Press release

Fraud Detection and Prevention Market was valued at $29.5 billion in 2022 and to generate $252.7 billion by 2032

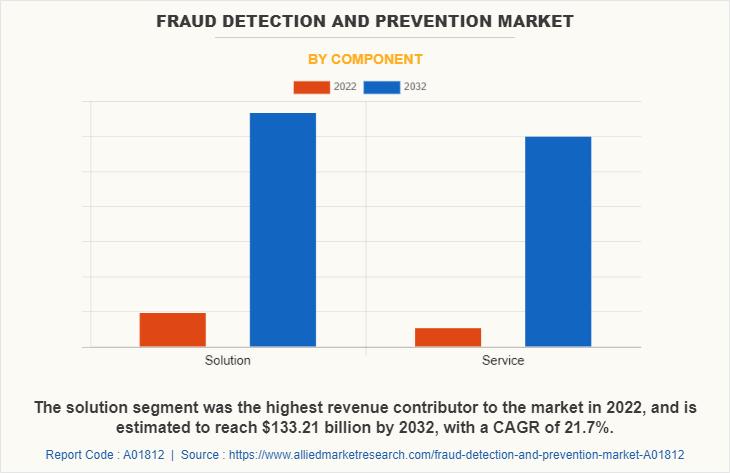

The fraud detection and prevention industry was valued at $29.46 billion in 2022, and is estimated to reach $252.7 billion by 2032, growing at a CAGR of 24.3% from 2023 to 2032.The retail sector registered highest market growth rate during the forecast period. Rise in penetration of mobiles and internet across retail sector propels adoption of fraud detection and prevention solutions in the Retail sector. In addition, data from the retail and consumer sectors has increased significantly during the pandemic and it needs to be secured as it contains sensitive customer data, hence adoption of fraud detection and prevention solutions across the retail sector propels the market growth.

Request Sample Report: https://www.alliedmarketresearch.com/request-sample/2142

Fraud detection and prevention systems have emerged as indispensable tools in combating the escalating tide of fraudulent activities globally. These sophisticated software applications provide analytical solutions aimed at identifying and mitigating fraud risks, thus safeguarding organizations against financial losses and reputational damage. The proliferation of fraudulent activities across industries has underscored the critical importance of robust fraud detection and prevention measures.

The surge in fraudulent activities on a global scale has heightened the demand for advanced fraud detection and prevention solutions. Organizations across sectors are increasingly investing in robust systems to protect themselves against evolving fraud tactics and schemes.

Enquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/2142

The advent of big data analytics and cloud computing has revolutionized the fraud detection landscape. These technologies enable organizations to leverage vast amounts of data and deploy sophisticated algorithms to detect anomalies and suspicious patterns indicative of fraudulent behavior.

The accessibility and scalability offered by cloud-based fraud detection and prevention solutions have led to widespread adoption across both small and large enterprises. The cloud infrastructure facilitates remote server access and centralized management of applications, enhancing operational efficiency and flexibility.

Buy Now and Get Discount: https://www.alliedmarketresearch.com/fraud-detection-and-prevention-market/purchase-options

By region, North America dominated the fraud detection and prevention market size in 2022 for the fraud detection and prevention market, as this region has been at the forefront of technological advancements, including the development and adoption of fraud detection and prevention technologies. The widespread adoption of digital platforms and online transactions in this region increases the risk of fraud, leading to a higher demand for effective fraud detection and prevention solutions. Thus, anticipated to propel the growth of the market. However, Asia-Pacific is expected to exhibit the highest growth during the forecast period. This is attributed to the increasing internet penetration, smartphone adoption, and e-commerce activities are expected to provide lucrative growth opportunities for the market in this region.

The major key players operating in the fraud detection and prevention market analysis are IBM Corporation, Oracle Corporation, SAS Institute Inc., Fair Isaac Corporation., SAP SE, BAE Systems, ACI Worldwide, NCR Limited, Precisely Holding LLC, and LexisNexis.

Read More: https://www.alliedmarketresearch.com/press-release/fraud-detection-and-prevention-market.html

David Correa

1209 Orange Street

Corporation Trust Center

Wilmington

New Castle

Delaware 19801

USA Int'l: +1-503-894-6022

Toll Free: +1-800-792-5285

Fax: +1-800-792-5285

help@alliedmarketresearch.com

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of "Market Research Reports Insights" and "Business Intelligence Solutions." AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fraud Detection and Prevention Market was valued at $29.5 billion in 2022 and to generate $252.7 billion by 2032 here

News-ID: 3474143 • Views: …

More Releases from Allied Market Research

Global Smart Waste Management Market to Hit $8.3 Billion by 2032 | Transforming …

One of the key factors fueling the growth of the smart waste management market is the increasing volume of waste generated worldwide. With rapid urbanization and expanding industrial activities, traditional waste management methods are struggling to keep up with the rising waste output. Smart waste management systems provide an effective solution by optimizing collection schedules, enhancing sorting accuracy, and streamlining disposal processes, making them vital for handling large-scale waste efficiently.

In…

Construction Equipment Market to Hit New Heights by 2031, Rising at 4.8% CAGR wi …

Construction equipment refers to specially engineered machinery designed to perform or support various construction activities. These machines include wheel bulldozers, front loaders, dump trucks, backhoe loaders, graders, crawler dozers, compactors, excavators, forklifts, concrete mixer trucks, and more. Each type of equipment serves distinct functions such as drilling, hauling, excavating, paving, grading, and lifting. Beyond construction and infrastructure projects, construction equipment also finds applications across industries like manufacturing and oil &…

Industrial Robotics Market to Soar at 12.6% CAGR Through 2032 | Powering Industr …

Industrial robotics is a sector that deals with the development, manufacture, and implementation of automated systems and robotic solutions in a variety of industries. These advanced robots are designed to perform a variety of tasks with remarkable accuracy, velocity, and productivity, and are employed in a variety of industrial settings to replace or assist human workers. These robots are employed to improve productivity, reduce safety, and streamline processes in a…

Modular Construction Industry on Track for $234.7 Billion by 2031, Growing at 6. …

According to the report published by Allied Market Research, the global modular construction market generated $131.1 billion in 2021, and is estimated to reach $234.7 billion by 2031, witnessing a CAGR of 6.1% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, key investment pockets, value chains, regional landscape, and competitive scenario. The report is a helpful source of information for leading market…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…