Press release

Monsoon Insurance Market Trends (2023-2032): Evaluating Suppliers' Bargaining Power

Protecting and insuring certain things such as cars or vehicles and many others in a particular season against the risks associated with the season are referred to as monsoon insurance. Huge monsoon floods have become all too common, wreaking havoc on communities. It's critical to protect valuables from the dangers of flooding. Furthermore, during the holiday season, a variety of health problems become more prevalent. So, customers can be protected from financial losses by having a safety net of appropriate insurance coverage. Moreover, the monsoon season can bring a slew of waterborne diseases and viral infections, as well as the risk of property damage from heavy rains or flooding. Therefore, the surge in demand for insurance has grown significantly, which is expected to boost the growth of the monsoon insurance market in the upcoming years.🔸𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂: https://www.alliedmarketresearch.com/request-toc-and-sample/15118

The Monsoon Insurance Market is segmented on the basis of Type, Application, Distribution Channel, Enterprise Size, and Region. Based on type, the market is divided into Motor Insurance[Depreciation Cover, Engine Protector, and 24*7 Spot Assistant], Health Insurance, Personal Accident Insurance and Home Insurance. In terms of application, the market is categorized into Personal and Commercial. On the basis of Distribution channels, the market is divided into Agents, Brokers, Retailer and Other Intermediaries. Geographically, the market is analyzed across several regions such as North America, Europe, Asia-Pacific, and Latin America, Middle East & Africa (LAMEA).

COVID-19 scenario analysis

• As a result of the COVID-19 pandemic, most people were confined to their homes as lockdown was declared in every country, and work from office was shifted to work from home.

• Since the COVID-19 pandemic has thrown the world into chaos and one of the notable changes that has emerged as the 'new normal' is home working. • Consumers and insurers alike are reevaluating the value of traditional motor insurance policies under monsoon insurance as a result of the decrease in driving observed across the industry.

Top impacting factors: market scenario analysis, trends, drivers, and impact analysis

Increased adoption of health insurance and rise in home insurance plans are driving the growth of the market. In addition, the significant adoption of motor insurance plays a major role in fueling the growth of the market. However, high premium rates might restrict the growth of the market. On the contrary, increased adoption of monsoon insurance among developed countries is expected to provide lucrative opportunities to the market in the upcoming years.

🔸𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐖𝐞 𝐩𝐫𝐨𝐯𝐢𝐝𝐞 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐬 𝐩𝐞𝐫 𝐲𝐨𝐮𝐫 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭: https://www.alliedmarketresearch.com/request-for-customization/15118

The global monsoon insurance market trends are as follows:

Increased adoption of health insurance:

While the monsoon provides much-needed relief from the heat, it also brings with it a slew of health issues, including a slew of airborne and waterborne diseases. Although anyone can become a victim of these diseases, it is important to realize that the treatment of these diseases can put a significant dent in one's wallet. Furthermore, medical costs are rapidly rising, with at least a 15% annual increase in medical inflation. As a result, it is necessary to have adequate health insurance coverage that will cover hospitalization costs, thereby lowering out-of-pocket healthcare costs. In addition, today's insurers offer customized health insurance plans for vector-borne diseases that occur during the season. Therefore, the increased adoption of health insurance is driving the growth of the monsoon insurance market during the forecast period.

Rise in adoption of home insurance plans:

People invest their life savings & pay huge EMIs to buy a house, which is one of the most significant financial investments they make in their lives. Many people, however, do not believe it is necessary to protect and insure it. In the event of a flood, comprehensive home insurance can protect not only the structure but also the contents of the home. Furthermore, flooding can cause irreversible damage to all of their valuables. It can also harm paint, electrical fittings, and other household items. In such a case, the people may have to rebuild their homes from the ground up, which is where home insurance comes in handy. It compensates for losses or damages to property or contents as a result of a calamity. Therefore, the rise in the adoption of home insurance plans is expected to boost the growth of the monsoon insurance market during the forecast period.

Key benefits of the report:

• This study presents an analytical depiction of the global monsoon insurance market along with the current trends and future estimations to determine the imminent investment pockets.

• The report presents information related to key drivers, restraints, and opportunities along with a detailed analysis of the market share.

• The current market is quantitatively analyzed to highlight the global monsoon insurance market growth scenario.

• Porter's five forces analysis illustrates the potency of buyers & suppliers in the market.

• The report provides a detailed market analysis depending on the present and future competitive intensity of the market.

Questions answered in the monsoon insurance market research report:

• Which are the leading players active in the global monsoon insurance market?

• What would be the detailed impact of COVID-19 on the global monsoon insurance market?

• What are current trends that would influence the market in the next few years?

• What are the driving factors, restraints, and opportunities of the global monsoon insurance market?

• What are the projections for the future that would help in taking further strategic steps?

🔸𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.alliedmarketresearch.com/purchase-enquiry/15118

Monsoon Insurance Market Report Highlights

By Type

• Motor Insurance

• Health Insurance

• Personal Accident Insurance

• Home Insurance

• End Point Security

• Cloud security

• Others

By Application

• Personal

• Commercial

By Distribution Channel

• Agent

• Broker

• Retailer

• Other Intermediaries

By Enterprise Size

• Large Enterprise

• Small & Medium Enterprises

By Region

• North America (U.S., Canada)

• Europe (UK, Germany, France, Spain, Italy, Rest of Europe)

• Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

• LAMEA (Latin America, Middle East, Africa)

Key Market Players: Trimble Inc., Telogis Inc, Tom Tom Telematics BV, Verizon Enterprise Solutions Inc., Cerner Corporation, Optum Inc., Sierra Wireless Inc, Conifer Health Solutions LLC, Cognizan, McKesson Corporation

🔸𝐓𝐨𝐩 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬:

Trade Finance Market https://www.alliedmarketresearch.com/trade-finance-market

Proximity Payment Market https://www.alliedmarketresearch.com/proximity-payment-market-A10042

QR Codes Payment Market https://www.alliedmarketresearch.com/qr-codes-payment-market-A13075

Wealth Management Market https://www.alliedmarketresearch.com/wealth-management-market-A13068

Business Travel Insurance Market https://www.alliedmarketresearch.com/business-travel-insurance-market

Finance Cloud Market https://www.alliedmarketresearch.com/finance-cloud-market-A12545

David Correa

1209 Orange Street, Corporation Trust Center, Wilmington, New Castle, Delaware 19801 USA.

Int'l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality "Market Research Reports" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients in making strategic business decisions and achieving sustainable growth in their respective market domains.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms the utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high-quality data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of the domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Monsoon Insurance Market Trends (2023-2032): Evaluating Suppliers' Bargaining Power here

News-ID: 3505563 • Views: …

More Releases from Allied Market Research

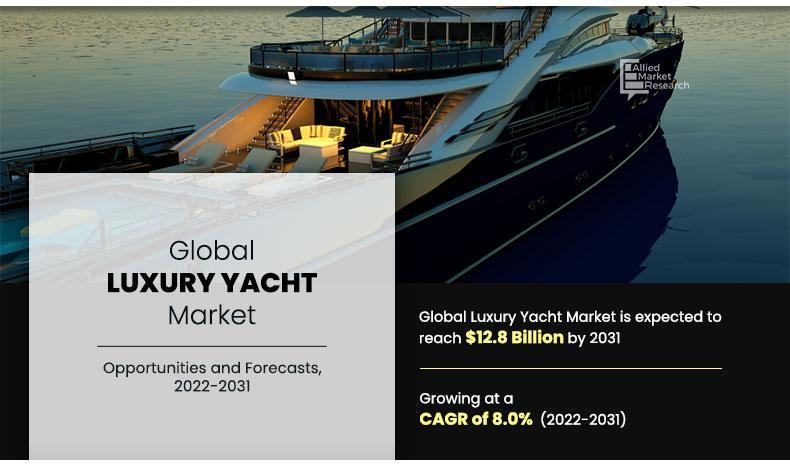

Luxury Yacht Market Size to Exceed USD 12.8 billion by 2031 | CAGR of 8.0%

According to a new report published by Allied Market Research, titled, "Luxury Yacht Market by Size, Type, and Material: Global Opportunity Analysis and Industry Forecast, 2022-2031," the luxury yacht market size was valued at $5.8 billion in 2020 and is expected to reach $12.8 billion by 2031, registering a CAGR of 8.0% from 2022 to 2031.In terms of volume, Europe occupied around two-thirds of the market share for 2020.

Get…

Corporate Luxury Events Market is likely to expand US$ 526,165.5 million at 14.5 …

The global corporate luxury events market size was valued at $152,508.6 million in 2020, and is projected to reach $526,165.5 million by 2030, registering a CAGR of 14.5% from 2021 to 2030.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/16332

A company hosts a corporate luxury event with the goal of providing entertainment and refreshment with a high level of elegance and grandeur. Business owners eventually support…

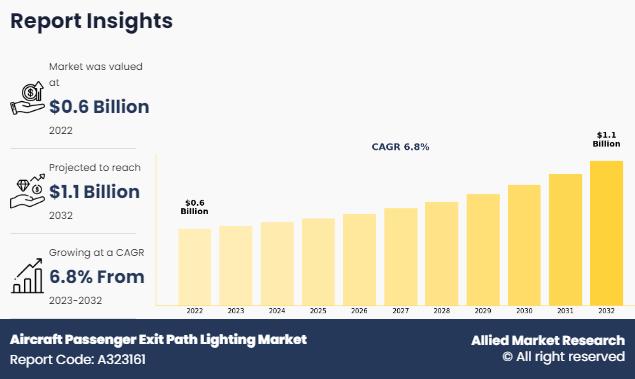

6.8% CAGR Aircraft Passenger Exit Path Lighting Market to generate $1,101.8 mill …

According to the report, the aircraft passenger exit path lighting market was valued at $585.2 million in 2022, and is estimated to reach $1,101.8 million by 2032, growing at a CAGR of 6.8% from 2023 to 2032.

The growth of the aviation industry, including passenger air traffic, is a key driver for the growth of the aircraft passenger exit path lighting market. As air travel continues to increase globally, a corresponding…

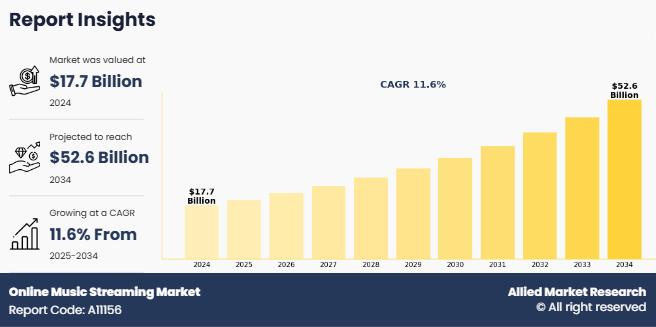

Online Music Streaming Market Estimated to Conquer Valuation of $52.6 billion by …

The global online music streaming market was valued at $17.7 billion in 2024, and is estimated to reach $52.6 billion by 2034, growing at a CAGR of 11.6% from 2025 to 2034.

Request The Sample PDF Of This Report: https://www.alliedmarketresearch.com/request-sample/11521

Online music streaming refers to the real-time delivery of audio content over the internet without requiring downloads. Listeners access songs, albums, playlists, podcasts, and other audio formats through digital…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…