Press release

Open Banking Market: A Comprehensive Analysis of Market Trends and Strategies for Sustainable Growth

The open banking market size has grown exponentially in recent years. It will grow from $24.67 billion in 2023 to $31.01 billion in 2024 at a compound annual growth rate (CAGR) of 25.7%. The growth in the historic period can be attributed to increasing demand for fast and real-time fund transfer, rising use of digital banking services, strong economic growth in emerging markets and government initiatives..The open banking market size is expected to see exponential growth in the next few years. It will grow to $75.4 billion in 2028 at a compound annual growth rate (CAGR) of 24.9%. The growth in the forecast period can be attributed to a surge in usage of online platforms, rising urbanization, an increase in younger generations, an increase in mergers and acquisitions and increasing adoption of financial technology for payment. Major trends in the forecast period include focus on use of big data, focus on banking as a service (baas) model, focus on personalization, focus on variable recurring payments, focus on strategic partnerships and investments and focus on new initiatives and programs..

Market Overview -

Open banking is a banking practice in which third-party financial service providers can use application programming interfaces (APIs) to gain access to consumer banking, transactions, and other data from banks and NBFCs. These APIs deliver a secure way to share financial information between two parties and make it easier for consumers to compare the details of current accounts and other banking services. Open banking unites banks, third parties, and technology providers, allowing them to exchange data easily and securely for the benefit of their consumers.

Download Free Sample of Report -

https://www.thebusinessresearchcompany.com/sample.aspx?id=6048&type=smp

Rapid Growth In Digital Payments Drives Expansion Of The Open Banking Market

The surge in the use of online platforms for making payments is contributing to the growth of the open banking market. The digital payment system is rapidly expanding with developing payment methods, increased e-commerce use, improved broadband access, and the advent of new technologies. Payment gateway APIs are used by online platforms such as Phone Pay, Paytm, and Google Pay to manage recurring billing, and these APIs are often used in open banking. For instance, in August 2021, Google Pay, a US-based digital wallet platform crossed 1 billion transactions. Additionally, in July 2021, PhonePe, a digital payments network, set a new milestone by processing 1.5 billion transactions through the unified payments interface (UPI). Therefore, the rise in the use of online platforms for making payments is expected to propel the growth of the open banking market going forward.

Competitive Landscape -

Major companies operating in the open banking market report are Banco Santander S.A, BBVA SA, Credit Agricole, HSBC Bank plc., Citigroup, Capital One, NatWest Group plc., DBS Bank, Lloyds Banking Group, Barclays, Axis Bank, Bank Of Baroda, BNL, FamPay, Federal Bank, Finin, HDFC Bank, Airwallex, American Express, ANZ, China Construction Bank (CCB), ICBC Bank, WeBank, ChiantiBanca, Ant Financial, Allied Irish Bank, Bank of Ireland, Danske, Nationwide, RBS Group, ING, Caixa Geral De Depositos, La Banque Postale, Cofidis, Hello bank, Bunq, BNP Paribas, Citi, OTP Bank, Ikano Bank, Oneggo Bank, Tinkoff Bank, Wise, Raiffeisen Bank, Microsoft Corporation, IBM, Amazon Web Services, Hewlett Packard Enterprise, Intel, Oracle Corporation, Deposit Solutions, Finestra, Jack Henry & Associates, Inc, Nordigen Solutions, AlphaPoint, Axway, Spire Technologies, Tarabut Gateway, Mono.

Scotiabank Drives Open Banking Innovation With Scotia Tranxacttm Digital Payments Platform

The launch of new, technologically advanced platforms and services is becoming a trend in the open banking market. Businesses are increasingly seeking more seamless access to banking and payment services. Thus, companies in the market are continuously investing in the ongoing digitization of cash and treasury management services to meet the increasingly digital needs of global business banking clients by launching new products. For instance, in August 2022, Scotiabank, a leading bank in the Americas launched Scotia TranXactTM, a digital payments platform that provides business banking clients with on-demand access to Scotiabank's payments and cash management Application Programming Interfaces (APIs). With Scotia TranXact business banking clients will have access to real-time payments, request-to-pay and account information services via APIs.

Browse Full Report @

https://www.thebusinessresearchcompany.com/report/open-banking-global-market-report

Key Segments -

The open banking market covered in this report is segmented -

1) By Service Type: Transactional Services, Communicative, Informative Services

2) By Distribution Channel: Bank Channels, App Market, Distributors, Aggregators

3) By Financial Services: Bank And Capital Markets, Payments, Digital Currencies, Value Added Services

4) By Deployment: Cloud, On-Premises, Hybrid

Key highlights covered in the report -

1. Detailed market size forecast and historical data analysis

2. Key drivers influencing market growth

3. Identification of upcoming trends and potential opportunities in the market

4. Analysis of major players strategies, to understand competitive dynamics and market positioning

5. Evaluation of regional dynamics

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

Want To Know More About The Business Research Company?

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialise in various industries including manufacturing, healthcare, financial services, chemicals, and technology.

Global Market Model - World's Most Comprehensive Database

The Business Research Company's flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Open Banking Market: A Comprehensive Analysis of Market Trends and Strategies for Sustainable Growth here

News-ID: 3469036 • Views: …

More Releases from The Business research company

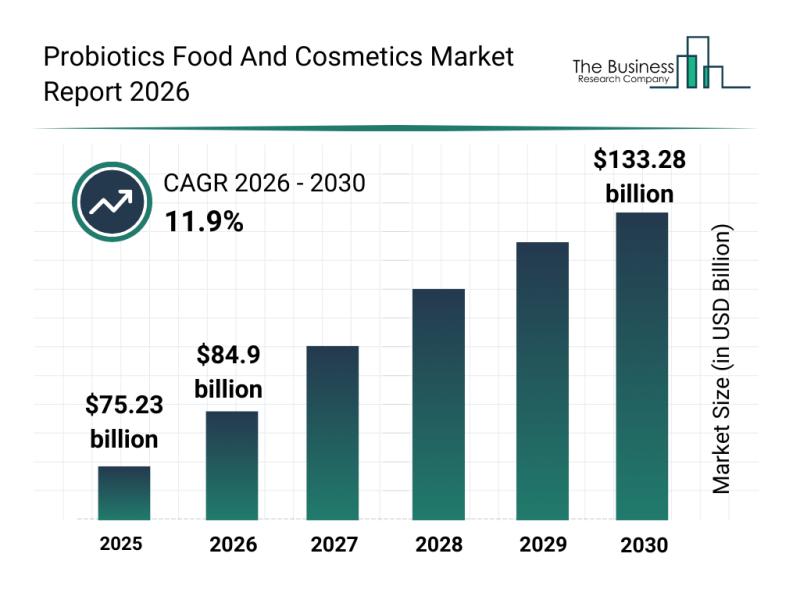

Outlook on the Probiotics Food and Cosmetics Market: Major Segments, Strategic D …

The probiotics food and cosmetics sector is on the brink of significant expansion, driven by increasing consumer awareness and innovative product developments. As wellness trends continue to evolve, this market is set to experience remarkable growth, presenting vast opportunities for manufacturers and retailers alike. Here, we explore the market's expected size, key players, emerging trends, and detailed segmentation.

Projected Market Size and Growth Trends in the Probiotics Food and Cosmetics Market…

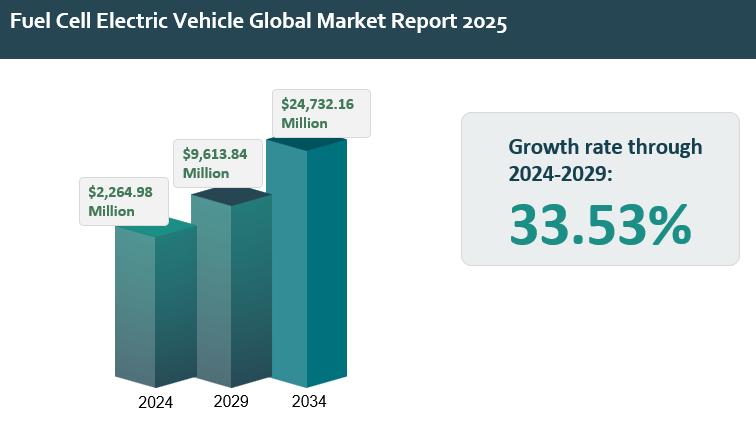

Global Fuel Cell Electric Vehicle Market Outlook 2025-2034: Growth Acceleration, …

The fuel cell electric vehicle report outlines and analyzes the fuel cell electric vehicle market, covering the historic period 2019-2024 and the forecast periods 2024-2029 and 2034F. The report assesses the market across regions and the major economies within each region.

The global fuel cell electric vehicle market was valued at $2.26498 billion in 2024, increasing at a CAGR of 6.88% since 2019. The market is projected to rise from $2.26498…

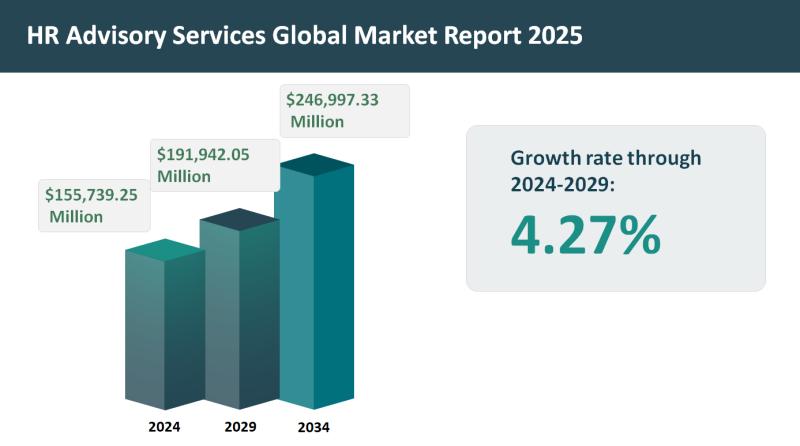

Global HR Advisory Services Market Set for 4.27% Growth, Projected to Reach $191 …

The HR advisory services report outlines and analyzes the HR advisory services market across 2019-2024 (historic period) and 2024-2029, 2034F (forecast period). It examines market performance across global regions and key economies.

The global HR advisory services market was valued at approximately $155.73925 billion in 2024, increasing at a CAGR of 4.22% since 2019. The market is anticipated to rise from $155.73925 billion in 2024 to $191.94205 billion in 2029, reflecting…

Evolving Market Trends In The Integrated Geophysical Services Industry: Enhancin …

The Integrated Geophysical Services Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Expected Integrated Geophysical Services Market Size During the Forecast Period?

The integrated geophysical services market has experienced consistent growth in recent years, expected to rise from $2.35 billion in 2024 to…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…