Press release

Trade Finance Market Report, Trends, Size, Analysis And Forecast 2024-2033

The trade finance market size has grown strongly in recent years. It will grow from $46.84 billion in 2023 to $49.48 billion in 2024 at a compound annual growth rate (CAGR) of 5.6%. The growth in the historic period can be attributed to globalization, rise in global trade, regulatory changes, economic uncertainty, shifts in supply chain dynamics.The trade finance market size is expected to see strong growth in the next few years. It will grow to $62.64 billion in 2028 at a compound annual growth rate (CAGR) of 6.1%. The growth in the forecast period can be attributed to adoption of structuring and pricing tools, emerging market growth, sustainable trade and ESG (environmental, social and governance) considerations, geopolitical developments and trade policies, supply chain resilience and risk management. Major trends in the forecast period include blockchain integration, digital transformation, artificial intelligence (AI) and machine learning (ML), technology advancements, cross-border payment innovations.

Market Overview -

Trade finance refers to techniques and instruments that facilitate trade transactions and protect both buyers and suppliers from the risks associated with international trade. It aims to make business transactions between companies smoother by mitigating risks like payment delays, quality discrepancies, and non-delivery of goods.

Download Free Sample of Report -

https://www.thebusinessresearchcompany.com/sample.aspx?id=14812&type=smp

Rising Financial Security Concerns Propel Growth In The Trade Finance Market

The rise in the need for safety and security in financial activities is expected to propel the growth of the trade finance market going forward. The security of financial activity refers to the measures and protocols put in place to safeguard financial transactions from unauthorized access, fraud, and theft. The need for safety and security in trading activities is on the rise due to increasing financial interconnectedness, necessitating measures to protect traders and transactions from evolving threats and risks. Trade finance facilitates secure payment mechanisms that ensure the timely and reliable settlement of trade transactions. It also provides access to trade credit and financing options that enable businesses to manage cash flow, mitigate liquidity risks, and expand their trading activities. For instance, in February 2024, according to the data released by the Federal Trade Commission, a US-based independent government agency, it was reported that consumers lost more than $10 billion to fraud in 2023, marking the first time that fraud losses have reached that benchmark. This represents a 14% increase over reported losses in 2022. Nearly 1 in 5 people reported a financial loss due to an imposter sca*m. Therefore, the rise in the need for safety and security in financial activities is driving the growth of the trade finance market.

Competitive Landscape -

Major companies operating in the trade finance market are JPMorgan Chase & Co., China Construction Bank, Bank of America Corporation, Citigroup Inc., BNP Paribas S.A., HSBC Holdings plc, Mitsubishi UFJ Financial Inc., Credit Agricole Group , Union Bank of Switzerland, Deutsche Bank AG, Unicredit SpA, Societe Generale SA, Standard Chartered plc, Asian Development Bank, Internationale Nederlanden Groep, Development Bank of Singapore Limited, Nordea Group Abp, Euler Hermes Group, The Royal Bank of Scotland Group plc, The Bank of Nova Scotia, TD Bank, Coöperatieve Rabobank U.A., Commerzbank AG, Rand Merchant Bank, Arab Bank

Innovative Digital Trade Finance Solutions Transforming Payment Processes

Major companies operating in the trade finance market are focused on launching innovative technologies, such as digital trade finance solutions, to gain a competitive edge. A digital trade finance solution refers to the use of emerging technologies in trade finance, such as blockchain, artificial intelligence (AI), optical character recognition (OCR), and digital signatures, to enhance operational efficiency, reduce transaction costs, and address challenges within the trade finance industry. For instance, in September 2023, Hong Kong and Shanghai Banking Corporation Limited (HSBC), a UK-based commercial banking corporation, launched HSBC TradePay, a trade finance solution to provide businesses with a faster, simpler, and fully digital way to pay suppliers, improve working capital positions, and strengthen relationships with trading partners through efficient trade finance solutions. This innovative solution streamlines the loan drawdown process, simplifies supplier payments, and gives businesses complete control over when their trade payables arrive.

Browse Full Report @

https://www.thebusinessresearchcompany.com/report/trade-finance-global-market-report

Key Segments -

The trade finance market covered in this report is segmented -

1) By Type: Supply Chain Finance, Structured Trade Finance, Traditional Trade Finance

2) By Service Provider: Banks, Financial Institutions, Trading Houses, Other Services

3) By Application: Domestic, International

4) By Industry: Banking, financial services, and Insurance (BFSI), Construction, Wholesale Or Retail, Manufacturing, Automobile, Shipping and Logistics, Other Industries

Key highlights covered in the report -

1. Detailed market size forecast and historical data analysis

2. Key drivers influencing market growth

3. Identification of upcoming trends and potential opportunities in the market

4. Analysis of major players strategies, to understand competitive dynamics and market positioning

5. Evaluation of regional dynamics

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Want To Know More About The Business Research Company?

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialise in various industries including manufacturing, healthcare, financial services, chemicals, and technology.

Global Market Model - World's Most Comprehensive Database

The Business Research Company's flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Trade Finance Market Report, Trends, Size, Analysis And Forecast 2024-2033 here

News-ID: 3489995 • Views: …

More Releases from The Business research company

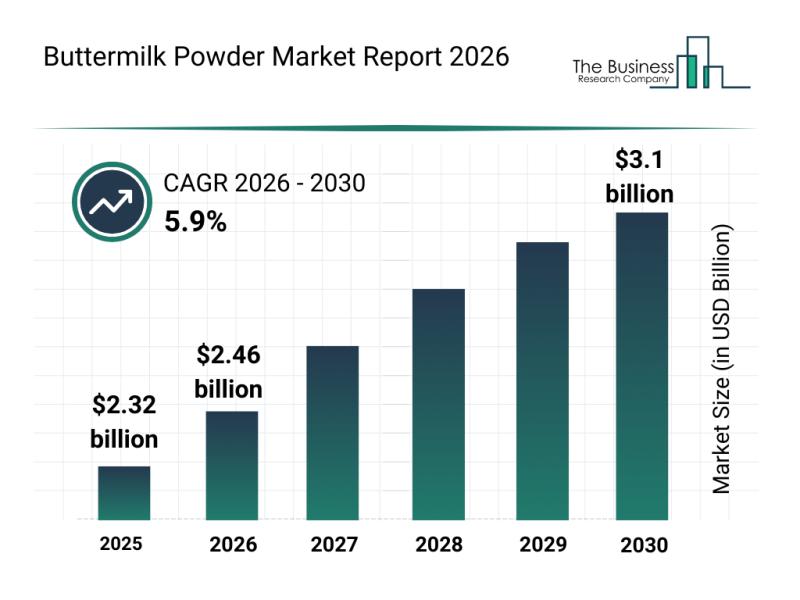

Future Prospects: Key Trends Shaping the Buttermilk Powder Market Up to 2030

The buttermilk powder market is poised for significant expansion in the coming years as demand for nutritious dairy ingredients continues to rise. With consumers increasingly seeking protein-rich and organic options, the industry is adapting to evolving preferences while benefiting from advances in distribution and production methods. This overview explores the expected market growth, key players, and segment dynamics shaping the future of buttermilk powder.

Projected Growth Trajectory and Market Size of…

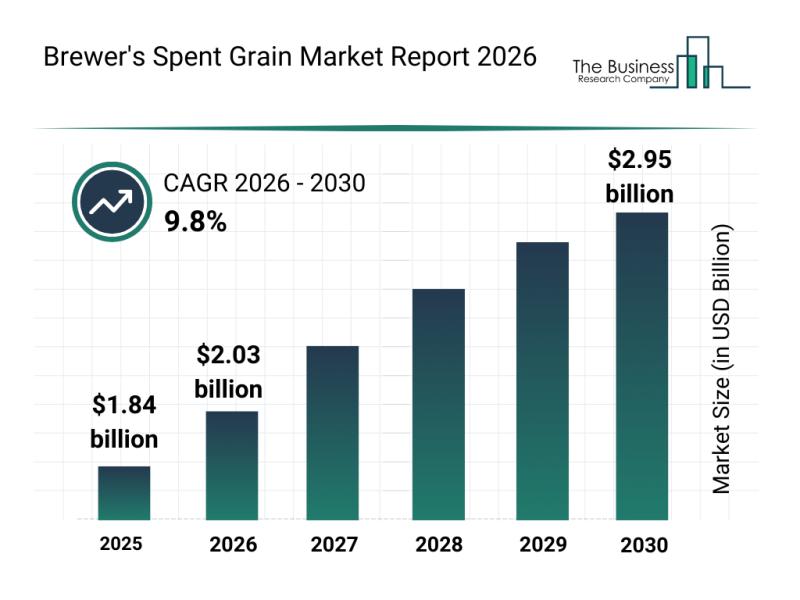

Segmentation, Major Trends, and Competitive Overview of the Brewer's Spent Grain …

The brewer's spent grain market is gaining significant attention as sustainability and circular economy practices become more critical in the food and beverage industry. As companies explore innovative ways to repurpose brewing byproducts, the market is poised for robust expansion. Let's delve into the market's size projections, key players, major trends, and segmentation details to better understand this evolving sector.

Projected Growth and Market Size of the Brewer's Spent Grain Market…

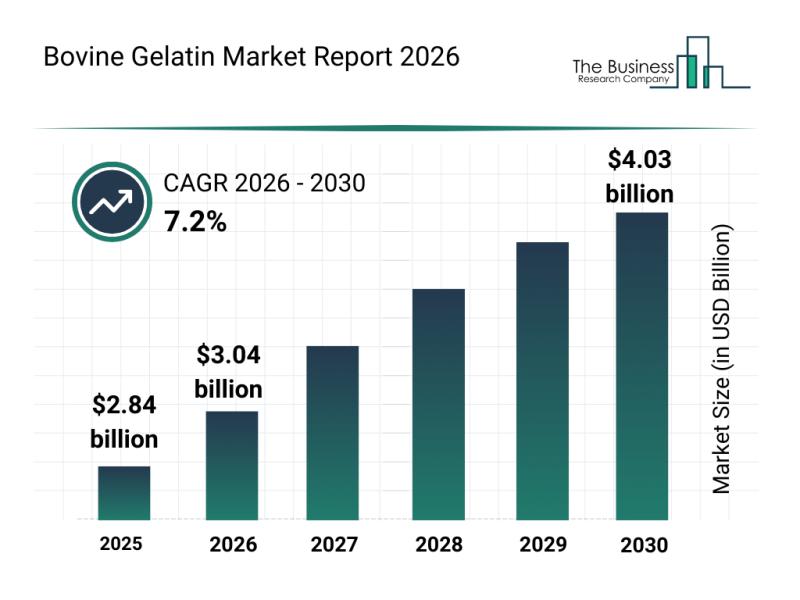

Competitive Analysis: Leading Companies and New Entrants in the Bovine Gelatin M …

The bovine gelatin market is on track for considerable expansion in the coming years, driven by evolving consumer preferences and innovative product applications. With growing awareness about nutrition and sustainability, this sector is expected to witness remarkable growth through 2030. Let's explore the market size projections, key players, influential trends, and detailed segment breakdowns shaping this industry.

Bovine Gelatin Market Size Forecast and Growth Drivers

The bovine gelatin market is…

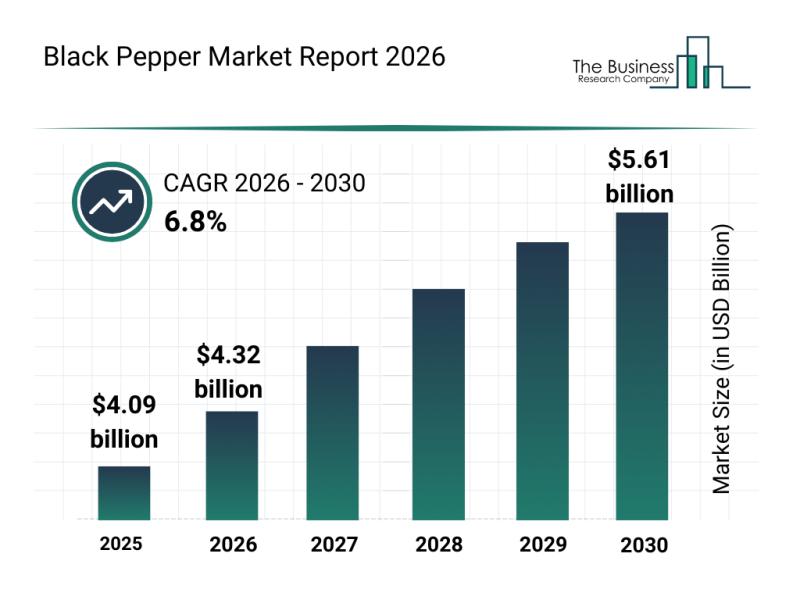

Future Perspectives: Key Trends Shaping the Black Pepper Market Until 2030

The black pepper market is poised for significant expansion over the coming years, driven by evolving consumer preferences and advancements in product offerings. As demand for high-quality and natural spices increases globally, this sector is set to undergo notable changes and opportunities. Let's explore the market size, key players, emerging trends, and detailed segmentation shaping the future of black pepper.

Projected Growth and Size of the Black Pepper Market by 2030…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…