Press release

Unlocking Financial Flexibility: Premium Finance Market Projected to Reach $139.74 Billion by 2032 with 11.5% CAGR

Allied Market Research published a report, titled, "Premium Finance Market by Type (Life Insurance and Non-life Insurance), Interest Rate (Fixed Interest Rate and Floating Interest Rate), and Provider (Banks, NBFCs, and Others): Global Opportunity Analysis and Industry Forecast, 2022-2032".➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A15358

According to the report, the global premium finance industry generated $47.8 billion in 2022, and is anticipated to generate $139.7 billion by 2032, witnessing a CAGR of 11.5% from 2023 to 2032.

Prime determinants of growth

The premium finance market is expected to witness notable growth owing to increase in demand for insurance, increase in premium rates, and technological advancements. Moreover, the adoption of AI in insurance platforms is expected to provide a lucrative opportunity for the growth of the market during the forecast period.

The integration of technology into financial services has streamlined and simplified the premium financing process. With user-friendly online platforms and mobile apps, individuals and businesses can easily access and apply for premium financing life insurance and other premium financing solutions which increases the adoption of premium finance options.

The life insurance segment to maintain its leadership status throughout the forecast period

Based on type, the life insurance segment held the highest market share in 2022, accounting for around three-fifths of the global premium finance market revenue, and is projected to manifest the highest CAGR of 12.8% from 2023 to 2032. This is attributed to the fact that more individuals are recognizing the importance of life insurance to safeguard their close ones, creating a greater demand for policies.

➡️𝐑𝐞𝐪𝐮𝐞𝐬𝐭 𝐂𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐚𝐭𝐢𝐨𝐧 𝐖𝐞 𝐨𝐟𝐟𝐞𝐫 𝐜𝐮𝐬𝐭𝐨𝐦𝐢𝐳𝐞𝐝 𝐫𝐞𝐩𝐨𝐫𝐭 𝐚𝐬 𝐩𝐞𝐫 𝐲𝐨𝐮𝐫 𝐫𝐞𝐪𝐮𝐢𝐫𝐞𝐦𝐞𝐧𝐭 : https://www.alliedmarketresearch.com/request-for-customization/A15358

The fixed interest rate segment to maintain its leadership status throughout the forecast period

Based on interest rate, the fixed interest rate segment held the highest market share in 2022, accounting for nearly three-fourths of the global premium finance market revenue, and is projected to manifest the highest CAGR of 12.6% from 2023 to 2032. The growth of fixed interest rates in the premium finance market is being driven by the desire for stability and predictability.

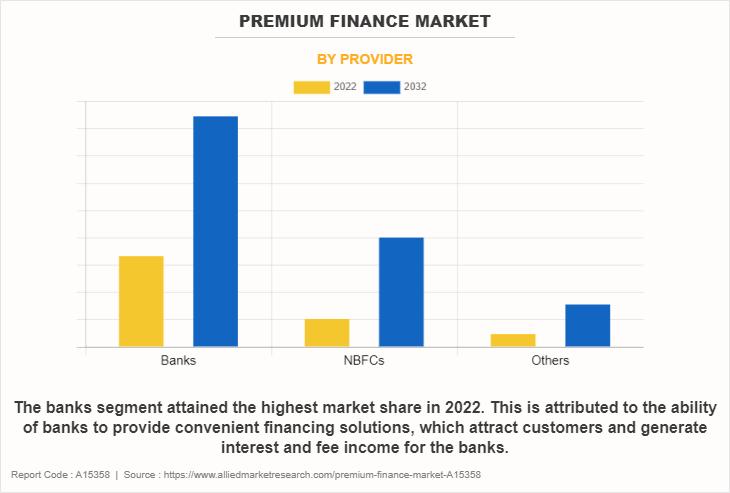

The banks segment to maintain its leadership status throughout the forecast period

Based on provider, the banks segment held the highest market share in 2022, accounting for more than two-thirds of the global premium finance market revenue, and is estimated to maintain its leadership status throughout the forecast period. The growth of the banks segment is propelled by their financial strength and expertise. Banks have the financial resources to offer competitive loan terms, making it attractive for individuals & businesses to choose them as their financing source. However, the NBFCs segment is projected to manifest the highest CAGR of 14.9% from 2023 to 2032, owing to their flexibility and ability to cater to a wide range of borrowers. NBFCs often have more lenient lending criteria compared to traditional banks, making it easier for individuals & businesses to secure premium financing.

North America to maintain its dominance by 2032

Based on region, North America held the highest market share in terms of revenue in 2022, accounting for more than one-third of the global premium finance market revenue, and is estimated to maintain its leadership status throughout the forecast period, owing to rise in awareness of premium finance options and increase in the cost of insurance premiums. These factors have been significant drivers for the premium finance market growth in North America. However, Asia-Pacific is expected to witness the fastest CAGR of 14.7% from 2023 to 2032. This is attributed to rise in affluence and economic growth in many Asian countries that drive the demand for insurance. Furthermore, increase in awareness of financial solutions such as premium finance is contributing to the premium finance market growth in Asia-Pacific.

➡️𝐈𝐧𝐪𝐮𝐢𝐫𝐞 𝐁𝐞𝐟𝐨𝐫𝐞 𝐁𝐮𝐲𝐢𝐧𝐠:

https://www.alliedmarketresearch.com/purchase-enquiry/A15358

Leading Market Players: -

IPFS Corporation

JPMorgan Chase & Co.

Lincoln National Corporation

AFCO Credit Corporation

Agile Premium Finance

ARI Financial Group

US Premium Finance

Byline Bank

Capital for Life

Valley National Bank

The report provides a detailed analysis of these key players in the global premium finance market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant position in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the premium finance market analysis from 2022 to 2032 to identify the prevailing premium finance market opportunity.

The market research is offered along with information related to key drivers, restraints, and opportunities.

The porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the premium finance market segmentation assists to determine the prevailing premium finance market opportunities.

Major countries in each region are mapped according to their revenue contribution to the market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as premium finance market trends, key players, market segments, application areas, and market growth strategies.

➡️𝐁𝐮𝐲 𝐂𝐨𝐦𝐩𝐥𝐞𝐭𝐞 𝐑𝐞𝐩𝐨𝐫𝐭 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞 @

https://www.alliedmarketresearch.com/checkout-final/ca4965b430f251cce190e4d1f760c868?utm_source=AMR&utm_medium=research&utm_campaign=P19623

Premium Finance Market Report Highlights

Aspects Details

By Type

Life Insurance

Non-life Insurance

By Interest Rate

Fixed Interest Rate

Floating Interest Rate

By Provider

Banks

NBFCs

Others

By Region

North America (U.S., Canada)

Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

LAMEA (Latin America, Middle East, Africa)

➡️𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐚𝐭 𝐃𝐢𝐬𝐜𝐨𝐮𝐧𝐭𝐞𝐝 𝐏𝐫𝐢𝐜𝐞:

Financial Risk Management Software Market https://www.alliedmarketresearch.com/financial-risk-management-software-market-A47377

RPA in Insurance Market https://www.alliedmarketresearch.com/rpa-in-insurance-market-A53549

Fingerprint Payment Market https://www.alliedmarketresearch.com/fingerprint-payment-market-A12966

Exchange Traded Fund Market https://www.alliedmarketresearch.com/exchange-traded-fund-market-A31686

Blockchain In Retail Banking Market https://www.alliedmarketresearch.com/blockchain-in-retail-banking-market-A31695

1209 Orange Street,

Corporation Trust Center,

Wilmington, New Castle,

Delaware 19801 USA.

Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies, and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Unlocking Financial Flexibility: Premium Finance Market Projected to Reach $139.74 Billion by 2032 with 11.5% CAGR here

News-ID: 3491660 • Views: …

More Releases from www.alliedmarketresearch.com

Pet Insurance Market Soars: Projected to Hit $38.3 Billion by 2033 as Demand for …

According to a new report published by Allied Market Research, titled, "Pet Insurance Market, By Policy Coverage (Accident Only, Accident and Illness, and Others), By Animal Type (Dogs, Cats, and Others), and By Sales Channel (Agency, Broker, and Others): Global Opportunity Analysis and Industry Forecast, 2024-2033". The pet insurance market was valued at $10.10 billion in 2023, and is estimated to reach $38.3 billion by 2033, growing at a CAGR…

Manual Spray Guns Market to Hit $2.6 Billion by 2032 | Key Growth Drivers & Oppo …

Prime determinants of growth

The demand for manual spray guns, which are mostly used for painting consumer durables, has increased because of this need, particularly in developing nations like India, China, and Vietnam. Additionally, there is a greater need for manual spray guns from car manufacturers due to the rising demand for automobiles around the world, particularly in industrialized nations like Europe and North America.

Download PDF Sample Report: www.alliedmarketresearch.com/request…ple/111362

Due to…

Hygienic Cladding Market Poised for Growth: Global Trends & Opportunities 2023-2 …

According to the report, the global hygienic cladding market generated $2.8 billion in 2022, and is anticipated to generate $6 billion by 2032, rising at a CAGR of 8.3% from 2023 to 2032.

Prime Determinants of Growth

The increased awareness & demand for health-related products, the increasing need for safe & healthy environments in healthcare facilities, and hygienic wall cladding's affordability & durability than traditional tiling methods are the factors expected to…

AI in Insurance Market Poised to Reach $45.74 Bn Globally by 2031, Soaring at a …

Global Opportunity Analysis and Industry Forecast, 2021-2031". According to the report, the global AI in insurance industry generated $2.74 billion in 2021, and is anticipated to generate $45.74 billion by 2031, witnessing a CAGR of 32.5% from 2022 to 2031.

➡️𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭 𝐒𝐚𝐦𝐩𝐥𝐞 & 𝐓𝐎𝐂 : https://www.alliedmarketresearch.com/request-sample/A11615

Higher deployment cost of AI, advanced machine learning, and lack of skilled labor hamper the market growth. On the contrary, surge in government initiatives…

More Releases for Premium

Premium Dedicated Proxy - Unmatched Exclusivity with Oculus Premium Dedicated Pr …

In today's increasingly data-centric world, enterprises are pushing the boundaries of automation, web intelligence, and digital security. Central to these evolving needs is the demand for fast, private, and reliable internet access. For companies that rely on uninterrupted, large-scale data extraction and secure browsing, shared IP infrastructures are simply no longer viable. This has led to a rise in the adoption of premium proxy solutions-particularly exclusive IP resources that deliver…

Premium Pets, Premium Nutrition: Inside the USD 332M Freeze-Dried Pet Food Surge

The home freeze-dried pet food industry represents one of the fastest growing segments within the global pet nutrition market due to increasing pet ownership worldwide, rising humanization of companion animals, and expanding demand for premium, nutritionally superior food products. Freeze drying, also known as lyophilization, preserves pet food by removing moisture under low temperature and pressure, enabling longer shelf life, superior nutrient retention, and convenient storage features that align strongly…

Introducing Premium Bail Bonds

Bartow, FL - 8/20/2023 - Premium Bail Bonds, a dynamic and dedicated player in the bail bond industry, is excited to announce its official launch in Bartow, FL. With a steadfast commitment to serving the local community, Premium Bail Bonds aims to redefine the standards of professionalism, reliability, and unwavering support.

Boasting a team of seasoned experts with extensive knowledge of the legal landscape, Premium Bail Bonds is poised to be…

Mighty Travels Premium

Haven't you wondered why online travel search always started with the same input that a few travel websites first started with in 1996? Two airport codes and two dates and a big search button - where has the innovation been since?

What if we could search by price instead and find trips that are inspiring and sometimes luxurious where we would like to go? The world has changed and flexible schedules…

Sydney Premium Detailing

Operating for more than 12 years, Sydney Premium Detailing provides services such as Paint Protection, Paint Protection Film (Clear Bra), Paint Correction and Interior & Wheel Protection.

Operating for more than 12 years, Sydney Premium Detailing provides services such as Paint Protection, Paint Protection Film (Clear Bra), Paint Correction and Interior & Wheel Protection.

Sydney Premium Detailing

7/3 Salisbury Rd, Castle Hill, NSW 2154…

Paint Colors & Trim Market Growth and Analysis by Major Top Vendors are BEHR Pre …

ResearchReportsInc.com adds a new 2018-2023 Global Paint Colors & Trim Market Report focuses on the major drivers and restraints for the global key players providing analysis of the market share, segmentation, revenue forecasts and geographic regions of the market. The Paint Colors & Trim Market report aims to provide a 360-degree view of the market in terms of cutting-edge technology, key developments, drivers, restraints and future trends with impact analysis…