Press release

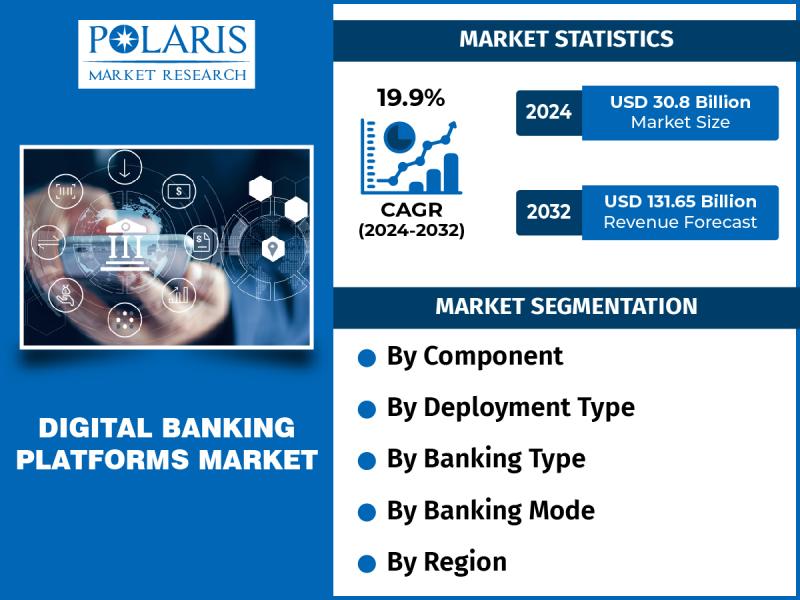

Digital Banking Platforms Market: A Booming Industry Expected to Reach USD 131.65 Billion By 2032 With 19.9% CAGR

𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐁𝐚𝐧𝐤𝐢𝐧𝐠 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦𝐬 𝐌𝐚𝐫𝐤𝐞𝐭The digital banking platforms market size is projected to be valued at USD 25.73 billion in 2023 and is expected to rise to USD 131.65 billion by 2032. The sales of digital banking platforms are expected to register a CAGR of 19.9% during the forecast period. Various factors propelling the demand for digital banking platforms include:

● The market for digital banking platforms is anticipated to continue expanding due to consumers' growing need for easy, accessible, and secure financial services via mobile devices.

● Because digital banking platforms have fewer operational costs, it is easier for them to provide their consumers with competitive rates and prices.

● Governments and regulatory agencies encourage the expansion of digital banking platforms because it increases access to banking services and financial inclusion.

𝐆𝐞𝐭 𝐚𝐧 𝐄𝐱𝐜𝐥𝐮𝐬𝐢𝐯𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐏𝐃𝐅 𝐨𝐟 𝐓𝐡𝐢𝐬 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.polarismarketresearch.com/industry-analysis/digital-banking-platforms-market/request-for-sample

𝐖𝐡𝐚𝐭 𝐢𝐬 𝐚 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐏𝐥𝐚𝐭𝐟𝐨𝐫𝐦 𝐢𝐧 𝐁𝐚𝐧𝐤𝐢𝐧𝐠?

An omnichannel or multichannel personal banking service provider is a digital banking platform. An advanced digital banking platform interfaces with hundreds of banking endpoints from various technology providers, including bill pay and core banking software suppliers. Many institutions also use this platform to eliminate human error and complete difficult jobs faster and more efficiently. Numerous financial institutions and banks are also developing intelligent banking platforms to lower expenses and enhance account security.

𝐌𝐚𝐫𝐤𝐞𝐭 𝐋𝐞𝐚𝐝𝐞𝐫𝐬

The competitive environment in the digital banking platforms market is fragmented due to the presence of numerous regional and international market participants. Here is a list of the major participants in the market:

• Alkami

• Apiture

• Appway

• Backbase

• BNY Mellon

• CR2

• EdgeVerve

• ebankIT

• Finastra

• Fiserv

• Intellect Design Arena

• Mambu

• MuleSoft

• nCino

• NCR

• NETinfo

• Oracle

• SAP

• Sopra Banking Software

• TCS

• Technisys

• Temenos

• TPS

• Velmie and Worldline.

𝐁𝐮𝐲 𝐭𝐡𝐢𝐬 𝐏𝐫𝐞𝐦𝐢𝐮𝐦 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.polarismarketresearch.com/buy/2276/2

𝐀𝐩𝐩𝐥𝐢𝐜𝐚𝐭𝐢𝐨𝐧𝐬

• Retail Banking: Digital platforms facilitate everyday banking activities for individual customers, including managing accounts, making transfers, and applying for credit.

• Corporate Banking: They offer tailored solutions for businesses, including cash management, trade financing, and treasury operations, all accessible via digital channels.

• Wealth Management: Integration of robo-advisors and personalized investment solutions into digital banking platforms to cater to wealth management clients.

• Customer Relationship Management: Advanced analytics and machine learning on digital platforms help in understanding customer behaviors, improving service, and cross-selling products.

𝐂𝐨𝐮𝐧𝐭𝐫𝐲-𝐖𝐢𝐬𝐞 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬

The report covers the major regions of Europe, North America, Latin America, Asia Pacific, the Middle East, and Africa. According to the research, Asia Pacific will have a stronger growth rate in the upcoming years. Numerous fintech companies based in the Asia Pacific region offer cutting-edge digital banking systems and upend established banking paradigms.

Also, because of the region's high rate of technological adoption, strong customer demand for digital banking services, and significant bank investments in digital banking infrastructure, North America is anticipated to have the highest revenue share in the market.

𝐀𝐜𝐜𝐞𝐬𝐬 𝐓𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭, 𝐡𝐞𝐫𝐞: https://www.polarismarketresearch.com/industry-analysis/digital-banking-platforms-market

𝐏𝐨𝐥𝐚𝐫𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡 𝐡𝐚𝐬 𝐬𝐞𝐠𝐦𝐞𝐧𝐭𝐞𝐝 𝐭𝐡𝐞 𝐝𝐢𝐠𝐢𝐭𝐚𝐥 𝐛𝐚𝐧𝐤𝐢𝐧𝐠 𝐩𝐥𝐚𝐭𝐟𝐨𝐫𝐦𝐬 𝐦𝐚𝐫𝐤𝐞𝐭 𝐫𝐞𝐩𝐨𝐫𝐭 𝐛𝐚𝐬𝐞𝐝 𝐨𝐧 𝐜𝐨𝐦𝐩𝐨𝐧𝐞𝐧𝐭, 𝐝𝐞𝐩𝐥𝐨𝐲𝐦𝐞𝐧𝐭 𝐭𝐲𝐩𝐞, 𝐛𝐚𝐧𝐤𝐢𝐧𝐠 𝐭𝐲𝐩𝐞, 𝐚𝐧𝐝 𝐛𝐚𝐧𝐤𝐢𝐧𝐠 𝐦𝐨𝐝𝐞:

Digital Banking Platforms, Component Outlook (Revenue - USD Billion, 2019 - 2032)

• Platforms

• Services

Digital Banking Platforms, Deployment Type Outlook (Revenue - USD Billion, 2019 - 2032)

• On-Premises

• Cloud

Digital Banking Platforms, Banking Type Outlook (Revenue - USD Billion, 2019 - 2032)

• Retail Banking

• Corporate Banking

• Investment Banking

Digital Banking Platforms, Banking Mode Outlook (Revenue - USD Billion, 2019 - 2032)

• Online Banking

• Mobile Banking

𝐌𝐨𝐫𝐞 𝐓𝐫𝐞𝐧𝐝𝐢𝐧𝐠 𝐋𝐚𝐭𝐞𝐬𝐭 𝐑𝐞𝐩𝐨𝐫𝐭𝐬 𝐛𝐲 𝐏𝐨𝐥𝐚𝐫𝐢𝐬 𝐌𝐚𝐫𝐤𝐞𝐭 𝐑𝐞𝐬𝐞𝐚𝐫𝐜𝐡:

U.S. AI Training Dataset Market: https://www.polarismarketresearch.com/industry-analysis/us-ai-training-dataset-market

Alternative Data Market: https://www.polarismarketresearch.com/industry-analysis/alternative-data-market

U.S. Sports Betting Market: https://www.polarismarketresearch.com/industry-analysis/us-sports-betting-market

𝐂𝐨𝐧𝐭𝐚𝐜𝐭 𝐈𝐧𝐟𝐨:

Polaris Market Research

Phone: +1-929-297-9727

Email: sales@polarismarketresearch.com

𝐀𝐛𝐨𝐮𝐭 𝐔𝐬:

Polaris Market Research is a worldwide market research and consulting organization. We give unmatched nature of offering to our customers present all around the globe across industry verticals. Polaris Market Research has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We at Polaris are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defence, among different ventures present globally.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Digital Banking Platforms Market: A Booming Industry Expected to Reach USD 131.65 Billion By 2032 With 19.9% CAGR here

News-ID: 3480212 • Views: …

More Releases from Polaris Market Research & Consulting

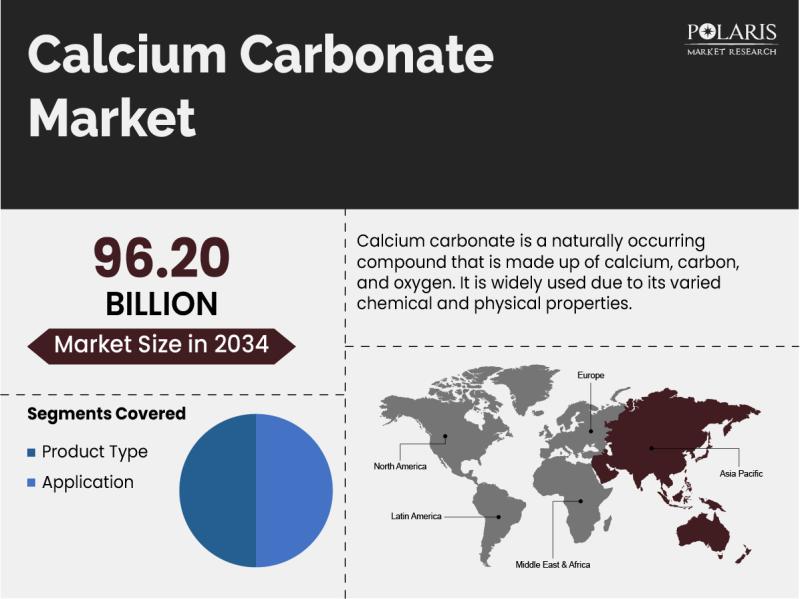

Calcium Carbonate Market Projected to Reach USD 96.20 Billion by 2034, Growing a …

The quantitative market research report published by Polaris Market Research on Calcium Carbonate Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Calcium Carbonate Market size, financial data, and projected future growth. All the information presented…

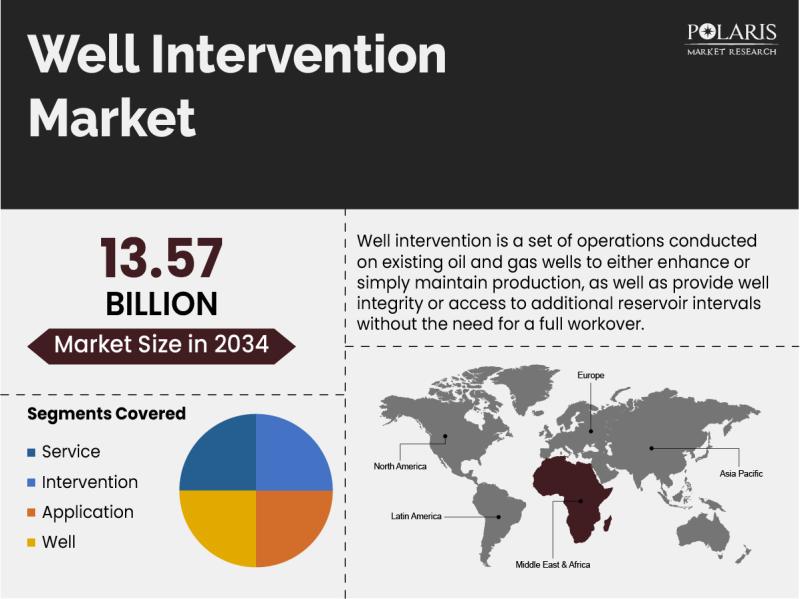

Well Intervention Market Size And Booming Worldwide From 2026-2034 | Archer Limi …

Market Size and Share:

Global Well Intervention Market is currently valued at USD 9.95 billion in 2025 and is anticipated to generate an estimated revenue of USD 13.57 billion by 2034, according to the latest study by Polaris Market Research. Besides, the report notes that the market exhibits a robust 3.5% Compound Annual Growth Rate (CAGR) over the forecasted timeframe, 2026 - 2034

Polaris Market Research has introduced the latest market research…

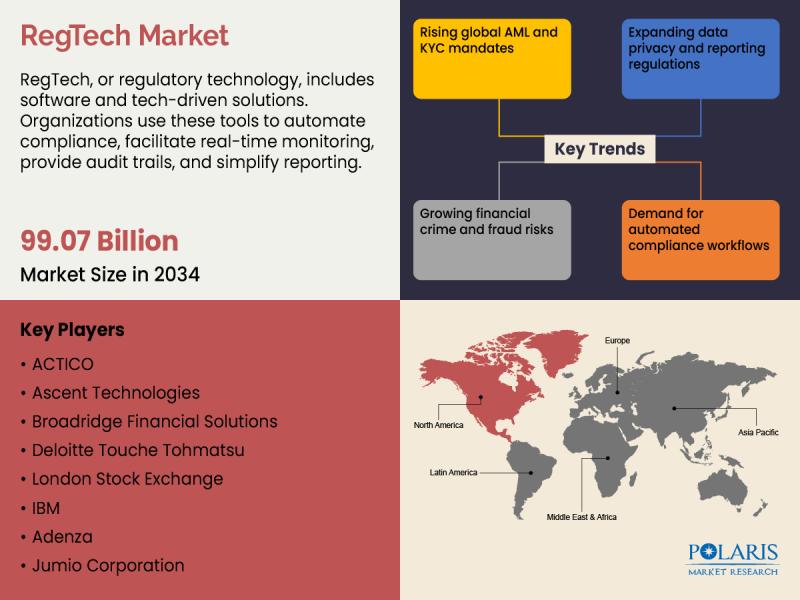

RegTech Market to Reach USD 99.07 Billion by 2034, Expanding at a 21.5% CAGR Ami …

The quantitative market research report published by Polaris Market Research on RegTech Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, RegTech Market size, financial data, and projected future growth. All the information presented in the…

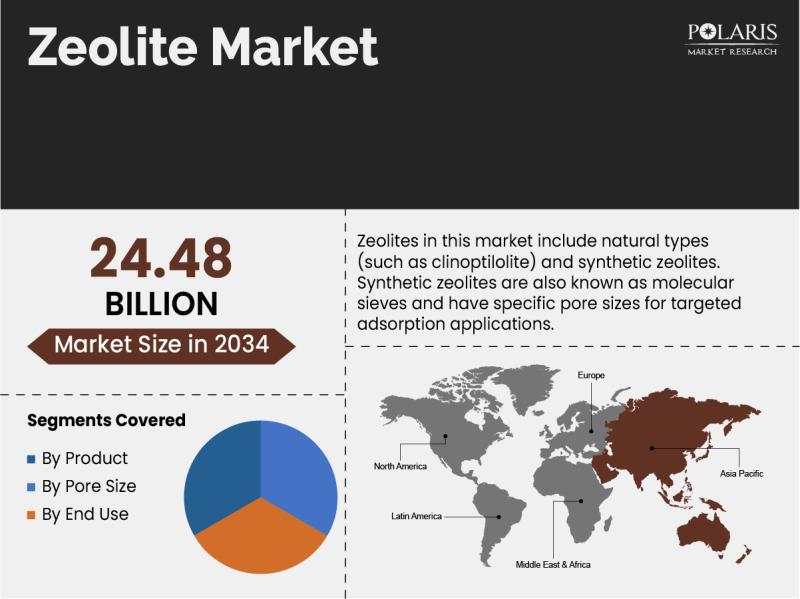

Zeolite Market to Reach USD 24.48 Billion by 2034, Expanding at a 5.4% CAGR | Ar …

The quantitative market research report published by Polaris Market Research on Zeolite Market aims to educate users with an in-depth understanding of a rapidly growing market. The study details important facts and figures, expert opinions, and major developments across the globe. The research study serves as a vital source of information with the historical data, Zeolite Market size, financial data, and projected future growth. All the information presented in the…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…