Press release

Life Insurance Benefits: From Covering Final Expenses to Ensuring Retirement Comfort

Our life can change in a blink of an eye, we may fall and hurt ourselves and become a victim of injury. Then we are left with a ton of medical bills to pay and use up all our savings. If only there was something that guaranteed to take care of us at our lowest points. That's when life insurance comes into play.Many think that we can live without it and that the worst won't happen. Even though it's good to have a positive attitude, we need to always be prepared for any mishaps. This makes a horrible situation much easier to deal with.

Life insurance [https://www.locanto.ca/g/Insurance-Financial-Services/513/], however, is something many don't think about until the last minute. Statistics say that 100 million Americans don't have life insurance or don't have enough coverage.

This policy helps families carry the financial and emotional burden of losing a loved one. Let's get more in depth on this topic.

Image: https://www.getnews.info/uploads/98f78bc71f4d3c061cded43f40d79397.jpg

Why Do We Need Insurance?

Losing a family member or partner can impact us greatly. It can also have a negative impact on our finances. Someone we shared our living expenses with is no longer there to help us. On top of that, a funeral costs around $8,000.

Life insurance policies make sure we are taken care of in these hard times. There are different types of these policies, like term life insurance, whole life insurance, and more.

Types of Life Insurance

Types of life insurance include:

1. Term Life Insurance

Term life insurance lasts around 10, 20, and up to 40 years. You pay for it monthly or once a year, and if it expires, you can renew it.

This type of insurance helps your beneficiaries if they are counting on your monthly income. It is suited for families who need coverage for a specific period, like paying off a mortgage or providing financial support for children until they can take care of themselves.

It doesn't last a lifetime, so keep that in mind. The biggest benefit is that it costs less than the lifelong policy, but your loved ones will get a similar amount of money.

2. Whole Life Insurance

Whole life insurance lasts a lifetime. The longer you pay for it, the more cash value it accumulates. When it is large enough, you can take out a loan, withdraw the cash, or use it to pay your premiums (your monthly or annual rate).

Some companies even offer dividends. It does cost more than term life insurance, but you can put your mind at ease knowing everything is taken care of for life.

3. Universal Life Insurance

Universal life insurance also lasts a lifetime. It also offers a fixed death benefit for your beneficiaries. You can choose the type of premium payments (rates) you want, and it also accumulates cash value. It is more flexible than whole life insurance and gives you plenty of options to choose from.

4. Variable Life Insurance

This type of life insurance is riskier because your cash value will vary based on your investments and payments. The biggest difference between this insurance and whole life insurance is that the cash value can be a part of the death benefit.

Image: https://www.getnews.info/uploads/72a88cb65b2167658e57389666a3b39f.jpg

The Benefits of Life Insurance

Here are some benefits of life insurance policies:

1. Protecting Your Loved Ones

The main benefit of using life insurance policies is that your loved ones will be taken care of. Think of it as a safety net that helps your family cover things like mortgage payments, education costs, daily living expenses, and funeral expenses.

2. Covering Final Expenses

Funeral and burial costs can be a financial burden for families. By using life insurance, your loved ones won't have to worry about the financial implications of your passing, allowing them to focus on the grieving process and honoring your memory.

3. Managing Debts

Life insurance can also help with managing debt. The proceeds from your life insurance policy can be used to settle any debts you may have, like loans, credit card balances, or medical bills.

Also, life insurance can make the transfer of your estate to your beneficiaries easier. These policies help minimize estate taxes and ensure your assets are distributed as you wished.

4. Retirement Planning

The cash value some of these policies accumulate can be used for loans or withdrawn. This can be a great way to save up for your retirement. It is important to think about taking care of yourself as much as others, and this will help you have a more comfortable lifestyle as you grow older.

Image: https://www.getnews.info/uploads/42776adb45fc3cdd20a66ad7b5e7ad11.jpg

5. Peace of Mind

Beyond the regular benefits, life insurance can give you peace of mind. Knowing your family will be taken care of if things go sour can help you relax and focus on what really matters. You can pursue your goals without the fear of leaving your dearest in a vulnerable position.

6. Protection for Business Owners

If you're a business owner, life insurance can make sure your company continues its path. It can ensure a smooth transition of ownership, helping your business stay operational.

Also, life insurance can be used to fund buy-sell agreements, enabling your business partners to buy out your share of the business from your heirs without depleting company resources or resorting to loans.

7. Access to Cash in Times of Need

A great thing about life insurance is that it can provide you with access to cash when you need it most. Some life insurance policies offer the option to accelerate the death benefit in the event of a terminal illness or chronic health condition. This can help cover medical expenses, long-term care costs, and more.

Always Plan Ahead

The bottom line is that planning ahead will always bring you peace in times of need. While you may not be thinking about life-and-death scenarios, preparing for the worst will help take care of things if it ever comes to that point.

By using life insurance policies, you can stay prepared and keep focusing on what matters.

Media Contact

Company Name: Yalwa GmbH

Contact Person: Daniela Edjedi

Email: Send Email [http://www.universalpressrelease.com/?pr=life-insurance-benefits-from-covering-final-expenses-to-ensuring-retirement-comfort]

Country: Germany

Website: https://www.yalwa.com/

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Life Insurance Benefits: From Covering Final Expenses to Ensuring Retirement Comfort here

News-ID: 3491444 • Views: …

More Releases from Getnews

ICIC's Business Administration Program Equips Students for an AI Powered Future

Image: https://www.globalnewslines.com/uploads/2026/02/1772081606.jpg

As technology transforms construction and accelerates decision making, ICIC advances professional training to help managers lead with clarity in a data driven economy.

Delegacion Alvaro Obregon, CDMX - February 26, 2026 - As artificial intelligence reshapes industries and accelerates decision making across sectors, the Instituto de Capacitacion de la Industria de la Construccion (ICIC) continues to strengthen its academic portfolio with a program designed for modern leadership. ICIC's Business Administration…

RESET Hotel Launches Exclusive Stargazing Partnership with Celestron

Image: https://www.globalnewslines.com/uploads/2026/02/1772079550.jpg

A new desert hotel near Joshua Tree National Park unveils a first-of-its-kind stargazing partnership, elevating cosmic escapes this season.

Twentynine Palms, CA - February 26, 2026 - RESET Hotel [https://512857c0.streaklinks.com/CnmyKtFZ2enYBgVAhw75oHbJ/https%3A%2F%2Fwww.stayreset.com%2F], a new boutique hotel located 5 minutes from Joshua Tree National Park, has just announced a new partnership with Celestron, the leading manufacturer of telescopes and optical instruments, bringing an elevated stargazing experience to the California desert.

Image: https://i.postimg.cc/YShb8vLq/Celestron.jpg [https://postimages.org/]

As part…

iCAUR Makes Strategic Entry into the Middle East: Announcing V27's Global Launch …

Recently, Chery Group's new energy vehicle brand iCAUR's mid-to-large all-round hybrid SUV-the iCAUR V27-made its global launch in Dubai, UAE. This launch marks a key step in the brand's commitment to its Vision-"Co-create with users to build a warm, trustworthy new energy brand"-and serves as an important milestone for iCAUR, as "a premium new energy mobility brand driven by design and technology," in conveying its core proposition that "CLASSIC NEVER…

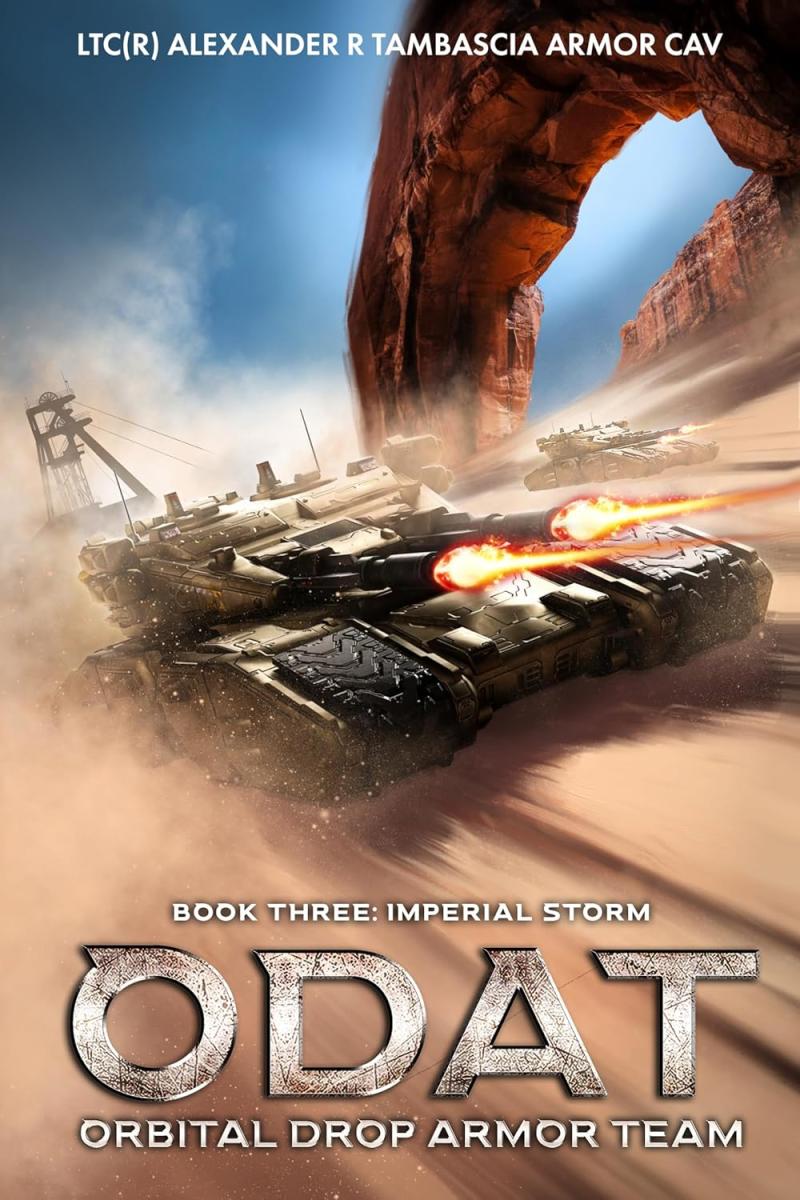

Veteran Combat Experience Meets Explosive Military SciFi

Image: https://www.aionewswire.com/storage/images/ckeditor//81J6D6xBOdL._SL1500__1772047334.jpg

ODAT: Orbital Drop Armor Team - Book 3: Imperial Storm

Retired U.S. Army officer LTC (R) Alexander R. Tambascia returns with the highly anticipated third installment of his military science fiction series, ODAT: Orbital Drop Armor Team - Book 3: Imperial Storm [https://www.amazon.com/gp/product/B0FPJ5R782?ref_=dbs_m_mng_rwt_calw_tkin_2&storeType=ebooks&qid=1772047291&sr=1-1]. Blending real-world combat experience with epic science fiction warfare, Imperial Storm delivers a gritty, authentic look at futuristic battlefields where survival is never guaranteed-and death may not…

More Releases for Life

Life Heater Reviews - How Does Life Heater Work? Read life heater reviews consum …

The Life Heater emerges as a revolutionary heating solution, redefining efficiency and safety standards for residents in the United States and Canada. More than a conventional heater, it boasts impressive energy savings of up to 30%, making it a beacon of sustainability in the realm of home heating. The device's convection heating system ensures rapid warmth, promising to elevate the comfort of spaces across North American homes with unprecedented speed.

The…

Russia Life Insurance Market to Eyewitness Massive Growth by 2026 | Renaissance …

A new research document is added in HTF MI database of 74 pages, titled as 'Russia Life Insurance - Key Trends and Opportunities to 2025' with detailed analysis, Competitive landscape, forecast and strategies. Latest analysis highlights high growth emerging players and leaders by market share that are currently attracting exceptional attention. The identification of hot and emerging players is completed by profiling 50+ Industry players; some of the profiled…

Life Insurance Market is Booming Worldwide | Sumitomo Life Insurance, Nippon Lif …

HTF MI recently added Global Life Insurance Market Study that gives deep analysis of current scenario of the Market size, demand, growth, trends, and forecast. Revenue for Life Insurance Market has grown substantially over the five years to 2019 as a result of strengthening macroeconomic conditions and healthier demand, however with current economic slowdown and Face-off with COVID-19 Industry Players are seeing Big Impact in operations and identifying ways to…

Online Life Insurance Market Swot Analysis by Key Players Nippon Life Insurance, …

Global Online Life Insurance Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Online…

Life Insurance Market Next Big Thing with Major Giants HDFC Life Insurance, SBI …

A new business intelligence report released by HTF MI with title "Life Insurance Market in India 2019" is designed covering micro level of analysis by manufacturers and key business segments. The Life Insurance Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some of…

Life Insurance Market to Witness Massive Growth| Allan Gray Life, Coronation Lif …

HTF Market Intelligence released a new research report of 35 pages on title 'Strategic Market Intelligence: Life Insurance in South Africa - Key Trends and Opportunities to 2022' with detailed analysis, forecast and strategies. The study covers key regions and important players such as Allan Gray Life, Coronation Life Assurance, Sygnia Life etc.

Request a sample report @ https://www.htfmarketreport.com/sample-report/1854964-strategic-market-intelligence-38

Summary

The ""Strategic Market Intelligence: Life Insurance in South Africa - Key Trends…