Press release

Digital Twin Financial Services and Insurance Market Size, Share Estimation, Business Strategies, Top Trends, Opportunities And Forecast To 2033

The digital twin financial services and insurance market size has grown rapidly in recent years. It will grow from $4.31 billion in 2023 to $5.12 billion in 2024 at a compound annual growth rate (CAGR) of 18.9%. The growth in the historic period can be attributed to increased volume of financial data, advances in data analytics and simulation technologies, regulatory compliance and risk management needs, digital transformation in financial services, growth in insurtech innovations.The digital twin financial services and insurance market size is expected to see rapid growth in the next few years. It will grow to $10.11 billion in 2028 at a compound annual growth rate (CAGR) of 18.5%. The growth in the forecast period can be attributed to adoption of blockchain for transparent financial transactions, expansion of personalized financial planning solutions, increased use of digital twins for fraud detection, emphasis on real-time analytics in financial services, rise of tokenization and digital assets in financial services. Major trends in the forecast period include integration of artificial intelligence in digital twins, simulation-based scenario planning in finance, digital twins for customer journey mapping in insurance, cybersecurity simulation and threat detection, integration of digital twins with robotic process automation (rpa).

Market Overview -

The digital twin financial services and insurance refers to a technology used for assisting customers with loan management, mitigating risks, policy buying and management, and more. Digital twins are digital replicas of physical products. The data is stored and visualized on a digital platform for better optimization of businesses. The digital twin framework in the insurance and financial services sectors is providing customers with more optimized solutions.

Download Free Sample of Report -

https://www.thebusinessresearchcompany.com/sample.aspx?id=7671&type=smp

Urbanization Powering The Future Of Digital Twin Financial Services And Insurance

The rising urbanization around the world is expected to propel the growth of the digital twin financial services and insurance market going forward. Urbanization refers to the increasing population densities in urban areas compared to rural areas. Due to urbanization and increased net income, people can afford to pay for digital services instead of physically visiting the banks. For instance, according to the United Nations Department of Economic and Social Affairs, a US-based government agency, 68% of the global population is expected to live in urban areas by 2050. Therefore, the rising urbanization and increasing disposable income is driving the digital twin financial services and insurance market growth.

Competitive Landscape -

Major companies operating in the digital twin financial services and insurance market report are International Business Machines Corporation, Atos SE, Swim Inc., General Electric Company, Microsoft Corporation, Capgemini SE, Ansys Inc., NVIDIA Corporation, Altair Engineering Inc., Accentur*e plc, Infosys Limited, Wipro Limited, Cognizant Technology Solutions Corporation, DXC Technology Company, Tata Consultancy Services Limited, Consultants to Government and Industry Incorporated, Genpact Limited, HCL Technologies Limited, Mindtree Limited, Larsen & Toubro Infotech Limited, Virtusa Corporation, Zensar Technologies Limited, Mphasis Limited, Hexaware Technologies Limited, Tech Mahindra Limited, Fidelity National Information Services Inc., Fiserv Inc., Mastercard Incorporated, Visa Inc., American Express Company

Accelerating Digital Twin Financial Services And Insurance

The increasing adoption of cloud technologies is a key trend gaining popularity in the digital twin financial services and insurance market. Cloud technologies are hosted in the cloud and are accessed via a web browser using the internet. The use of cloud technologies in digital insurance and financial services is expected to promote the adoption of digital twin financial services and insurance as it offers greater security, and quicker processing times with reduced prices. For instance, in 2022, according to hybrid cloud adoption study conducted by Hornetsecurity, surveyed 900 IT professionals primarily based in North America and Europe, found that 93% of businesses were adopting a hybrid of cloud and on-premise solutions or migrating fully to the cloud within 5 years.

Browse Full Report @

https://www.thebusinessresearchcompany.com/report/digital-twin-financial-services-and-insurance-global-market-report

Key Segments -

The digital twin financial services and insurance market covered in this report is segmented -

1) By Type: System Digital Twin, Process Digital Twin

2) By Technology: IOT And IIOT, Artificial Intelligence And Machine Learning, 5G, Big Data Analytics, Blockchain And Augmented Reality, Virtual Reality, Mixed Reality

3) By Deployment: Cloud, On-Premises

4) By Application: Bank Account Funds Checking, Digital Fund Transfer Checks, Policy Generation, Other Applications

Key highlights covered in the report -

1. Detailed market size forecast and historical data analysis

2. Key drivers influencing market growth

3. Identification of upcoming trends and potential opportunities in the market

4. Analysis of major players strategies, to understand competitive dynamics and market positioning

5. Evaluation of regional dynamics

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Want To Know More About The Business Research Company?

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialise in various industries including manufacturing, healthcare, financial services, chemicals, and technology.

Global Market Model - World's Most Comprehensive Database

The Business Research Company's flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Twin Financial Services and Insurance Market Size, Share Estimation, Business Strategies, Top Trends, Opportunities And Forecast To 2033 here

News-ID: 3488201 • Views: …

More Releases from The Business research company

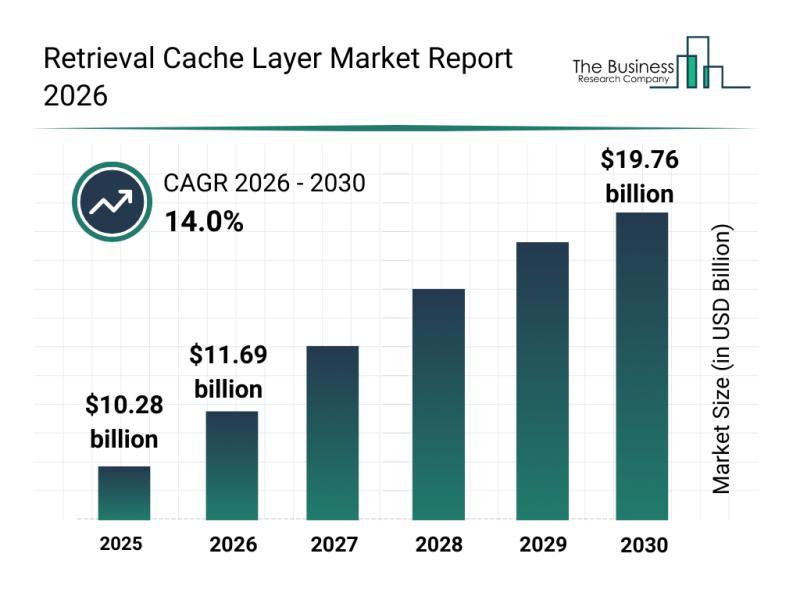

Competitive Analysis: Leading Companies and New Entrants in the Retrieval Cache …

Understanding the future potential of the retrieval cache layer market reveals exciting growth possibilities driven by advancements in technology and increasing industry demands. This sector is set to evolve significantly as companies innovate and expand their capabilities to meet the rising needs of AI workloads, edge computing, and real-time data processing. Let's explore the market size projections, key players, emerging trends, and market segmentation to get a comprehensive view of…

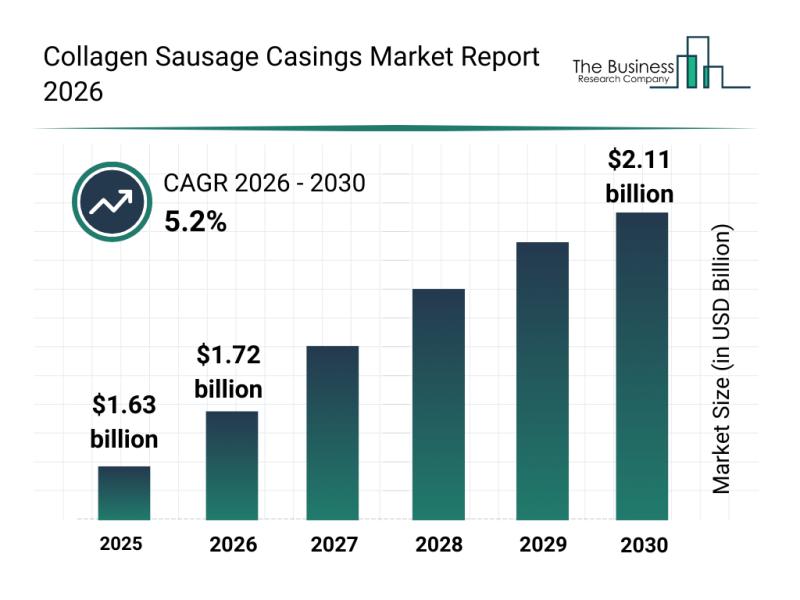

In-Depth Examination of Segments, Industry Trends, and Key Players in the Collag …

The collagen sausage casings market is positioned for significant expansion as consumer preferences and industry practices evolve. Growing demand for convenience foods and advancements in production methods are playing key roles in shaping this sector's future. Let's explore the current market size, leading players, trending innovations, and major segments that define the collagen sausage casings landscape.

Projected Market Size and Growth for Collagen Sausage Casings

The collagen sausage casings market…

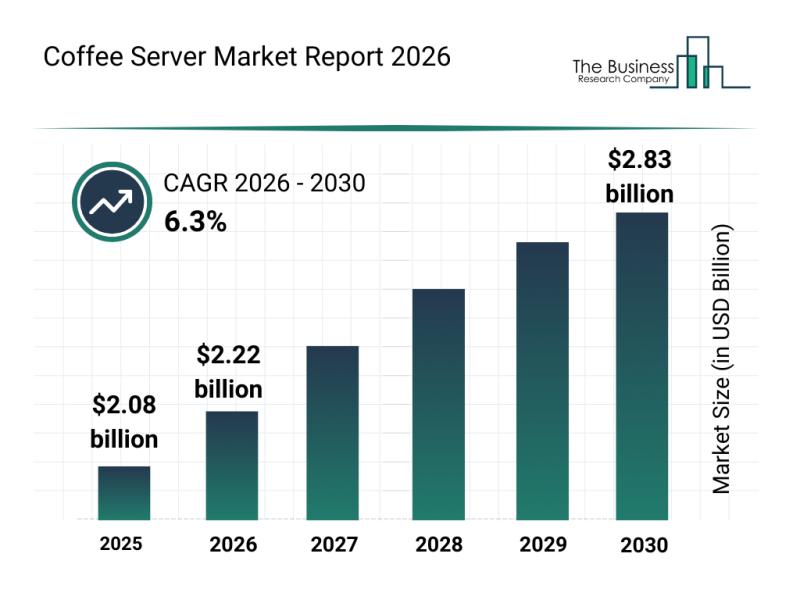

Leading Companies Fueling Growth and Innovation in the Coffee Server Market

The coffee server market is on track for impressive expansion over the coming years, driven by evolving consumer preferences and industry innovations. As coffee culture continues to thrive globally, the need for functional, stylish, and sustainable coffee serving solutions is becoming increasingly important. Let's explore the market size, leading players, emerging trends, and key segments shaping the future of the coffee server industry.

Forecasting the Coffee Server Market Growth and Size…

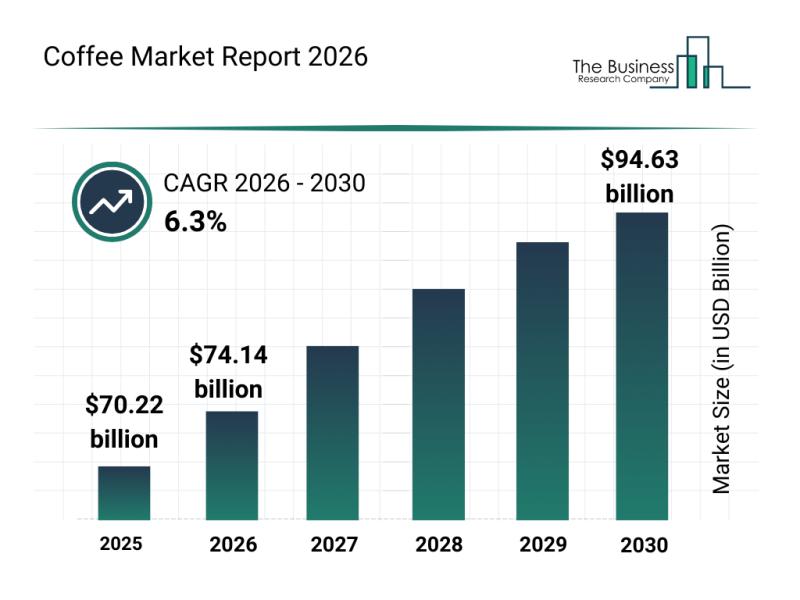

Key Strategic Developments and Emerging Changes Shaping the Coffee Market Landsc …

The coffee industry is on track for substantial growth, driven by evolving consumer preferences and innovative product developments. As coffee continues to hold a vital place in daily routines globally, the market is adapting to meet new demands and broaden its appeal. Let's explore the projected market size, key players, emerging trends, and detailed segments that define the coffee sector's trajectory.

Forecasted Expansion and Market Size of the Coffee Market by…

More Releases for Limited

Cold Chain Market in India 2020 | Snowman Logistics Limited, Coldstar Logistics …

Request Free sample on this latest research report @ https://www.marketreportsonline.com/contacts/requestsample.php?name=828960

Key Players: Snowman Logistics Limited, Coldstar Logistics Private Limited, Gati Kausar India Limited, Gubba Cold Storage Private Limited, Kool-ex Cold Chain Limited, Seabird Logisolutions Limited, DHL Logistics Private Limited, Kuehne + Nagel Private Limited

Cold chains provide storage and distribution services for products that are temperature-sensitive. Depending on the nature and purpose of storage application, cold chains have been categorized as frozen…

Power Sector in India 2021 | Adani Power Limited, CESC Limited, Damodar Valley C …

Request a FREE sample on this latest research report @ https://www.marketreportsonline.com/contacts/requestsample.php?name=837846

Companies covered: Adani Power Limited, CESC Limited, Damodar Valley Corporation (DVC), NHPC Limited, NTPC Limited, SJVN Limited, Suzlon Energy, Tata Power Limited, Websol Energy System Limited, Nuclear Power Corporation of India Limited (NPCIL)

The Indian power sector has undergone a significant transformation in terms of power supply, energy demand, fuel mix, and market operations. India appeared to be the third-largest power…

Financial Brokerage Market in India 2021 | Angel Broking Limited, Geojit Financi …

Request a sample on this latest research report @ https://www.marketreportsonline.com/contacts/requestsample.php?name=839020

The brokerage market was valued at INR 135.0 Bn in FY 2016. In FY 2020, it reached INR 210 Bn from INR 195 Bn in FY 2019, expanding at an annual growth rate ~7.69%.

Key Players: Angel Broking Limited, Geojit Financial Services Limited, ICICI Securities Limited, IIFL Finance Limited, Kotak Securities Limited, Motilal Oswal Financial Services Limited, Reliance Capital Limited, SMC Global…

Gin Market major keyplayers Tilaknagar Industries Limited, United Spirits Limite …

Future Market Insights (FMI) has published a new report, which is titled, “Gin Market: Driven By Changing Lifestyle and Expanding Urban Population - India Industry Analysis and Opportunity Assessment, 2015 – 2025.” The Indian gin market is witnessing a steady rise on account of the growing urban population and changing demographics. The change in outlook of the Indian society towards social consumption of alcohol is driving the growth of the…

India footwear Market 2018-2025 Growth Analysis by Key Players, Khadim India Lim …

India footwear market

Currently, India is the second largest footwear manufacturer in the world after China. The footwear market consists of companies engaged in manufacturing, selling and marketing of different kinds of footwear and accessories to the end users, namely men, women and kids. Footwear has evolved from being a necessity, as protection for feet, to an accessory which has become a style statement for customers. The Indian footwear market…

India auto ancillary Market Emerging Trends and Prospects by leading Players, Am …

India auto ancillary market

The auto ancillary industry is the other side of the automotive industry, which deals with the manufacturing and selling of intermediate parts, equipment and chemicals among others. The auto ancillary supply chain members are original equipment manufacturers (OEMs), tier I, tier II, tier III manufacturers and intermediaries. OEMs deal in high-value instruments and dominate the market, while the unorganized sector serves the aftermarket and deals in…