Press release

Virtual Cards Market to Revolutionize Digital Transactions, Projected to Reach New Heights by 2030

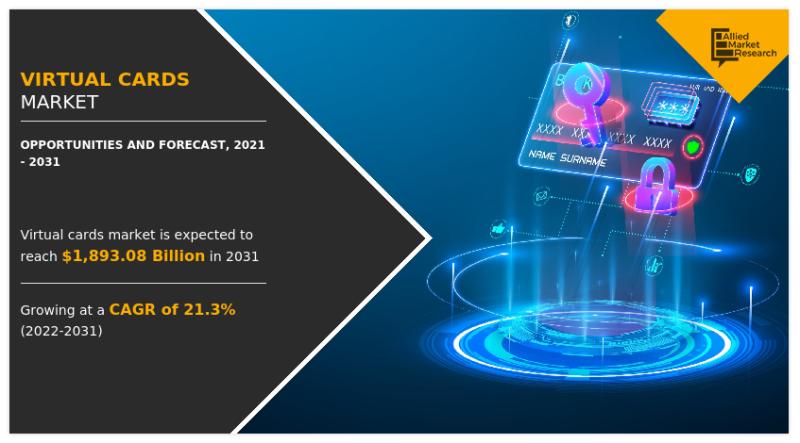

According to the report published by Allied Market Research, the global virtual cards market was estimated at $281.22 billion in 2021 and is expected to hit $1.89 trillion by 2031, registering a CAGR of 21.3% from 2022 to 2031.➡️𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 :

https://www.alliedmarketresearch.com/request-sample/A17176

The report provides a detailed analysis of the top investment pockets, top winning strategies, drivers & opportunities, market size & estimations, competitive landscape, and evolving market trends. The market study is a helpful source of information for the frontrunners, new entrants, investors, and shareholders in crafting strategies for the future and heightening their position in the market.

Covid-19 Scenario

Throughout the pandemic, most banks across the world offered their services online.

The trend of using virtual cards experienced a steep incline, since customers found it suitable to use virtual cards for making any transactions without touching any surface, such as card swipe machines, which are regularly touched by various people, and could be potentially contaminated with the virus.

This is why the demand for virtual cards increased significantly, thus impacting the global virtual cards market positively.

The global market virtual cards market is analyzed across end user, product type, industry vertical, and region. The report takes in an exhaustive analysis of segments and their sub-segments with the help of tabular and graphical representation. Investors and market players can benefit from the breakdown and devise stratagems based on the highest revenue-generating and fastest-growing segments stated in the report.

➡️𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐖𝐞 𝐨𝐟𝐟𝐞𝐫 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐬 𝐩𝐞𝐫 𝐲𝐨𝐮𝐫 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭 : https://www.alliedmarketresearch.com/request-for-customization/A17176

Based on end user, the business segment contributed to around three-fourths of the global virtual cards market revenue in 2021, and is expected to lead the trail by the end of 2031. The individuals segment, on the other hand, would exhibit the fastest CAGR of 23.1% throughout the forecast period.

Based on product type, the B2B virtual card segment contributed to more than two-fifths of the global virtual cards market revenue in 2021, and is expected to dominate by 2031. At the same time, the B2C POS virtual cards segment would showcase the fastest CAGR of 25.4% throughout the forecast period. The B2C remote payment virtual cards segment is also assessed in the study.

Based on industry vertical, the media and entertainment segment nearly one-fourth of the total market revenue in 2021, and is expected to dominate by 2031. The advertising segment, simultaneously, would manifest the fastest CAGR of 26.9% throughout the forecast period. The other segments analyzed in the report take in hospitality, consumer goods, energy & utilities, and education.

Based on region, the market across North America generated nearly two-fifths of the total market revenue in 2021, and is anticipated to retain the lion's share by 2031. The Asia-Pacific region, at the same time, would manifest the fastest CAGR of 24.1% during the forecast period. The other regions studied in the report include LAMEA and Europe.

➡️𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.alliedmarketresearch.com/purchase-enquiry/A17176

The key market players analyzed in the global virtual cards market report include BTRS Holdings Inc. dba Billtrust, Bento Technologies Inc., Revolut Ltd., HSBC Group, Citigroup Inc., Capital One, DBS Bank Ltd., ePayService, JPMorgan Chase & Co., American Express, Mastercard, Marqeta, Inc., Stripe, Inc., Standard Chartered Bank, Wise Payments Limited, WEX Inc., and State Bank of India, These market players have embraced several strategies including partnership, expansion, collaboration, joint ventures, and others to highlight their prowess in the industry. The report is helpful in formulating the business performance, product portfolio, operating segments, and developments by the top players.

Market Growth Drivers

Increase in Online Shopping: Surge in e-commerce and digital transactions.

Adoption by Businesses: Growing use in corporate travel and expense management.

Technological Advancements: Innovations in fintech and payment technologies.

Consumer Demand for Security: Rising concerns over data breaches and payment fraud.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the virtual cards market analysis from 2021 to 2031 to identify the prevailing virtual cards market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the virtual cards market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global virtual cards market trends, key players, market segments, application areas, and market growth strategies.

➡️𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @

https://www.alliedmarketresearch.com/checkout-final/c831b04b7b0983400e7497145a4ec5c4?utm_source=AMR&utm_medium=research&utm_campaign=P19623

Key Market Segments

End User

Businesses

Individuals

Product Type

B2B Virtual Card

B2C Remote Payment Virtual Cards

B2C POS Virtual Cards

Industry Vertical

Media and Entertainment

Hospitality

Consumer Goods

Energy and Utilities

Advertising

Education

Others

By Region

North America

U.S.

Canada

Europe

United Kingdom

Germany

France

Italy

Spain

Netherlands

Rest of Europe

Asia-Pacific

South Korea

Rest of Asia-Pacific

China

India

Japan

Australia

LAMEA

Latin America

Middle East

Africa

➡️𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞:

Money Transfer Agencies Market https://www.alliedmarketresearch.com/money-transfer-agencies-market-A06935

Fuel Cards Market https://www.alliedmarketresearch.com/fuel-cards-market

India Factoring Services Market https://www.alliedmarketresearch.com/india-factoring-services-market-A21885

RegTech Market https://www.alliedmarketresearch.com/regtech-market

Decentralized Finance Market https://www.alliedmarketresearch.com/decentralized-finance-market-A200418

Robo-advisory Market https://www.alliedmarketresearch.com/robo-advisory-market

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Virtual Cards Market to Revolutionize Digital Transactions, Projected to Reach New Heights by 2030 here

News-ID: 3505847 • Views: …

More Releases from www.alliedmarketresearch.com

Pet Insurance Market Soars: Projected to Hit $38.3 Billion by 2033 as Demand for …

According to a new report published by Allied Market Research, titled, "Pet Insurance Market, By Policy Coverage (Accident Only, Accident and Illness, and Others), By Animal Type (Dogs, Cats, and Others), and By Sales Channel (Agency, Broker, and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033". The pet insurance market was valued at $10.10 billion in 2023, and is estimated to reach $38.3 billion by 2033, growing at a CAGR…

Manual Spray Guns Market to Hit $2.6 Billion by 2032 | Key Growth Drivers & Oppo …

Prime determinants of growth

The demand for manual spray guns, which are mostly used for painting consumer durables, has increased because of this need, particularly in developing nations like India, China, and Vietnam. Additionally, there is a greater need for manual spray guns from car manufacturers due to the rising demand for automobiles around the world, particularly in industrialized nations like Europe and North America.

Download PDF Sample Report: www.alliedmarketresearch.com/request…ple/111362

Due to…

Hygienic Cladding Market Poised for Growth: Global Trends & Opportunities 2023-2 …

According to the report, the global hygienic cladding market generated $2.8 billion in 2022, and is anticipated to generate $6 billion by 2032, rising at a CAGR of 8.3% from 2023 to 2032.

Prime Determinants of Growth

The increased awareness & demand for health-related products, the increasing need for safe & healthy environments in healthcare facilities, and hygienic wall cladding's affordability & durability than traditional tiling methods are the factors expected to…

AI in Insurance Market Poised to Reach $45.74 Bn Globally by 2031, Soaring at a …

Global Opportunity Analysis and Industry Forecast, 2021-2031". According to the report, the global AI in insurance industry generated $2.74 billion in 2021, and is anticipated to generate $45.74 billion by 2031, witnessing a CAGR of 32.5% from 2022 to 2031.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A11615

Higher deployment cost of AI, advanced machine learning, and lack of skilled labor hamper the market growth. On the contrary, surge in government initiatives…

More Releases for Card

Gift Card and Incentive Card Market Set for Explosive Growth | National Gift Car …

A new business intelligence report released by AMA with title "Gift Card and Incentive Card Market" has abilities to raise as the most significant market worldwide as it has remained playing a remarkable role in establishing progressive impacts on the universal economy. The Global Gift Card and Incentive Card Market Report offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through…

IC Card/Smart Card Market 2022 | Detailed Report

The IC Card/Smart Card research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the IC Card/Smart Card research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope, market overview, and driving force.

Download FREE Sample Report…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future.

A new report published by Allied Market Research, titled, Prepaid Card Market…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future

Prepaid Card Market is projected to grow at a CAGR of 22.7%…

Card Intelligent Lock Market Report 2018: Segmentation by Type (Magnetic card Lo …

Global Card Intelligent Lock market research report provides company profile for Tri-circle, Dessmann, Royalwand, Bangpai, ZKTeco, Schlage, KEYLOCK, Yale, Tenon, KAADAS, BE-TECH and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also…

Prepaid Card Market Report 2018: Segmentation by Card Type (Single-purpose prepa …

Global Prepaid Card market research report provides company profile for Green Dot Corporation, NetSpend Holdings, Inc., H&R Block Inc., American Express Company, JPMorgan Chase & Co., PayPal Holdings, Inc., BBVA Compass Bancshares, Inc. and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and…