Press release

Automotive Insurance Market to Hit USD 935.03 Billion by 2031 Driven by Rising Traffic Incidents and Regulatory Requirements

The Automotive Insurance Market, was valued USD 680.06 billion in 2023 and is estimated to reach a staggering USD 935.03 billion by 2031, exhibiting a steady compound annual growth rate (CAGR) of 4.05% from 2024 to 2031.Booming Automotive Industry and Rising Traffic Incidents Drive Growth in Automotive Insurance Market

Fueled by rising traffic accidents and government mandates, the automotive insurance market is poised for significant growth. To safeguard against financial losses from accidents, theft, or fire, vehicle owners increasingly rely on insurance. Expanding coverage options like medical expense compensation and customizable plans cater to diverse needs, enhancing customer experience. Additionally, the projected growth of the global automotive industry presents a promising future for the insurance market.

Get PDF of Report for More Study @ https://www.snsinsider.com/sample-request/1821

Top key Vendors of Automotive Insurance Market

Allstate Insurance Company

RAC Motoring Services

Progressive Casualty Insurance Company

Zhongshan Insurance

CPIC

ABIC Inc.

Zurich Insurance Group

RSA Insurance Group

Clements Worldwide

Recent Developments in Automotive Insurance

-In July 2022 Bajaj Allianz, a leading Indian insurance company, blazed a trail by launching a "Pay As You Consume" (PAYC) add-on cover for usage-based insurance. This innovative product, approved by the Insurance Regulatory and Development Authority of India (IRDAI), allows for more sophisticated insurance options tailored to individual driving habits.

-In May 2022 Liberty Mutual Insurance, a major player in the global insurance market, recognized the growing importance of technology by acquiring the technology assets of Insurance Portal Services. This strategic move strengthens Liberty's position in utilizing embedded insurance capabilities within the automotive industry.

-In March 2024 ACKO, a digital-first insurance company, announced a collaboration with Maruti and Tata, two of India's largest car manufacturers. This partnership offers specialized insurance plans for Maruti and Tata car owners, promising a streamlined and cost-effective insurance experience.

The Automotive Insurance Market Landscape Is Diversifying With A Range Of Coverage Options Catering To Different Needs

Third-party liability insurance remains dominant in many regions, exceeding half the market share in some areas. This mandatory coverage protects others in case of accidents. Comprehensive coverage is another popular choice, safeguarding both the insured vehicle and third-party damages. However, the future is leaning towards personalization. Pay-as-you-drive policies are gaining traction, offering premiums based on individual driving habits. Technology is also playing a key role. Telematics and big data analytics are empowering insurers to assess risk profiles with greater accuracy, leading to customized premiums and faster claims processing. Finally, to enhance customer experience, insurance companies are prioritizing user-friendly online platforms for policy management, swift claims processing, and readily available customer support.

For Any Enquiry Click Here @ https://www.snsinsider.com/enquiry/1821

Segmenting the Automotive Insurance Market

The automotive insurance market thrives on its ability to cater to diverse needs through segmentation by both insurance type and vehicle type. In terms of insurance type, mandatory third-party liability insurance reigns supreme in many regions, exceeding a staggering 50% market share in some areas. This vital coverage protects others on the road from property damage and injuries caused by the insured vehicle. Following closely behind is comprehensive coverage, safeguarding both the insured vehicle (around 60-70% of the market share) and third-party damages in case of accidents, theft, fire, or natural disasters.

The vehicle type segmentation further highlights the market's diversity. Passenger cars, due to their sheer prevalence, dominate the market with a commanding 60-70% share. Light commercial vehicles (LCVs) such as vans and pickups hold a significant share of around 15-20%, likely due to their commercial usage and potentially higher repair costs associated with their size. Finally, heavy commercial vehicles (HCVs) like trucks and buses, despite the potential for larger claims due to their size and operation, occupy a smaller market share of approximately 10-15%. This segmentation ensures the automotive insurance market caters to a wide range of vehicles and the specific needs of their owners.

The Russia-Ukraine War's Impact on Automotive Insurance

The Russia-Ukraine war has sent shockwaves through the automotive insurance landscape, primarily impacting specialized sectors. While the general market has seen some conflict-related claims, these are unlikely to reach the staggering heights experienced during the COVID-19 pandemic. Since most war-related damages fall outside standard policy coverage, insurers' overall exposure is minimized.

Aviation insurance may face policy hardening, further hindering its post-pandemic recovery by an estimated 10-15%. Sanctions have disrupted international coverage for satellite launches, particularly those involving Russia, potentially impacting billions of dollars in insured assets. Marine insurance has seen a rise in claims due to damaged hulls, ports, and cargo, especially in Ukraine, with some reports suggesting a 20-30% increase in claims volume in the region.

Furthermore, global supply chain disruptions caused by the conflict and sanctions could lead to increased hull and cargo war rates by as much as 21%. The energy insurance sector has also been directly affected by sanctions on Russian oil, potentially leading to a 5-10% increase in global energy prices. This situation could accelerate the shift towards renewable energy sources.

The Asia Pacific Region Is Expected To Dominate The Global Automotive Insurance Market Throughout The Forecast Period, Holding An Estimated Share Of 41.20%

This dominance can be attributed to the flourishing presence of numerous insurance providers, including both traditional and third-party insurers, in this region. Additionally, countries like India and China have witnessed a significant surge in automobile sales in recent years. Other regions like the Middle East & Africa and South America are also anticipated to exhibit impressive growth during the forecast period. The rising number of vehicles on the road in these regions is a potential factor that could significantly bolster their contribution to the global market.

Key Takeaways for Automotive Insurance Market Study

In-depth understanding of market drivers, trends, and challenges in the global automotive insurance market.

Granular segmentation analysis by insurance type and vehicle type, providing insights into specific market segments.

Evaluation of the impact of the Russia-Ukraine war and economic slowdowns on the automotive insurance market.

Identification of key growth opportunities in emerging regions like Asia Pacific, Middle East & Africa, and South America.

Insights into recent developments, including the launch of innovative insurance products and strategic acquisitions.

Browse This Full Report with Charts and Graphs @ https://www.snsinsider.com/reports/automotive-insurance-market-1821

Our Related Report

https://www.whatech.com/og/markets-research/transport/814844-autonomous-vehicles-market-going-to-reach-at-value-usd-265-01-billion-by-2031-cagr-of-22

https://www.whatech.com/og/markets-research/transport/814846-electric-bus-market-to-touch-usd-56-28-billion-rising-at-a-cagr-of-15-by-2031

https://www.whatech.com/og/markets-research/transport/814847-hyper-car-market-will-usd-38-80-billion-and-cagr-of-10-5-by-2030

https://www.whatech.com/og/markets-research/transport/814874-hybrid-train-market-to-worth-usd-38-48-billion-by-2031-cagr-of-7-3

https://www.whatech.com/og/markets-research/transport/814878-motorcycles-market-to-grow-at-a-staggering-rate-of-8-by-2023-to-2030

https://www.whatech.com/og/markets-research/transport/814880-electric-commercial-vehicle-market-is-witnessing-remarkable-growth-in-cagr-of-24-over-2024-2031

https://www.whatech.com/og/markets-research/transport/814881-car-rental-market-to-surpass-usd-311-63-billion-by-2031-driven-by-rising-disposable-incomes-and-increased-urbanization

https://www.einpresswire.com/article/708041784/the-automotive-metal-stamping-market-is-forecasted-to-hit-usd-156-55-billion-by-2031

https://www.whatech.com/og/markets-research/transport/818840-electric-forklift-market-report-analysis-2023-2030-growth-rate-market-players-by-sns-insider

https://www.whatech.com/og/markets-research/transport/818447-new-energy-vehicle-taxi-market-revenue-to-touch-usd-494-59-billion-by-2031-propelled-by-continuous-advancements-in-battery-technology-electric-drivetrains

https://www.whatech.com/og/markets-research/transport/818680-public-transportation-market-size-trends-latest-insights-analysis-and-forecast-2024-2031-transport-for-london-uk-the-san-diego-metropolitan-transit-system-us

Contact Us:

Akash Anand - Head of Business Development Strategy

Email: info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Automotive Insurance Market to Hit USD 935.03 Billion by 2031 Driven by Rising Traffic Incidents and Regulatory Requirements here

News-ID: 3485997 • Views: …

More Releases from SNS Insider

Private Cloud Services Market Forecast Predicts Promising Growth Ahead

Private Cloud Services Market Scope and Overview

The Private Cloud Services Market has witnessed significant growth in recent years, fueled by the increasing adoption of cloud computing technologies across various industries. Private clouds offer enhanced security, control, and customization compared to public cloud services, making them a preferred choice for enterprises seeking to leverage cloud capabilities while maintaining data sovereignty and compliance. This report delves into the competitive landscape, market segmentation,…

Video Surveillance Market Analysis Unveils Insights for Growth and Development

Video Surveillance Market Scope and Overview

The Video Surveillance Market has seen significant growth over the past few decades, driven by advancements in technology and an increasing need for security across various sectors. Video surveillance systems, once primarily used for security purposes, have now expanded their applications to include monitoring, analysis, and even preventive measures in various industries. This report provides a comprehensive analysis of the video surveillance market, covering its…

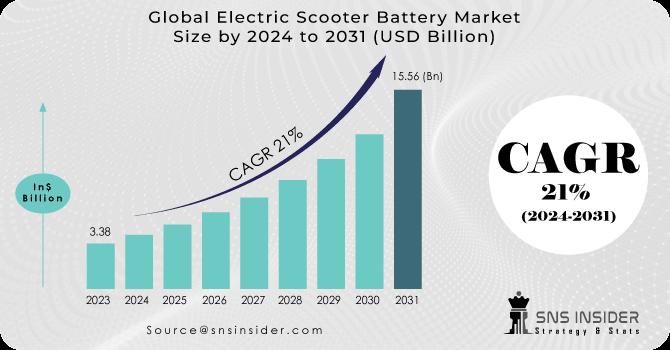

Electric Scooter Battery Market Charges Ahead, Propelling Sustainable Urban Mobi …

The Global Electric Scooter Battery Market is experiencing a remarkable surge, fueled by the rising demand for eco-friendly and convenient transportation solutions in urban environments. As cities around the world grapple with traffic congestion, air pollution, and the need for sustainable mobility, the electric scooter battery market is poised to play a pivotal role in shaping the future of urban transportation. According to a comprehensive market research report, the electric…

Solar-Powered Vehicle Market Accelerates Towards a Sustainable Future, Projected …

The Global Solar-Powered Vehicle Market is rapidly gaining momentum, driven by the urgent need to combat climate change and reduce greenhouse gas emissions. As the world transitions towards a greener and more sustainable future, the adoption of solar-powered vehicles is emerging as a game-changer in the automotive industry. According to a comprehensive market research report, the solar-powered vehicle market, valued at $1.27 billion in 2023, is expected to reach a…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…