Press release

Open Banking Market Future Strategies and Growth Forecast till 2030

The Open Banking Market 2024 Report makes available the current and future technical and financial analysis of the industry. It is one of the most comprehensive and important additions to the USD Analytics archive of market research studies. It offers detailed research and analysis of key aspects of the global Open Banking market. This global report explores the key factors affecting the growth of the dynamic Open Banking market, including the demand-supply scenario, pricing structure, profit margins, SWOT, and value chain analysis.The Open Banking market is expected to register a robust CAGR of 23.5% between 2024 and 2030.

The report analyzes in-depth company and business profiles of major players in the Physical Security Information Management (Banco Bilbao Vizcaya Argentaria, S.A., Crédit Agricole, DemystData Ltd, Finastra, FormFree Holdings Corp, Jack Henry & Associates Inc, Mambu, MineralTree Inc, NCR Corp, Qwist)

Free Sample + All Related Graphs and Charts @ https://www.usdanalytics.com/sample-request/25686

Introduction:

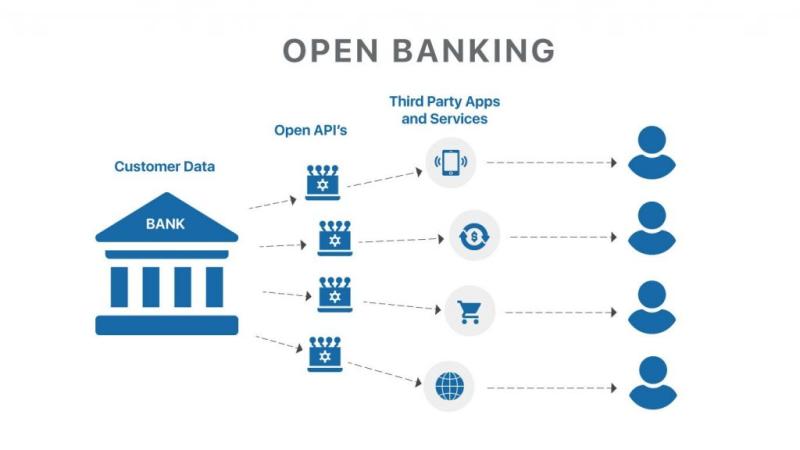

Open banking refers to a system where banks and financial institutions allow third-party service providers to access their customers' financial information securely, typically through APIs (Application Programming Interfaces). This enables consumers to share their banking data with authorized third parties, such as fintech companies and other banks, to access innovative financial products and services, facilitate seamless transactions, and gain a more comprehensive view of their financial situation across multiple accounts and platforms.

Market Segmentation and Scope:

By Service (Banking & Capital Markets, Payments, Digital Currencies, Value Added Services), By Deployment Mode (Cloud, On-premise), By Distribution Channel (Bank Channels, App Markets, Distributors, Aggregators)

USD Analytics offers enticing discounts tailored to your needs. We also provide customization options for reports to meet your specific requirements. Contact our sales team to receive a personalized report that perfectly suits your needs. Reach out today and unlock valuable insights for your business.

Engage with our analyst for a detailed discussion on the findings above and inquire about potential discounts on the report @ https://www.usdanalytics.com/discount-request/25686

The report covers the competitive analysis of the market. The report identifies the most promising growth opportunities across the 6 regions and 24 countries. This section exclusively shares insight into the growth strategies of the largest market share holders helping key players and new entrants understand the investment potential in the Global Open Banking Market. It can be better employed by both traditional and new players in the industry for complete know-how of the market.

Regional Analysis: North America (United States, Canada, Mexico)

Europe (Germany, France, United Kingdom, Spain, Italy, Rest of Europe)

Asia Pacific (China, India, Japan, South Korea, Rest of Asia Pacific)

South America (Brazil, Argentina, Rest of South America)

Middle East and Africa (Saudi Arabia, UAE, Rest of Middle East, South Africa, Egypt, Rest of Africa

Furthermore, the years considered for the study are as follows:

Historical year - 2018-2023

Base year - 2023

Forecast period - 2024 to 2030

Major Highlights of TOC:

Chapter 1: Overview of the Global Open Banking Market in 2024

1.1 Open Banking Industry Analysis

1.2 Key Companies and Product Profiles

1.3 Open Banking Market Segments

1.4 Industry Value Chain Analysis

1.5 Market Dynamics- Trends, Drivers, and Opportunities

1.6 Pricing Analysis

1.7 Porter's Five Forces Analysis

1.8 SWOT Profile

1.9 Macro-Economic and Demographic Impact Analysis

1.10 Scenario Analysis

Chapter 2: Global Open Banking Demand Forecasts

2.1 Overview of the Segment

2.2 Global Historic Open Banking Market Size (2018-2023) by Types, Applications, and Other Segments

2.3 Global Forecast Open Banking Market Size (2024-2030) by Types, Applications, and Other Segments

Chapter 3: Segment-wise Open Banking Market Forecasts

3.1 Key Market Segments

3.2 Premium Insights- Largest Types, Applications and Segments

3.3 Premium Insights- Most Lucrative Types, Applications, and Segments

Chapter 4: Open Banking Market Outlook by Country

4.1 Open Banking Market by Regions

4.2 Open Banking Market Revenue Share by Region

4.3 North America (US, Canada, Mexico)

4.4 Europe (Germany, UK, France, Spain, Italy, Russia, Others)

4.5 Asia Pacific (China, Japan, India, South Korea, Australia, South East Asia, Others)

4.6 Latin America (Brazil, Argentina, Chile, Others)

4.7 Middle East and Africa (Saudi Arabia, UAE, Qatar, South Africa, Nigeria, Egypt, Others)

Player Analysis in Chapter Five

5.1 Players' Market Share Analysis (2023)

5.2 Regional Market Concentration Rates

5.3 Business Profiles, SWOT Analysis, Financial Details, Product Portfolio of Companies

..........continued

For a comprehensive competitive analysis, Buy this report now and gain access to a detailed table of contents @ https://www.usdanalytics.com/payment/report-25686

Why should you purchase this report?

USD Analytics offers essential historical and analytical data on the global Open Banking market. The report thoroughly evaluates future market trends and potential changes in market behavior. It provides various strategic business methodologies to support informed business decisions. Gain a competitive advantage in the market with this detailed research report, which covers competitive landscape analysis, growth drivers, applications, market dynamics, and other essential details.

In conclusion, the Open Banking Market report is a genuine source for accessing the research data which is projected to exponentially grow your business. The report provides vital information including economic scenarios, benefits, limits, trends, market growth rates, and figures. Further, SWOT analysis and PESTLE analysis are also incorporated in the report.

Review the Executive Report: @ https://www.usdanalytics.com/industry-reports/open-banking

Thanks for reading this article; You can also get individual chapter-wise sections or region-wise report versions like North America, Middle East, Africa, Europe, MENA, LATAM, and Southeast Asia.

Contact Us: Harry (Business Consultant)

USD Analytics Market

Phone: +1 213-510-3499

sales@usdanalytics.com

About Author:

USD Analytics is a leading information and analytics provider for customers across industries worldwide. Our high-quality research publications are connected market. Intelligence databases and consulting services support end-to-end support our customer research needs.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Open Banking Market Future Strategies and Growth Forecast till 2030 here

News-ID: 3490304 • Views: …

More Releases from USD Analytics

Commercial Vehicle Telematics Market Is Booming So Rapidly | Gurtam, Teletrac Na …

The Global Commercial Vehicle Telematics Market Size is estimated at $7.1 Billion in 2025 and is forecast to register an annual growth rate (CAGR) of 13.6% to reach $22.4 Billion by 2034.

The latest study released on the Global Commercial Vehicle Telematics Market by USD Analytics Market evaluates market size, trend, and forecast to 2034. The Commercial Vehicle Telematics market study covers significant research data and proofs to be a handy…

Wind Turbine Operations and Maintenance Market Is Booming So Rapidly | Vestas, N …

The Global Wind Turbine Operations and Maintenance Market Size is estimated at $18.2 Billion in 2025 and is forecast to register an annual growth rate (CAGR) of 7.4% to reach $34.6 Billion by 2034.

The latest study released on the Global Wind Turbine Operations and Maintenance Market by USD Analytics Market evaluates market size, trend, and forecast to 2034. The Wind Turbine Operations and Maintenance market study covers significant research data…

Solar Trackers Market Is Booming So Rapidly | , Soltec, SunPower, Valmont

The Global Solar Trackers Market Size is estimated at $6.2 Billion in 2025 and is forecast to register an annual growth rate (CAGR) of 24.5% to reach $44.6 Billion by 2034.

The latest study released on the Global Solar Trackers Market by USD Analytics Market evaluates market size, trend, and forecast to 2034. The Solar Trackers market study covers significant research data and proofs to be a handy resource document for…

Aircraft Sensors Market Is Booming So Rapidly | Meggitt, Esterline, Indra

The Global Aircraft Sensors Market Size is estimated at $6.9 Billion in 2025 and is forecast to register an annual growth rate (CAGR) of 4.3% to reach $10.1 Billion by 2034.

The latest study released on the Global Aircraft Sensors Market by USD Analytics Market evaluates market size, trend, and forecast to 2034. The Aircraft Sensors market study covers significant research data and proofs to be a handy resource document for…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…