Press release

Exploring the Global Accidental Death Insurance Market: A Comprehensive Overview

The accidental death insurance market size has grown steadily in recent years. It will grow from $70.09 billion in 2023 to $72.45 billion in 2024 at a compound annual growth rate (CAGR) of 3.4%. The growth in the historic period can be attributed to awareness and education, insurance market evolution, occupational hazards, changing lifestyles.The accidental death insurance market size is expected to see steadily grown in the next few years. It will grow to $83.46 billion in 2028 at a compound annual growth rate (CAGR) of 3.6%. The growth in the forecast period can be attributed to risk management, digital platforms, health and wellness incentives, travel and adventure. Major trends in the forecast period include digital distribution, customized coverage, bundled insurance products, riders and add-ons.

Market Overview -

An accidental death insurance policy protects you and your family in the event of serious injuries or death in an accident. The financial institutions pay a lump sum amount to the beneficiary in case of an accidental death, in addition to the standard benefit payable if the insured died of natural causes. This type of insurance is often an addition, or a clause connected to a life insurance policy.

Download Free Sample of Report -

https://www.thebusinessresearchcompany.com/sample.aspx?id=2451&type=smp

Growing Influence Of Environmental Concerns On The Accidental Death Insurance Market

The rising awareness of environmental issues is expected to drive the growth of the accidental death insurance market going forward. Environmental issues encompass concerns related to the natural world, including challenges such as pollution, climate change, deforestation, habitat destruction, and biodiversity loss, which impact the environment and ecosystems. The increasing frequency of natural disasters such as floods, hurricanes, and wildfires is expected to increase demand for accidental death insurance policies. For instance, in March 2023, according to the UN Office for the Coordination of Humanitarian Affairs (OCHA), a US-based humanitarian information source on global crises and disasters, the total of 387 catastrophic events in 2022 was slightly higher than the average from 2002 to 2021 (370). The occurrence of each type of disaster was also close to average levels in the last two decades. In 2022, the Emergency Event Database (EM-DAT) recorded 387 natural hazards and disasters worldwide, resulting in the loss of 30,704 lives and affecting 185 million individuals. Economic losses totaled around $ 223.8 billion. Heat waves caused over 16,000 excess deaths in Europe, while droughts affected 88.9 million people in Africa. Hurricane Ian single-handedly caused damage costing $100 billion in the Americas. Therefore, the rising awareness of environmental issues is expected to drive the growth of the accidental death insurance market.

Competitive Landscape -

Major companies operating in the accidental death insurance market include Allianz SE, Assicurazioni Generali SpA, China Life Insurance Company Limited, MetLife Inc., Ping An Insurance Company of China Ltd., AXA SA, Sumitomo Life Insurance Company, Aegon Life Insurance Company Limited, Dai-ichi Life Insurance Company Limited, Clinical Pharmacogenetics Implementation, Aviva plc, Munich Re Group, Zurich Insurance Group Ltd., Reliance Nippon Life Insurance Company, Gerber Life Insurance Company, American International Group Inc., Prudential Financial Inc., Mutual of Omaha Insurance Company, Aflac Inc., Transamerica Corporation, Fidelity Life Association, Hartford Financial Services Group Inc., Sun Life Financial Inc., Taiwan Life Insurance Co. Ltd., Massachusetts Mutual Life Insurance Company, Farglory Life Insurance Col Ltd., TruStage Financial Group Inc., Securian Financial Group Inc., American National Insurance Company, American Family Insurance, Amica Mutual Insurance Company, Erie Insurance Group

Introduction Of Innovative Products By Key Players In The Accidental Death Insurance Market

Major companies operating in the accidental death insurance market are introducing innovative products to gain a competitive edge in the market. For instance, in March 2022, a US-based media company, Asteya, a U.S.-based technology company specializing in income insurance, unveiled a new product, namely accidental death coverage. Asteya's digital insurance platform is designed to cater to the needs of modern entrepreneurs, offering cost-effective, rapid, and easily accessible insurance to safeguard their earnings. The company's mission is to ensure that income insurance is within reach for everyone, with the ultimate objective of bolstering individuals' financial, physical, and mental well-being.

Browse Full Report @

https://www.thebusinessresearchcompany.com/report/accidental-death-insurance-global-market-report

Key Segments -

The accidental death insurance market covered in this report is segmented -

1) By Application: Personal, Enterprise

2) By Product: Personal Injury Claims, Road Traffic Accidents, Work Accidents, Other Products

3) By Distribution Channel: Direct Marketing, Bancassurance, Agencies, E-commerce, Brokers

Key highlights covered in the report -

1. Detailed market size forecast and historical data analysis

2. Key drivers influencing market growth

3. Identification of upcoming trends and potential opportunities in the market

4. Analysis of major players strategies, to understand competitive dynamics and market positioning

5. Evaluation of regional dynamics

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Want To Know More About The Business Research Company?

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialise in various industries including manufacturing, healthcare, financial services, chemicals, and technology.

Global Market Model - World's Most Comprehensive Database

The Business Research Company's flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Exploring the Global Accidental Death Insurance Market: A Comprehensive Overview here

News-ID: 3475669 • Views: …

More Releases from The Business research company

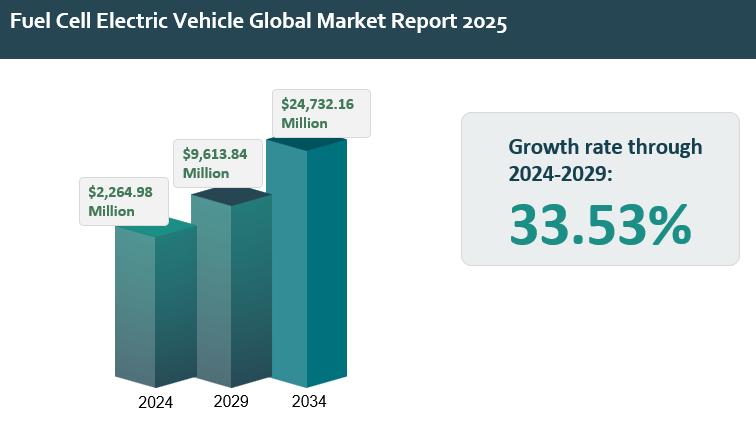

Global Fuel Cell Electric Vehicle Market Outlook 2025-2034: Growth Acceleration, …

The fuel cell electric vehicle report outlines and analyzes the fuel cell electric vehicle market, covering the historic period 2019-2024 and the forecast periods 2024-2029 and 2034F. The report assesses the market across regions and the major economies within each region.

The global fuel cell electric vehicle market was valued at $2.26498 billion in 2024, increasing at a CAGR of 6.88% since 2019. The market is projected to rise from $2.26498…

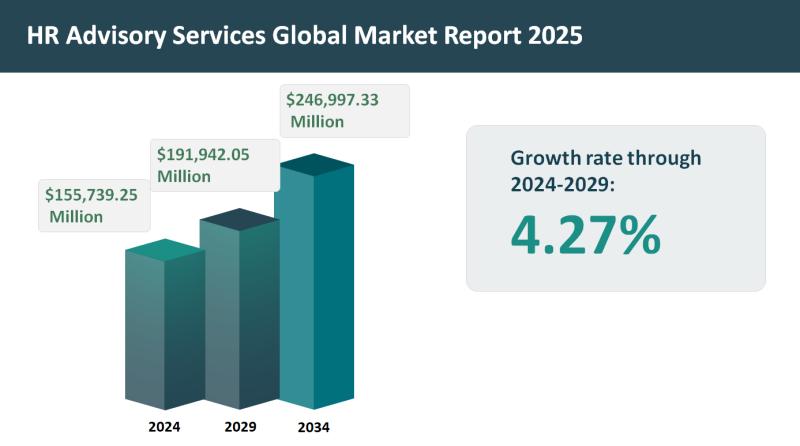

Global HR Advisory Services Market Set for 4.27% Growth, Projected to Reach $191 …

The HR advisory services report outlines and analyzes the HR advisory services market across 2019-2024 (historic period) and 2024-2029, 2034F (forecast period). It examines market performance across global regions and key economies.

The global HR advisory services market was valued at approximately $155.73925 billion in 2024, increasing at a CAGR of 4.22% since 2019. The market is anticipated to rise from $155.73925 billion in 2024 to $191.94205 billion in 2029, reflecting…

Evolving Market Trends In The Integrated Geophysical Services Industry: Enhancin …

The Integrated Geophysical Services Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Integrated Geophysical Services Market Size During the Forecast Period?

The integrated geophysical services market has experienced consistent growth in recent years, expected to rise from $2.35 billion in 2024 to…

Global HR Advisory Services Market: Key Trends, Market Share, Growth Drivers, An …

The HR advisory services market report describes and explains the HR advisory services market and covers 2019-2024, termed the historic period, and 2024-2029, 2034F termed the forecast period. The report evaluates the market across each region and for the major economies within each region.

The global HR advisory services market reached a value of nearly $155.74 billion in 2024, having grown at a compound annual growth rate (CAGR) of 4.22% since…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…