Press release

Takaful Insurance Market - growing at CAGR of +15% by 2031 - by Application, Type, Distribution Channel, and Key Players: Syarikat Takaful Brunei Darussalam, Qatar Islamic Insurance, Abu Dhabi National Takaful Co, Zurich Malaysia, ISLAMIC INSURANCE

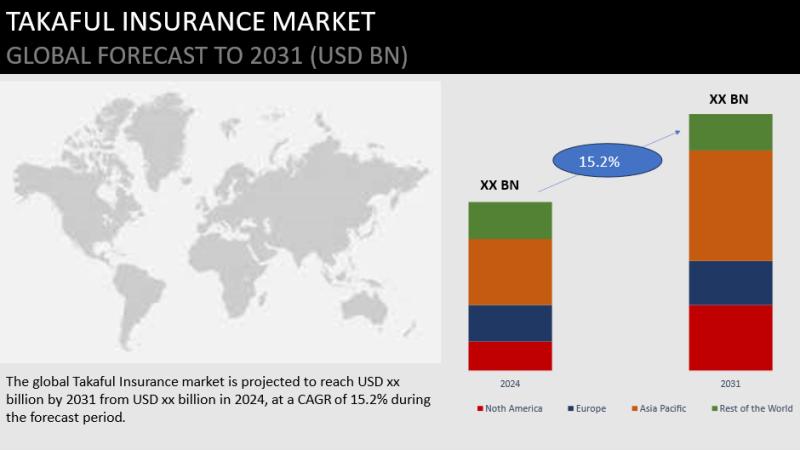

Takaful insurance is a cooperative Islamic insurance concept based on mutual assistance and shared responsibility. It operates on the principles of solidarity, mutual protection, and risk-sharing among participants. In Takaful, individuals and corporations combine their contributions into a fund to protect themselves against defined losses or damages. Unlike traditional insurance, which entails shifting risk to the insurer, Takaful stresses shared guarantee and collaboration. In accordance with Islamic values of justice and social welfare, any surplus money from the Takaful fund is given to participants as dividends or contributions to charity organisations.The Global Takaful Insurance Market in terms of revenue was estimated to be worth USD XX billion in 2023 and is poised to grow at a CAGR of 15.2% from 2024 to 2031.

Ask for Free Sample Copy of this Report:

https://www.theresearchinsights.com/request_sample.php?id=559162

Top Key Players Profiled in This Report:

Syarikat Takaful Brunei Darussalam, Qatar Islamic Insurance, Abu Dhabi National Takaful Co, Zurich Malaysia, ISLAMIC INSURANCE, Takaful International, Prudential BSN Takaful Berhad, AMAN INSURANCE, SALAMA Islamic Arab Insurance Company, Allianz and Others.

The report provides insights on the following pointers:

- Market Penetration: Comprehensive information on the product portfolios of the top players in the Takaful Insurance market.

- Product Development/Innovation: Detailed insights on the upcoming technologies, R&D activities, and product launches in the market

- Competitive Assessment: In-depth assessment of the market strategies, geographic and business segments of the leading players in the market

- Market Development: Comprehensive information about emerging markets. This report analyzes the market for various segments across geographies

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the Takaful Insurance market

The report presents a thorough overview of the competitive landscape of the global Takaful Insurance Market and the detailed business profiles of the market's notable players. Threats and weaknesses of leading companies are measured by the analysts in the report by using industry-standard tools such as Porter's five force analysis and SWOT analysis. The Takaful Insurance Market report covers all key parameters such as product innovation, market strategy for leading companies, Takaful Insurance market share, revenue generation, the latest research and development and market expert perspectives.

Get 30% Discount on First Purchase of This Report:

https://www.theresearchinsights.com/ask_for_discount.php?id=559162

Growth in demand for takaful insurance across Muslim-majority has significant driver for the expansion of the takaful insurance. A growing middle class and strong economic growth have been seen in several nations with a majority of Muslims. As people's financial circumstances improve, they are more interested in using insurance to protect their possessions and well-being, and Takaful offers a Sharia-compliant choice. Furthermore, distribution of investment profit among both participants are driving the takaful insurance market.

Takaful Insurance Market Segmentation by Application:

• Personal

• Commercial

Takaful Insurance Market Segmentation by Type:

• Family Takaful

• General Takaful

Takaful Insurance Market Segmentation by Distribution Channel:

• Agents and Brokers

• Banks

• Direct Response

• Others

Takaful Insurance Market by Regions:

• North America (United States, Canada and Mexico)

• Europe (Germany, France, UK, Russia and Italy)

• Asia-Pacific (China, Japan, Korea, India and Southeast Asia)

• South America (Brazil, Argentina, Colombia etc.)

• Middle East and Africa (Saudi Arabia, UAE, Egypt, Nigeria and South Africa)

Reasons for buying this report: -

• It offers an analysis of changing competitive scenario.

• For making informed decisions in the businesses, it offers analytical data with strategic planning methodologies.

• It offers seven-year assessment of Takaful Insurance Market.

• It helps in understanding the major key product segments.

• Researchers throw light on the dynamics of the market such as drivers, restraints, trends, and opportunities.

• It offers regional analysis of Takaful Insurance Market along with business profiles of several stakeholders.

• It offers massive data about trending factors that will influence the progress of the Takaful Insurance Market.

Purchase Complete Takaful Insurance Market Report at:

https://www.theresearchinsights.com/checkout?id=559162

Contact us:

Robin

Sales manager

+91-996-067-0000

sales@theresearchinsights.com

https://www.theresearchinsights.com

About us:

The Research Insights - A global leader in analytics, research and advisory that can assist you to renovate your business and modify your approach. With us, you will learn to take decisions intrepidly. We make sense of drawbacks, opportunities, circumstances, estimations and information using our experienced skills and verified methodologies. Our research reports will give you an exceptional experience of innovative solutions and outcomes. We have effectively steered businesses all over the world with our market research reports and are outstandingly positioned to lead digital transformations. Thus, we craft greater value for clients by presenting advanced opportunities in the global market.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Takaful Insurance Market - growing at CAGR of +15% by 2031 - by Application, Type, Distribution Channel, and Key Players: Syarikat Takaful Brunei Darussalam, Qatar Islamic Insurance, Abu Dhabi National Takaful Co, Zurich Malaysia, ISLAMIC INSURANCE here

News-ID: 3467015 • Views: …

More Releases from The Research Insights

Latest Research Report on Travel Services Market by Forecast to 2032

The Global Travel Services Market has experienced substantial growth, driven by increasing globalization, rising disposable incomes, technological advancements, and growing consumer preference for experiential travel. The market encompasses a wide range of services, including travel planning, transportation, accommodation, and tourism activities. This article provides a detailed analysis of the market size, share, trends, and growth prospects, highlighting the factors shaping the industry's future through 2032.

𝐂𝐥𝐢𝐜𝐤 𝐭𝐡𝐞 𝐥𝐢𝐧𝐤 𝐭𝐨 𝐠𝐞𝐭 𝐚…

Commercial Insurance Market is Expected to Grow at a CAGR 2024 - 2031

The Commercial Insurance Insights of 2024 is a thorough analysis that offers a thorough look at the market's size, revenues, market shares, various categories, drivers, and other pertinent factors in addition to trends and possible new developments. Aside from the 2031 forecast period, the research study discusses market restraints and regional industrial presence that may impact market growth patterns. In PDF version, the Commercial Insurance Market study comprises an extensive…

Portable Power Station Market Forecast 2024-2031 - 46.6% CAGR Growth by 2031

The Portable Power Station Insights of 2024 is a thorough analysis that offers a thorough look at the market's size, revenues, market shares, various categories, drivers, and other pertinent factors in addition to trends and possible new developments. Aside from the 2031 forecast period, the research study discusses market restraints and regional industrial presence that may impact market growth patterns. In PDF version, the Portable Power Station Market study comprises…

Portable Power Station Market To Grow at a Stayed CAGR from 2024 to 2031

The Portable Power Station Insights of 2024 is a thorough analysis that offers a thorough look at the market's size, revenues, market shares, various categories, drivers, and other pertinent factors in addition to trends and possible new developments. Aside from the 2031 forecast period, the research study discusses market restraints and regional industrial presence that may impact market growth patterns. In PDF version, the Portable Power Station Market study comprises…

More Releases for Takaful

Islamic Insurance (Takaful) Market Hits New High | Major Giants Takaful Malaysia …

HTF MI recently introduced Global Islamic Insurance (Takaful) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Takaful Malaysia, Syarikat Takaful Malaysia, Abu Dhabi Islamic Insurance.

Download Sample Report PDF…

Takaful Market Is Going To Boom | Etiqa, SALAMA, Takaful Emarat

According to HTF Market Intelligence, the Global Takaful market is expected to grow from USD 35 Billion in 2023 to USD 65 Billion by 2032, with a CAGR of 9.10% from 2025 to 2032.

HTF MI recently introduced Global Takaful Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2032). The market Study is segmented by key regions which…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024 - Takaful Market Scope, Demand And Growth

"The Business Research Company recently released a comprehensive report on the Global Takaful Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

Takaful Market Report 2024-2032, Product Type (Life/Family Takaful, General Taka …

According to latest research report by IMARC Group, titled "Takaful Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032," The global takaful market size reached US$ 33.6 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 74.0 Billion by 2032, exhibiting a growth rate (CAGR) of 8.9% during 2024-2032.

Sample Copy of Report at - https://www.imarcgroup.com/takaful-market/requestsample

Takaful Market Trends:

The global takaful market is experiencing significant growth…