Press release

Why Invest in $2.09 Bn Identity Theft Insurance Market Size Reach by 2030 At CAGR 4.2% CAGR, Key Factors Behind Market's Growth

Increase in adoption of digital payments along with the rise in cybercrimes relating to digital payments drive identity theft insurance market growth. However, lack of awareness among of people and less popularity of identity theft insurance hamper the growth of the market. Moreover, increase in adoption of digital and electronic identification in developing countries is expected to provide lucrative opportunities for the market growth.🔹 𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A11987

Allied Market Research published a report, titled, "Identity Theft Insurance Market By Type (Credit Card Fraud, Employment Or Tax-Related Fraud, Phone Or Utilities Fraud, Bank Fraud and Others) and Application (Individuals and Business): Global Opportunity Analysis and Industry Forecast, 2021-2030".

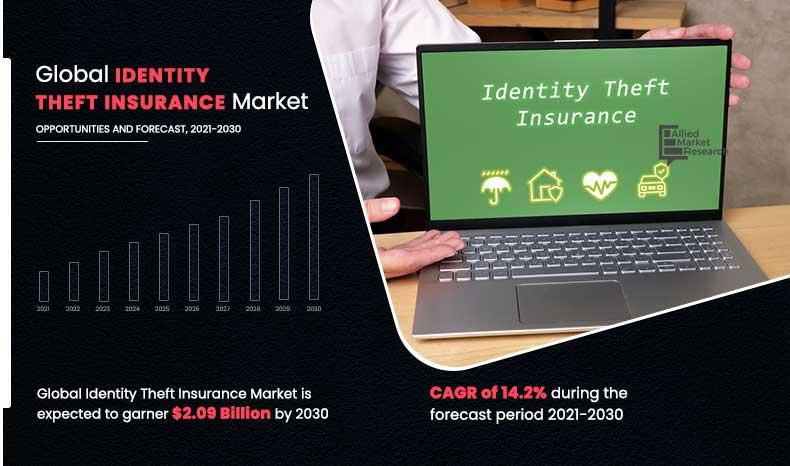

According to the report, the global identity theft insurance industry generated $0.57 billion in 2020, and is anticipated to generate $2.09 billion by 2030, witnessing a CAGR of 14.2% from 2021 to 2030.

Prime Determinants of growth

Surge in adoption of digital payments, rise in cybercrimes, and increase in the number of credit card users drive the growth of the global identity theft insurance market. However, lack of awareness among consumers hinders the market growth. On the other hand, growth in digitalization in developing countries and increase in number of users on online platform present new opportunities in the coming years.

Covid-19 Scenario

The outbreak of the COVID-19 pandemic has had a significant impact on the identity theft insurance, owing to increase in usage and adoption of online & digitalized platforms among consumers globally.

Identity theft insurance cost are experiencing massive growth as consumers are getting familiar with the risks related with electronic identification technologies in the market.

The Credit Card Fraud Segment to Maintain its Leadership Status throughout the Forecast Period

🔹 𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐖𝐞 𝐩𝐫𝐨𝐟𝐟𝐞𝐫 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐬 𝐩𝐞𝐫 𝐲𝐨𝐮𝐫 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭 : https://www.alliedmarketresearch.com/request-for-customization/A11987

Based on type, the credit card fraud segment held the highest market share in 2020, accounting for nearly two-fifths of the global identity theft insurance market, and is estimated to maintain its leadership status throughout the forecast period. The increase in cases of credit card fraud owing to digitization is proving beneficial for the growth of identity theft insurance market. Moreover, the bank fraud segment is projected to manifest the highest CAGR of 18.6% from 2021 to 2030, owing to rise in digital usage in the banking industry.

The Individuals Segment to Maintain its Lead Position during the Forecast Period

Based on application, the individuals segment accounted for the largest share in 2020, contributing to more than half of the global identity theft insurance market, and is projected to maintain its lead position during the forecast period. This is due to rise in cases for the personal data theft on social media. However, the business segment is expected to portray the largest CAGR of 15.5% from 2021 to 2030. While imitating a company's letterhead or sending forged communications are traditional approaches, newer and more sophisticated methods are being developed. As a result, the demand for identity insurance have been surged in recent years by business firms.

🔹 𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠: https://www.alliedmarketresearch.com/purchase-enquiry/A11987

North America to Maintain its Dominance by 2030

Based on region, North America held the highest market share in terms of revenue 2020, accounting for more than two-fifths of the global identity theft insurance market, owing to developed digitalized platform. Moreover, the Asia-Pacific region is expected to witness the fastest CAGR of 17.8% during the forecast period. This is attributed to the continued high speed of digital adoption, along with a rapidly increasing digital ecosystem.

Leading Market Players

Allstate Insurance Company

Aura

Chubb

Experian

GEICO

IdentityForce, Inc.

IDShield

McAfee, LLC

NortonLifeLock In

Nationwide Mutual Insurance Company

➡️𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @

https://www.alliedmarketresearch.com/checkout-final/f37fd0c4af92639a6232944bb933cba2?utm_source=AMR&utm_medium=research&utm_campaign=P19623

➡️𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞:

Restaurant Point of Sale (POS) Terminal Market https://www.alliedmarketresearch.com/restaurant-point-of-sale-pos-terminal-market-A30184

Syndicated Loans Market https://www.alliedmarketresearch.com/syndicated-loans-market-A31434

Forex Brokers Market : https://www.alliedmarketresearch.com/forex-brokers-market-A323400

India E-commerce Market : https://www.alliedmarketresearch.com/india-e-commerce-market-A126917

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Why Invest in $2.09 Bn Identity Theft Insurance Market Size Reach by 2030 At CAGR 4.2% CAGR, Key Factors Behind Market's Growth here

News-ID: 3505075 • Views: …

More Releases from www.alliedmarketresearch.com

Pet Insurance Market Soars: Projected to Hit $38.3 Billion by 2033 as Demand for …

According to a new report published by Allied Market Research, titled, "Pet Insurance Market, By Policy Coverage (Accident Only, Accident and Illness, and Others), By Animal Type (Dogs, Cats, and Others), and By Sales Channel (Agency, Broker, and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033". The pet insurance market was valued at $10.10 billion in 2023, and is estimated to reach $38.3 billion by 2033, growing at a CAGR…

Manual Spray Guns Market to Hit $2.6 Billion by 2032 | Key Growth Drivers & Oppo …

Prime determinants of growth

The demand for manual spray guns, which are mostly used for painting consumer durables, has increased because of this need, particularly in developing nations like India, China, and Vietnam. Additionally, there is a greater need for manual spray guns from car manufacturers due to the rising demand for automobiles around the world, particularly in industrialized nations like Europe and North America.

Download PDF Sample Report: www.alliedmarketresearch.com/request…ple/111362

Due to…

Hygienic Cladding Market Poised for Growth: Global Trends & Opportunities 2023-2 …

According to the report, the global hygienic cladding market generated $2.8 billion in 2022, and is anticipated to generate $6 billion by 2032, rising at a CAGR of 8.3% from 2023 to 2032.

Prime Determinants of Growth

The increased awareness & demand for health-related products, the increasing need for safe & healthy environments in healthcare facilities, and hygienic wall cladding's affordability & durability than traditional tiling methods are the factors expected to…

AI in Insurance Market Poised to Reach $45.74 Bn Globally by 2031, Soaring at a …

Global Opportunity Analysis and Industry Forecast, 2021-2031". According to the report, the global AI in insurance industry generated $2.74 billion in 2021, and is anticipated to generate $45.74 billion by 2031, witnessing a CAGR of 32.5% from 2022 to 2031.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A11615

Higher deployment cost of AI, advanced machine learning, and lack of skilled labor hamper the market growth. On the contrary, surge in government initiatives…

More Releases for Identity

Comprehensive Automated Online Identity Verification Services | ARGOS Identity

ARGOS Identity offers comprehensive automated online identity verification services that streamline and secure the customer onboarding process. These services are designed to enhance identity management in sectors requiring reliable verification, such as banking, finance, and government.

ARGOS's Identity Verification Solutions

- Global ID Verification:

ARGOS can analyze over 4,000 types of IDs from around the world, providing reliable verification across borders, regardless of the ID type or country of origin. This global reach…

Identity Empowered: Consumer Identity and Access Management Market Redefining Se …

The Business Research Company has updated its global market reports, featuring the latest data for 2024 and projections up to 2033

The Business Research Company offers in-depth market insights through Consumer Identity and Access Management Global Market Report 2024, providing businesses with a competitive advantage by thoroughly analyzing the market structure, including estimates for numerous segments and sub-segments.

Market Size And Growth Forecast:

The consumer identity and access management market size has…

Decentralized Identity Systems Market Enhancing Identity Management with Decentr …

The Report on "Decentralized Identity Systems Market" provides Key Benefits, Market Overview, Regional Analysis, Market Segmentation, Future Trends Upto 2030 by Infinitybusinessinsights.com. The report will assist reader with better understanding and decision making.

Market Growth of Decentralized Identity Systems Market: The decentralized identity systems market is experiencing significant growth as digital identity solutions evolve to address privacy concerns and enhance security. With the adoption of blockchain and distributed ledger technologies, the…

Decentralized Identity Management Market Worth Observing Growth | Microsoft, Ser …

Latest Study on Industrial Growth of Decentralized Identity Management - Global and China Top Players Market 2023-2029. A detailed study accumulated to offer the Latest insights about acute features of the Decentralized Identity Management - Top Players market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the…

Identity Verification Market

New York, Global Identity Verification Market report from Global Insight Services is the single authoritative source of intelligence on Identity Verification Market. The report will provide you with analysis of impact of latest market disruptions such as Russia-Ukraine war and Covid-19 on the market. Report provides qualitative analysis of the market using various frameworks such as Porters' and PESTLE analysis. Report includes in-depth segmentation and market size data by categories,…

Presidio Identity Aims to Eliminate Identity Theft and Financial Fraud with Inno …

Presidio Identity Aims to Eliminate Identity Theft and Financial Fraud with Innovative Trust and Identity Services

Startup emerges from stealth to focus on banking and financial services digital initiatives; raises $1.55 million seed round

San Francisco, CA, August 17, 2020 – Presidio Identity, Inc., a provider of cloud-based trust and identity services, announced today the close of $1.55 million in initial funding in a seed round led by Marc Benioff, with participation…