Press release

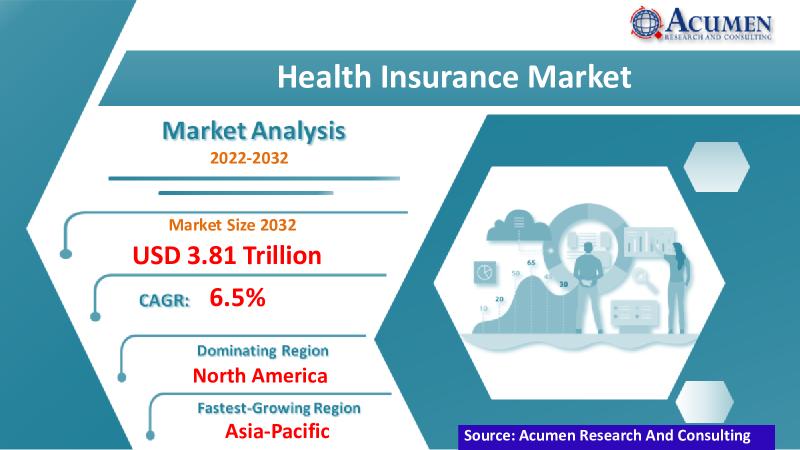

Health Insurance Market Size, Share, Growth, and Forecast 2023-2032

The health insurance market is a vital component of the healthcare ecosystem, serving as a financial safety net for individuals and families against the high costs of medical care. In recent years, this market has undergone significant transformation driven by factors such as technological advancements, regulatory changes, and shifting consumer preferences. In this article, we'll delve into the competitive landscape of the health insurance market, explore future growth prospects, and identify key opportunities and challenges that lie ahead.Download Free Health Insurance Market Sample Report Here: (Including Full TOC, List of Tables & Figures, Chart) https://www.acumenresearchandconsulting.com/request-sample/1381

Competitive Landscape:

The health insurance market is highly competitive, with a diverse array of players ranging from traditional insurance companies to newer entrants such as health tech startups. Established insurers like UnitedHealth Group, Anthem, and Aetna dominate the market with their extensive networks and comprehensive coverage options. However, they face increasing competition from disruptors like Oscar Health, who leverage technology to offer innovative solutions and personalized experiences to consumers.

Future Growth Prospects:

Despite the challenges posed by rising healthcare costs and regulatory uncertainty, the health insurance market is poised for steady growth in the coming years. The increasing prevalence of chronic diseases, aging populations, and the growing demand for healthcare services in emerging markets present significant opportunities for expansion. Moreover, advancements in data analytics, artificial intelligence, and telemedicine are expected to drive greater efficiency and affordability in healthcare delivery, further fueling market growth.

Opportunities:

One of the key opportunities in the health insurance market lies in catering to the needs of underserved populations, including low-income individuals, rural communities, and minority groups. By offering tailored insurance products and expanding access to healthcare services in these areas, insurers can tap into new customer segments and drive revenue growth. Additionally, the rise of value-based care models presents an opportunity for insurers to collaborate with healthcare providers to improve patient outcomes while reducing costs.

Drivers:

Several factors are driving the growth of the health insurance market, including increasing healthcare expenditures, regulatory reforms, and shifting consumer preferences. The implementation of the Affordable Care Act (ACA) has expanded insurance coverage to millions of previously uninsured Americans, driving demand for health insurance products. Additionally, the rise of digital health solutions and telemedicine platforms is enabling insurers to engage with consumers in new ways and deliver more personalized experiences.

Restraints:

Despite the opportunities, the health insurance market faces several challenges, including rising healthcare costs, regulatory uncertainty, and ongoing political debates surrounding healthcare reform. Insurers must navigate complex regulatory environments and adapt to changing market dynamics to remain competitive. Moreover, concerns about data privacy and security pose challenges for insurers leveraging technology to improve healthcare delivery and customer experience.

Current Market Trends:

Several trends are shaping the evolution of the health insurance market, including the rise of consumer-driven healthcare, the growing popularity of high-deductible health plans, and the increasing focus on preventive care and wellness initiatives. Insurers are also investing heavily in digital technologies to enhance customer engagement, streamline administrative processes, and improve health outcomes.

Table Of Content:

CHAPTER 1. Industry Overview of Health Insurance Market

CHAPTER 2. Research Approach

CHAPTER 3. Market Dynamics And Competition Analysis

CHAPTER 4. Manufacturing Plant Analysis

CHAPTER 5. Health Insurance Market By Service Provider

CHAPTER 6. Health Insurance Market By Type

CHAPTER 7. Health Insurance Market By Network Provider

CHAPTER 8. Health Insurance Market By Demographics

CHAPTER 9. Health Insurance Market By Time Period

CHAPTER 10. Health Insurance Market By Distribution Channel

CHAPTER 11. North America Health Insurance Market By Country

CHAPTER 12. Europe Health Insurance Market By Country

CHAPTER 13. Asia Pacific Health Insurance Market By Country

CHAPTER 14. Latin America Health Insurance Market By Country

CHAPTER 15. Middle East & Africa Health Insurance Market By Country

CHAPTER 16. Player Analysis Of Health Insurance Market

CHAPTER 17. Company Profile

Health Insurance Market Segmentation:

The worldwide market for health insurance is split based on service provider, type, network provider, demographics, time period, distribution channel, and geography.

Health Insurance Service Providers

Public

Private

Health Insurance Types

Hospitalization Insurance

Income Protection Insurance

Medical Insurance

Critical Illness Insurance

Health Insurance Network Providers

Preferred Provider Organization

Health Maintenance Organization

Exclusive Provider Organization

Point of Service

Health Insurance Demographics

Senior Citizens

Adults

Minors

Health Insurance Time Periods

Term Insurance

Life Insurance

Health Insurance Distribution Channels

Direct Sales

Financial Institutions

E-Commerce

Hospitals

Clinics

Others

Regional Insights:

The health insurance market exhibits varying dynamics across different regions, influenced by factors such as demographic trends, regulatory frameworks, and healthcare infrastructure. In developed markets like North America and Europe, insurers face intense competition and regulatory scrutiny, driving consolidation and innovation. In contrast, emerging markets in Asia-Pacific and Latin America offer untapped growth opportunities fueled by rising disposable incomes and expanding middle-class populations.

Main Market Players:

Some of the top health insurance companies offered in our report includes Axa, Aetna Inc., Zurich, Allianz, Aia Group Limited, Aviva, Assicurazioni Generali S.p.A., Cigna, Ping An Insurance (Group) Company of China, Ltd., UnitedHealth Group, Anthem Health Insurance, Blue Cross Blue Shield Companies, Highmark and HCSC, Humana, and Wellcare.

Buy the premium market research report here: https://www.acumenresearchandconsulting.com/buy-now/0/1381

Find more such market research reports on our website or contact us directly

Write to us at sales@acumenresearchandconsulting.com

Call us on +918983225533

or +13474743864

201, Vaidehi-Saaket, Baner - Pashan Link Rd, Pashan, Pune, Maharashtra 411021

Acumen Research and Consulting (ARC) is a global provider of market intelligence and consulting services to information technology, investment, telecommunication, manufacturing, and consumer technology markets. ARC helps investment communities, IT professionals, and business executives to make fact based decisions on technology purchases and develop firm growth strategies to sustain market competition.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Health Insurance Market Size, Share, Growth, and Forecast 2023-2032 here

News-ID: 3486901 • Views: …

More Releases from Acumen Research and Consulting

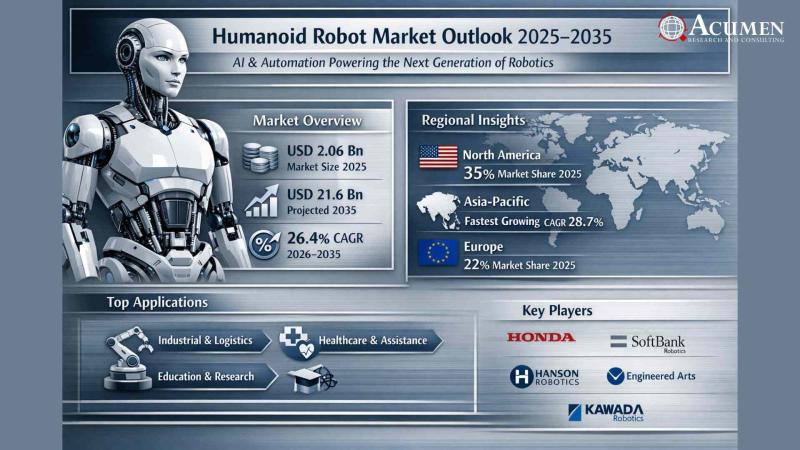

Humanoid Robot Market to Reach USD 21.6 Billion by 2035 | AI & Automation Drive …

Humanoid Robot Market to Surpass USD 21.6 Billion by 2035: AI-Driven Automation Unlocks a New Era of Human-Machine Collaboration

The Humanoid Robot Market is undergoing a transformative boom, reflecting a seismic shift in how industries leverage robotics, artificial intelligence (AI), and automation to meet the growing demands of a rapidly evolving global economy.

According to Acumen Research and Consulting, the global Humanoid Robot Market is projected to grow from USD 2,060.4 million…

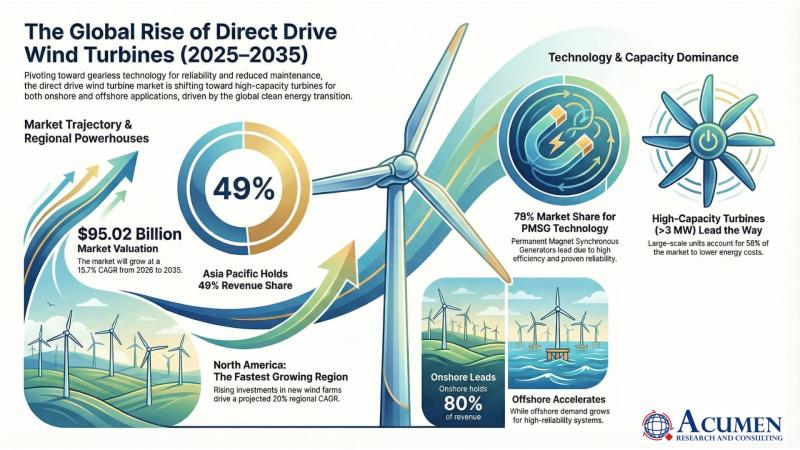

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035 | Acumen Res …

Direct Drive Wind Turbine Market to Reach USD 95.02 Billion by 2035, Driven by Global Renewable Expansion and Offshore Innovation | Acumen Research and Consulting

The Direct Drive Wind Turbine Market is witnessing unprecedented growth momentum as the global renewable energy transition accelerates. According to a new report by Acumen Research and Consulting, the global Direct Drive Wind Turbine Market size is projected to grow from USD 21.91 billion in 2025…

Physical AI Market Set to Surge to USD 83,642.5 Million by 2035 - Groundbreaking …

Global Physical AI Market Report 2026-2035: Robust Growth, Transformational Trends, and Unmatched Opportunities

The Physical AI Market is on the brink of remarkable expansion with groundbreaking advancements in artificial intelligence systems that interact intelligently with the physical world. According to a new market study by Acumen Research and Consulting, the global physical AI market is projected to grow from USD 3,137.5 Million in 2025 to USD 83,642.5 Million by 2035, exhibiting…

Semiconductor Packaging Market to Double from USD 44.21 Billion in 2024 to USD 1 …

Acumen Research And Consulting announces the release of its latest industry report highlighting the robust growth of the Semiconductor Packaging Market. The report reveals that the global market, valued at USD 44.21 billion in 2024, is projected to reach USD 104.76 billion by 2033, expanding at a steady Compound Annual Growth Rate (CAGR) of 10.1% between 2025 and 2033. This rapid growth underscores the increasing importance of packaging innovations in…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…