Press release

Corporate Digital Banking Market Gaining Momentum with Positive External Factors

HTF Market Intelligence recently released a survey document on Corporate Digital Banking market and provides information and useful stats on market structure and size. The report is intended to provide market intelligence and strategic insights to help decision-makers take sound investment decisions and identify potential gaps and growth opportunities. Additionally, the report also identifies and analyses changing dynamics, and emerging trends along with essential drivers, challenges, opportunities, and restraints in the Corporate Digital Banking market. Some of the companies listed in the study from the complete survey list are Appway AG, (Switzerland), Cor Financial Solution Ltd. (UK), Edgeverve, (India), FIS, (US), NCino, (US), Fiserv, Inc. (US), Oracle Corporation, (US), SAP SE, (Germany), Temenos, (Switzerland), Vsoft Corporation Bank (US).According to HTF Market Intelligence, the Corporate Digital Banking market size is estimated to increase by USD 29.05 Billion at a CAGR of 7.6% from 2023 to 2030. Currently, the market value is pegged at USD 14.2 Billion.

Get inside Scoop of Corporate Digital Banking Market @ https://www.htfmarketintelligence.com/sample-report/global-corporate-digital-banking-market?utm_source=Krati_OpenPR&utm_id=Krati

Definition:

Corporate Digital banking solutions allow banks to provide flexible and convenient management of customers finances to corporate sector. It provides services in all devices which reduce the development and maintenance costs. Corporate digital banking solution offers various services such as cost optimization, real time interaction, personalized customer experience, and new revenue streams. Moreover, the solution can help to meet increasing customer demand, growing regulations, new banking competition and reduce costs pressures. These factors are increasing market growth.

Market Trends:

Adoption of Electronic and Mobile Payment Solutions

Market Drivers:

Change in Customer Behavior is Fueling the Market

Rising Investments in Fintech is affecting the Market Positively

Market Opportunities:

Supporting Government Policies is Boosting the Market Growth

Growing E-Commerce Industry

Market Leaders & Development Strategies

On 6th December 2022, Wells Fargo Launches New Digital Banking Platform Vantage for Commercial and Corporate Clients. The Commercial Electronic Office, or CEO Portal, of the bank has been upgraded by Wells Fargo's brand-new Vantage digital banking software. By utilising AI and machine learning, the new service aims to provide Wells Fargo's commercial, corporate, and investment banking customers with a more individualised experience. Vantage adapts and enhances its capacity for personalization as clients use the technology, using both enabling and enabling technologies to provide suggestions and actionable insights based on the unique needs of clients.

Get Complete Scope of Work @ https://www.htfmarketintelligence.com/report/global-corporate-digital-banking-market

The titled segments and sub-section of the market are illuminated below:

In-depth analysis of Corporate Digital Banking market segments by Types: Retail Banking, Investment banking, Corporate Banking, Others

Detailed analysis of Corporate Digital Banking market segments by Applications:

Major Key Players of the Market: Appway AG, (Switzerland), Cor Financial Solution Ltd. (UK), Edgeverve, (India), FIS, (US), NCino, (US), Fiserv, Inc. (US), Oracle Corporation, (US), SAP SE, (Germany), Temenos, (Switzerland), Vsoft Corporation Bank (US)

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

• The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

• North America (United States, Mexico & Canada)

• South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

• Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

• Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Objectives of the Report:

• -To carefully analyse and forecast the size of the Corporate Digital Banking market by value and volume.

• -To estimate the market shares of major segments of the Corporate Digital Banking market.

• -To showcase the development of the Corporate Digital Banking market in different parts of the world.

• -To analyse and study micro-markets in terms of their contributions to the Corporate Digital Banking market, their prospects, and individual growth trends.

• -To offer precise and useful details about factors affecting the growth of the Corporate Digital Banking market.

• -To provide a meticulous assessment of crucial business strategies used by leading companies operating in the Corporate Digital Banking market, which include research and development, collaborations, agreements, partnerships, acquisitions, mergers, new developments, and product launches.

The Corporate Digital Banking Market is segmented by Type (Retail Banking, Investment banking, Corporate Banking, Others) and by Geography (North America, South America, Europe, Asia Pacific, MEA).

Purchase Latest Edition Now @ https://www.htfmarketintelligence.com/buy-now?format=1&report=2224?utm_source=Krati_OpenPR&utm_id=Krati

Key takeaways from the Corporate Digital Banking market report:

- Detailed consideration of Corporate Digital Banking market-particular drivers, Trends, constraints, Restraints, Opportunities, and major micro markets.

- Comprehensive valuation of all prospects and threats in the

- In-depth study of industry strategies for growth of the Corporate Digital Banking market-leading players.

- Corporate Digital Banking market latest innovations and major procedures.

- Favourable dip inside Vigorous high-tech and market latest trends remarkable the Market.

- Conclusive study about the growth conspiracy of Corporate Digital Banking market for forthcoming years.

Enquire for customization in Report @ https://www.htfmarketintelligence.com/enquiry-before-buy/global-corporate-digital-banking-market?utm_source=Krati_OpenPR&utm_id=Krati

Major highlights from Table of Contents:

Corporate Digital Banking Market Study Coverage:

• It includes major manufacturers, emerging player's growth story, and major business segments of Corporate Digital Banking market, years considered, and research objectives. Additionally, segmentation on the basis of the type of product, application, and technology.

• Corporate Digital Banking Market Executive Summary: It gives a summary of overall studies, growth rate, available market, competitive landscape, market drivers, trends, and issues, and macroscopic indicators.

• Corporate Digital Banking Market Production by Region Corporate Digital Banking Market Profile of Manufacturers-players are studied on the basis of SWOT, their products, production, value, financials, and other vital factors.

Key Points Covered in Corporate Digital Banking Market Report:

• Corporate Digital Banking Overview, Definition and Classification Market drivers and barriers

• Corporate Digital Banking Market Competition by Manufacturers

• Corporate Digital Banking Capacity, Production, Revenue (Value) by Region (2023-2029)

• Corporate Digital Banking Supply (Production), Consumption, Export, Import by Region (2023-2029)

• Corporate Digital Banking Production, Revenue (Value), Price Trend by Type {Retail Banking, Investment banking, Corporate Banking, Others}

• Corporate Digital Banking Market Analysis by Application {}

• Corporate Digital Banking Manufacturers Profiles/Analysis Corporate Digital Banking Manufacturing Cost Analysis, Industrial/Supply Chain Analysis, Sourcing Strategy and Downstream Buyers, Marketing

• Strategy by Key Manufacturers/Players, Connected Distributors/Traders Standardization, Regulatory and collaborative initiatives, Industry road map and value chain Market Effect Factors Analysis.

Major questions answered:

• What are influencing factors driving the demand for Corporate Digital Banking near future?

• What is the impact analysis of various factors in the Global Corporate Digital Banking market growth?

• What are the recent trends in the regional market and how successful they are?

• How feasible is Corporate Digital Banking market for long-term investment?

Thanks for reading this article; you can also get individual chapter-wise sections or region-wise report versions like North America, MINT, BRICS, G7, Western / Eastern Europe, or Southeast Asia. Also, we can serve you with customized research services as HTF MI holds a database repository that includes public organizations and Millions of Privately held companies with expertise across various Industry domains.

Craig Francis (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketreport.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to empower businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Corporate Digital Banking Market Gaining Momentum with Positive External Factors here

News-ID: 3506595 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Precision Medicine Certification Market Hits New High | Major Giants Harvard Med …

The latest study released on the Global Precision Medicine Certification Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Precision Medicine Certification study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Major…

Satellite-powered Classrooms Market May See a Big Move | Major Giants OneWeb, Hu …

The latest study released on the Global Satellite-powered Classrooms Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Satellite-powered Classrooms study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Major companies profiled…

Floating Schools Innovation Market to Expand Rapidly Over Next Decade| Shidhulai …

The latest study released on the Global Floating Schools Innovation Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Floating Schools Innovation study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Major…

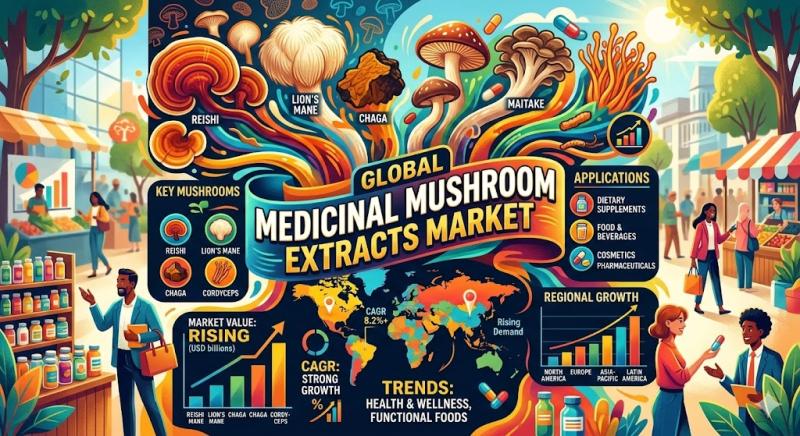

Medicinal Mushroom Extracts Market to Expand Rapidly Over Next Decade| Swanson, …

The latest study released on the Global Medicinal Mushroom Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Medicinal Mushroom study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Major companies profiled…

More Releases for Cor

3D Concrete Printing Market Is Going to Boom |• Vertico • ICON • Apis Cor

Worldwide Market Reports has recently published an in-depth research study titled "3D Concrete Printing Market Size and Forecast 2026-2033: Analysis by Manufacturers, Key Regions, Product Types, and Applications." The report is developed using a robust blend of primary and secondary research methodologies, ensuring accuracy, reliability, and comprehensive market coverage. Leveraging historical data and forward-looking projections, the study presents a detailed evaluation of the 3D Concrete Printing market growth, analyzing trends…

Robotics-Assisted Telesurgery Market Next Big Thing | Hansen Medical, Stryker Co …

Advance Market Analytics published a new research publication on "Robotics-Assisted Telesurgery Market Insights, to 2030" with 232 pages and enriched with self-explained Tables and charts in presentable format. In the Study you will find new evolving Trends, Drivers, Restraints, Opportunities generated by targeting market associated stakeholders. The growth of the Robotics-Assisted Telesurgery market was mainly driven by the increasing R&D spending across the world.

Get inside Scoop of the report, request…

3D Printing In Construction Market Insights, Forecast to 2031 Apis Cor, Winsun.

A new Report by DataM Intelligence, titled "3D Printing In Construction Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2031,"" offers a comprehensive analysis of the industry, which comprises insights on the 3D Printing In Construction market analysis. The report also includes competitor and regional analysis, and contemporary advancements in the market.

This report has a complete table of contents, figures, tables, and charts, as well as insightful analysis. The…

AI Camera Market Next Big Thing | Huawei Technology, Sony Cor., HikVision, EZVIZ

Latest Study on Industrial Growth of Worldwide AI Camera Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Worldwide AI Camera market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends…

Online Banking Market Worth Observing Growth | ACI Worldwide, Cor Financial Solu …

The latest released on Global Online Banking Market delivers comprehensive data ecosystem with 360° view of customer activities, segment-based analytics-and-data to drive opportunities of evolving Online Banking marketplace and future outlook to 2026. It includes integrated insights of surveys conducted with executives and experts from leading institutions across various countries. Some of the listed companies profiled in the report are Fiserv, Inc, Capital Banking Solutions, ACI Worldwide, Cor Financial Solutions…

BPO Business Analytics Market Update - The Growth Trend Continues | Fujikin, MET …

A latest survey on Global BPO Business Analytics Market is conducted to provide hidden gems performance analysis. The study is a perfect mix of qualitative and quantitative information covering market size breakdown of revenue and volume (if applicable) by important segments. The report bridges the historical data from 2013 to 2018 and forecasted till 2025*. Some are the key & emerging players that are part of coverage and have being…