Press release

2024 Business Travel Accident Insurance Market Report : Market Size, Growth Drivers, And Key Trends | MetLife Inc, Allianz SE, American International Group Inc, Zurich Insurance Group, AXA,Assicurazioni Generali S.P.A

"The business travel accident insurance market size has grown exponentially in recent years. It will grow from $6.1 billion in 2023 to $7.53 billion in 2024 at a compound annual growth rate (CAGR) of 23.5%. The growth in the historic period can be attributed to rise in awareness of travel-associated risks, increased incidences of natural catastrophes and rise in healthcare costs.The business travel accident insurance market size is expected to see exponential growth in the next few years. It will grow to $16.58 billion in 2028 at a compound annual growth rate (CAGR) of 21.8%. The growth in the forecast period can be attributed to globalization and increase in business travel and growing volume of corporate conferences and events. Major trends in the forecast period include integration of technology to elevate services, customized coverage for diverse employee groups, business-centric travel insurance solutions, and business-centric travel insurance solutions.

Market Overview -

Business travel accident insurance is a sort of pseudo-life insurance that covers the policyholders while they're on the road. The coverage pays out if something happens, even if the policyholder has additional insurance. Business travel accident insurance covers accidental death, dismemberment, travel support services, emergency medical bills, and other losses. Business travel accident insurance is used to protect an individual or a group of individuals against accidental death and dismemberment.

Download Free Sample of Report -

https://www.thebusinessresearchcompany.com/sample.aspx?id=8114&type=smp

Business Travel Resurgence Driving Accident Insurance Market

The surge in business travel is expected to propel the growth of the business travel accident insurance market. Business travel refers to traveling from one place to another for business purposes only. As the pandemic is getting better, business travel is booming. Business travel accident insurance aids in traveling, as it insures the travelers against any losses occurring at the time of travel. For instance, according to a US-based business travel and meetings trade organization Global Business Travel Association (GBTA) on Business Travel Recovery report, in August 2022, the percentage of business travel has climbed to 86%, up from 73% in the GBTA's February report. Therefore, the rise in business travel will drive the business travel accident insurance market.

Competitive Landscape -

Major companies operating in the business travel accident insurance market report are MetLife Inc, Allianz SE, American International Group Inc, Zurich Insurance Group, AXA,Assicurazioni Generali S.P.A., Chubb Corporation, The Hartford, Starr International Company, Tata AIG General Insurance Company Limited, Corporate Risks India Insurance Brokers Pvt Ltd, New India Assurance - General Insurance Brokers, Oriental Insurance Company, ICICI Lombard General Insurance Company, United India Insurance, HDFC ERGO Non-Life Insurance Company, Fanhua Holdings, Insubuy LLC, China Life Insurance Company Limited, SafetyWing, Genki, Insured Nomads, Sompo Japan Nipponkoa Insurance Inc, Mitsui Sumitomo Insurance Co. Ltd, Marsh & McLennan Companies UK Limited, Aon UK Limited, Arthur J Gallagher & Co, Willis Towers Watson plc, Lloyd's of London Limited, Funk Gruppe GmbH, Ecclesia Holding GmbH, Hannover Re, Crédit Agricole Assurances, Société Générale, Sogaz Insurance Group, Ingosstrakh Insurance Co, UNIQA, Ceská Pojištovna, Groupama, RSHB Insurance, Soglasie Insurance Company, Sberbank Insurance Company LLC, Travel Insurance Center, Global Underwriters Agency Inc., International Citizens Insurance, AIG Seguros Brasil SA, Mapfre Argentina Holding S.A., Sancor Seguros Argentina, Nación Seguros, Arabia Insurance Cooperative Company, Abu Dhabi National Insurance, Dubai Insurance Co, Al-Etihad Co-operative Insurance Co, Saudi Arabian Cooperative Insurance Co., Care Line Group, De Wet De Villiers, Travelinsure, Lensure Insurance Brokers Cc, Oojah Travel Protection, Takaful Insurance of Africa, Bryte Insurance Company Limited

Strategic Partnerships Reshaping The Business Travel Accident Insurance Market

Collaboration is a key trend in the business travel accident insurance market. Companies are entering into strategic partnerships with business travel accident insurance providers to leverage each other's resources and enter a new market. For instance, in July 2021, Ahlibank, a Qatar-based private banking company, entered into a partnership with Dhofar Insurance Company. Through this partnership, Ahlibank will expand its range of insurance options, including comprehensive family and home insurance policies with long-term plans. The collaboration with Dhofar Insurance will shield people and their assets from monetary risks brought on by many potential risks and any unfavorable occurrence. Dhofar Insurance Company is an Oman-based insurance service provider. In addition, in April 2021, KMRD Partners, Inc., a UK-based risk management company providing risk management, insurance brokerage, and human capital solutions, partnered with The Hartford. The partnership aims at offering the group benefits options to small business clients. The Hartford is a US-based investment and insurance company that offers life and accidental death and dismemberment, accident, critical illness, and business travel accident insurance.

Browse Full Report @

https://www.thebusinessresearchcompany.com/report/business-travel-accident-insurance-global-market-report

Key Segments -

The business travel accident insurance market covered in this report is segmented -

1) By Type: Single Trip Coverage, Annual Multi-Trip Coverage, Other Types

2) By Distribution Channel: Insurance Company, Insurance Broker, Banks, Insurance Aggregators, Other Distribution Channels

3) By End-User: Corporations, Government, International Travelers, Employees

Key highlights covered in the report -

1. Detailed market size forecast and historical data analysis

2. Key drivers influencing market growth

3. Identification of upcoming trends and potential opportunities in the market

4. Analysis of major players strategies, to understand competitive dynamics and market positioning

5. Evaluation of regional dynamics

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model "

Want To Know More About The Business Research Company?

The Business Research Company (www.thebusinessresearchcompany.com) is a market intelligence firm that pioneers in company, market, and consumer research. Located globally, TBRC's consultants specialise in various industries including manufacturing, healthcare, financial services, chemicals, and technology.

Global Market Model - World's Most Comprehensive Database

The Business Research Company's flagship product, Global Market Model (www.thebusinessresearchcompany.com/global-market-model) is a market intelligence platform covering various macroeconomic indicators and metrics across 60 geographies and 27 industries. The Global Market Model covers multi-layered datasets which help its users assess supply-demand gaps

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release 2024 Business Travel Accident Insurance Market Report : Market Size, Growth Drivers, And Key Trends | MetLife Inc, Allianz SE, American International Group Inc, Zurich Insurance Group, AXA,Assicurazioni Generali S.P.A here

News-ID: 3468684 • Views: …

More Releases from The Business Research Company

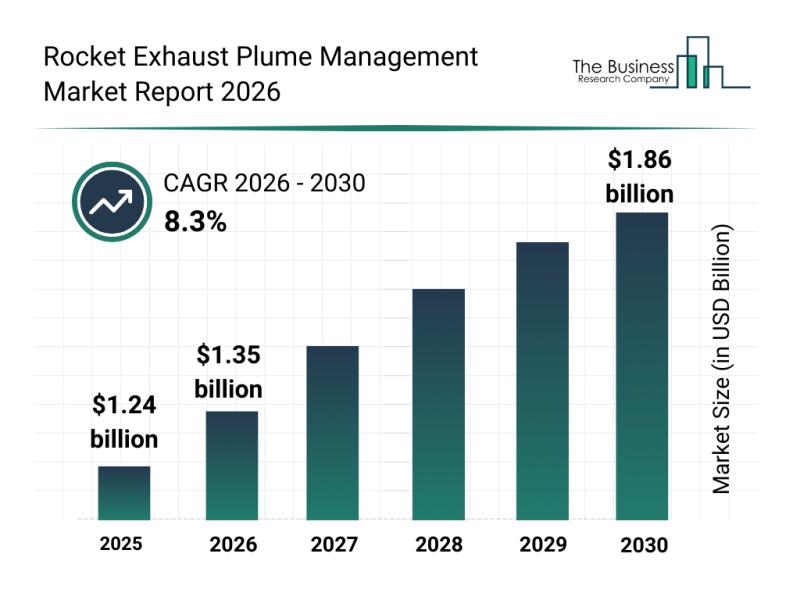

Emerging Growth Trends Driving Expansion in the Rocket Exhaust Plume Management …

The rocket exhaust plume management sector is poised for significant expansion as space activities intensify worldwide. Growing demand for efficient and environmentally conscious technologies is driving innovation and investment in this specialized market. The following analysis explores the market size, key players, prevailing trends, and the main segments shaping this industry's future.

Forecasted Growth of the Rocket Exhaust Plume Management Market

The rocket exhaust plume management market is projected to reach…

In-Depth Examination of Segments, Industry Trends, and Key Competitors in the Na …

The naval-based remote weapons station market is on track for significant expansion in the coming years, driven by advances in maritime defense technology and evolving naval strategies. As navies worldwide seek to enhance operational efficiency and safety, the demand for sophisticated remote weapon systems is rising steadily. Here's an insightful overview of the market's size, key players, driving factors, notable trends, and segmentation.

Projected Market Valuation and Growth Trajectory of the…

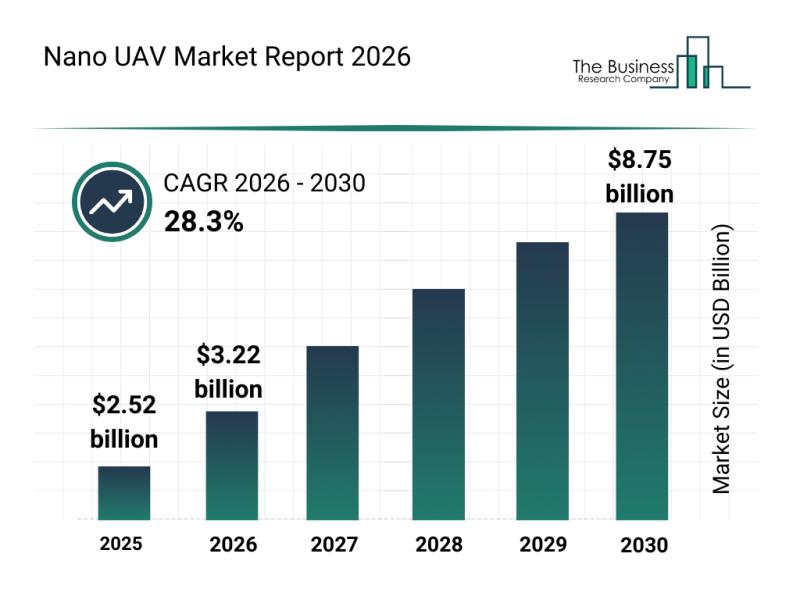

Top Players and Competitive Dynamics in the Nano UAV Market

The nano UAV market is on the verge of remarkable expansion, driven by technological advancements and widening applications across various sectors. As these ultra-compact drones evolve, they are set to transform industries such as agriculture, environmental monitoring, and urban surveillance, offering unprecedented precision and efficiency. Let's explore the current market size, influential players, key trends, and significant opportunities shaping the future of this dynamic industry.

Forecasted Expansion and Size of the…

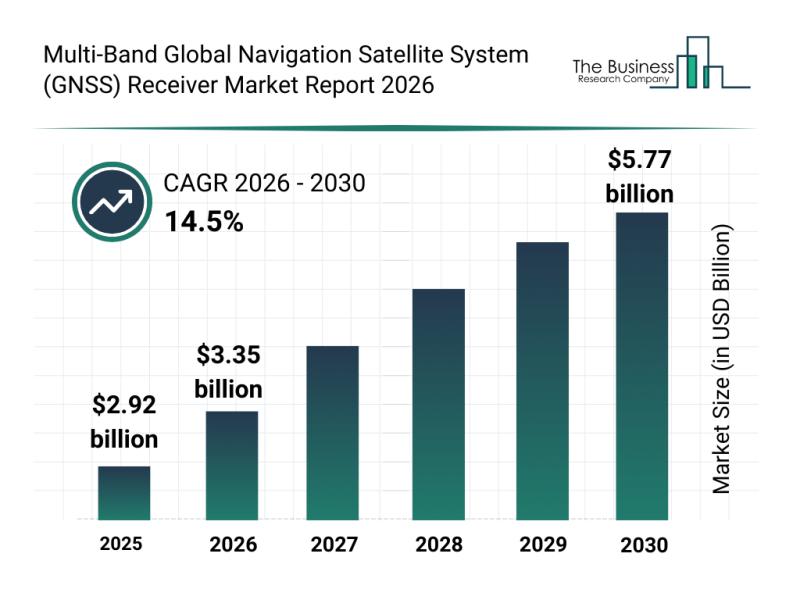

Overview of Segmentation, Market Dynamics, and Competitive Landscape in the Glob …

The multi-band global navigation satellite system (GNSS) receiver market is poised for significant expansion in the coming years, driven by technological advancements and growing applications across various sectors. As navigation needs become more complex and diverse, the demand for sophisticated GNSS receivers continues to rise, making this a crucial market to watch through 2030.

Projected Market Size and Growth of the Multi-Band GNSS Receiver Market

The multi-band GNSS receiver market is…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…