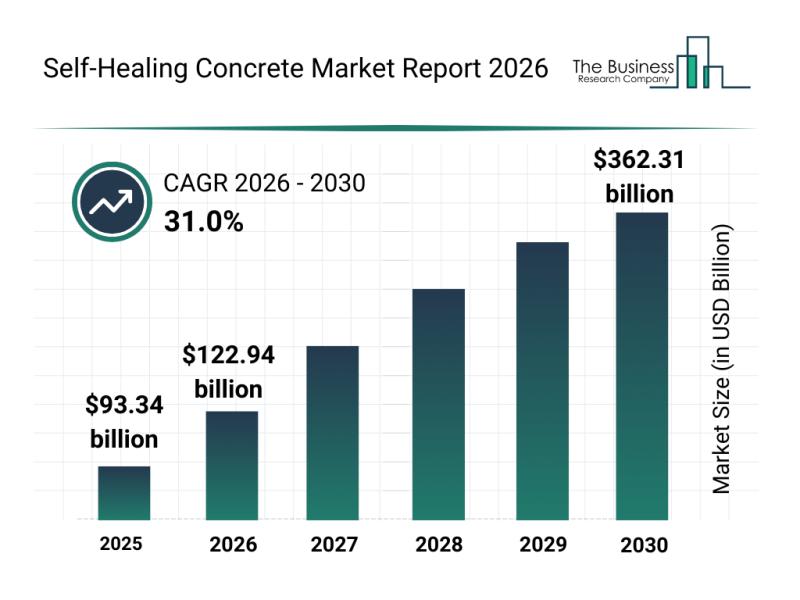

Future Prospects: Key Trends Shaping the Self-Healing Concrete Market up to 2030

The self-healing concrete market is capturing significant attention as innovations and sustainability demands rise in construction. This sector is set to experience remarkable growth due to advancements in materials and technology, shaping the future of durable and intelligent infrastructure solutions. Let's explore the market's size, key players, emerging trends, and segment outlook to understand its trajectory.

Projected Market Size and Growth Prospects for the Self-Healing Concrete Market

The self-healing concrete market…

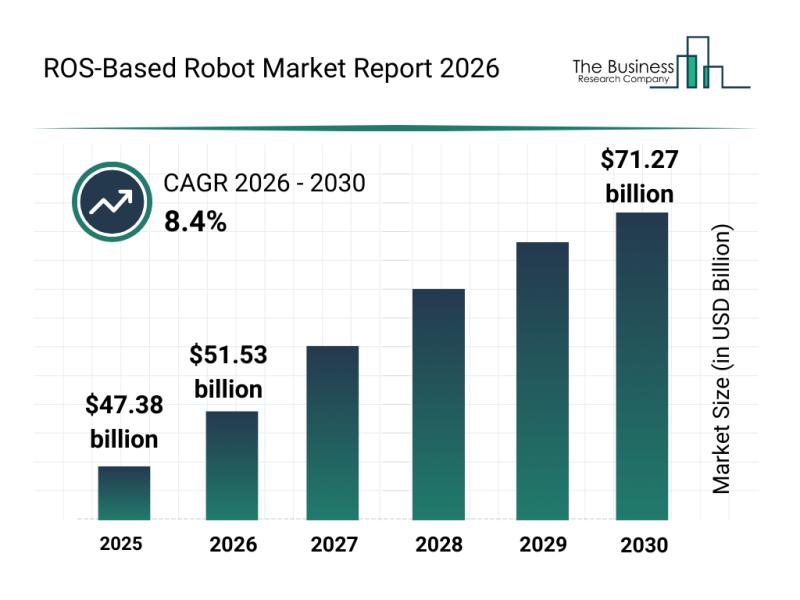

Analysis of Key Market Segments Driving the ROS-Based Robot Industry

The ROS-based robot market is positioned for substantial growth as robotics technology continues to advance rapidly. With increasing innovation in software, hardware, and AI integration, this sector is set to transform multiple industries by 2030. Below, we explore the market's future size, leading companies, key trends, and segmentation details to understand its evolving landscape.

Projected Market Size and Expansion of the ROS-Based Robot Market

The ROS-based robot market is anticipated to…

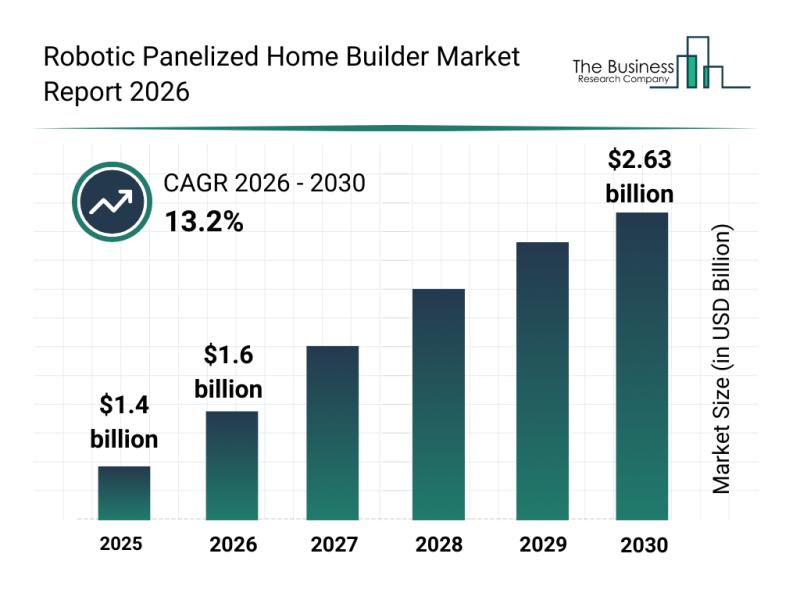

Global Trends Overview: The Rapid Evolution of the Robotic Panelized Home Builde …

The robotic panelized home builder market is positioned for impressive growth in the coming years as automation and robotics increasingly transform construction processes. Driven by technological advancements and expanding prefab housing projects, this market is set to reshape how homes are built with greater speed and efficiency. Let's explore the market's size, leading companies, emerging trends, and key segments that are shaping its future.

Strong Growth Forecast for the Robotic Panelized…

More Releases for Soft

Soft Robotics Grippers Market 2026-2033: Key Trends, Opportunities, and Growth F …

The latest report titled "Soft Robotics Grippers Market" Trends, Share, Size, Growth, Opportunity, and Forecast 2026-2033. offering a comprehensive and in-depth analysis of the industry. The report provides key insights into current market trends, growth drivers, challenges, and opportunities shaping the market landscape. It also includes a thorough competitor analysis, regional market evaluation, and recent technological or strategic developments influencing the market trajectory.

➤ Currently, the Soft Robotics Grippers Market holds…

Soft Robotic Gripper Market Size, Trends Analysis 2033 by Key Vendors- SoftGripp …

USA, New Jersey: According to Verified Market Reports analysis, the global Soft Robotic Gripper Market sizewas valued at USD 1.2 Billion in 2024 and is estimated to reach USD 5.7 Billion by 2033, growing at a CAGR of 18.6% from 2026 to 2033.

How AI and Machine Learning Are Redefining the Future of the Soft Robotic Gripper Market?

AI and machine learning are accelerating a new era of intelligent automation, enabling soft…

Soft Drink Concentrates Market

Introduction

The soft drink concentrates market plays a pivotal role in the global beverage industry. These concentrates are primarily used to prepare soft drinks, offering a cost-effective and efficient way for manufacturers to produce various beverages. Soft drink concentrates are essentially flavored syrups or powders that, when mixed with water or carbonated water, create popular soft drinks. The market for these concentrates has seen remarkable growth in recent years, driven by…

Soft Robot Technology Market Upcoming Trend & Positions 2027 | Cyberdyne, Soft R …

Soft Robot Technology Market Strengths, Weaknesses, Opportunities, and Threats analysis.

Demanding Market Research Report on Global Soft Robot Technology Market conducted by a team of industry specialists. The report covers briefly the products or services in the market and their application. The report also provides data on the technological advancements taking place in the Soft Robot Technology market, helping the market vendors to increase their business productivity and operational efficiency. The…

Soft Skills Management Market - Increasing Demand For Cloud-Based Soft Skill Tra …

According to a new market report published by Transparency Market Research, the global soft skills management market was valued at US$ 11,289.7 Mn in 2016 and is expected to expand at a CAGR of 11.9% from 2018 to 2026, reaching US$ 33,736.1 Mn by the end of the forecast period. According to the report, the global soft skills management market will continue to be influenced by a range of macroeconomic…

Suma Soft

Texas (USA), Canada (Toronto) & India (Business Network)— Suma Soft’s BPO for companies in USA, Canada and UK efficiently streamline business processes. Suma Soft has developed an integrated back-office system that assists these companies giving them round the clock support.

Credibility & Certification :

Suma Soft is an ISO 27001 and 9001 certified company which gives paramount importance to security, accuracy and quality while delivering BPO support services. We have a…